India Polyester Staple Fiber Market Size, Share, Trends and Forecast by Origin, Product, Application, and Region, 2025-2033

India Polyester Staple Fiber Market Size and Share:

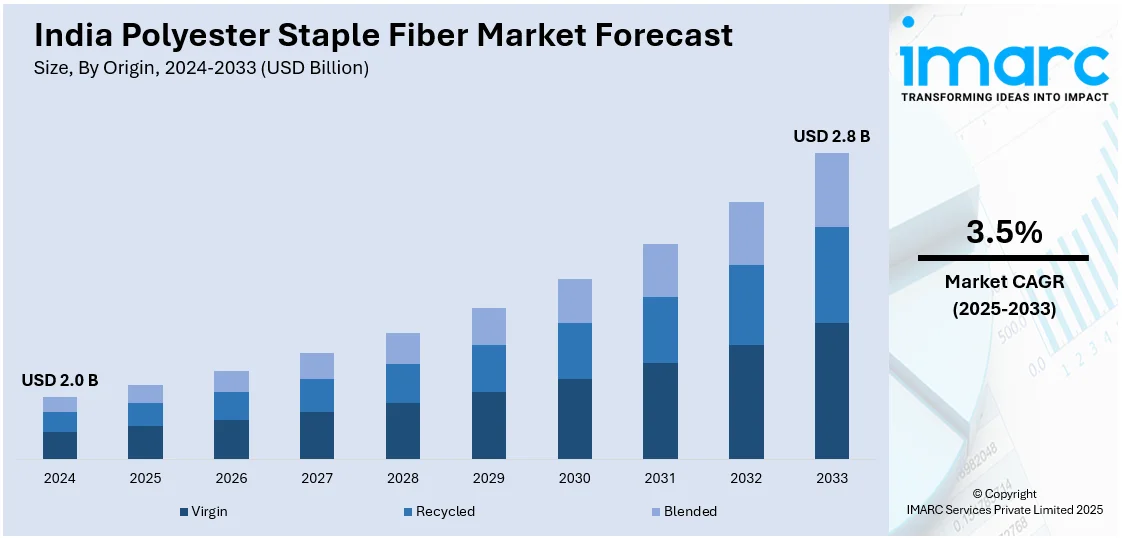

The India polyester staple fiber market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The rising demand from the textile and apparel industry, growth in non-woven applications like hygiene and automotive, increasing preference for recycled polyester, government support for synthetic fiber production, and cost advantages over natural fibers are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Market Growth Rate 2025-2033 | 3.5% |

India Polyester Staple Fiber Market Trends:

Shift toward Modernized PSF Manufacturing

India’s polyester staple fiber (PSF) sector is undergoing rapid modernization as manufacturers increasingly adopt advanced machinery to upgrade production capabilities. This shift is driven by the need for higher efficiency, consistent quality, and reduced dependency on imported fibers and equipment. Companies are enhancing their technological base to meet rising domestic and export demands for synthetic fibers, especially in technical textiles and performance apparel. The movement aligns with national objectives promoting industrial self-reliance and manufacturing growth. With investments focused on high-output, energy-efficient systems, the PSF industry is positioning itself to compete globally while supporting sustainability goals. This operational upgrade is expected to boost domestic capacity, lower production costs, and encourage innovation across the synthetic textile value chain. For example, in August 2024, India witnessed rising interest in Oerlikon Barmag’s machinery as manufacturers expanded polyester staple fiber production. Investments in advanced yarn systems aimed to boost quality, efficiency, and self-reliance. The shift supported the country's efforts to modernize synthetic fiber manufacturing under the Make in India initiative, strengthening domestic PSF capacity and reducing reliance on imports for high-performance textile applications.

To get more information on this market, Request Sample

Rising Focus on Recycled PSF Production

India is witnessing increased focus on recycled polyester staple fiber (PSF) manufacturing as part of broader efforts to promote sustainable textile production. New capacity additions are being planned to strengthen the availability of eco-friendly raw materials for domestic use. These developments support circular economy practices by utilizing post-consumer PET waste to produce high-quality fibers for textile and non-woven applications. With rising demand for sustainable materials in fashion and technical textiles, companies are investing in large-scale, efficient facilities dedicated to recycled PSF. This shift is expected to reduce environmental impact, lower dependence on virgin polyester, and enhance India’s position in the global recycled fiber market. The move also aligns with government initiatives promoting sustainability and resource-efficient manufacturing practices. For instance, in September 2024, Ganesha Ecosphere formed a joint venture with Thailand-based Indorama Ventures to strengthen recycled polyester staple fiber production in India. The new entity, Ganesha Ecotech Private Limited, would set up a manufacturing facility with an annual capacity of 30,000 tonnes. This move is expected to boost India’s recycled PSF market, support circular economy goals, and enhance the domestic availability of sustainable raw materials for textile and non-woven applications.

