India Precision Fermentation Market Size, Share, Trends and Forecast by Microbe, End User, and Region, 2025-2033

India Precision Fermentation Market Overview:

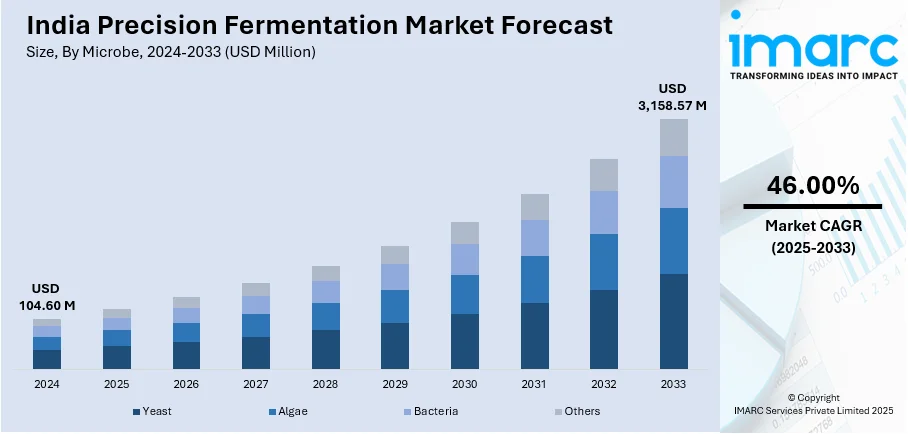

The India precision fermentation market size reached USD 104.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,158.57 Million by 2033, exhibiting a growth rate (CAGR) of 46.00% during 2025-2033. The rising demand for sustainable and animal-free proteins, increased investments in synthetic biology startups, and growing consumer preference for health-conscious and ethical food choices are some of the kay factors bolstering the market demand. Additionally, government support for biotech innovation and industry collaborations are accelerating adoption across food, nutraceutical, and personal care sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 104.60 Million |

| Market Forecast in 2033 | USD 3,158.57 Million |

| Market Growth Rate 2025-2033 | 46.00% |

India Precision Fermentation Market Trends:

Rising Demand for Alternative Proteins

A prominent trend shaping India’s precision fermentation market is the surge in demand for alternative proteins. Driven by increasing health awareness, ethical concerns around animal farming, and the environmental impact of conventional protein sources, Indian consumers are gradually shifting towards sustainable protein alternatives. Precision fermentation allows the production of high-quality, animal-free proteins such as casein, whey, and egg white proteins without involving livestock. This trend is further supported by growing interest from food tech startups and plant-based food companies seeking to diversify their product lines. The availability of protein-rich dairy and meat substitutes made using microbial fermentation is attracting urban consumers, especially among younger demographics concerned with wellness, sustainability, and cruelty-free consumption practices.

To get more information on this market, Request Sample

Investment Surge in Synthetic Biology Startups

India is witnessing a surge in investments in synthetic biology and precision fermentation startups, driven by growing interest from venture capitalists and global investors. Startups producing animal-free dairy proteins, bio-based enzymes, and specialty ingredients through microbial fermentation are gaining traction. Government initiatives supporting biotechnology research and development (R&D) and incubator programs at academic institutions are further accelerating growth. The Indian biotechnology industry currently comprises over 3,500 biotech startups and is projected to reach 10,000 by 2024-25. This influx of funding is enabling startups to scale pilot projects, develop fermentation infrastructure, and fast-track commercialization. As investor confidence strengthens, India is emerging as a key player in synthetic biology innovation, aligning with global sustainability goals and fostering localized production hubs for precision-fermented bio-based products.

Integration of Fermentation Tech in Traditional Industries

The integration of precision fermentation into India's food processing, nutraceuticals, and personal care sectors is accelerating innovation. Established dairy and food companies are collaborating with biotech firms to incorporate fermentation-derived proteins and enzymes into conventional product lines. Fermentation-based bioactives such as vitamins, probiotics, and flavor enhancers are enhancing nutritional value and shelf life, aligning with clean-label trends and consumer demand for transparency. This hybridization of traditional industries with biotechnology is driving advancements in product formulation and processing. The total economic opportunity for smart protein in India, including plant-based and fermentation-derived proteins, is projected to range from INR 12,075 crore (USD 1.5 billion) to INR 33,194 crore (USD 4.2 billion) by 2030. This shift is fostering a more diverse and sustainable food and wellness ecosystem.

India Precision Fermentation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on microbe and end user.

Microbe Insights:

- Yeast

- Algae

- Bacteria

- Others

The report has provided a detailed breakup and analysis of the market based on the microbe. This includes yeast, algae, bacteria, and others.

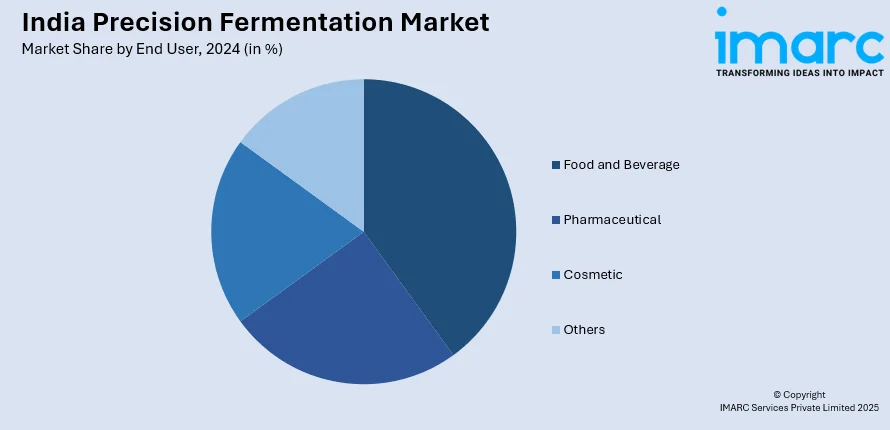

End User Insights:

- Food and Beverage

- Pharmaceutical

- Cosmetic

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage, pharmaceutical, cosmetic, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Precision Fermentation Market News:

- In December 2024, Sterling Biotech Ltd, a joint venture between Perfect Day and Zydus, begun constructing the world’s first precision fermentation-based dairy protein facility in Bharuch, Gujarat. Spread across 27 acres, the plant is expected to be operational by early 2026. With strong market interest and future expansion plans, the facility aims to meet global demand for sustainable dairy proteins. Perfect Day’s CEO highlighted its role in revolutionizing eco-friendly food production.

India Precision Fermentation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Microbes Covered | Yeast, Algae, Bacteria, Others |

| End Users Covered | Food and Beverage, Pharmaceutical, Cosmetic, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India precision fermentation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India precision fermentation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India precision fermentation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The precision fermentation market in India was valued at USD 104.60 Million in 2024.

The precision fermentation market in India is projected to exhibit a (CAGR) of 46.00% during 2025-2033, reaching a value of USD 3,158.57 Million by 2033.

The market is driven by growing demand for alternative proteins, dairy alternatives, and sustainable food ingredients. Heightening awareness of environmental footprint, health, and biotechnology innovation fuels adoption. Growing use in pharmaceuticals, food & beverage, and industrial enzymes and government encouragement of biotech startups also support the precision fermentation market in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)