India Religious and Spiritual Market Size, Share, Trends and Forecast by Sector, Income Source, Distribution Channel, Religion, and Region, 2026-2034

India Religious and Spiritual Market Summary:

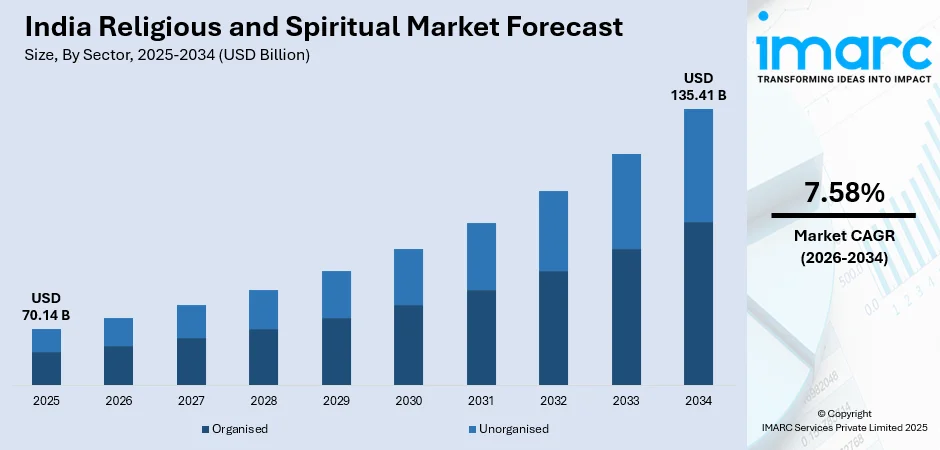

The India religious and spiritual market size was valued at USD 70.14 Billion in 2025 and is projected to reach USD 135.41 Billion by 2034, growing at a compound annual growth rate of 7.58% from 2026-2034.

The market is driven by deeply rooted cultural traditions, increasing disposable incomes, growing interest in spiritual wellness and mindfulness practices, expanding pilgrimage infrastructure, and rising digital accessibility to religious content and services. Government initiatives promoting religious tourism circuits, enhanced connectivity to sacred destinations, and the commercialization of spiritual experiences further contribute to sustained demand across diverse demographic segments, strengthening India religious and spiritual market share.

Key Takeaways and Insights:

- By Sector: Organised dominates the market with a share of 54% in 2025, driven by professionalization of temple management, large-scale religious trusts, and corporate involvement in pilgrimage services.

- By Income Source: Religious tourism leads the market with a share of 26% in 2025, owing to enhanced connectivity to pilgrimage destinations and growing preference for organized spiritual travel experiences.

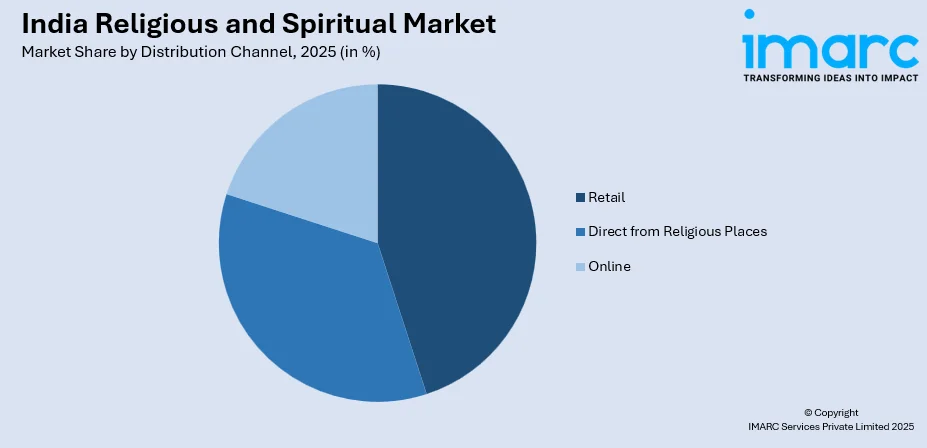

- By Distribution Channel: Retail represents the largest segment with a market share of 42% in 2025, driven by widespread availability of religious merchandise through specialty stores and neighbourhood shops.

- By Religion: Hinduism dominates the market with a share of 68% in 2025, owing to majority population following Hindu traditions, extensive temple networks, and year-round festivals.

- By Region: North India leads the market with a share of 32% in 2025, driven by major pilgrimage destinations including Varanasi, Mathura, Haridwar, and Ayodhya attracting devotees throughout the year.

- Key Players: The India religious and spiritual market exhibits a fragmented competitive landscape, with established religious trusts and charitable organizations operating alongside private enterprises offering pilgrimage services, spiritual merchandise, and digital religious content platforms serving diverse faith communities.

To get more information on this market Request Sample

The India religious and spiritual market continues to experience robust expansion fueled by the nation's deep-rooted spiritual heritage and evolving consumer preferences toward organized religious experiences. Increasing urbanization and demanding lifestyles have intensified the search for spiritual solace, driving participation in meditation retreats, yoga programs, and pilgrimage journeys. For example, in 2025, the sacred city of Kashi (Varanasi) recorded a record-breaking influx of over 72.6 Million devotees, with approximately 80% of visitors being youth, highlighting rising engagement among younger generations at historic pilgrimage sites. Moreover, government initiatives focusing on developing religious tourism circuits and improving infrastructure at sacred destinations have significantly enhanced accessibility for domestic and international devotees. The proliferation of digital platforms has democratized access to religious content, enabling virtual darshans, online puja bookings, and spiritual guidance from anywhere. Rising disposable incomes among middle-class households have translated into increased spending on religious ceremonies, premium spiritual merchandise, and organized pilgrimage packages offering comprehensive services and enhanced experiences.

