India Public Cloud Market Size, Share, Trends and Forecast by Service, Enterprise Size, End Use, and Region, 2025-2033

India Public Cloud Market Size and Share:

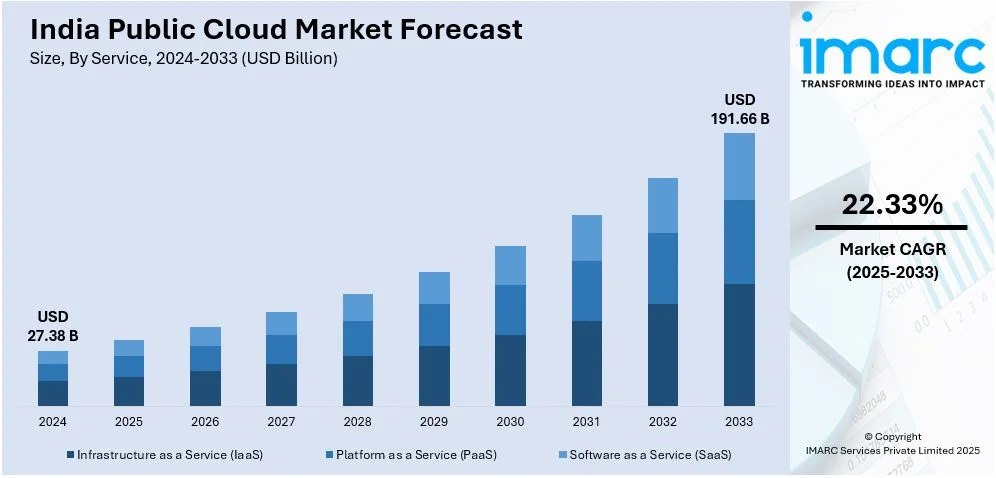

The India public cloud market size was valued at USD 27.38 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 191.66 Billion by 2033, exhibiting a CAGR of 22.33% from 2025-2033. The market is fueled by growing digital economy and pay-as-you-go pricing models of flexibility. Sophisticated cloud services such as AI and analytics are contributing to business innovation and improved operational efficiency in various industries. Scalable infrastructure without heavy capital expenditure is made possible through cost-effective solutions such as Spot Instances. This increasing use of advanced, on-demand cloud technologies will fuel digital transformation across the country, highly boosting the India public cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 27.38 Billion |

|

Market Forecast in 2033

|

USD 191.66 Billion |

| Market Growth Rate 2025-2033 | 22.33% |

The growth of India's digital economy is at the center of the public cloud market expansion. Digital services are increasingly becoming part of industries like finance, healthcare, education, and governance, which require cloud infrastructure that is scalable and dependable. According to the sources, in January 2025, Microsoft committed a \\$3 billion investment to expand AI and cloud infrastructure in India, its biggest public cloud market expansion in the nation to date. Moreover, the government programs like Digital India have also intensified this trend by encouraging public service digitization and a national transition toward digital communication and service provision. The focus on digital records, websites, and safe data storage has raised the need for cloud solutions that provide high availability and adherence to data protection standards. With public and private organizations venturing into digital transformation, the requirement for central yet adaptable computing resources has become a necessity. The public cloud satisfies these needs by delivering strong computing power, streamlining the effectiveness of digital initiatives. This momentum continues to make the public cloud a core pillar in India's changing digital ecosystem.

To get more information on this market, Request Sample

India's accelerating demand for operational scalability, business agility, and cost savings is another key driver of the public cloud market. As per the sources, in January 2025, RBI will pilot a cloud platform for financial companies using Indian IT vendors as an effort to challenge global cloud superiority and increase data localization in India's financial sector. Furthermore, companies across sectors are looking towards cloud offerings to handle variable workloads, lower capital expenditure, and provide assured service delivery. Cloud platforms offer elastic resource allocation, allowing businesses to dynamically scale their infrastructure without sacrificing performance. This elasticity is essential in meeting market demands as well as maintaining remote or hybrid work environments that demand secure and uninterrupted access to data. The cloud also supports business continuity by offering disaster recovery as well as real-time synchronization of data. In addition, pay-as-you-go pricing supports IT cost management by balancing the cost of usage with actual use, and it negates the need for physical servers. By letting cloud providers handle infrastructure management, businesses can concentrate more on strategic and innovative development. This growing dependency on the public cloud is part of an even greater transition towards digital resilience and efficiency, needed in the increasingly competitive and fast-digitizing Indian economy.

India Public Cloud Market Trends:

Economic Growth and Scalable Cost Models Drive Cloud Adoption

India's public cloud market is transforming at a rapid pace, mainly due to the expanding digital economy, which added 11.74% to the GDP in 2022–23 and totaled USD 402 billion, according to the Press Information Bureau. The cloud's pay-as-you-go structure allows companies to dynamically scale operations without making substantial capital expenditures. Such flexibility is especially beneficial in a dynamic and fast-paced economy. One example is AceCloud's introduction of Spot Instances in February 2025, offering affordable compute options in all cloud regions. Such instances enable customers to reduce costs by 30–80% versus standard on-demand pricing, making high-power computing more affordable for startups and SMEs. Such a cost model promotes competitiveness and fast-tracks cloud adoption across industries. Overall, such economic alignment and elastic pricing have placed the public cloud at the heart of India's digital and economic evolution, resonating with organizations that are looking for efficiency and affordability in their digital processes.

