India Pesticide Residue Testing Market Size, Share, Trends and Forecast by Type, Technology, Class, Food Tested, and Region, 2025-2033

India Pesticide Residue Testing Market Overview:

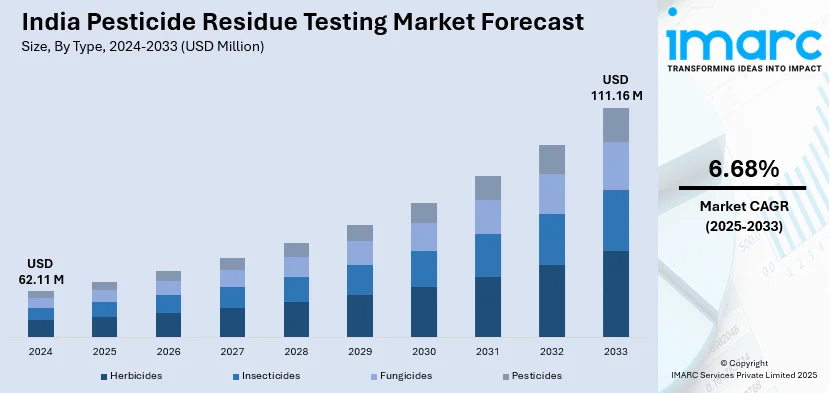

The India pesticide residue testing market size reached USD 62.11 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 111.16 Million by 2033, exhibiting a growth rate (CAGR) of 6.68% during 2025-2033. The market is driven by the implementation of stringent food safety regulations by government bodies, rising organic food demand, advancements in testing technologies, increased agricultural exports requiring compliance with international standards, growing consumer awareness about health risks, the launch government initiatives promoting food quality, and rapid adoption of AI-based detection systems in food and beverage industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.11 Million |

| Market Forecast in 2033 | USD 111.16 Million |

| Market Growth Rate 2025-2033 | 6.68% |

India Pesticide Residue Testing Market Trends:

Growing Adoption of Organic Farming and Consumer Demand for Chemical-Free Food

The increasing demand from consumers for chemical-free and organic food is among the key factors driving the market. Consumers in India, in recent times, consumers have shown heightened consciousness regarding their health and are consciously seeking out chemical-free food products. Consequently, this has given rise to strong demand for organic vegetables, fruits, milk products, and processed food items adhering to organic certification requirements. But for a product to be certified organic, it has to be subjected to rigorous pesticide residue analysis to prove that it is compliant with the zero-residue requirements required by organic certifying agencies. Moreover, the Indian government has been aggressively promoting organic farming through programs, such as the Paramparagat Krishi Vikas Yojana (PKVY) and the National Program for Organic Production (NPOP). Such schemes offer funding and technical assistance to farmers switching over to organic farming, thus enhancing the demand for intensive residue analysis to prove their products to be pesticide-free.

To get more information on this market, Request Sample

Advancements in Analytical Testing Technology

Another major growth driver of the pesticide residue testing market in India is the rapid advancement in analytical testing technologies. Over the years, processes for the testing of pesticide residues in food and agricultural products have been greatly improved. Old-fashioned methods of testing, including enzyme-linked immunosorbent assays (ELISA) or gas chromatography, have become gradually supplanted by higher precision, high-throughput, and more accurate technologies such as liquid chromatography-mass spectrometry (LC-MS) and gas chromatography-mass spectrometry (GC-MS). These advanced technologies provide greater sensitivity, accuracy, and the capability to identify numerous pesticide residues in one test, even in traces. The continuous growth and application of such sophisticated test systems have notably cut testing costs and times, enhancing the general dependability of outcomes. This is especially valuable to large agricultural production, food manufacturers, and exporters who need precise and swift pesticide residue analyses in order to compete in markets. In addition, the automation of such analytical systems guarantees increased testing volumes with less human error, further justifying the propelling demand for rapid, precise pesticide residue analysis.

India Pesticide Residue Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, technology, class, and food tested.

