India Private Banking Market Size, Share, Trends and Forecast by Banking Sector, Application, and Region, 2025-2033

India Private Banking Market Overview:

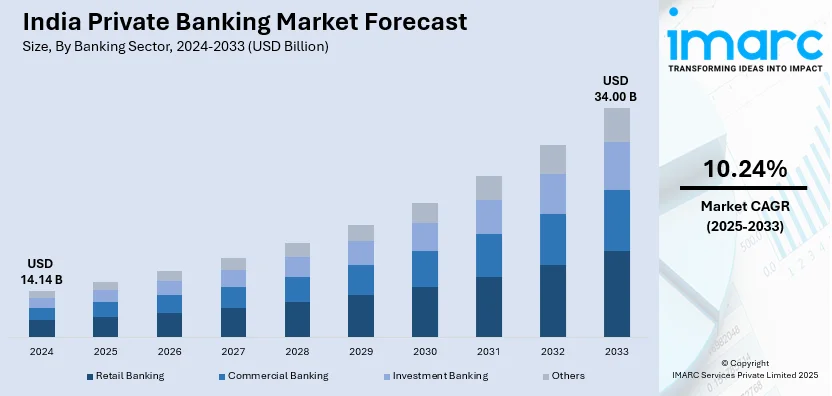

The India private banking market size reached USD 14.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.00 Billion by 2033, exhibiting a growth rate (CAGR) of 10.24% during 2025-2033. The market is growing due to the rising high-net-worth individual (HNWI) population, increasing demand for personalized wealth management, and rapid digital transformation. With growing financial awareness and investment diversification, the market outlook remains strong for sustained long-term growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.14 Billion |

| Market Forecast in 2033 | USD 34.00 Billion |

| Market Growth Rate (2025-2033) | 10.24% |

India Private Banking Market Trends:

Rising High-Net-Worth Individual (HNWI) Population

India's High-Net-Worth Individual (HNWI) population is expanding due to rapid economic growth, rising entrepreneurship and strong financial markets. This surge is directly influencing India private banking market growth as wealthy individuals seek personalized wealth management, estate planning and investment advisory services. According to the report published by IBEF, India's high-net-worth individuals (HNIs) are projected to double to 1.65 million by 2027 with 20% under 40. Driven by tech startups and IPOs the UHNI population is growing rapidly boosting luxury real estate sales to 28%. Investment diversification trends show a focus on real estate, private equity and overseas assets. Private banks are enhancing their offerings with tailored solutions including offshore investments, structured products and succession planning to cater to the complex financial needs of HNWIs. The increasing demand for exclusive banking services, concierge benefits and digital wealth management platforms is driving innovation in the sector. Additionally, wealth creation in Tier-2 and Tier-3 cities is broadening the client base for private banks. With regulatory advancements, increased focus on ESG investing and a growing appetite for alternative investments like private equity and hedge funds, the India private banking market outlook remains strong with sustained demand for sophisticated financial solutions.

To get more information on this market, Request Sample

Digital Transformation and Fintech Integration

Private banks in India are rapidly embracing digital transformation to enhance customer experience, streamline operations and offer personalized financial solutions. Technologies like AI-driven analytics, blockchain for secure transactions and robo-advisory services are reshaping wealth management and investment advisory. For instance, in August 2024, SWIFT and Axis Bank launched an AI pilot project to combat payment fraud in cross-border transactions. Collaborating with major banks they will use secure data sharing and AI anomaly detection to enhance fraud detection aiming to bolster security measures and ensure safer international payments. AI-powered chatbots and virtual assistants are improving customer interactions while blockchain is enhancing security in high-value transactions. Robo-advisors are enabling automated portfolio management catering to tech-savvy high-net-worth individuals (HNWIs). Fintech partnerships are allowing private banks to offer seamless digital banking experiences, mobile-based wealth management and instant loan approvals. As clients demand more digital convenience private banks are investing heavily in data-driven decision-making, cybersecurity and AI-based risk assessment. This ongoing technological shift is making private banking more accessible beyond metro cities driving long-term growth and strengthening India private banks market share in the competitive financial landscape.

India Private Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on banking sector and application.

Banking Sector Insights:

- Retail Banking

- Commercial Banking

- Investment Banking

- Others

The report has provided a detailed breakup and analysis of the market based on the banking sector. This includes retail banking, commercial banking, investment banking and others.

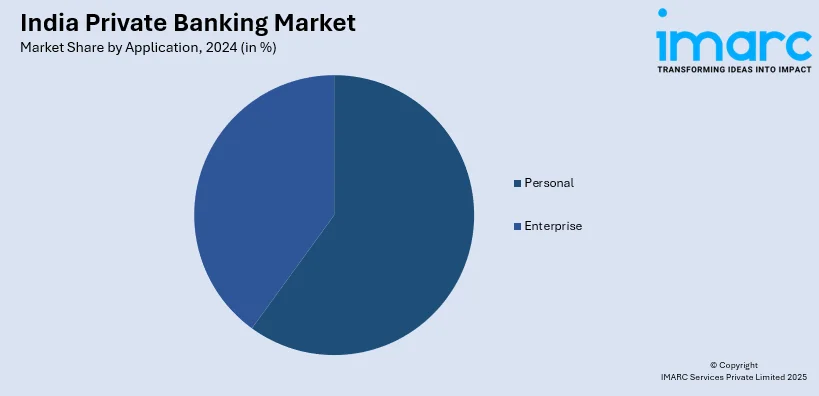

Application Insights:

- Personal

- Enterprise

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal and enterprise.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Private Banking Market News:

- In December 2024, HSBC India launched the exclusive HSBC Privé credit card for its private banking clients, offering premium travel benefits, access to luxury lounges, and unique lifestyle experiences. The card caters to high-net-worth individuals and ultra-high-net-worth individuals, enhancing their wealth management with tailored services and personalized offerings.

- In December 2024, ICICI Bank announced its partnership with the Commonwealth Bank of Australia to strengthen the Australia-India business corridor. The MoU aims to enhance trade and investment opportunities, provide banking services for relocation, and develop solutions for cross-border payments, fostering economic ties between the two nations.

India Private Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Banking Sectors Covered | Retail Banking, Commercial Banking, Investment Banking, Others |

| Applications Covered | Personal, Enterprise |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India private banking market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India private banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India private banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The private banking market in India was valued at USD 14.14 Billion in 2024.

The India private banking market is projected to exhibit a CAGR of 10.24% during 2025-2033, reaching a value of USD 34.00 Billion by 2033.

The India private banking market is driven by inflating disposable incomes, the rising population of high-net-worth individuals, and a growing need for personalized wealth management services. The shift towards digital banking solutions, coupled with expanding financial literacy and investment awareness, also plays a significant role in boosting demand for private banking products and services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)