India Ready-to-Cook Food Market Size, Share, Trends and Forecast by Product Category, Sales Channel, and Region, 2025-2033

India Ready-to-Cook Food Market Overview:

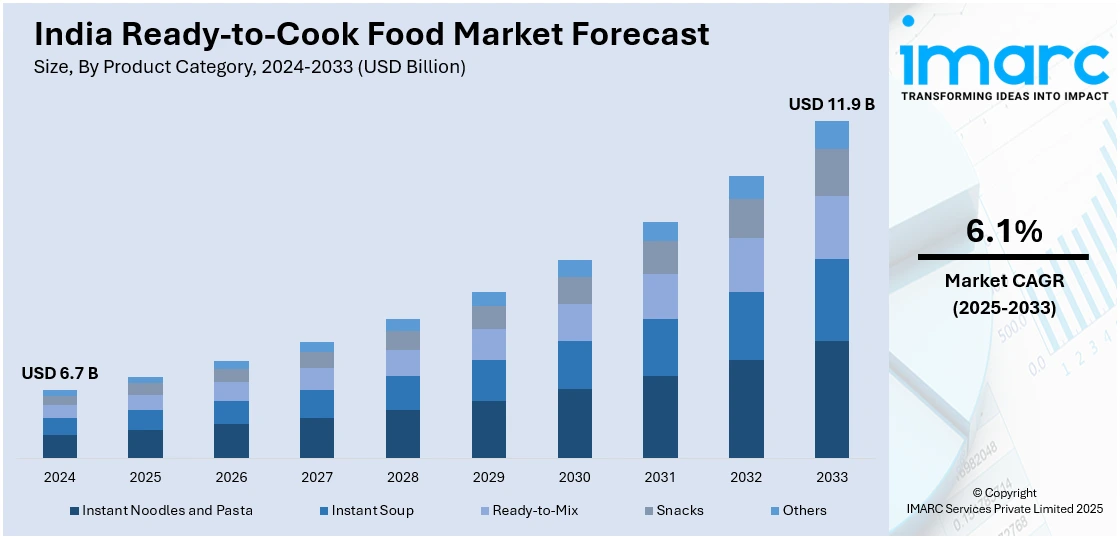

The India ready-to-cook food market size reached USD 6.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.1% during 2025-2033. The market is driven by rising urbanization, busy lifestyles, growing demand for convenience food products, increasing nuclear families, and working professionals. Furthermore, rising preference of nutritious RTC options among health-conscious consumers, e-commerce expansion, improved cold chain logistics, and brand innovations accelerate India ready-to-cook food market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.7 Billion |

| Market Forecast in 2033 | USD 11.9 Billion |

| Market Growth Rate (2025-2033) | 6.1% |

India Ready-to-Cook Food Market Trends:

Changing Lifestyles and Busy Schedules

With increasing urbanization, nuclear families, and dual-income households, consumers have less time for traditional cooking. The demand for quick, hassle-free meal solutions has surged, making ready-to-cook (RTC) foods a preferred choice for working professionals, students, and homemakers. People nowadays seek easy-to-prepare yet nutritious meals that require minimal effort but retain authentic flavors. The fast-paced lifestyle in metro cities, along with long working hours, has fueled the adoption of RTC foods, including instant meals, pre-marinated meats, and semi-cooked products that significantly reduce cooking time while maintaining taste and quality. For instance, in March 2025, Ready-to-cook food company iD Fresh Food introduced instant "homestyle sambar," signifying its entry into the ₹5,000-crore ready-to-heat sector. The introduction is also part of the firm's goal to broaden its breakfast lineup to provide "a full variety of food items". The item will be accessible on all online shopping sites in Bengaluru, Chennai, Hyderabad, Mumbai, Pune, and Delhi. This caters to the fast-paced urban lifestyle where people prefer convenient yet flavorful food options which creates a positive India ready-to-cook food market outlook.

