India Rainwater Harvesting Equipment Market Size, Share, Trends and Forecast by Type, Method, Component, End Use, and Region, 2025-2033

India Rainwater Harvesting Equipment Market Overview:

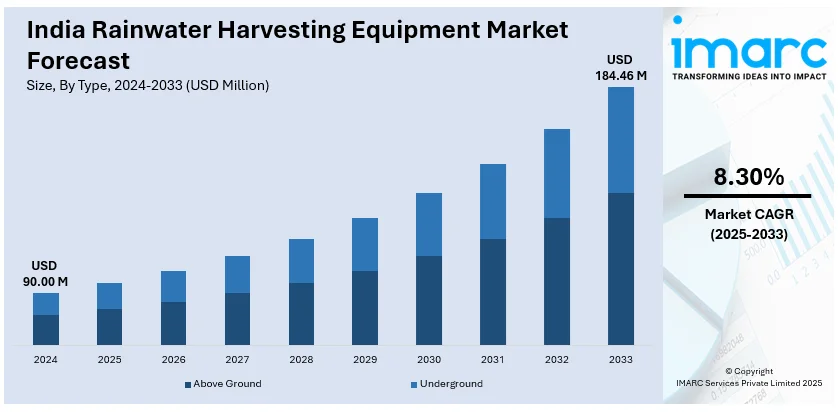

The India rainwater harvesting equipment market size reached USD 90.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 184.46 Million by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. The market is expanding due to increasing water scarcity, government initiatives, and rising awareness of sustainable water management. Technological advancements in filtration and storage systems enhance efficiency. Growth is supported by regulatory policies promoting rainwater harvesting in residential, commercial, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 90.00 Million |

| Market Forecast in 2033 | USD 184.46 Million |

| Market Growth Rate (2025-2033) | 8.30% |

India Rainwater Harvesting Equipment Market Trends:

Rising Government Initiatives in Rainwater Harvesting

The Indian government is actively promoting rainwater harvesting through various policies, subsidies and awareness campaigns to combat water scarcity and groundwater depletion. Initiatives such as the Jal Shakti Abhiyan, Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and state-level mandates require residential, commercial and industrial establishments to adopt rainwater harvesting systems. The Central Ground Water Authority (CGWA) has made rainwater harvesting mandatory in certain urban areas while tax incentives and financial assistance programs are encouraging adoption across sectors. These regulatory measures coupled with increasing investments in advanced filtration and storage technologies are significantly influencing India rainwater harvesting equipment market share driving demand across residential, commercial and industrial segments. Additionally, Smart City projects are integrating rainwater harvesting infrastructure to ensure sustainable urban water management. Public-private partnerships (PPPs) are further driving innovation and large-scale implementation of advanced rainwater collection and filtration technologies. The Indian government continues to introduce large-scale initiatives to strengthen water conservation efforts. For instance, in September 2024, the Government of India launched the 'Jal Sanchay Jan Bhagidari' initiative, focusing on water and nature conservation with public participation. Approximately 24,800 rainwater harvesting structures will be constructed in Gujarat to enhance sustainability. Prime Minister emphasized water conservation as essential for future generations and crucial for India’s cultural consciousness. With increasing policy support, awareness and regulatory enforcement, rainwater harvesting is becoming a key solution for water conservation accelerating India rainwater harvesting equipment market growth.

To get more information on this market, Request Sample

Rising Focus on Sustainability and Water Conservation

India is witnessing a growing emphasis on sustainability and water conservation as climate change and depleting groundwater resources intensify concerns over long-term water security. Government regulations, such as mandatory rainwater harvesting in urban developments and Smart City projects, are accelerating adoption across residential, commercial, and industrial sectors. Public awareness campaigns further promote responsible water management practices. For instance, in March 2024, the Ministry of Jal Shakti launched 'Jal Shakti Abhiyan: Catch the Rain-2024' in New Delhi to promote sustainable water management. The campaign includes rainwater harvesting, desilting water bodies, and geo-tagging, aiming to empower women in managing water resources. Industries and agricultural sectors are increasingly implementing rainwater harvesting systems to reduce dependence on traditional water sources, enhancing long-term sustainability. Technological advancements in water filtration, underground storage, and real-time monitoring are improving the efficiency of rainwater harvesting solutions. Additionally, eco-conscious consumers and businesses are prioritizing green infrastructure, boosting demand for advanced rainwater collection and storage equipment. These trends indicate strong future growth, shaping the India rainwater harvesting equipment market outlook positively.

