India Pharmacovigilance Market Size, Share, Trends and Forecast by Service Provider, Product Life Cycle, Type, Process Flow, Therapeutic Area, End Use, and Region, 2025-2033

India Pharmacovigilance Market Overview:

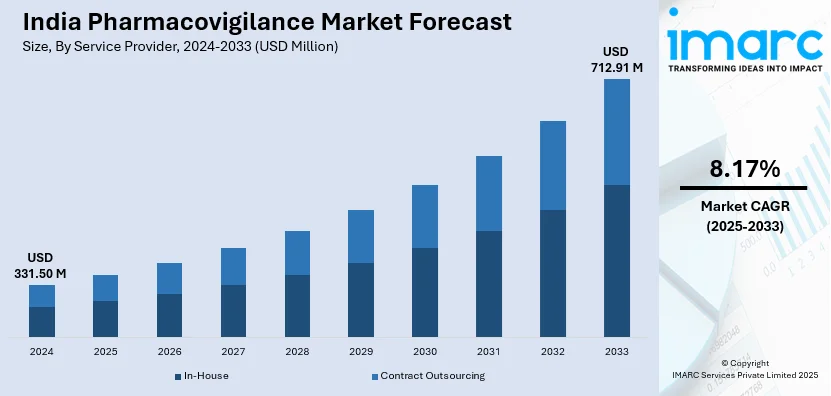

The India pharmacovigilance market size reached USD 331.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 712.91 Million by 2033, exhibiting a growth rate (CAGR) of 8.17% during 2025-2033. The market is growing with increasing drug consumption, tough regulatory requirements, higher adverse drug reaction (ADR) monitoring, and rising clinical trials. Demand for AI-based pharmacovigilance solutions, global collaborations, and real-time drug safety evaluation needs are also driving the growth of the market in the pharmaceutical industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 331.50 Million |

| Market Forecast in 2033 | USD 712.91 Million |

| Market Growth Rate 2025-2033 | 8.17% |

India Pharmacovigilance Market Trends:

Integration of Artificial Intelligence and Automation

The adoption of artificial intelligence (AI) and automation in pharmacovigilance is transforming drug safety monitoring in India. AI-powered tools enhance adverse event detection, improve data accuracy, and streamline case processing by analyzing vast datasets efficiently. These technologies assist in early signal detection, minimizing risks associated with delayed ADR reporting. Automation in pharmacovigilance workflows reduces human errors and increases efficiency in regulatory submissions. Machine learning algorithms are being employed to identify patterns in patient data, allowing predictive analytics to assess potential safety risks before they escalate. As regulatory bodies in India emphasize faster drug approval and post-market surveillance, AI-driven solutions are becoming essential in handling large-scale pharmacovigilance operations with greater precision and compliance. For instance, in November 2024, at the 2024 NAPT conference, AIIMS Bhopal’s pharmacology head emphasized AI’s role in improving pharmacovigilance by quickly detecting adverse drug reactions (ADRs). AI analyzes large datasets to identify hidden patterns, enhancing drug safety and refining prescribing practices. This innovation accelerates medical responses and supports the development of safer medications.

To get more information on this market, Request Sample

Growing Emphasis on Post-Marketing Surveillance

Post-marketing surveillance (PMS) has become a critical component of pharmacovigilance in India, driven by regulatory mandates and patient safety concerns. The Central Drugs Standard Control Organization (CDSCO) has strengthened guidelines for post-market drug monitoring, requiring pharmaceutical companies to conduct real-world evidence studies and periodic safety update reports. For instance, in August 2024, the Indian government prohibited 156 fixed-dose combination (FDC) drugs, citing a lack of therapeutic justification and potential risks to patients. This action affected major pharmaceutical companies like Torrent, Dr. Reddy’s, Sun Pharma, Cipla, and Alkem. The move is part of ongoing efforts to enhance drug regulatory procedures and ensure patient safety. The growing awareness of adverse drug reactions among healthcare professionals and patients has further emphasized the need for robust surveillance mechanisms. With increasing generic drug production and biosimilar approvals, continuous monitoring of drug efficacy and safety has become imperative. The implementation of electronic health records (EHRs) and pharmacovigilance databases facilitates real-time tracking of adverse events, ensuring proactive risk mitigation and regulatory compliance across the pharmaceutical landscape. In another example, in February 2025, the Union Health Ministry swiftly responded to reports of unapproved Tapentadol-Carisoprodol drug exports by Aveo Pharmaceuticals. A joint audit by CDSCO and Maharashtra FDA resulted in a Stop Activity Order, halting operations and seizing 1.3 crore tablets. A Stop Production Order was issued, and Export NOCs were revoked.

India Pharmacovigilance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service provider, product life cycle, type, process flow, therapeutic area, and end use.

Service Provider Insights:

- In-House

- Contract Outsourcing

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes in-house and contract outsourcing.