To get more information on this market, Request Sample

Rising Disposable Incomes and Changing Eating Habits

As disposable incomes rise, consumers are willing to spend more on convenience-driven, high-quality food products. This shift has led to an increase in premium RTC food options, including gourmet dishes, exotic cuisines, and healthier alternatives. With a growing middle class, people are moving away from basic home-cooked meals to more diverse and experimental food choices. Brands have responded by introducing regionally inspired RTC meals, organic ingredients, and preservative-free options to cater to evolving preferences. Additionally, exposure to global cuisines and international food trends has contributed to the expanding RTC food segment. For instance, in March 2023, Adani Wilmar launched its Kohinoor Biryani Kit, aiming to simplify biryani preparation for food enthusiasts. Available in Hyderabadi and Lucknowi variants, the kit includes 200g of basmati rice, 125g of biryani masala paste, whole spices, and raita seasoning. Customers can enhance the dish with vegetables or meat. The increasing preference for specialty, ready-to-cook meals shows that consumers are experimenting with diverse cuisines beyond everyday home-cooked meals, fueling the India ready-to-cook food market share.

India Ready-to-Cook Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product category and sales channel.

Product Category Insights:

- Instant Noodles and Pasta

- Instant Soup

- Ready-to-Mix

- Snacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product category. This includes instant noodles and pasta, instant soup, ready-to-mix, snacks, and others.

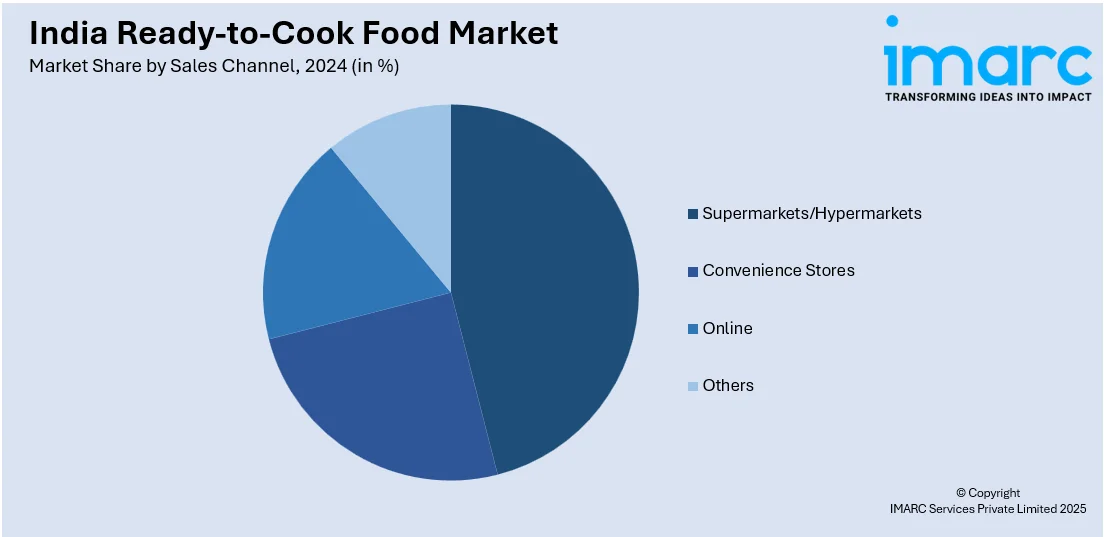

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ready-to-Cook Food Market News:

- In October 2024, Eastern launched a new line of ready-to-cook Kerala breakfast products, including Puttu, Dosa, and Idli, catering to modern consumers' needs for convenience. Priced competitively and with a six-month shelf life, these products aim to capture a share of the INR 400 crore breakfast food segment.

- In February 2025, ITC finalized agreements for the purchase of Prasuma, a company involved in frozen, chilled, and ready-to-cook food products in India. This family enterprise has been expanded by Lisa Suwal and Siddhant Wangdi, a husband and wife team who started the company to transform the frozen food sector in India and enhance frozen food to surpass fresh options.

India Ready-to-Cook Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Categories Covered | Instant Noodles and Pasta, Instant Soup, Ready-to-Mix, Snacks, Others |

| Sales Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ready-to-cook food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ready-to-cook food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ready-to-cook food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India ready-to-cook food market was valued at USD 6.7 Billion in 2024.

The India ready-to-cook food market is projected to exhibit a CAGR of 6.1% during 2025-2033, reaching a value of USD 11.9 Billion by 2033.

The India ready-to-cook food market is driven by busy lifestyles, changing eating habits, and the need for quick meal solutions. The rise of working professionals and smaller households fuels demand. Consumers seek convenience, variety, and ease of preparation, making ready-to-cook options increasingly popular in urban and semi-urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)