India Pneumococcal Vaccine Market Size, Share, Trends, and Forecast by Vaccine Type, Product Type, Distribution Channel, End User, and Region, 2025-2033

India Pneumococcal Vaccine Market Overview:

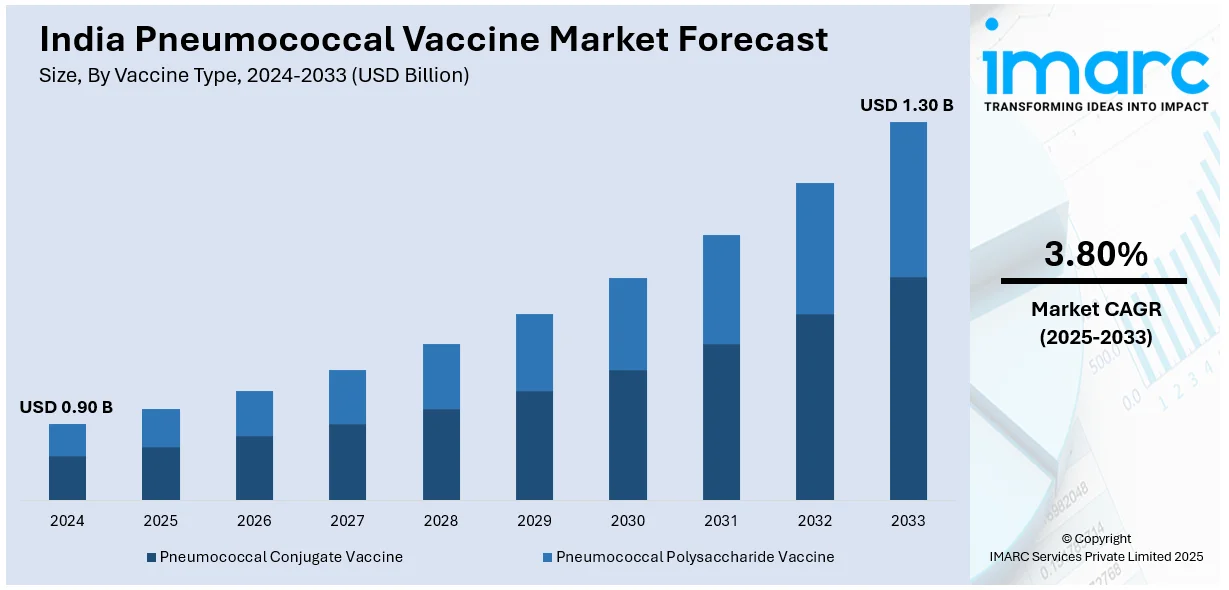

The India pneumococcal vaccine market size reached USD 0.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.30 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is witnessing significant growth due to increasing awareness of vaccine-preventable diseases, rising healthcare access, and government immunization programs. Additionally, the market is driven by an enhanced focus on preventing pneumococcal infections, particularly in children and elderly populations, with an expanding range of vaccine options available.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.90 Billion |

| Market Forecast in 2033 | USD 1.30 Billion |

| Market Growth Rate 2025-2033 | 3.80% |

India Pneumococcal Vaccine Market Trends:

Government-Led Vaccination Programs

India’s pneumococcal vaccine market is expanding due to strong government intervention in immunization programs. Government-backed procurement and distribution have improved accessibility, reducing pneumonia-related mortality and morbidity. With continuous policy reinforcements, coverage is expected to increase further, particularly in rural areas where child mortality remains a concern. Additionally, partnerships between government agencies and vaccine manufacturers ensure stable supply chains, making vaccines more affordable. The expansion of routine immunization campaigns and increased healthcare funding for disease prevention are reinforcing market growth. For instance, in February 2024, the Government of Jharkhand announced that between November 2024 and February 2025, it administered 1.99 million pneumococcal conjugate vaccine doses under the SAANS campaign. This initiative aimed to reduce childhood pneumonia deaths by expanding vaccination coverage among children under five. Furthermore, future policies may focus on broader adult immunization, targeting high-risk groups like the elderly and individuals with chronic conditions. As India strengthens its public healthcare infrastructure, the pneumococcal vaccine market is poised to benefit from sustained government support, improving long-term disease control and prevention efforts nationwide.

To get more information on this market, Request Sample

Growing Indigenous Manufacturing and Cost Efficiency

India’s pneumococcal vaccine market has witnessed a shift toward domestic production, reducing reliance on costly imports. The introduction of locally produced PCVs has enhanced accessibility, particularly in low-income regions where cost remains a barrier. Domestic manufacturing also enables large-scale production, ensuring a consistent supply to meet rising demand. Moreover, India’s vaccine exports are also increasing, with these affordable alternatives gaining traction in global immunization programs. Additionally, continued investment in research and development (R&D) will enhance vaccine efficacy and adaptability, addressing regional serotype variations. For instance, in July 2024, Biological E. Limited announced the progression of Phase IV clinical trials for its 14-valent pneumococcal polysaccharide conjugate vaccine (PNEUBEVAX-14). The trials, approved in October 2024, aim to evaluate the immunogenicity and safety of the vaccine in healthy children aged 5 to under 18 and adults aged 18 and above. As domestic manufacturers scale up production, India’s pneumococcal vaccine market is likely to grow steadily, with affordability and availability driving higher immunization rates across diverse population segments.

