India Pharmaceutical Manufacturing Market Size, Share, Trends and Forecast by Molecule Type, Drug Development Type, Formulation, Route of Administration, Therapy Area, Prescription, Age Group, Sales Channel, and Region, 2025-2033

India Pharmaceutical Manufacturing Market Overview:

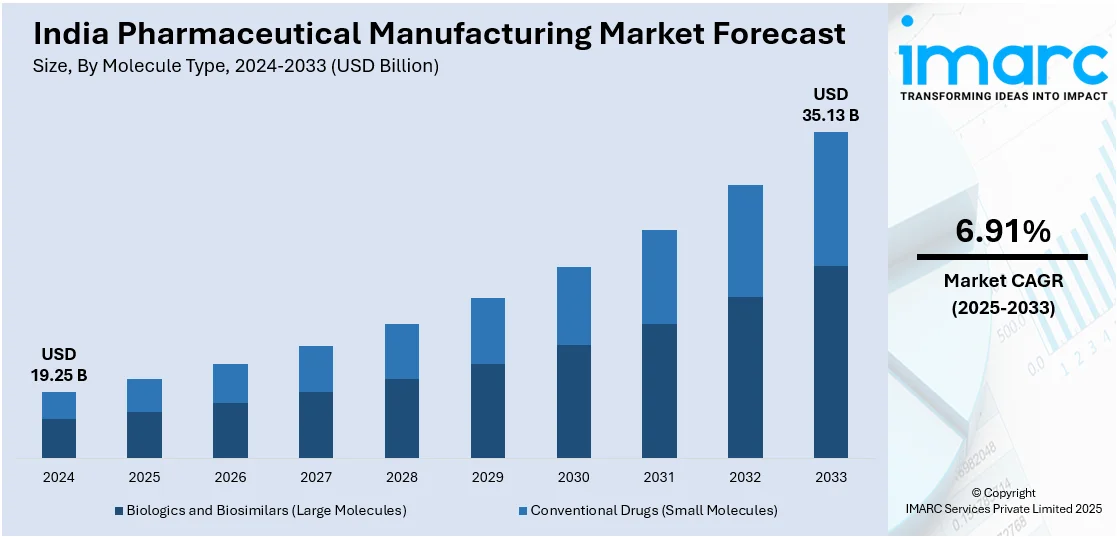

The India pharmaceutical manufacturing market size reached USD 19.25 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.13 Billion by 2033, exhibiting a growth rate (CAGR) of 6.91% during 2025-2033. India's pharmaceutical manufacturing market is driven by a combination of cost-effective production capabilities, strong domestic demand, robust export opportunities for generics and biosimilars, supportive government policies like the PLI scheme, elevating demand for affordable healthcare solutions, and a well-established medical infrastructure network backed by a large pool of skilled professionals and R&D expertise.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.25 Billion |

| Market Forecast in 2033 | USD 35.13 Billion |

| Market Growth Rate 2025-2033 | 6.91% |

India Pharmaceutical Manufacturing Market Trends:

Cost-Effective Manufacturing and Skilled Workforce

India's pharmaceutical manufacturing industry is driven mainly by its affordable production capacity and large pool of skilled manpower. The country provides considerable cost benefits over Western counterparts, especially in the manufacturing of generic medicines, Active Pharmaceutical Ingredients (APIs), and bulk drugs. Indian producers enjoy lower labor costs, affordable infrastructure, and competitive utility charges, making it one of the most cost-effective pharma hubs in the world. This cost benefit enables Indian pharmaceutical companies to provide competitive pricing in the local as well as export markets. International pharmaceutical leaders tend to outsource or create manufacturing facilities in India to decrease their production costs without sacrificing the quality. WHO-GMP-approved facilities and conformity to US FDA and EU laws further enhance the country's international manufacturing attractiveness. Besides, India's vast number of scientifically qualified personnel, such as chemists, pharmacists, biotechnologists, and engineers, provides significantly to the productivity and innovative potential of the sector. A number of premier institutions like the Indian Institutes of Technology (IITs), National Institutes of Pharmaceutical Education and Research (NIPERs), and various medical colleges provide a steady supply of skilled manpower.

To get more information on this market, Request Sample

Rising Global Demand for Generic Drugs and Biosimilars

A key driver for India's pharmaceutical manufacturing business is the escalating global demand for biosimilars and generic pharmaceuticals. As health systems globally face increased treatment expenditures and aging populations, the necessity for cost-effective but effective medicines is accelerating. Generic medicines and affordable substitutes of patented medicines after the expiration of patents are now necessities for the plans of public as well as private health systems. India, labeled the "Pharmacy of the World", is a key player in fulfilling this requirement by providing more than 20% of global generic medicines. Indian pharma firms have made themselves adept at the process of reverse engineering and process improvement, allowing them to manufacture generics in high volumes and with great speed, frequently within months of worldwide patent expirations. Additionally, India has the largest number of US FDA-approved pharma manufacturing plants outside of the United States, further cementing its reliability and trustworthiness as an international generics supplier.

India Pharmaceutical Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on molecule type, drug development type, formulation, route of administration, therapy area, prescription, age group, and sales channel.

Molecule Type Insights:

- Biologics and Biosimilars (Large Molecules)

- Monoclonal Antibodies

- Vaccines

- Cell and Gene Therapy

- Others

- Conventional Drugs (Small Molecules)

The report has provided a detailed breakup and analysis of the market based on the molecule type. This includes biologics and biosimilars (large molecules) (monoclonal antibodies, vaccines, cell and gene therapy, and others) and conventional drugs (small molecules).