Cloud Service Diversification Boosts Market Attractiveness

The Indian public cloud industry is no longer confined to simple computing and storage capabilities. Top cloud vendors now provide a broad set of services that include sophisticated analytics, elastic data storage, artificial intelligence, and machine learning capabilities. These capabilities are inducing greater enterprise integration and are particularly important for data-intensive sectors like fintech, e-commerce, and health care. Organizations are increasingly utilizing these capabilities to innovate and adapt to shifting market conditions without creating elaborate in-house infrastructure. In addition, local players such as AceCloud are customizing offerings for regional demands, bringing in flexible capabilities like Spot Instances to meet fluctuating demand and costs. This specialization and value-added services trend is substantially enhancing the public cloud's strategic importance. With companies looking for smarter, data-driven choices, the spread of scalable and high-performance tools in the cloud environment is enabling Indian companies to capitalize on new efficiencies and stay ahead in a digitally oriented market.

Industrial Adoption and Operational Agility Fuel Expansion

The use of public cloud technology in India has revolutionized the way enterprises do business, with increased scalability, responsiveness, and cost savings. Businesses can now outsource the intricacies of IT infrastructure to the cloud provider so that internal organizations can focus on core business strategy and innovation. It has been especially advantageous for aggressively expanding sectors like IT services, media, and manufacturing, where flexibility and speed-to-market are essential. Besides, the utility-based model of the cloud caters to both large businesses and startups by lifting the prohibitive aspect of initial hardware and maintenance expenses. Consequently, the public cloud emerged as a strategic cornerstone for digital transformation across industries. The wide reach—from education to retail—continues to grow its presence. By this, adoption of public cloud in India is not merely a technical advancement, but a core driver of organizational resilience and responsiveness, paving the way for continued India public cloud market growth over the next few years.

India Public Cloud Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India public cloud market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service, enterprise size, and end use.

Analysis by Service:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

India Infrastructure as a Service (IaaS) is gaining ground as companies look for agile, scalable computing capacities without significant capital investment. IaaS allows companies to efficiently handle workloads, facilitating digital transformation. Its use is motivated by needs in data storage, disaster recovery applications, and requirements for responsive computing environments in various industries.

Platform as a Service (PaaS) is becoming more popular because it can automate application development and deployment. Indian businesses use PaaS to minimize time-to-market and manage the software lifecycle easily. It facilitates innovation in web and mobile applications, allowing developers to concentrate on coding and the infrastructure and updates being taken care of by cloud providers.

Software as a Service (SaaS) continues to interest Indian businesses because of its simplicity, reduced initial costs, and availability. SaaS applications enable a variety of business processes ranging from CRM, HRM, to collaboration tools. The transition towards subscription models is generating increased interest among startups as well as in established firms.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises in India are embracing public cloud solutions to improve operational efficiency, catalyze digital transformation, and facilitate global outreach. The ease of scalability and robust security capabilities of public cloud environments enable these businesses to deal with enormous volumes of data, execute intricate applications, and ensure compliance with regulatory requirements while minimizing IT expenditure.

Small and medium-sized enterprises (SMEs) use public cloud computing to obtain cost-effective, elastic, and scalable IT infrastructure without huge initial investments. Cloud deployment allows SMEs to innovate at a fast pace, enhance customer experiences, and optimize operations, which allows them to compete favorably in a dynamic business environment while concentrating on core business development.

Analysis by End Use:

.webp)

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

The BFSI segment in India is implementing public cloud solutions to improve digital banking services, increase customer interaction, and achieve regulatory compliance. Cloud infrastructure facilitates secure transactions, real-time analysis, and risk management systems, which allow banks and insurers to offer efficient, scalable, and customer-focused financial products in a highly competitive environment.

Adoption of public cloud by India's telecom and IT industries is necessitated by the demand for fast infrastructure, quick deployment, and scalable computing. These industries leverage cloud services in software development, network optimization, and hassle-free delivery of customer services, facilitating growth of digital services and adoption of new technologies such as 5G.

Indian consumer goods and retail businesses leverage public cloud platforms to oversee omnichannel initiatives, customize customer experiences, and streamline supply chains. In light of changing market trends and shifting customer expectations, cloud offerings facilitate real-time insights, inventory management, and adaptive operations, driving growth in both physical and digital shops.

India's manufacturing industry uses public cloud services to deploy intelligent factory operations, track production lines, and handle logistics. Predictive maintenance, IoT integration, and data-driven decision-making are enabled by cloud-based solutions, making operations more efficient and allowing manufacturers to stay responsive in the face of volatile demand and supply chain volatility across the globe.

India's energy and utilities industry is embracing public cloud technologies to enhance grid operations, track assets, and facilitate the integration of renewable resources. Cloud technology provides real-time analytics of data and remote monitoring of systems, enabling smarter energy distribution and higher reliability in managing urban as well as rural energy needs.