Type Insights:

- Herbicides

- Insecticides

- Fungicides

- Pesticides

The report has provided a detailed breakup and analysis of the market based on the type. This includes herbicides, insecticides, fungicides, and pesticides.

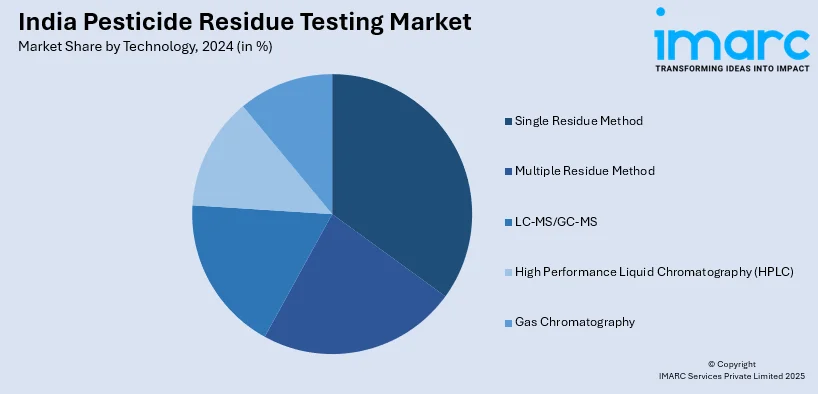

Technology Insights:

- Single Residue Method

- Multiple Residue Method

- LC-MS/GC-MS

- High Performance Liquid Chromatography (HPLC)

- Gas Chromatography

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes single residue method, multiple residue method, LC-MS/GC-MS, high performance liquid chromatography (HPLC), and gas chromatography.

Class Insights:

- Organochlorine

- Organophosphates

- Organonitrogens and Carbamates

A detailed breakup and analysis of the market based on the class have also been provided in the report. This includes organochlorine, organophosphates, and organonitrogens and carbamates.

Food Tested Insights:

- Meat and Poultry

- Dairy Products

- Processed Food

- Fruits and Vegetables

- Cereals

- Grain and Pulses

A detailed breakup and analysis of the market based on the food tested have also been provided in the report. This includes meat and poultry, dairy products, processed food, fruits and vegetables, cereals, and grain and pulses.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pesticide Residue Testing Market News:

- July 2024: Researchers in Kolkata developed an AI-based kit to rapidly detect pesticide residues in tea leaves, ensuring compliance with food safety standards. This innovation enhances testing efficiency, helping tea producers meet export and regulatory requirements. The advancement drives India's pesticide residue testing market by promoting faster, cost-effective, and accurate detection methods, escalating demand for such technologies across the food industry.

- May 2024: The Food Safety and Standards Authority of India (FSSAI) launched strict surveillance on various food items, including fruit, vegetables, fish products, spices, fortified rice, and dairy products, following quality concerns in branded spices. FSSAI collected samples of spices from all brands, including MDH and Everest, after Hong Kong's Center for Food Safety and Singapore Food Agency found a pesticide, ethylene oxide, in several kinds of pre-packaged spice-mix products.

India Pesticide Residue Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Herbicides, Insecticides, Fungicides, Pesticides |

| Technologies Covered | Single Residue Method, Multiple Residue Method, LC-MS/GC-MS, High Performance Liquid Chromatography (HPLC), Gas Chromatography |

| Classes Covered | Organochlorine, Organophosphates, Organonitrogens and Carbamates |

| Foods Tested Covered | Meat and Poultry, Dairy Products, Processed Food, Fruits and Vegetables, Cereals, Grain and Pulses |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pesticide residue testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pesticide residue testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pesticide residue testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pesticide residue testing market in India was valued at USD 62.11 Million in 2024.

The India pesticide residue testing market is projected to exhibit a CAGR of 6.68% during 2025-2033, reaching a value of USD 111.16 Million by 2033.

The India pesticide residue testing market is driven by rising food safety concerns, stricter government regulations, and growing consumer demand for certified products. Expanding agricultural exports, coupled with the need to meet international quality standards, further accelerates adoption of advanced testing methods across food and beverage supply chains.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)