India Potato Chips Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Potato Chips Market Overview:

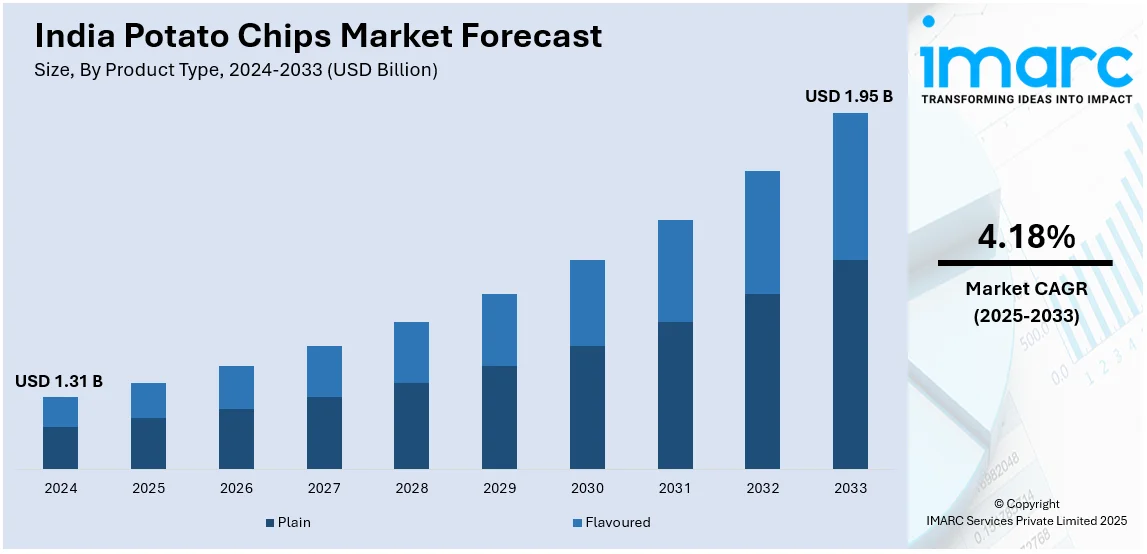

The India potato chips market size reached USD 1.31 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.95 Billion by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The market is growing due to the increased consumer demand for convenient snacks, rising urbanization, changing tastes, and greater availability across offline and online channels, with innovation, premiumization, and healthier options gaining emphasis fueling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.31 Billion |

| Market Forecast in 2033 | USD 1.95 Billion |

| Market Growth Rate (2025-2033) | 4.18% |

India Potato Chips Market Trends:

Growing Demand for Healthier Potato Chips

India potato chips market is shifting towards healthier versions as consumers grow more aware of their food habits. Demand for low-fat, baked, and air-fried chips is rising, targeting people seeking lower-calorie snacking options. For instance, in August 2024, Sabatino Nutrition Private Limited joined forces with Nesto Hypermarket to increase its McKrunch potato chips product line in Kerala, bolstering India's made potato chips industry with new flavors such as moong lentil and chana-based chips. Moreover, brands are also adding natural ingredients such as Himalayan salt, olive oil, and vegetable-based flavorings to cater to health-oriented consumers. Also, organically cultivated potato chips without artificial preservatives are picking up among city consumers. As awareness about lifestyle diseases like obesity and heart disease increases, there is a demand for snacks with reduced sodium and trans fat content. Increasing popularity of fitness culture and clean eating also supports this demand. Consequently, companies are launching new products with high fiber, protein, and lower oil content to appeal to a wider range of consumers without compromising taste and texture.

To get more information on this market, Request Sample

Expansion of Regional and Ethnic Flavors

Indian potato chips market is changing with an increase in demand for ethnic and regional flavors, which are representative of the country's varied food choices. Classic spices and flavorings deriving from local food cultures, including masala, peri-peri, and tandoori, are gaining popularity. Other flavors like curry, chaat masala, and mustard-based flavorings are also meeting the increased demand for true Indian flavors. Consumers increasingly gravitate towards chips that offer a comforting yet adventurous snacking experience, fueling innovation in season blends. With a growing young demographics and evolving palates, companies are playing with fusion flavors, blending Indian spices with international flavors such as cheese, barbecue, and sour cream. Demand for spicy, tangy, and bold continues to grow, and regional authenticity emerges as the differentiator. For example, in March 2024, Lay's broadened its Wafer Chips range in India with a spicy Red Chilli taste, appealing to those who crave spicy snacks and affirming PepsiCo India's focus on product innovation inspired by culture. Furthermore, this trend will influence future product launches to meet both local and global markets looking for Indian-inspired flavors.

