India Pyridine & Pyridine Derivatives Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Pyridine & Pyridine Derivatives Market Overview:

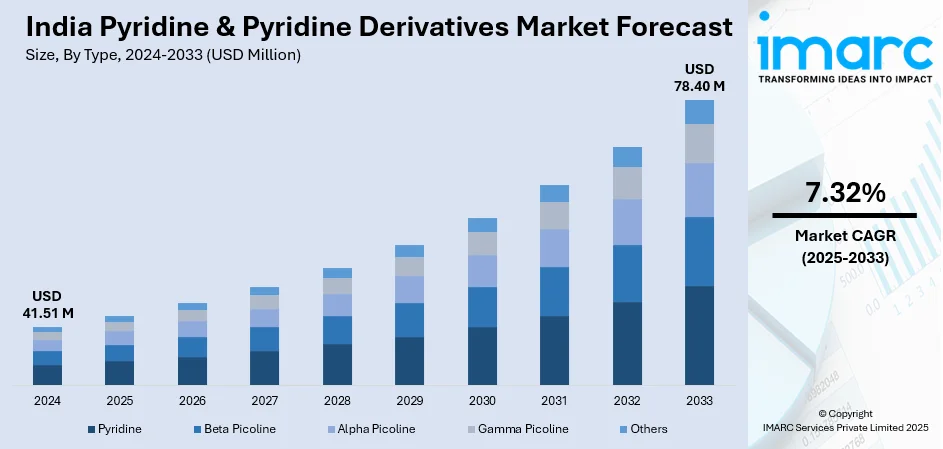

The India pyridine & pyridine derivatives market size reached USD 41.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 78.40 Million by 2033, exhibiting a growth rate (CAGR) of 7.32% during 2025-2033. The growth of market is driven by the expanding pharmaceutical sector, which utilizes these compounds in drug synthesis and as solvents. Additionally, the growing demand for these products in the agrochemicals sector, especially in the production of pesticides and herbicides, is acting as another significant growth-inducing factor.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 41.51 Million |

| Market Forecast in 2033 | USD 78.40 Million |

| Market Growth Rate 2025-2033 | 7.32% |

India Pyridine & Pyridine Derivatives Market Trends:

Rising Demand from the Pharmaceutical Industry

Pyridine and its derivatives are vital components in pharmaceutical synthesis, serving as key intermediates and solvents in the production of essential drugs such as anti-inflammatory agents, antihistamines, and vitamin B3 (niacin). With India's pharmaceutical sector experiencing rapid expansion, driven by rising domestic consumption and export demand, the market for pyridine derivatives is also witnessing significant growth. The Indian pharmaceutical market was valued at USD 61.36 billion in 2024 and is expected to reach USD 174.31 billion by 2033, exhibiting a CAGR of 11.32%. A major driver of this growth is the government’s Production Linked Incentive (PLI) scheme, designed to enhance self-reliance in pharmaceutical raw materials and reduce dependence on Chinese Active Pharmaceutical Ingredients (APIs). As pyridine derivatives are crucial for API synthesis, their local production is on the rise. Additionally, India's API market is growing at a CAGR of 7.79% (2025-2033), further strengthening demand for pyridine-based intermediates. This trend highlights the increasing importance of pyridine in ensuring a stable and competitive pharmaceutical supply chain, positioning India as a key player in the global pharmaceutical market.

To get more information on this market, Request Sample

Expanding Utilization Across Agrochemicals for Sustainable Farming

India’s agriculture sector is a key consumer of pyridine derivatives, particularly in the production of pesticides, herbicides, and fungicides. As the country focuses on enhancing crop yields and adopting modern farming techniques, the demand for agrochemicals containing pyridine-based compounds like paraquat and diquat has surged. The agrochemical market in India was valued at USD 15.5 billion in 2024 and is expected to reach USD 23.3 billion by 2033, growing at a CAGR of 4.28%. Additionally, India's installed pesticide capacity stood at 444,000 metric tons (MT) in 2024, with the pesticide market—where pyridine derivatives play a crucial role—expanding at a CAGR of 5.72% during 2025-2033. Moreover, favorable government initiatives, such as Atmanirbhar Bharat, which offers subsidies and incentives for domestic pesticide production, have further accelerated local manufacturing. In addition to this, the push for sustainable farming through precision agriculture and controlled pesticide usage is increasing the demand for efficient and less toxic agrochemical solutions. Pyridine-based herbicides are also helping reduce manual labor costs while improving crop efficiency, making them essential for India's agricultural transformation.

India Pyridine & Pyridine Derivatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Pyridine

- Beta Picoline

- Alpha Picoline

- Gamma Picoline

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pyridine, beta picoline, alpha picoline, gamma picoline, and others.

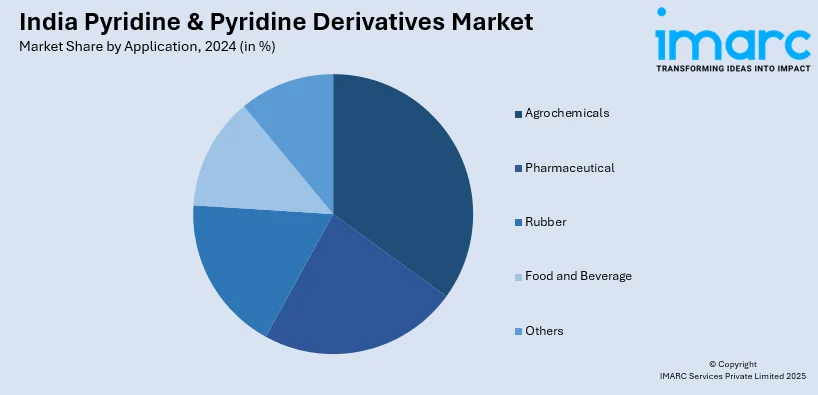

Application Insights:

- Agrochemicals

- Pharmaceutical

- Rubber

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agrochemicals, pharmaceutical, rubber, food and beverage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pyridine & Pyridine Derivatives Market News:

- September 2024: FMC Corporation, a leading agricultural sciences company, introduced three innovative crop protection solutions tailored for Indian farmers: Velzo® fungicide, Vayobel® herbicide, and Ambriva® herbicide. These products aim to enhance crop productivity and address specific agricultural challenges in India.

- June 2024: India Pesticides Ltd., an agrochemical manufacturer, announced the successful commissioning of an intermediate plant aimed at the backward integration of a fungicide previously imported. This initiative, based on the company's indigenous R&D technology, aligns with the Government of India's Atmanirbhar Bharat initiative. India Pesticides specializes in the manufacture, sale, and distribution of insecticides, fungicides, herbicides, and various other agrochemical products, with production facilities located in Sandila and Dewa Road, Uttar Pradesh.

India Pyridine & Pyridine Derivatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pyridine, Beta Picoline, Alpha Picoline, Gamma Picoline, Others |

| Applications Covered | Agrochemicals, Pharmaceutical, Rubber, Food and Beverage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pyridine & pyridine derivatives market performed so far and how will it perform in the coming years?

- What is the breakup of the India pyridine & pyridine derivatives market on the basis of type?

- What is the breakup of the India pyridine & pyridine derivatives market on the basis of application?

- What are the various stages in the value chain of the India pyridine & pyridine derivatives market?

- What are the key driving factors and challenges in the India pyridine & pyridine derivatives market?

- What is the structure of the India pyridine & pyridine derivatives market and who are the key players?

- What is the degree of competition in the India pyridine & pyridine derivatives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pyridine & pyridine derivatives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pyridine & pyridine derivatives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pyridine & pyridine derivative industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)