India Pneumococcal Vaccine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vaccine type, product type, distribution channel, and end user.

Vaccine Type Insights:

- Pneumococcal Conjugate Vaccine

- Pneumococcal Polysaccharide Vaccine

The report has provided a detailed breakup and analysis of the market based on the vaccine type. This includes pneumococcal conjugate vaccine and pneumococcal polysaccharide vaccine.

Product Type Insights:

- Prevnar 13

- Synflorix

- Pneumovax 23

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes prevnar 13, synflorix, and pneumovax 23.

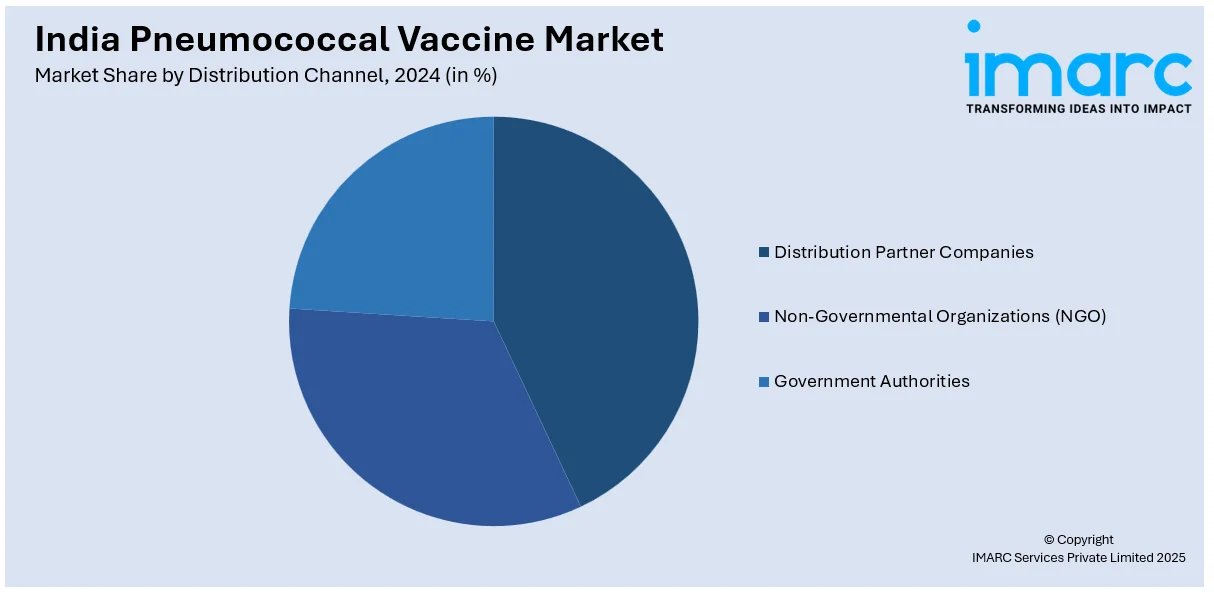

Distribution Channel Insights:

- Distribution Partner Companies

- Non-Governmental Organizations (NGO)

- Government Authorities

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes distribution partner companies, non-governmental organizations (NGO), and government authorities.

End User Insights:

- Pediatrics

- Adults

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes pediatrics and adults.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pneumococcal Vaccine Market News:

- In November 2024, Abbott India announced the launch of the PneumoShield 14, a 14-valent pneumococcal conjugate vaccine for children over six weeks old. This vaccine provides broader protection than PCV-10 and PCV-13, covering 14 strains. This development underscores Abbott's commitment to strengthening its pediatric portfolio and enhancing child health in India.

India Pneumococcal Vaccine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vaccine Types Covered | Pneumococcal Conjugate Vaccine, Pneumococcal Polysaccharide Vaccine |

| Product Types Covered | Prevnar 13, Synflorix, Pneumovax 23 |

| Distribution Channels Covered | Distribution Partner Companies, Non-Governmental Organizations (NGO), Government Authorities |

| End Users Covered | Pediatrics, Adults |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pneumococcal vaccine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pneumococcal vaccine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pneumococcal vaccine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India pneumococcal vaccine market size reached USD 0.90 Billion in 2024.

The India pneumococcal vaccine market is expected to reach USD 1.30 Billion by 2033, exhibiting a CAGR of 3.80% during 2025-2033.

The India pneumococcal vaccine market is driven by rising awareness about immunization, government vaccination programs, increasing healthcare expenditure, and the growing incidence of pneumococcal diseases among children and the elderly.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)