India Reclaimed Lumber Market Size, Share, Trends and Forecast by Application, End Use, and Region, 2025-2033

India Reclaimed Lumber Market Size and Share:

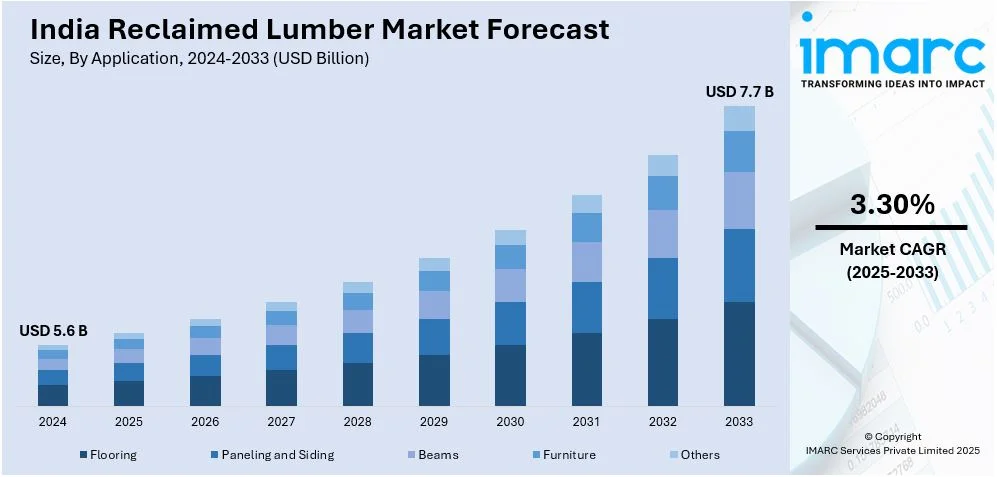

The India reclaimed lumber market size reached USD 5.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The rising demand for sustainable building materials, increasing urbanization, government initiatives promoting green construction, growing consumer preference for eco-friendly interiors, expanding furniture and flooring industries, cost-effectiveness compared to new timber, and the unique aesthetic appeal of aged, weathered wood in modern design are some of the major factors positively impacting the India reclaimed lumber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.6 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Market Growth Rate 2025-2033 | 3.30% |

India Reclaimed Lumber Market Trends:

Growing Demand in the Furniture Industry

The rising consumer preference for sustainable and eco-friendly products is positively influencing the India reclaimed lumber market outlook. Reclaimed lumber is sourced from repurposed wood and aligns with environmental consciousness by reducing the need for new timber and minimizing deforestation. The unique aesthetic appeal of reclaimed wood captivates both artisans and consumers. Also, the distinct textures of reclaimed lumber and its historical significance, is leading to an increase in its use for crafting bespoke furniture pieces. The furniture made from reclaimed wood continues to expand, with designers exploring innovative ways to highlight its aged beauty. According to the Trade Promotion Council of India, the furniture industry is expected to increase at a 10.9% CAGR to reach USD 32.7 Billion by 2026. This growth of the furniture market, coupled with the adoption of e-commerce platforms by furniture retailers, has further propelled the demand for reclaimed lumber. Consumers are increasingly seeking products that combine sustainability with unique design elements, making reclaimed wood furniture a preferred choice in modern Indian households.

To get more information on this market, Request Sample

Government Policies Promoting Green Building Initiatives

Government policies in India are increasingly promoting green building initiatives, resulting in a heightened demand and India reclaimed lumber market growth. A significant indicator of this shift is India's ranking in the U.S. Green Building Council's (USGBC) annual list of the Top 10 Countries and Regions for LEED in 2024, where India secured the third position. In 2024 alone, approximately 370 projects, covering a total of 8.5 million gross square meters (91.5 million square feet) of buildings and spaces, received LEED certification. This rise in LEED-certified projects underscores the growing emphasis on sustainable construction, where the use of eco-friendly materials such as reclaimed lumber plays a vital role. Reclaimed lumber assists in achieving credits in materials and resources, as well as indoor environmental quality, contributing to the parameters required for such certifications. Therefore, developers are increasingly incorporating it into their projects to meet certification standards. Moreover, government incentives, such as tax benefits and subsidies for green buildings, further drive the adoption of reclaimed wood, positioning it as a key material in India's evolving sustainable construction landscape. This regulatory support accelerates the shift towards sustainable construction practices, positioning reclaimed lumber as a pivotal component in India's evolving architectural landscape.

India Reclaimed Lumber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application and end use.

Application Insights:

- Flooring

- Paneling and Siding

- Beams

- Furniture

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes flooring, paneling and siding, beams, furniture, and others.

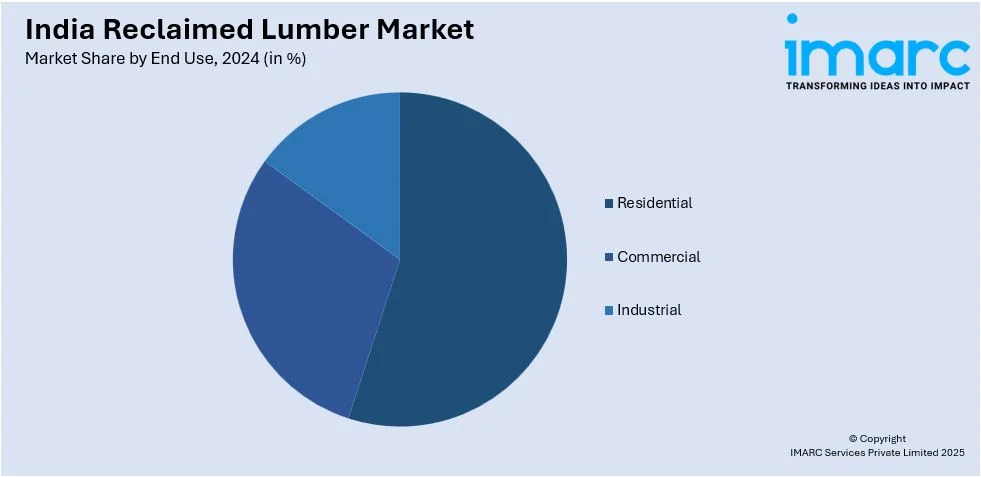

End Use Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Reclaimed Lumber Market News:

- On December 1, 2024, the World Architecture Festival honored two Indian projects. 'AGRITECTURE' by the gRID Architects won in the Future Project: Experimental category. AGRITECTURE integrates sustainable urban living with agricultural elements, and it uses mild steel, polycarbonate sheets, and reclaimed wood to ensure light penetration and structural endurance. Additionally, 'OH HO Residence' by Play Architecture secured awards, showcasing innovative design and material application.

India Reclaimed Lumber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Flooring, Paneling and Siding, Beams, Furniture, Others |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India reclaimed lumber market performed so far and how will it perform in the coming years?

- What is the breakup of the India reclaimed lumber market on the basis of application?

- What is the breakup of the India reclaimed lumber market on the basis of end use?

- What is the breakup of the India reclaimed lumber market on the basis of region?

- What are the various stages in the value chain of the India reclaimed lumber market?

- What are the key driving factors and challenges in the India reclaimed lumber market?

- What is the structure of the India reclaimed lumber market and who are the key players?

- What is the degree of competition in the India reclaimed lumber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India reclaimed lumber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India reclaimed lumber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India reclaimed lumber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)