India Polyester Staple Fiber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on origin, product, and application.

Origin Insights:

- Virgin

- Recycled

- Blended

The report has provided a detailed breakup and analysis of the market based on the origin. This includes virgin, recycled, and blended.

Product Insights:

- Solid

- Hollow

The report has provided a detailed breakup and analysis of the market based on the product. This includes solid and hollow.

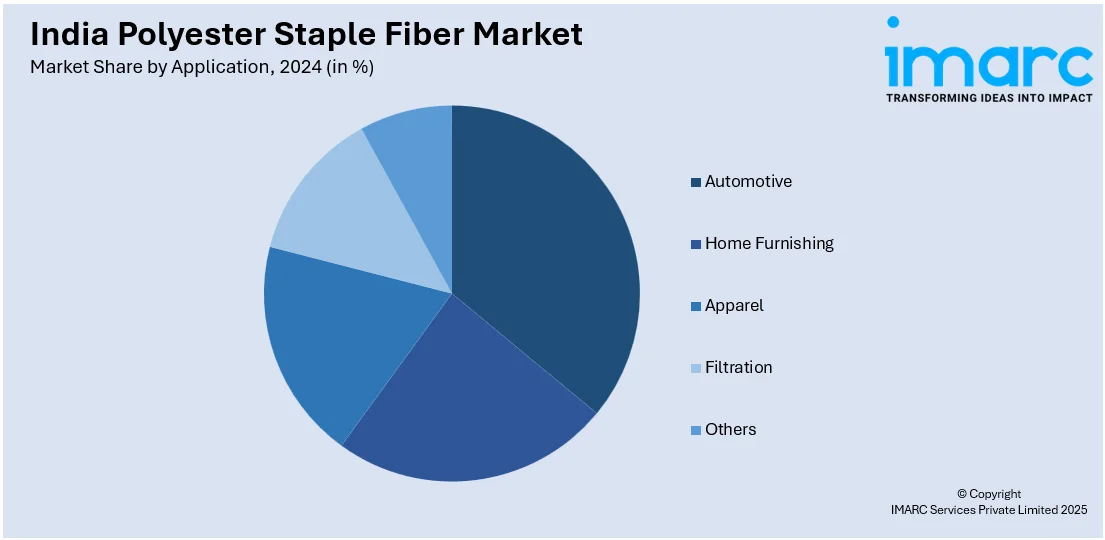

Application Insights:

- Automotive

- Home Furnishing

- Apparel

- Filtration

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, home furnishing, apparel, filtration, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polyester Staple Fiber Market News:

- In June 2024, the Indian government relaxed the quality control order (QCO) for polyester fibers, easing import norms for textile manufacturers. The move would benefit small and medium units reliant on imported raw materials, especially polyester staple fiber. Industry stakeholders believe the extension would support uninterrupted production, stabilize input costs, and provide more time for companies to meet BIS standards without affecting manufacturing operations or export commitments.

India Polyester Staple Fiber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Origins Covered | Virgin, Recycled, Blended |

| Products Covered | Solid and Hollow |

| Applications Covered | Automotive, Home Furnishing, Apparel, Filtration, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India polyester staple fiber market performed so far and how will it perform in the coming years?

- What is the breakup of the India polyester staple fiber market on the basis of origin?

- What is the breakup of the India polyester staple fiber market on the basis of product?

- What is the breakup of the India polyester staple fiber market on the basis of application?

- What are the various stages in the value chain of the India polyester staple fiber market?

- What are the key driving factors and challenges in the India polyester staple fiber market?

- What is the structure of the India polyester staple fiber market and who are the key players?

- What is the degree of competition in the India polyester staple fiber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polyester staple fiber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polyester staple fiber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polyester staple fiber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)