Rise of Premium and Gourmet Potato Chips

Premiumization is transforming the Indian potato chips segment because consumers are looking for good quality, gourmet snacking experiences. There is increasing demand for chips prepared using specialty potatoes like purple and sweet potatoes, which provide distinct textures and nutritional advantages. Hand-cooked and kettle-cooked chips are also becoming popular because of their better crunch and artisanal character. Further, consumers are also willing to pay extra for exotic tastes, truffle-seasoned varieties, and healthier oils, such as avocado or coconut oil for frying the chips. Minimal processing methods and natural spices also add to the perception of quality. With growing disposable incomes, urban consumers are increasingly favoring indulgent snacking experiences that are both rich in taste and exclusivity. The move towards premium potato chips is also driven by gifting patterns, as fashionable packaging and gourmet products are good-looking gifts. This category is likely to see sustained growth as consumers want a balance of indulgence and quality.

India Potato Chips Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plain

- Flavoured

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plain and flavoured.

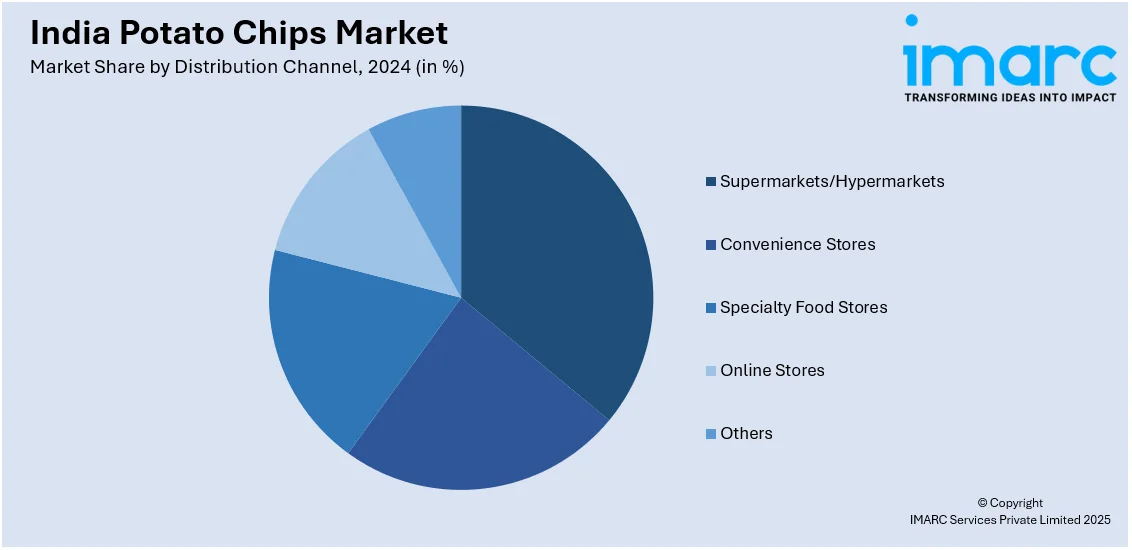

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty food stores, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Potato Chips Market News:

- In May 2024, Shark Tank India-backed brand Tagz Foods grew its portfolio of healthy popped chips to meet increasing consumer demand for low-fat, gluten-free potato snacks. The brand's innovative products are available in 22 Indian cities and on several online platforms, offering health-conscious snackers nutritious alternatives to fried chips.

- In March 2024, Lay's introduced Shapez Heartiez, the country's first-ever 3D heart-shaped potato-based pellet chips. The new offering is offered in caramel and masala flavors and adds to Lay's product portfolio, responding to changing consumer tastes for exciting, crunchy, and tasty snacking occasions in retail and online channels.

India Potato Chips Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plain, Flavoured |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India potato chips market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India potato chips market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India potato chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The potato chips market in India was valued at USD 1.31 Billion in 2024.

The India potato chips market is projected to exhibit a CAGR of 4.18% during 2025-2033, reaching a value of USD 1.95 Billion by 2033.

India’s potato chips market is driven by changing lifestyles, growing preference for convenient snacks, and rising disposable incomes. Flavor innovation, regional taste customization, and health-focused options enhance appeal. Expanding retail networks and e-commerce platforms improve accessibility, while aggressive marketing and brand diversification further boost consumer demand across urban and rural markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)