Adoption of public cloud in India's healthcare industry allows safe storage of patient data, telemedicine facilities, and management of electronic health records. Cloud-based systems allow data sharing, improve research capabilities, and aid healthcare regulatory compliance, leading to more affordable, efficient, and personalized healthcare services in India.

The Indian media and entertainment sector makes use of public cloud solutions for content creation, distribution, and live streaming. Scalable storage and processing capacity are provided by cloud platforms that support high-definition rendering of video and global content delivery while allowing media companies to respond to increasing demand for digital entertainment.

India's public sector organizations and government are highly embracing public cloud platforms to drive e-governance, facilitate better citizen services, and simplify administrative functions. Cloud services enable secure hosting of data, cross-departmental collaboration, and economical management of infrastructure, complementing national digital initiatives and enhancing transparency and responsiveness.

Other industries, such as travel, logistics, and education, are also embracing India's public cloud technologies to enhance efficiency and innovation. Cloud platforms enable e-learning, dynamic networked logistics, and real-time travel management systems to address changing user needs while providing scalability, dependability, and cost savings in various service segments.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India's public cloud expansion is driven by top metro cities, banking and financial centers, and growing IT facilities. Growing adoption of digital applications in urban and semi-urban regions backs demand for elastic cloud solutions across sectors, solidifying the region's role in India public cloud market forecast.

West and Central India's varied industry base, such as finance and manufacturing, is driving adoption in public cloud. Committed commercial cities and facilitative government policies boost digital infrastructure, allowing businesses to avail themselves of cloud technology for operational efficiency and innovation, which continues to add to the increasing cloud market presence in the region.

South India dominates India's public cloud market with its established IT and software industries. With robust technology parks, skilled labor, and innovation-led ecosystems, the region quickly adopts cloud services in various industries, enabling strong growth and technological progress in cloud computing.

East and Northeast India are up-and-coming public cloud markets, driven by enhanced digital literacy and government initiatives. While they are developing markets, they have growth potential through expansion in education, health care, and public administration, setting the stage for strong future cloud technology adoption.

Competitive Landscape:

India public cloud market outlook is marked by rapid innovation, strategic partnerships, and ongoing service diversification. Competition is centered around offering innovative and advanced services beyond simple computing and storage to include advanced technologies like artificial intelligence, machine learning, data analytics, and cloud-native app development. There is focus on building capabilities in infrastructure, optimizing data centers, and offering high availability and security. Moreover, initiatives to localize data centers and adhere to regulatory requirements are affecting competitive positioning. Payment models like pay-as-you-go and subscription plans are being fine-tuned to win over a wide range of customers, ranging from startups to large business groups. The increasing dependence on multi-cloud and hybrid cloud environments is driving providers to create interoperable solutions that align with on-premise infrastructure seamlessly. In addition, emphasis on innovations that focus on customers, fast deployment, and technical support is gaining momentum as cloud adoption intensifies across industries like healthcare, retail, education, and manufacturing.

The report provides a comprehensive analysis of the competitive landscape in the India public cloud market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Redington Limited established a strategic alliance with Banyan Cloud, a cybersecurity company based in the United States, in order to expedite the rollout of safe cloud infrastructure throughout India. Redington will act as a value-added reseller under this partnership, offering Banyan's robust range of security solutions to businesses across India's major sectors.

- March 2025: Neon Cloud launched its public cloud services in India with a new data center in Gurugram. The platform offers virtual machines, Kubernetes, block and object storage, secure backups, virtual private cloud, cloud firewall, and load balancing. GPU services are expected to be available soon.

- March 2025: Tata Communications unveiled Vayu, a next-generation public cloud platform tailored for intelligent enterprises. Vayu integrates IaaS, PaaS, AI tools, security, and multi-cloud connectivity into a unified ecosystem. It offers transparent pricing, built-in FinOps automation, and promises up to 30% cost savings.

- February 2025: Jio Platforms Limited and Confluent, Inc. entered into a strategic agreement for Jio Cloud Services. With this partnership, Confluent Cloud will be accessible on Jio Cloud Services, making it simpler for more Indian businesses to begin data streaming.

- January 2025: Amazon Web Services (AWS) unveiled an investment of USD 8.3 billion in cloud infrastructure in Maharashtra's AWS Asia-Pacific (Mumbai) Region in order to increase cloud computing capacity in India. By 2030, this investment is expected to generate approximately 81,300 full-time positions in the local data center supply chain and add USD 15.3 billion to India's GDP.

India Public Cloud Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Uses Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India public cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India public cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India public cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The public cloud market in the India was valued at USD 27.38 Billion in 2024.

The India public cloud market is projected to exhibit a CAGR of 22.33% during 2025-2033, reaching a value of USD 191.66 Billion by 2033.

Key drivers of the India public cloud market are accelerated digitalization across sectors, government policies such as Digital India, increased need for scalable and economical IT infrastructure, and greater use of remote and hybrid work models. The market is also complemented by increased dependency on data-driven services, improved internet connectivity, and the move towards pay-as-you-go cloud models.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)