India Polyamide Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

India Polyamide Market Overview:

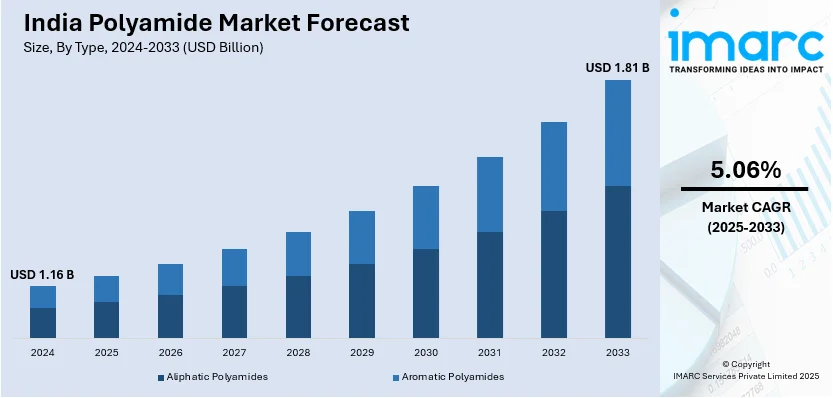

The India polyamide market size reached USD 1.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.81 Billion by 2033, exhibiting a growth rate (CAGR) of 5.06% during 2025-2033. The market is growing due to rising polyamide demand in the automotive, electronics, and packaging industries, increasing adoption of lightweight materials for fuel efficiency, advancements in polymer technology, and government initiatives promoting domestic manufacturing and sustainability efforts in nylon-based materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.16 Billion |

| Market Forecast in 2033 | USD 1.81 Billion |

| Market Growth Rate (2025-2033) | 5.06% |

India Polyamide Market Trends:

Expansion of the Automotive Industry and Demand for Lightweight Materials

The Indian automotive sector has been a major consumer of polyamides due to their favorable properties, such as high mechanical strength, thermal stability, and chemical resistance. As the industry strives for fuel efficiency and reduced emissions, there's a growing emphasis on lightweight materials. Polyamides serve as ideal substitutes for metal components, contributing to vehicle weight reduction. In September 2024, the total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 27,73,039 units. The burgeoning growth of the automotive industry is propelling the demand for these materials. Moreover, the push for fuel-efficient vehicles has led to increased adoption of polyamides to replace heavier metal parts, aligning with global sustainability goals, and thereby creating a positive outlook for market expansion.

To get more information on this market, Request Sample

Rise of Bio-Polyamides and Sustainable Practices

Growing environmental concerns and sustainability initiatives are driving the development and adoption of bio-based polyamides in India. A survey by PwC India found that 46% of Indian consumers consider climate change a major threat, leading 60% to adopt more sustainable behaviors. Additionally, consumers are willing to pay a 13.1% premium for sustainably sourced products, reflecting a strong market shift toward eco-friendly alternatives. Bio-polyamides, derived from renewable resources, offer a significantly lower carbon footprint than traditional petroleum-based polyamides. As a result, numerous industries, such as automotive, textiles, and packaging, are increasingly integrating these sustainable materials to align with both regulatory mandates and evolving consumer preferences. The Indian government’s emphasis on sustainable industrial practices, including initiatives promoting biodegradable materials and circular economy strategies, has further accelerated the adoption of bio-polyamides. Moreover, multinational corporations and domestic manufacturers are investing in R&D to enhance the performance and cost-effectiveness of bio-based polyamides. In 2024, sustainability investments saw a significant boost among Indian corporate leaders, with 91% of CXOs reporting an increase in spending. This trend is expected to drive further innovation, ensuring wider application across various industries.

India Polyamide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Aliphatic Polyamides

- Aromatic Polyamides

The report has provided a detailed breakup and analysis of the market based on the type. This includes aliphatic polyamides and aromatic polyamides.

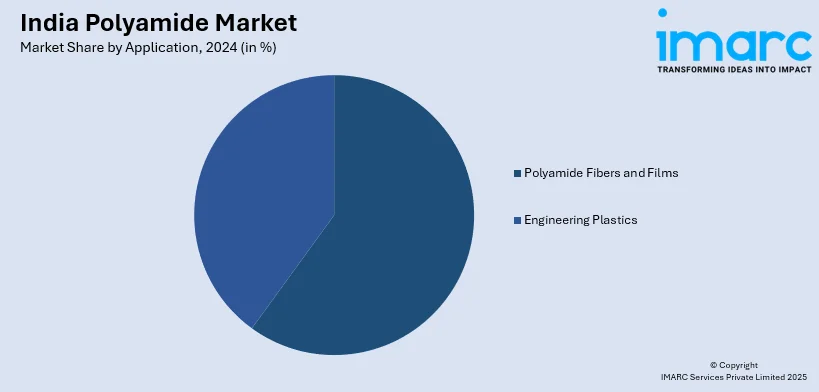

Application Insights:

- Polyamide Fibers and Films

- Engineering Plastics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes polyamide fibers and films, and engineering plastics.

End Use Industry Insights:

- Automotive

- Electrical and Electronics

- Textile

- Construction

- Packaging

- Consumer Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electrical and electronics, textile, construction, packaging, consumer goods, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polyamide Market News:

- January 2025: JPFL Films Private Limited, a subsidiary of the BC Jindal Group, introduced Biaxially Oriented Polyamide (BOPA) nylon films. A strategic step to support the company's growth, JPFL Films Private Limited spent Rs 120 crore in its state-of-the-art facility in Nasik, in line with the government's 'Make in India' policy.

- May 2024: BASF India Limited expanded the production capacity of its Ultradur polybutylene terephthalate (PBT) and Ultramid polyamide (PA) compounding plants located in Thane, Maharashtra, and Panoli, Gujarat. The Polyurethane Technical Development Center India will help the market grow for polyurethane applications in sectors like furniture, appliances, construction, footwear, and transportation.

India Polyamide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aliphatic Polyamides, Aromatic Polyamides |

| Applications Covered | Polyamide Fibers and Films, Engineering Plastics |

| End Use Industries Covered | Automotive, Electrical and Electronics, Textile, Construction, Packaging, Consumer Goods, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polyamide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polyamide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polyamide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India polyamide market was valued at USD 1.16 Billion in 2024.

The India polyamide market is projected to exhibit a (CAGR) of 5.06% during 2025-2033, reaching a value of USD 1.81 Billion by 2033.

The India polyamide market is driven by increasing demand from automotive, electronics, textiles, and packaging sectors. Factors include growing industrialization, rising need for lightweight and durable materials, advances in polymer technology, and the shift toward sustainable materials. Government initiatives and expanding domestic manufacturing also support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)