India Probiotic Drinks Market Size, Share, Trends and Forecast by Product Type, Flavor, Packaging Type, Distribution Channel, and Region, 2025-2033

Market Overview:

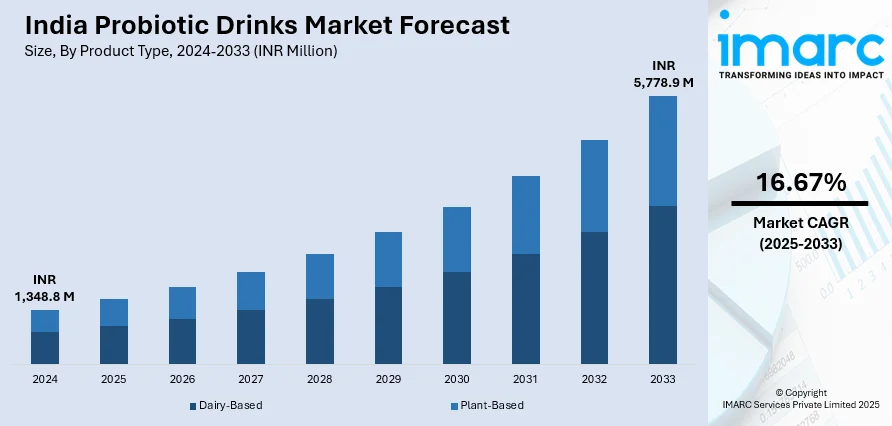

The India probiotic drinks market size reached INR 1,348.8 Million in 2024. Looking forward, IMARC Group expects the market to reach INR 5,778.9 Million by 2033, exhibiting a growth rate (CAGR) of 16.67% during 2025-2033. The rising consumer health consciousness, the increasing awareness of numerous associated benefits of probiotic drinks, and improving consumer living standards represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | INR 1,348.8 Million |

| Market Forecast in 2033 | INR 5,778.9 Million |

| Market Growth Rate (2025-2033) | 16.67% |

Probiotic drinks are functional drinks that contain particular microorganisms that assist in maintaining gut health. The probiotic culture of microbes is combined with water, sugar, herbal, or fruit extracts and then subjected to bio-fermentation during manufacturing. Probiotic drinks help enhance digestive health, promote weight loss, and improve immune function by encouraging a healthy balance of gut bacteria. In addition, these beverages are useful in preventing various gastrointestinal disorders, such as constipation, irritable bowel syndrome, diarrhea, and more. Probiotic drinks are becoming increasingly popular among health-conscious consumers who are looking for natural ways to maintain their health. They are widely available in supermarkets, health food stores, and online retailers in a variety of flavors and formulations to suit different tastes and preferences.

To get more information of this market, Request Sample

India Probiotic Drinks Market Trends:

The demand for probiotic drinks in India is primarily driven by the increasing prevalence of gastrointestinal disorders resulting from the changing dietary patterns and unhealthy food habits of the masses. Additionally, the growing health consciousness among consumers and the increasing awareness of the associated benefits of probiotic drinks in promoting gut health are further propelling the market growth. The rise in urbanization and the improving living standards of consumers are also contributing to the adoption of functional, ready-to-drink beverages. Moreover, consumers are shifting their preferences from high-calorie, carbonated beverages to healthier, functional ones, thus further boosting demand for probiotic drinks in the country. Key players in the market are focusing on introducing probiotic drinks in exotic flavors and attractive packaging, which is acting as a significant growth-inducing factor. These manufacturers are also adopting several promotional activities through traditional retail and e-commerce platforms to expand their consumer base. Furthermore, the introduction of dairy-, allergen-, lactose-, and sugar-free formulations is further strengthening the demand for probiotic drinks in the country. Besides, the rising consumer concerns about the high prevalence of numerous gastrointestinal ailments are driving the market further. The increasing elderly population, who are more susceptible to chronic gastrointestinal ailments, is a significant driving factor driving the growth of the probiotics market. The shift in consumer preferences from high-calorie diets to functional foods and beverages is fueling the demand for probiotics. Additionally, the rise in the number of working women and the growing focus on women's health are accelerating the use of specialized probiotics like L. acidophilus, L. rhamnosus, and Bifidobacterium.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India probiotic drinks market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, flavor, packaging type and distribution channel.

