India PIR Sensor Switch Market Size, Share, Trends and Forecast by Connectivity, Application, End User, and Region, 2025-2033

India PIR Sensor Switch Market Overview:

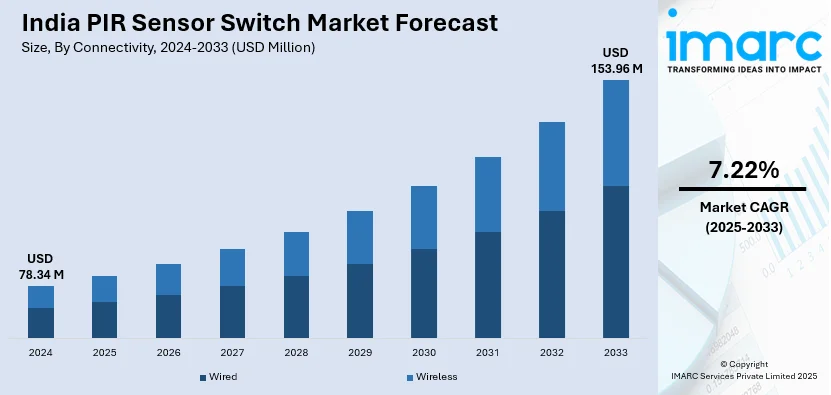

The India PIR sensor switch market size reached USD 78.34 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 153.96 Million by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The rising demand for energy-efficient lighting solutions, the advent of smart home automation, the need for enhanced building security, the launch of favorable government initiatives promoting smart cities and green buildings, and increased awareness regarding the importance of energy conservation and cost savings are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 78.34 Million |

| Market Forecast in 2033 | USD 153.96 Million |

| Market Growth Rate 2025-2033 | 7.22% |

India PIR Sensor Switch Market Trends:

Integration of PIR Sensors in Smart Home and Building Automation

The rapid adoption of smart homes and intelligent building management systems in India is significantly driving the demand for Passive Infrared (PIR) sensor switches. These motion-detection devices are increasingly integrated into home automation ecosystems to manage lighting, HVAC, and security systems based on occupancy, delivering both energy efficiency and user convenience. India’s smart home security market is projected to grow rapidly over the near-term. This surge is fueled by rising disposable incomes, urbanization, and growing interest in IoT-enabled devices. PIR sensor switches play a pivotal role by automating systems based on human presence, making them crucial in energy-conscious households and commercial spaces, where electricity can account for up to 20% of monthly costs. Government initiatives, such as the Smart Cities Mission and the Energy Conservation Building Code (ECBC), are also mandating energy-efficient technologies, including occupancy-based lighting. Additionally, increasing compatibility with platforms like Alexa, Google Home, and Zigbee is cementing PIR sensor switches as key components in India’s expanding smart infrastructure.

To get more information on this market, Request Sample

Rise in Demand for Contactless Solutions in Commercial and Public Infrastructure

The rising demand for contactless and automated solutions across India’s public infrastructure and commercial spaces is propelling the widespread adoption of PIR sensor switches. These motion-sensing devices are increasingly implemented in offices, malls, hospitals, airports, and educational institutions to enable hygienic, touch-free lighting control. The majority of new commercial projects in Tier 1 cities are incorporating PIR-based systems for lighting and ventilation, driven by heightened hygiene awareness and the need to reduce surface contact in shared environments. Supporting this shift, the Ministry of Electronics and Information Technology (MeitY) reported a 30% rise in public infrastructure automation between 2023 and 2025, particularly in transport hubs and healthcare sectors, where PIR sensors play a pivotal role. Beyond hygiene, these sensors contribute to substantial energy savings. Urban planners and municipal bodies are also deploying PIR-based lighting in public washrooms and streetlights to enhance safety and reduce energy consumption. As India continues to prioritize smart, clean, and efficient infrastructure, the PIR sensor switch market is gaining strong traction in both new developments and retrofitting projects.

India PIR Sensor Switch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on connectivity, application, and end user.

Connectivity Insights:

- Wired

- Wireless

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes wired and wireless.

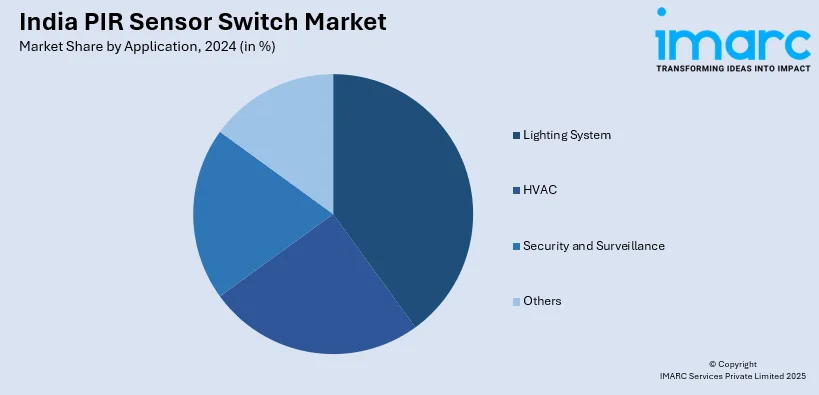

Application Insights:

- Lighting System

- HVAC

- Security and Surveillance

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes lighting system, HVAC, security and surveillance, and others.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India PIR Sensor Switch Market News:

- February 2025: The Indian Defense Research Wing (IDRW) unveiled the Infrared Search and Track (IRST) system for the Tejas MkII program at Aero India 2025. The technology, a broad Field-of-View (FOV) aerial surveillance system based on a passive infrared sensor, is likely to be integrated into the Tejas MkII prototype, which is set to launch later the same year.

- February 2023: UK-based Faradite launched its Motion Sensor 360 – KNX in India, featuring a compact 49mm diameter and advanced PIR sensing technology. Tailored for KNX smart home systems, the sensor supports four independent functions—such as switching, dimming, HVAC control, and scene setting—with customizable day/night modes and brightness-based automation.

India PIR Sensor Switch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connectivities Covered | Wired, Wireless |

| Applications Covered | Lighting System, HVAC, Security and Surveillance, Others |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India PIR sensor switch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India PIR sensor switch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India PIR sensor switch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India PIR sensor switch market was valued at USD 78.34 Million in 2024.

The India PIR sensor switch market is projected to exhibit a CAGR of 7.22% during 2025-2033, reaching a value of USD 153.96 Million by 2033.

The India PIR sensor switch market is driven by increasing smart home adoption and energy-efficient lighting, where these motion-activated devices reduce electricity use and enhance automation. Government-backed smart city initiatives and green building codes further boost deployment. In commercial and public sectors, demand for contactless, hygienic solutions propels growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)