India Portable Oxygen Concentrators Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

India Portable Oxygen Concentrators Market Overview:

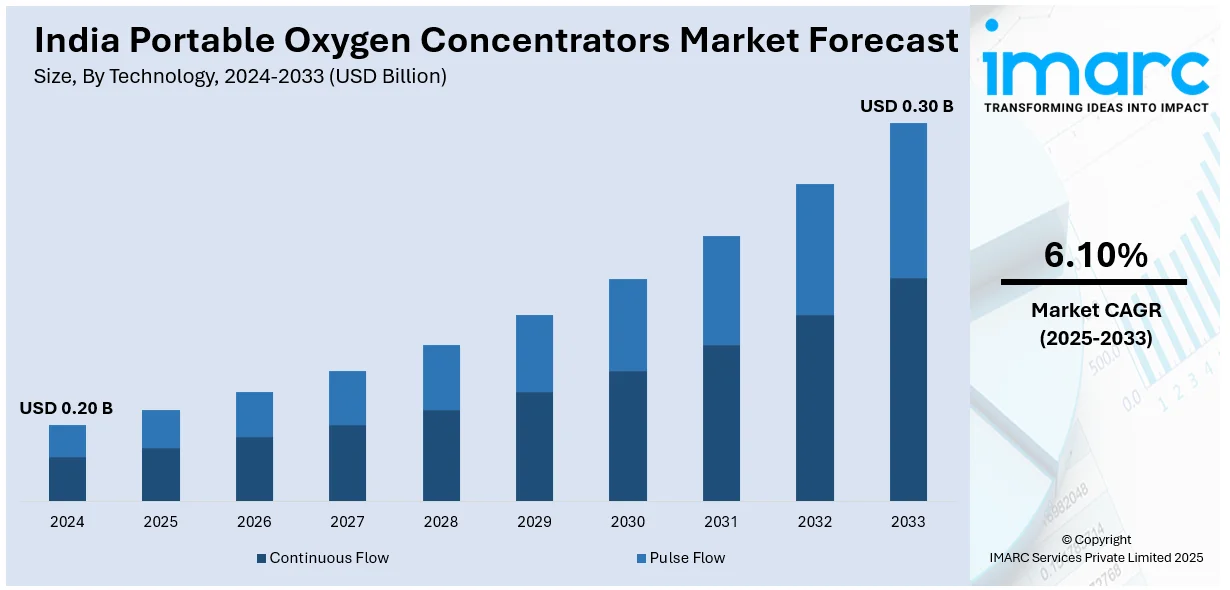

The India portable oxygen concentrators market size reached USD 0.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.30 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The market is fueled by growing respiratory diseases, accelerating demand for home oxygen therapy, technological innovation, growing rural penetration, and affordability programs, with a greater emphasis on energy-efficient, compact, and high-performance devices to meet varied patient requirements in urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.20 Billion |

| Market Forecast in 2033 | USD 0.30 Billion |

| Market Growth Rate (2025-2033) | 6.10% |

India Portable Oxygen Concentrators Market Trends:

Growing Demand for Home Healthcare Solutions

The rising incidence of respiratory conditions such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea is fueling the demand for portable oxygen concentrators (POCs) in India. Patients opt for small, lightweight devices that enable them to treat their oxygen requirement without being tied to a medical facility. For instance, in September 2024, Oxymed launched the P2 Portable Oxygen Concentrator in India, with a weight of 1.98 kg and oxygen purity of 90-95%, five pulse flow rates, and battery life of up to 10 hours.Moreover, urbanization and lifestyle changes have also favored home-based treatments, lessening the reliance on hospitals. The presence of POCs with sophisticated filtration systems, variable oxygen flow settings, and enhanced battery life has led to them being a desirable choice for patients needing long-term oxygen therapy. Further, the improving availability of the devices through offline and online sources has also spurred their use. The Indian healthcare sector's trend towards decentralized care, coupled with enhanced affordability and financing, is set to propel sustained demand for portable oxygen concentrators in urban as well as rural regions.

To get more information on this market, Request Sample

Advancements in Lightweight and Energy-Efficient Designs

Advances in technology for portable oxygen concentrators (POCs) aim to reduce devices to lighter, smaller, and energy-efficient sizes to improve patients' mobility and ease of movement. New concentrators incorporate long-life batteries, enabling patients to move about without needing to recharge them repeatedly. Advances in miniaturization have resulted in smaller concentrators with high oxygen flow rates to provide effective therapy for patients with different oxygen requirements. In addition, energy-efficient versions are being developed to require less power consumption, thus ideal for application in regions with an unstable electricity supply. The inclusion of smart technology, including digital screens and real-time oxygen tracking, is further enhancing user experience through enhanced control over therapy options. While research and development (R&D) efforts on minimizing noise output and maximizing durability continue, future generations of POCs should be even more user-friendly for patients, thereby facilitating wider uptake among various demographic groups.

