India Premium Lingerie Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Premium Lingerie Market Size and Share:

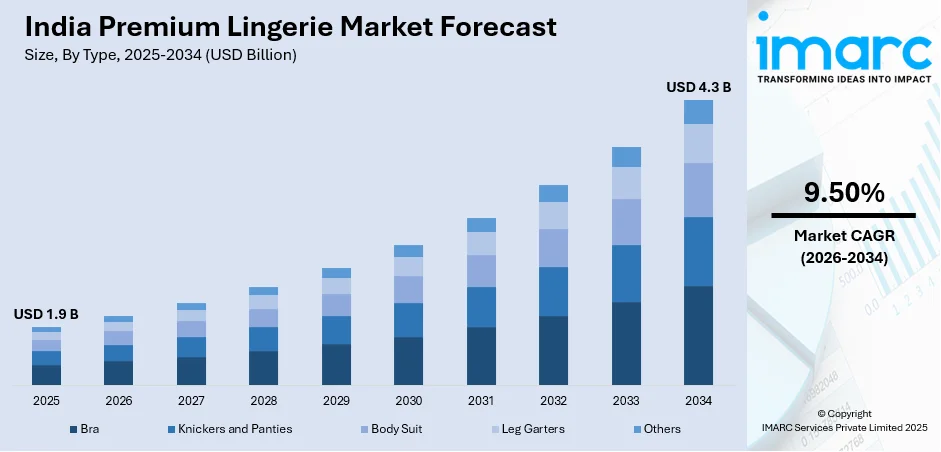

The India premium lingerie market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2034, exhibiting a growth rate (CAGR) of 9.50% during 2026-2034. The market in India is growing due to rising disposable incomes, increasing fashion consciousness, and demand for superior-quality fabrics. E-commerce expansion, D2C brand innovations, and body-positive marketing are further augmenting the India premium lingerie market share. Sustainability trends and customization options, such as size inclusivity and personalized designs, are also key drivers shaping consumer preferences in this changing segment.

Key Takeaways:

- The premium lingerie market in India reached USD 1.9 billion in 2025.

- By 2034, the market value is anticipated to reach USD 4.3 billion, with a CAGR of nearly 9.50% from 2026-2034.

- Major growth drivers include rising disposable incomes, increasing fashion consciousness among consumers, expanding e-commerce and organized retail networks, growing influence of global lingerie brands, and the shifting preference toward comfort, quality, and premium innerwear products across India.

- Segmentation Highlights:

- Type: Bra, Knickers and Panties, Body Suit, Leg Garters, Others.

- Application: Offline, Online.

- Regional Insights: North, South, East, and West India are analyzed, with the report highlighting growth drivers and opportunities in each region.

To get more information on this market, Request Sample

India Premium Lingerie Market Trends:

Rising Demand for Sustainable and Ethical Lingerie

The significant shift toward sustainable and ethically produced products is majorly driving the India premium lingerie market growth. Consumers, especially millennials and Gen Z, are becoming more conscious of environmental and social impacts, thereby driving demand for lingerie made from organic cotton, bamboo fabric, and recycled materials. Brands are responding by adopting eco-friendly practices, such as reducing water usage, minimizing chemical dyes, and ensuring fair labor conditions. International labels and homegrown brands are leading this trend with biodegradable and toxin-free lingerie options. Additionally, certifications, including GOTS (Global Organic Textile Standard) and OEKO-TEX, are gaining prominence as trust indicators. The Global Organic Textile Standard (GOTS) noted that in 2023, a total of 14,676 facilities across 89 countries had been certified to the standard, an increase of 8 percent in 2023, showing a growing emphasis on sustainable practices in the textile industry. Moreover, GOTS is using satellite data to identify and map the location of cotton fields in India, the world's largest organic cotton supplier, in collaboration with the European Space Agency (ESA). This project aims to improve the accuracy of organic cotton yield estimates and enable the conversion of uncertified fields. By guaranteeing traceability and authenticity, these initiatives strengthen consumer confidence and incentivize brands to implement responsible sourcing practices. This transition signifies a wider consumer inclination toward quality, comfort, and sustainability within the premium lingerie sector. With increasing awareness of fast fashion's environmental toll, Indian consumers are willing to pay a premium for lingerie that aligns with their values, making sustainability a key growth driver in the segment.

