India Polyisobutylene Market Size, Share, Trends and Forecast by Product, End Use Industry, Application, and Region, 2025-2033

India Polyisobutylene Market Overview:

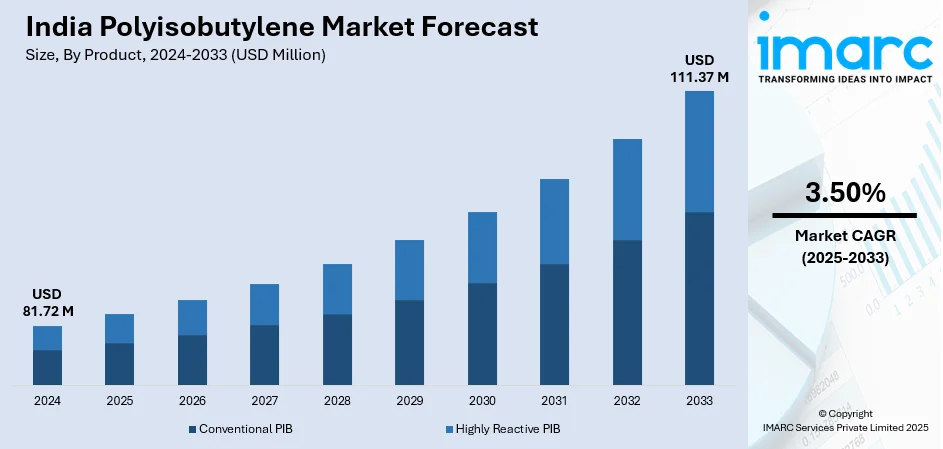

The India polyisobutylene market size reached USD 81.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 111.37 Million by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The rising product demand in automotive applications, particularly for fuel additives and lubricants, the expanding pharmaceutical, and the increasing investments in sustainable and high-performance synthetic rubber are among the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 81.72 Million |

| Market Forecast in 2033 | USD 111.37 Million |

| Market Growth Rate 2025-2033 | 3.50% |

India Polyisobutylene Market Trends:

Expansion of the Adhesives and Sealants Industry

India’s adhesives and sealants market has experienced remarkable growth, driven by rapid urbanization and expansion in construction and infrastructure. Polyisobutylene, valued for its flexibility and impermeability, is a key component in pressure-sensitive and hot-melt adhesives used for sealing joints, protecting electrical wiring, and preventing moisture ingress. With India’s urban population expected to cross 500 million by 2025, the rising number of residential and commercial construction projects has fueled the demand for advanced adhesives and sealants. The National Investment Pipeline (NIP) has earmarked USD 1.4 trillion for infrastructure development, with major investments in renewable energy, roads, highways, urban infrastructure, and railways. Additionally, India’s office market is projected to achieve record leasing activity in 2025, with gross leasing expected to hit 65-70 million square feet, further driving the need for durable sealants. Government initiatives like the "Smart Cities Mission" and Pradhan Mantri Awas Yojana-Urban (PMAY-U), which has sanctioned 1.18 crore houses, have also intensified demand, leading to a significant rise in polyisobutylene-based adhesive consumption.

To get more information on this market, Request Sample

Increasing Demand for High-Performance Lubricants in the Automotive Sector

India’s automotive industry continues its strong growth trajectory, establishing the nation as a key global automobile producer. Polyisobutylene plays a vital role in this sector, particularly in high-performance lubricants and fuel additives, enhancing viscosity, reducing engine deposits, and improving fuel efficiency. According to the Organization Internationale des Constructeurs d'Automobiles (OICA), India’s automotive production surged by 30% in 2021, reaching 4,399,112 units, followed by a 24% rise in 2022, totaling 5.45 million units. This sharp increase in vehicle manufacturing has directly driven the demand for lubricants, amplifying polyisobutylene consumption. By the end of 2025, India’s electric vehicle (EV) market is projected to witness a major shift, with EV launches outpacing petrol and diesel models, potentially doubling EV sales to 4% of total car sales and contributing 200,000 units to the passenger vehicle segment. Despite fewer moving parts, EVs still require specialized lubricants, further increasing the demand for polyisobutylene-based formulations. Additionally, growing concerns over fuel efficiency and emission reduction have accelerated the adoption of polyisobutylene-based additives, positioning the lubricant additives segment for substantial expansion.

India Polyisobutylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, application, and end use industry.

Product Insights:

- Conventional PIB

- Highly Reactive PIB

The report has provided a detailed breakup and analysis of the market based on the product. This includes conventional PIB and highly reactive PIB.

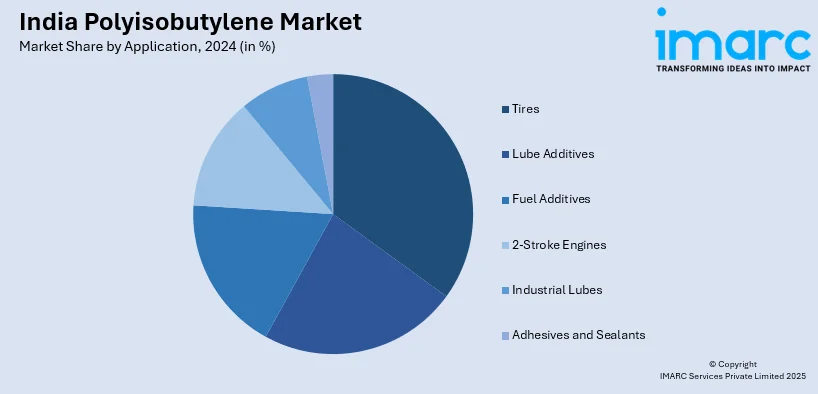

Application Insights:

- Tires

- Lube Additives

- Fuel Additives

- 2-Stroke Engines

- Industrial Lubes

- Adhesives and Sealants

The report has provided a detailed breakup and analysis of the market based on the application. This includes tires, lube additives, fuel additives, 2-stroke engines, industrial lubes, and adhesives and sealants.

End Use Industry Insights:

- Transportation Sector

- Industrial

- Food

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes transportation sector, industrial, food, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Polyisobutylene Market News:

- December 2024: Gulf Oil Lubricants India partnered with Nayara Energy, India's largest private fuel retailer, to distribute its automotive lubricants across over 6,500 fuel stations nationwide. This three-year alliance aims to enhance Gulf Oil's market presence by leveraging Nayara's extensive network, catering to the growing automotive sector and expanding highway infrastructure. The collaboration also includes the exclusive retailing of Gulf Oil's AdBlue, a diesel exhaust fluid that reduces emissions, and a specialized range of two-wheeler batteries.

- August 2024: Henkel Anand India Private Limited (HAIPL) began expanding its sealing solutions that improve vehicle safety and comfort. By engaging with manufacturers from the design phase, HAIPL began providing advanced sealants and structural adhesives that contribute to vehicle lightweighting and crash resilience. Their high-crash-resistant structural adhesives are designed to resist cracks, carry greater loads, and diminish impact energy, thereby meeting stringent crash safety requirements.

India Polyisobutylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Conventional PIB, Highly Reactive PIB |

| Applications Covered | Tires, Lube Additives, Fuel Additives, 2-Stroke Engines, Industrial Lubes, Adhesives and Sealants |

| End Use Industries Covered | Transportation Sector, Industrial, Food, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India polyisobutylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India polyisobutylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India polyisobutylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polyisobutylene market in India was valued at USD 81.72 Million in 2024.

The India polyisobutylene market is projected to exhibit a CAGR of 3.50% during 2025-2033, reaching a value of USD 111.37 Million by 2033.

The growth of the India polyisobutylene market is driven by increasing demand from the automotive industry for fuel additives, lubricants, and tire production. The expansion of the construction sector for sealants and adhesives further contributes. Additionally, the rising need for polyisobutylene in manufacturing high-performance polymers and the growth in consumer electronics for insulation materials play significant roles in market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)