Product Life Cycle Insights:

- Pre-Clinical

- Phase I

- Phase II

- Phase III

- Phase IV

A detailed breakup and analysis of the market based on the product life cycle have also been provided in the report. This includes pre-clinical, phase I, phase II, phase III, and phase IV.

Type Insights:

- Spontaneous Reporting

- Intensified ADR Reporting

- Targeted Spontaneous Reporting

- Cohort Event Monitoring

- EHR Mining

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes spontaneous reporting, intensified ADR reporting, targeted spontaneous reporting, cohort event monitoring, and EHR mining.

Process Flow Insights:

- Case Data Management

- Case Logging

- Case Data Analysis

- Medical Reviewing and Reporting

- Signal Detection

- Adverse Event Logging

- Adverse Event Analysis

- Adverse Event Review and Reporting

- Risk Management System

- Risk Evaluation System

- Risk Mitigation System

A detailed breakup and analysis of the market based on the process flow have also been provided in the report. This includes case data management (case logging, case data analysis, and medical reviewing and reporting), signal detection (adverse event logging, adverse event analysis, and adverse event review and reporting), and risk management system (risk evaluation system and risk mitigation system).

Therapeutic Area Insights:

- Oncology

- Neurology

- Cardiology

- Respiratory Systems

- Others

A detailed breakup and analysis of the market based on the therapeutic area have also been provided in the report. This includes oncology, neurology, cardiology, respiratory systems, and others.

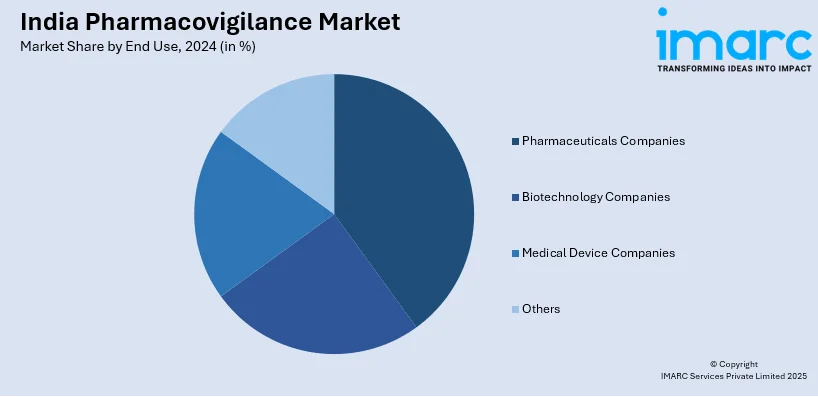

End Use Insights:

- Pharmaceuticals Companies

- Biotechnology Companies

- Medical Device Companies

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes pharmaceuticals companies, biotechnology companies, medical device companies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pharmacovigilance Market News:

- In February 2024, Ergomed Group Limited, a pharmacovigilance company that operates through its PrimeVigilance brand, expanded its presence in India by opening a new office in Pune, strengthening its global operations.

- In March 2025, Sun Pharma announced that it is acquiring Checkpoint Therapeutics for up to USD 355 Million, adding UNLOXCYT™ (cosibelimab-ipdl), an FDA-approved anti-PD-L1 treatment for advanced cutaneous squamous cell carcinoma, to its oncology portfolio. The acquisition strengthens Sun Pharma’s onco-dermatology franchise and accelerates global patient access. Moreover, once the acquisition is completed, Sun Pharma will be responsible for monitoring the safety profile of UNLOXCYT™ globally, leading to the expansion of the company’s pharmacovigilance obligations.

India Pharmacovigilance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | In-House, Contract Outsourcing |

| Product Life Cycles Covered | Pre-Clinical, Phase I, Phase II, Phase III, Phase IV |

| Types Covered | Spontaneous Reporting, Intensified ADR Reporting, Targeted Spontaneous Reporting, Cohort Event Monitoring, EHR Mining |

| Process Flows Covered |

|

| Therapeutic Areas Covered | Oncology, Neurology, Cardiology, Respiratory Systems, Others |

| End Uses Covered | Pharmaceuticals Companies, Biotechnology Companies, Medical Device Companies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pharmacovigilance market performed so far and how will it perform in the coming years?

- What is the breakup of the India pharmacovigilance market on the basis of service provider?

- What is the breakup of the India pharmacovigilance market on the basis of product life cycle?

- What is the breakup of the India pharmacovigilance market on the basis of type?

- What is the breakup of the India pharmacovigilance market on the basis of process flow?

- What is the breakup of the India pharmacovigilance market on the basis of therapeutic area?

- What is the breakup of the India pharmacovigilance market on the basis of end use?

- What are the various stages in the value chain of the India pharmacovigilance market?

- What are the key driving factors and challenges in the India pharmacovigilance market?

- What is the structure of the India pharmacovigilance market and who are the key players?

- What is the degree of competition in the India pharmacovigilance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pharmacovigilance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pharmacovigilance market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pharmacovigilance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)