India Pressure Washer Market Size, Share, Trends and Forecast by Power Source, Output, Application, Distribution Channel, and Region, 2025-2033

India Pressure Washer Market Size and Share:

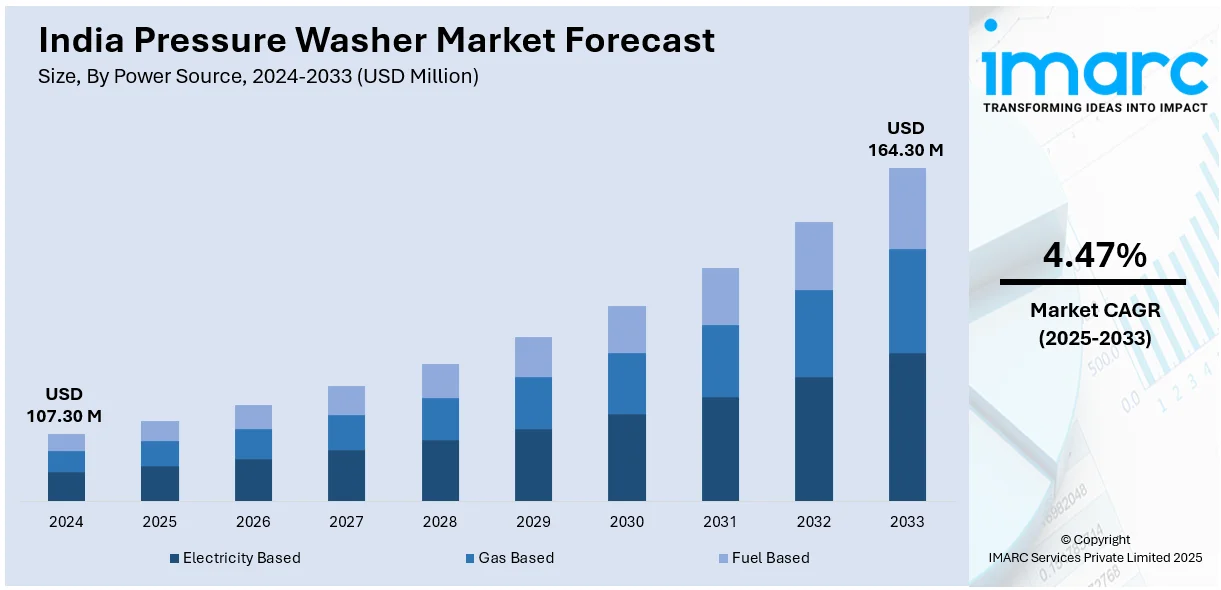

The India pressure washer market size reached USD 107.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 164.30 Million by 2033, exhibiting a growth rate (CAGR) of 4.47% during 2025-2033. The market is driven by increasing demand for efficient cleaning solutions in residential and commercial sectors, rising awareness about hygiene, rapid urbanization, and growing disposable incomes. Additionally, growing e-commerce penetration, technological advancements, and a shift toward eco-friendly and water-efficient cleaning equipment further support market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.30 Million |

| Market Forecast in 2033 | USD 164.30 Million |

| Market Growth Rate (2025-2033) | 4.47% |

India Pressure Washer Market Trends:

Rising Demand from Residential and Commercial Sectors

The rising emphasis on hygiene and cleanliness in residential and commercial areas is largely fueling pressure washer demand in India. Urban homes are increasingly using pressure washers for cleaning vehicles, outdoor furniture, patios, and house facades. At the same time, commercial venues such as hotels, malls, hospitals, and service centers are incorporating high-pressure cleaning machines to maintain good sanitation and lower labor costs. As there is increasing recognition of the advantages of mechanized cleaning against manual cleaning, consumers are now showing preference towards effective and time-saving solutions. Growing disposable incomes and increased middle-class populations are also driving the use of these appliances in domestic cleaning applications, thus contributing towards the overall market growth.

To get more information on this market, Request Sample

Growth in E-commerce and Online Retail Channels

The expansion of digital channels, coupled with higher penetration of smartphones and the internet in Tier I and Tier II cities, has increased the availability of pressure washers through e-commerce portals. Retail channels like Amazon, Flipkart, and company websites are responsible for facilitating direct sales to customers, bypassing physical retail distribution. This transition not only increases consumer access but also ensures greater price transparency, user reviews, and simple product comparison. To boot, online tutorials and video content enable consumers to learn about product uses and advantages more effectively, leading to adoption. To counter this Indian digital retail boom, firms are launching digital-first strategies and online-only products.

Technological Advancements and Energy Efficiency Focus

Technological innovation is transforming India’s pressure washer market, with manufacturers focusing on compact designs, reduced noise levels, and improved water efficiency. The demand for cordless, battery-operated, and portable models is rising, especially in urban homes with limited storage. Energy-efficient motor technology, smart pressure control, and automatic shut-off features cater to environmentally conscious consumers. Additionally, the Bureau of Water Use Efficiency (BWUE), under the National Water Mission, is developing standards for water-efficient fixtures and appliances, influencing the design of pressure washers. Eco-friendly models that minimize water usage while maintaining high performance are gaining popularity, aligning with India’s sustainability goals. These innovations encourage both manufacturers and consumers to invest in greener pressure washing solutions.

India Pressure Washer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on power source, output, application and distribution channel.