India Rainwater Harvesting Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, method, component and end use.

Type Insights:

- Above Ground

- Underground

The report has provided a detailed breakup and analysis of the market based on the type. This includes above ground and underground.

Method Insights:

- Traditional

- Modern

A detailed breakup and analysis of the market based on the method have also been provided in the report. This includes traditional and modern.

Component Insights:

- Gutters

- Conduits

- First Flushing

- Filter

- Storage Tanks

- Recharging Structure

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes gutters, conduits, first flushing, filter, storage tanks, recharging structure and others.

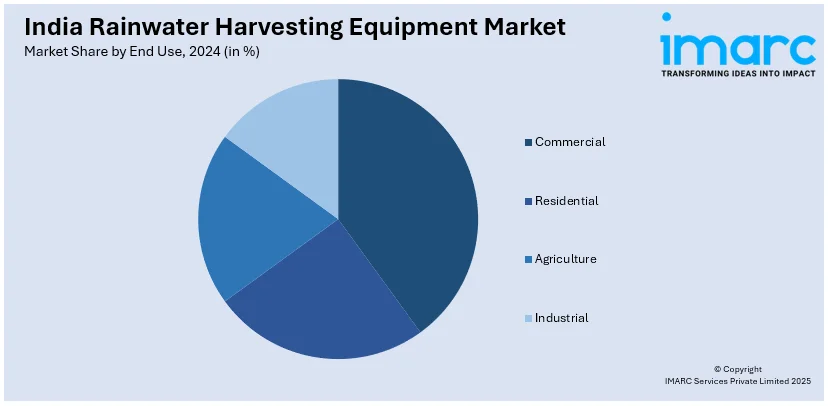

End Use Insights:

- Commercial

- Residential

- Agriculture

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, agriculture and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Rainwater Harvesting Equipment Market News:

- In March 2024, Supreme Industries Ltd. launched ‘Aquasource Smart Rainwater Filters’ to address the increasing need for rainwater harvesting amid urbanization and climate challenges. The filters, suitable for varied applications and compliant with CGWA guidelines, enhance filtration efficiency, ensuring clean water management for residential, commercial, and industrial projects.

- In January 2024, the government announced the modernization of Rajasthan's traditional rainwater harvesting system 'tankas' under MGNREGA, constructing reinforced concrete water storage tanks to combat water scarcity. Since 2016, over 184,000 tanks have been built, providing clean drinking water to households and alleviating the burden on women who previously traveled long distances for water.

India Rainwater Harvesting Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Above Ground, Underground |

| Methods Covered | Organic, Conventional |

| Components Covered | Gutters, Conduits, First Flushing, Filter, Storage Tanks, Recharging Structure, Others |

| End Uses Covered | Commercial, Residential, Agriculture, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India rainwater harvesting equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India rainwater harvesting equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India rainwater harvesting equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rainwater harvesting equipment market in India was valued at USD 90.00 Million in 2024.

The India rainwater harvesting equipment market is projected to exhibit a CAGR of 8.30% during 2025-2033, reaching a value of USD 184.46 Million by 2033.

The India rainwater harvesting equipment market is driven by rising water scarcity, government initiatives promoting sustainable water management, and increasing urbanization. Growing demand in residential, commercial, and industrial sectors, coupled with heightened awareness about water conservation and cost savings, is further accelerating market adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)