Product Type Insights:

- Dairy-Based

- Plant-Based

The report has provided a detailed breakup and analysis of the probiotic drinks market based on the product type. This includes dairy-based and plant-based.

Flavor Insights:

- Strawberry

- Vanilla

- Mango

- Others

The report has provided a detailed breakup and analysis of the probiotic drinks market based on the flavor. This includes strawberry, vanilla, mango, and others.

Packaging Type Insights:

- Plastic Bottles

- Glass Bottles

- Others

The report has provided a detailed breakup and analysis of the probiotic drinks market based on the packaging type. This includes plastic bottles, glass bottles, and others.

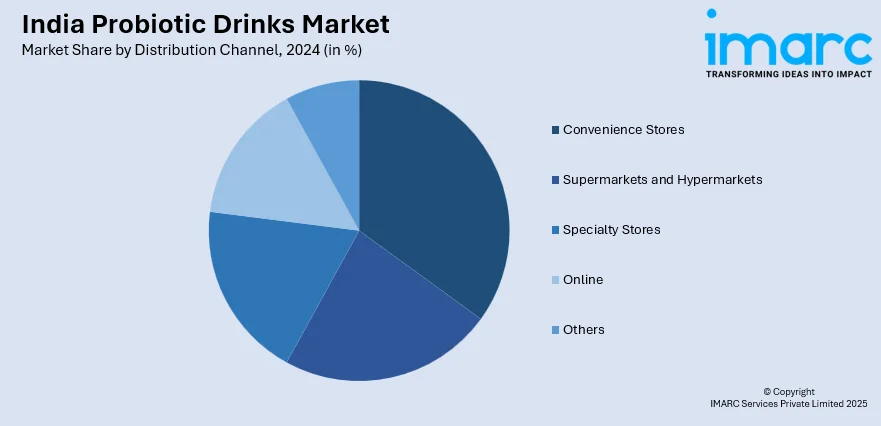

Distribution Channel Insights:

- Convenience Stores

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the probiotic drinks market based on the distribution channel have also been provided in the report. This includes convenience stores, supermarkets and hypermarkets, specialty stores, online, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India probiotic drinks market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Gujarat Cooperative Milk Marketing Federation, Mother Dairy Fruits and Vegetables Pvt. Ltd., and Yakult (Danone India Pvt. Ltd.). Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million INR, ‘000 Kg |

| Segment Coverage | Product Type, Flavor, Packaging Type, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Gujarat Cooperative Milk Marketing Federation, Mother Dairy Fruits and Vegetables Pvt. Ltd. and Yakult (Danone India Pvt. Ltd.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India probiotic drinks market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India probiotic drinks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India probiotic drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India probiotic drinks market was valued at INR 1,348.8 Million in 2024.

We expect the India probiotic drinks market to exhibit a CAGR of 16.67% during 2025-2033.

The rising consumer preferences towards healthier and functional drinks, such as probiotic drinks in dairy, allergen, lactose, and sugar-free formulations, are primarily driving the India probiotic drinks market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of probiotic drinks as an immunity booster against the coronavirus infection.

Based on the product type, the India probiotic drinks market has been segmented into dairy-based and plant-based, where dairy-based probiotic drinks hold the majority of the total market share.

Based on the flavor, the India probiotic drinks market can be divided into strawberry, vanilla, mango, and others. Among these, strawberry currently exhibits a clear dominance in the market.

Based on the packaging type, the India probiotic drinks market has been categorized into plastic bottles, glass bottles, and others. Currently, plastic bottles account for the largest market share.

Based on the distribution channel, the India probiotic drinks market can be segregated into convenience stores, supermarkets and hypermarkets, specialty stores, online, and others. Among these, convenience stores exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India probiotic drinks market.

Some of the major players in the India probiotic drinks market include Gujarat Cooperative Milk Marketing Federation, Mother Dairy Fruits and Vegetables Pvt. Ltd., and Yakult (Danone India Pvt. Ltd.).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)