Expanding Rural Accessibility and Affordability

The use of portable oxygen concentrators (POCs) in India is growing beyond metropolitan areas, with increased attempts to enhance availability in rural and semi-urban areas. The rising prevalence of respiratory ailments in these areas, along with poor access to sophisticated healthcare centers, is fuelling demand for cost-effective and effective oxygen therapy solutions. Government programs and healthcare initiatives are encouraging subsidies and awareness, ensuring that patients in underserved areas have better access to POCs. Local manufacturing has also increased, and cost savings have been achieved, which has paved the way for more affordable models to become available. The creation of strong distribution channels and internet-based sales sites has also ensured easier access, as patients can buy concentrators without having to travel long distances. With enhanced healthcare infrastructure and funding facilities like equated monthly installment (EMI) plans and rental services, rural communities are highly getting access to life-improving oxygen therapy solutions.

India Portable Oxygen Concentrators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, application, end user.

Technology Insights:

- Continuous Flow

- Pulse Flow

The report has provided a detailed breakup and analysis of the market based on the technology. This includes continuous flow and pulse flow.

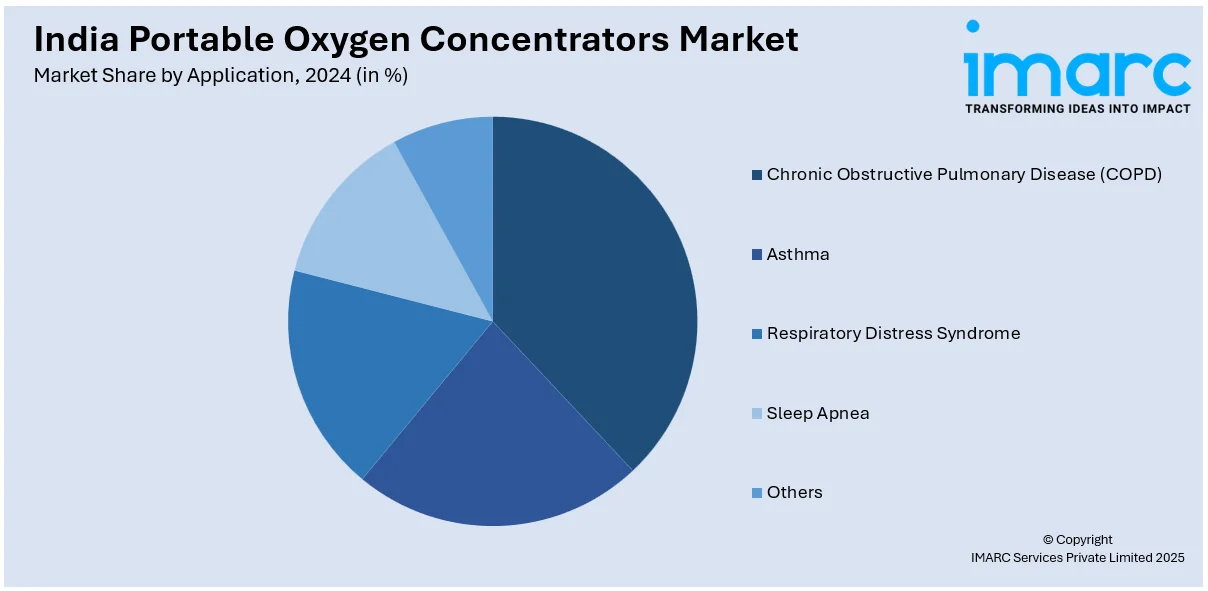

Application Insights:

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Respiratory Distress Syndrome

- Sleep Apnea

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chronic obstructive pulmonary disease (COPD), asthma, respiratory distress syndrome, sleep apnea, and others.

End User Insights:

- Hospitals

- Ambulatory Surgery Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgery centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Portable Oxygen Concentrators Market News:

- In April 2024, GCE introduced the Zen-O™ portable oxygen concentrator in India, delivering up to 2 LPM of oxygen continuously and in pulse mode. The device weighs 4.66 kg and is FAA approved, Rate Responsive Therapy™ enabled, and has a field-replaceable sieve bed for effective oxygen therapy and improved patient mobility.

- In March 2024, Philips introduced the EverFlo Oxygen Concentrator in India, a light, energy-saving device providing 93% oxygen purity at 0.5-5 LPM flow rate. It offers low maintenance, quietness, and lower environmental footprint, promoting cost-effective and dependable oxygen therapy for home and medical applications .

India Portable Oxygen Concentrators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Continuous Flow, Pulse Flow |

| Applications Covered | Chronic Obstructive Pulmonary Disease (COPD), Asthma, Respiratory Distress Syndrome, Sleep Apnea, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India portable oxygen concentrators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India portable oxygen concentrators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India portable oxygen concentrators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India portable oxygen concentrators market was valued at USD 0.20 Billion in 2024.

The India portable oxygen concentrators market is projected to exhibit a CAGR of 6.10% during 2025-2033, reaching a value of USD 0.30 Billion by 2033.

The India portable oxygen concentrator market is driven by rising respiratory illnesses, increasing geriatric population, and growing health awareness post-pandemic. Demand is further boosted by improved healthcare infrastructure, better affordability of medical devices, and expanding use in homecare and emergency medical services. Technological advancements and easier financing also support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)