Power Source Insights:

- Electricity Based

- Gas Based

- Fuel Based

The report has provided a detailed breakup and analysis of the market based on the power source. This includes electricity based, gas based, and fuel based.

Output Insights:

- Up to 1500 PSI

- 1501 to 3000 PSI

- 3001 to 4000 PSI

- Above 4000 PSI

A detailed breakup and analysis of the market based on the output have also been provided in the report. This includes up to 1500 PSI, 1501 to 3000 PSI, 3001 to 4000 PSI, and above 4000 PSI.

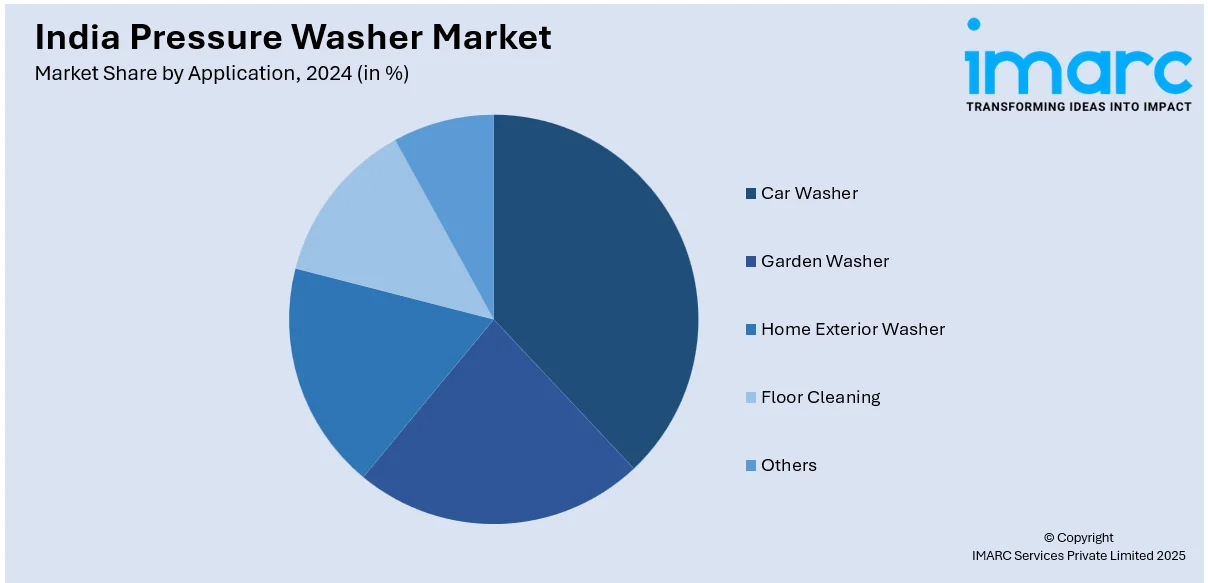

Application Insights:

- Car Washer

- Garden Washer

- Home Exterior Washer

- Floor Cleaning

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes car washer, garden washer, home exterior washer, floor cleaning, and others.

Distribution Channel Insights:

- Online Distribution

- Offline Distribution

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online distribution, and offline distribution.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pressure Washer Market News:

- In October 2024, Kärcher India hosted a PR event at The Lalit, Delhi, unveiling its growth and innovation strategies. Emphasizing sustainability and market expansion, the company highlighted strong growth in professional and consumer segments. Kärcher plans to boost market share through customer-centric sales, new branch offices, and enhanced training programs. The brand is also diversifying its offerings by launching new cleaning detergents and upgrading its existing product portfolio.

- In September 2024, Trichy Corporation introduced high-pressure washers to clean public and community toilets in Zone IV of the city. A trial run was conducted under the supervision of Mayor Mu Anbalagan at Chinna Kothamangalam near Karumandapam. The initiative aims to enhance sanitation and hygiene standards. The civic body also plans to expand the use of such cleaning equipment to community toilets in other zones, promoting efficient and modern urban sanitation practices.

- In January 2024, Dylect launched its new high-pressure washer range in India, including DYLECT Ultra Clean, Ultra Flow, Ultra Force, and Ultra Power, priced between Rs 4,999 and Rs 8,999. Available on Amazon.in, these washers cater to the mid-premium vehicle maintenance segment. Designed for efficient cleaning and durability, the products meet global quality standards. Dylect plans further innovation in auto accessories, aiming to enhance driving experiences and redefine industry benchmarks.

India Pressure Washer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Sources Covered | Electricity Based, Gas Based, Fuel Based |

| Outputs Covered | Up to 1500 PSI, 1501 to 3000 PSI, 3001 to 4000 PSI, Above 4000 PSI |

| Applications Covered | Car Washer, Garden Washer, Home Exterior Washer, Floor Cleaning, Others |

| Distribution Channels Covered | Online Distribution, Offline Distribution |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pressure washer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pressure washer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pressure washer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure washer market in India was valued at USD 107.30 Million in 2024.

The India pressure washer market is projected to exhibit a (CAGR) of 4.47% during 2025-2033, reaching a value of USD 164.30 Million by 2033.

The key factors driving the India pressure washer market include rising demand for cleaning solutions in residential, commercial, and industrial sectors, increasing awareness about hygiene, growing adoption of advanced technology for efficient cleaning, and rapid innovations catalyzing the need for quick and effective cleaning tools.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)