Growth of Online D2C Brands and Customization

The rise of direct-to-consumer (D2C) brands offering personalized shopping experiences is creating a positive India premium lingerie market outlook. As of June 2023, India had a significant 895 Million internet connections and is expected to have 1.1 Billion smartphones by 2025, fueling the digital growth of the country. This improved connection, along with rising incomes, is promoting e-commerce, which is expected to touch USD 1 Trillion by 2030. With categories such as direct-to-consumer (D2C) and business-to-business (B2B) growing, premium brands for lingerie are well-poised to cater to India's fast-growing online sales space. In addition to this, e-commerce platforms are leveraging AI-driven fit technology, virtual try-ons, and body-positive marketing to attract discerning buyers. These brands focus on inclusivity, offering diverse sizes, skin-tone-friendly shades, and adaptive designs for plus-size and post-surgery needs. Social media and influencer collaborations further amplify brand visibility, with Instagram and YouTube becoming key discovery channels. Subscription models, loyalty programs, and hassle-free returns enhance customer retention. Additionally, made-to-order and monogramming services cater to the growing demand for bespoke lingerie. As digital penetration increases in Tier 2 and Tier 3 cities, online D2C brands are poised to dominate the premium lingerie market, reshaping consumer expectations with convenience and customization.

India Premium Lingerie Market Segmentation:

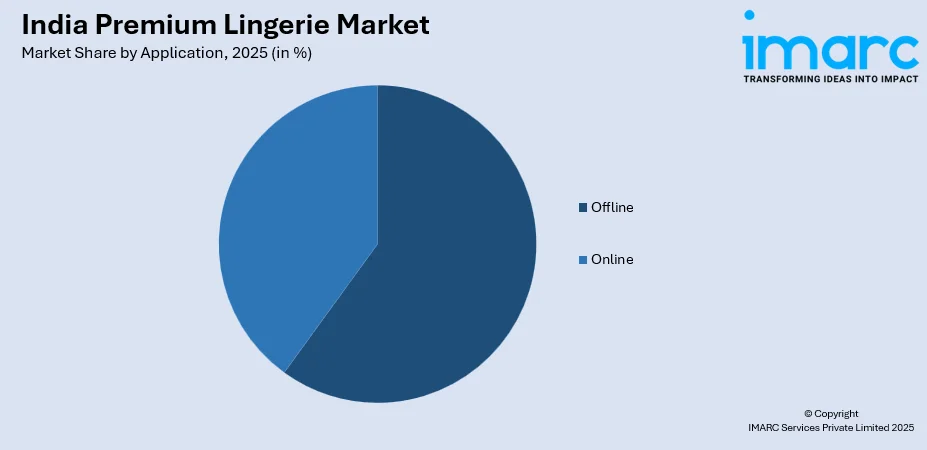

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Bra

- Knickers and Panties

- Body Suit

- Leg Garters

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bra, knickers and panties, body suit, leg garters, and others.

Application Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes offline and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Premium Lingerie Market News:

- December 11, 2024: Indian luxury lingerie brand MHYTH has raised Angel funding, gaining a valuation of over USD 1 Million just one month after its launch. Founded by Mitali Rai, the brand’s focus is on fusing innovative design with traditional Indian craftsmanship, catering to international markets. With their extensive product line consisting of lingerie, nightwear, and shapewear, MHYTH wants to revolutionize the premium lingerie market with a strong focus on quality and inclusivity.

- September 04, 2024: Clovia launched its first collection of plus-size bras as the demand for beautiful and perfectly fitting lingerie rises among plus-sized women. With sizes from 32B to 44F, full-coverage, and minimizer bras specifically to help with uplift and comfort, the collection is an efficient success. The launch is a commitment towards Clovia's ethos of inclusivity and quality-led products, addressing the unique needs of the country's premium lingerie segment.

India Premium Lingerie Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bra, Knickers and Panties, Body Suit, Leg Garters, Others |

| Applications Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India premium lingerie market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India premium lingerie market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India premium lingerie industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The premium lingerie market in India was valued at USD 1.9 Billion in 2025.

The India premium lingerie market is projected to exhibit a CAGR of 9.50% during 2026-2034, reaching a value of USD 4.3 Billion by 2034.

The India premium lingerie market is driven by rising disposable incomes, evolving fashion awareness, and strong demand for high-quality fabrics and brands. The rise of online D2C platforms offering convenience, personalized fit, and inclusivity, along with sustainability trends and size customization, further shape consumer preferences, influencing the market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)