Drug Development Type Insights:

- In-House

- Outsource

A detailed breakup and analysis of the market based on the drug development type have also been provided in the report. This includes in-house and outsource.

Formulation Insights:

- Tablets

- Capsules

- Injectable

- Sprays

- Suspensions

- Powders

- Others

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes tablets, capsules, injectable, sprays, suspensions, powders, and others.

Route of Administration Insights:

- Oral

- Topical

- Parenteral

- Inhalations

- Others

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral, topical, parenteral, inhalations, and others.

Therapy Area Insights:

- Cardiovascular Diseases (CVDs)

- Pain

- Diabetes

- Cancer

- Respiratory Diseases

- Others

A detailed breakup and analysis of the market based on the therapy area have also been provided in the report. This includes cardiovascular diseases (CVDs), pain, diabetes, cancer, respiratory diseases, and others.

Prescription Insights:

- Prescription Medicines

- Over-the-counter (OTC) Medicines

A detailed breakup and analysis of the market based on the prescription have also been provided in the report. This includes prescription medicines and over-the-counter (OTC) medicines.

Age Group Insights:

- Children and Adolescents

- Adults

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children and adolescents, adults, and geriatric.

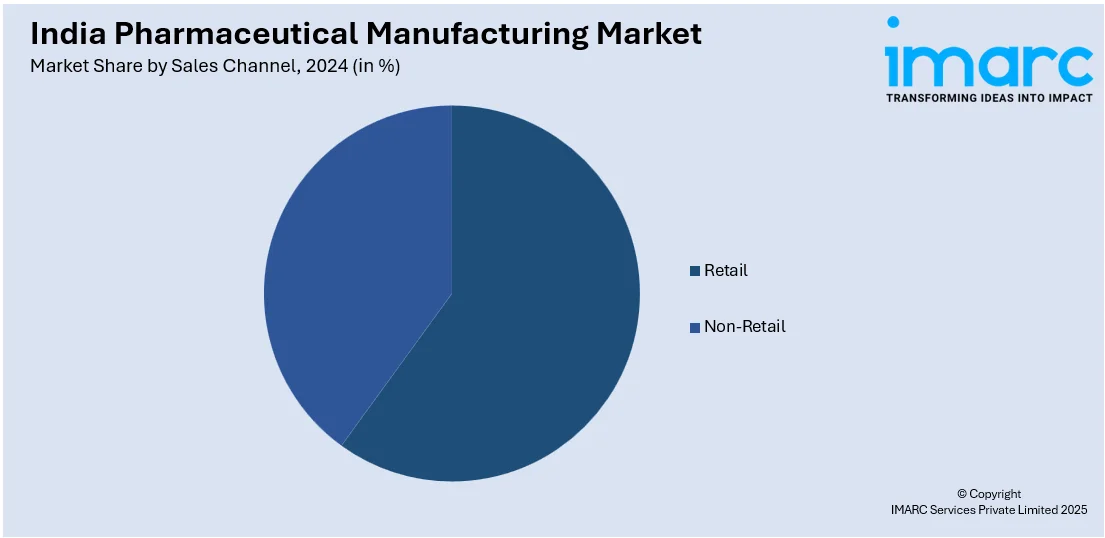

Sales Channel Insights:

- Retail

- Non-Retail

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes retail and non-retail.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pharmaceutical Manufacturing Market News:

- November 2024: ACG Engineering launched the ADAPT X feeder at CPhI & PMEC India 2024, designed to handle complex tablet shapes with high-speed, tool-less changeovers. This innovation enhances packaging flexibility and efficiency in pharmaceutical manufacturing.

- November 2024: Clariant introduced eight high-performing excipients at CPHI India 2024, including the VitiPure LEX series and Polyglykol 1450 S, aimed at enhancing drug formulation and delivery. It reportedly combines Swiss expertise with local manufacturing in India to support the pharmaceutical industry's evolving needs.

- November 2024: Pfizer announced that it would be expanding its manufacturing and R&D capacities in India by shifting oncology and chemotherapy production from Australia to Gujarat and increasing R&D staff in Chennai. This move would enhance local production, with nearly 70% of Pfizer's Indian sales being manufactured domestically.

India Pharmaceutical Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Molecule Types Covered |

|

| Drug Development Types Covered | In-House, Outsource |

| Formulations Covered | Tablets, Capsules, Injectable, Sprays, Suspensions, Powders, Others |

| Routes of Administration Covered | Oral, Topical, Parenteral, Inhalations, Others |

| Therapy Areas Covered | Cardiovascular Diseases (CVDs), Pain, Diabetes, Cancer, Respiratory Diseases, Others |

| Prescriptions Covered | Prescription Medicines, Over-the-counter (OTC) Medicines |

| Age Groups Covered | Children and Adolescents, Adults, Geriatric |

| Sales Channels Covered | Retail, Non-Retail |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pharmaceutical manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pharmaceutical manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pharmaceutical manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India pharmaceutical manufacturing market was valued at USD 19.25 Billion in 2024.

The India pharmaceutical manufacturing market is projected to exhibit a CAGR of 6.91% during 2025-2033, reaching a value of USD 35.13 Billion by 2033.

Key drivers of the India pharmaceutical manufacturing market include strong government support through initiatives promoting generic production, increasing global demand for affordable medicines, and a robust domestic API supply chain. Additionally, improvements in regulatory compliance and investment in advanced technologies, such as continuous manufacturing and biotech platforms, are further accelerating growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)