India Prefabricated Buildings Market Size, Share, Trends, and Forecast by Material Type, Application, and Region, 2026-2034

India Prefabricated Buildings Market Overview:

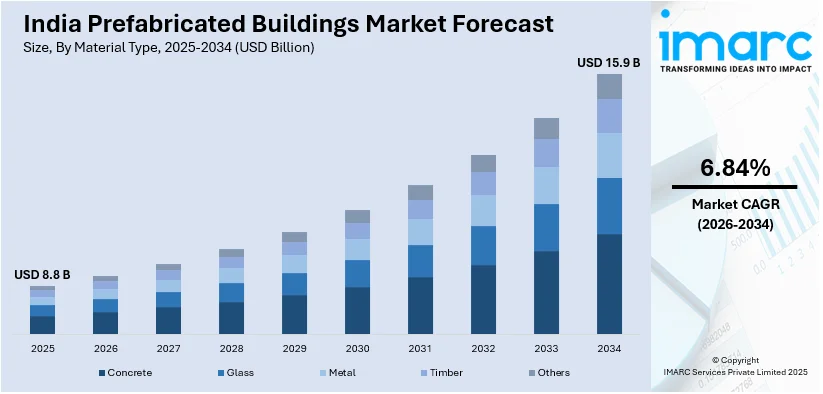

The India prefabricated buildings market size reached USD 8.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.9 Billion by 2034, exhibiting a growth rate (CAGR) of 6.84% during 2026-2034. The market is expanding due to rapid urbanization, infrastructure growth, and demand for cost-effective, time-efficient construction. Moreover, developers focus on modular designs, eco-friendly materials, and advanced manufacturing to enhance efficiency and durability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.8 Billion |

| Market Forecast in 2034 | USD 15.9 Billion |

| Market Growth Rate 2026-2034 | 6.84% |

India Prefabricated Buildings Market Trends:

Rising Adoption of Modular and Off-Site Construction

India's prefabricated buildings market is witnessing the widespread adoption of modular and off-site construction methods as developers seek faster project completion and cost-effective solutions. Pre-engineered buildings (PEBs) and volumetric modular construction are increasingly in demand across residential, commercial, and industrial infrastructure. Prefabrication cuts down material wastage, project duration, and labor costs, which serve as key benefits over conventional practices. Urban growth and the pursuit of low-cost housing schemes under government policies such as Pradhan Mantri Awas Yojana (PMAY) have contributed even more to the move towards modular solutions. For instance, as of June 2024, under Pradhan Mantri Awas Yojana - Gramin (PMAY-G), the government sanctioned 2.94 crore houses, completing 2.62 crore, significantly enhancing rural housing and living conditions across India. Additionally, technology integration in prefabrication, including 3D printing and BIM (Building Information Modeling), is enabling precise manufacturing and reducing on-site complexities. With real estate developers looking to streamline operations and enhance structural durability, off-site prefabrication is becoming a key solution for meeting the rising demand for efficient and scalable construction across India.

To get more information on this market, Request Sample

Growing Demand for Sustainable and Green Construction

Sustainability is driving innovation in India's prefabricated buildings market, with developers focusing on energy-efficient materials, eco-friendly designs, and waste reduction. The use of recycled steel, precast concrete, and insulated panels is gaining traction to reduce the carbon footprint of construction. Moreover, government regulations promoting green building certifications like IGBC (Indian Green Building Council) and GRIHA (Green Rating for Integrated Habitat Assessment) are further pushing the market toward sustainable practices. For instance, as per industry reports, India ranked third on the U.S. Green Building Council’s 2024 LEED list, certifying 370 projects spanning 8.5 Million gross square meters, highlighting its strong commitment to sustainable building practices. Prefabrication minimizes construction waste and energy consumption, making it a preferred choice for environmentally responsible projects. Additionally, advancements in solar-integrated prefabricated structures and rainwater harvesting systems are making these buildings more self-sufficient. Corporates and commercial developers are increasingly adopting modular green office spaces and prefabricated housing to align with global sustainability goals. As awareness of climate impact and resource conservation grows, the prefabricated construction sector in India is rapidly moving toward eco-friendly and energy-efficient building solutions.

India Prefabricated Buildings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on material type and application.

Material Type Insights:

- Concrete

- Glass

- Metal

- Timber

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes concrete, glass, metal, timber, and others.

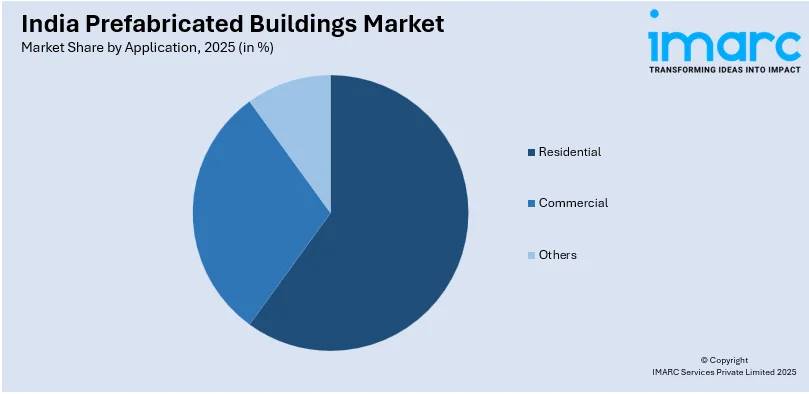

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Residential

- Commercial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Prefabricated Buildings Market News:

- In November 2024, EPACK Prefab set a world record, completing India’s fastest-built structure in 150 hours in Mambattu, Andhra Pradesh. The 151,000 sq ft building, recognized by the Golden Book of World Records, was constructed with precision, speed, and sustainability using advanced prefabrication and PEB technology.

India Prefabricated Buildings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Concrete, Glass, Metal, Timber, Others |

| Applications Covered | Residential, Commercial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India prefabricated buildings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India prefabricated buildings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India prefabricated buildings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The prefabricated buildings market in India was valued at USD 8.8 Billion in 2025.

The India prefabricated buildings market is projected to exhibit a CAGR of 6.84% during 2026-2034, reaching a value of USD 15.9 Billion by 2034.

The market is driven by the need for faster construction methods, rising labor costs, and growing demand for efficient project delivery. Prefabrication offers cost savings, quality control, and reduced on-site work. Additionally, increased industrial and commercial construction, along with space constraints in urban areas, is pushing builders to adopt modular, off-site building solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)