India Religious and Spiritual Market Trends:

Digital Transformation of Religious Practices

The integration of technology into spiritual practices represents a significant shift in how devotees engage with their faith. Mobile applications and web platforms now facilitate virtual temple visits, online donation management, and live streaming of religious ceremonies. As per sources, the devotional app Sri Mandir has amassed over 40 Million downloads and enabled more than 1.2 Million devotees to perform online prayers and offerings across over 70 temples in India in the past year, reflecting strong digital engagement with religious services. Furthermore, digital platforms offer personalized horoscope services, astrological consultations, and customized puja arrangements based on individual requirements. E-commerce channels have expanded the reach of religious merchandise vendors, enabling consumers to access authentic products from renowned pilgrimage centers regardless of geographical location.

Wellness-Integrated Spiritual Experiences

The convergence of spiritual practices with holistic wellness approaches has created new market opportunities and consumer expectations. Spiritual retreats increasingly incorporate yoga, meditation, Ayurvedic treatments, and naturopathy alongside traditional religious activities. As per sources, in 2025, the Kshemavana Naturopathy and Yoga Centre in Bengaluru was named Best Wellness Retreat in Asia at the Asia’s Excellence Awards, underscoring the rising prominence of holistic and spiritually infused wellness destinations in India. Moreover, this integration appeals to health-conscious consumers seeking comprehensive mind-body-soul rejuvenation experiences. Destination ashrams and wellness centers have emerged across the country, offering curated programs combining ancient wisdom with contemporary wellness methodologies.

Premium Pilgrimage and Spiritual Tourism Services

The emergence of organized, premium pilgrimage services has transformed traditional religious travel into sophisticated tourism experiences. Tour operators now offer comprehensive packages including luxury accommodations, dedicated guides, priority access to temples, and specialized spiritual programs. According to sources, Epic Yatra accredited by India’s Ministry of Tourism, announced its Luxury Char Dham Yatra Packages for the 2026 season, featuring premium hotels, private transportation, and optional helicopter transfers to Kedarnath to enhance the comfort and ease of the sacred journey. Further, helicopter services to mountain shrines, chartered train journeys connecting sacred destinations, and exclusive ashram stays cater to affluent devotees seeking comfortable pilgrimage experiences. This premiumization trend extends to customized religious ceremonies, VIP darshan arrangements, and personalized spiritual counselling services that command higher price points while delivering enhanced convenience and memorable experiences.

Market Outlook 2026-2034:

The India religious and spiritual market is projected to witness sustained revenue growth throughout the forecast period, driven by increasing spiritual consciousness among urban populations and continued infrastructure development at pilgrimage destinations. Government investments in religious tourism circuits will enhance destination appeal and visitor capacity. Digital innovation will create new revenue streams through online services. Growing preference for organized spiritual experiences among younger demographics and expanding middle-class populations will support sustained market expansion. The market generated a revenue of USD 70.14 Billion in 2025 and is projected to reach a revenue of USD 135.41 Billion by 2034, growing at a compound annual growth rate of 7.58% from 2026-2034.

India Religious and Spiritual Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Sector | Organised | 54% |

| Income Source | Religious Tourism | 26% |

| Distribution Channel | Retail | 42% |

| Religion | Hinduism | 68% |

| Region | North India | 32% |

Sector Insights:

- Organised

- Unorganised

Organised dominates with a market share of 54% of the total India religious and spiritual market in 2025.

The organised has established dominance in the India religious and spiritual market, encompassing professionally managed temples, registered religious trusts, and corporate-structured pilgrimage service providers. This category benefits from systematic management practices, standardized service delivery, and transparent financial operations that build consumer trust and confidence. According to sources, in 2025 December, the Kanakadurga Temple in Vijayawada announced plans to introduce Tirumala-style online darshan slot bookings, prasadam orders, and parking reservations through a dedicated mobile platform to streamline pilgrim services and enhance devotee experience. Moreover, large temple administrations have implemented modern amenities, digital booking systems, and visitor management technologies to enhance devotee experiences and operational efficiency.

The growth trajectory of the organised reflects broader formalization trends in the Indian economy and increasing consumer expectations for quality and accountability in religious services. Religious institutions under organized management demonstrate superior capacity for infrastructure development, crowd management, and service diversification across multiple touchpoints. This category attracts institutional donations and government grants that fund facility upgrades, preservation projects, and community welfare initiatives. These investments create virtuous cycles of improvement and visitor satisfaction, further strengthening market position.

Income Source Insights:

- Religious Tourism

- Donations

- Media and Music

- Religious Items and Merchandise

- Construction and Infrastructure

- Others

Religious tourism leads with a share of 26% of the total India religious and spiritual market in 2025.

Religious tourism has emerged as the leading income source within the market, driven by the cultural significance of pilgrimage in Indian traditions and improved accessibility to sacred destinations nationwide. According to reports, MakeMyTrip reported that 63% of pilgrimage bookings were made within six days of travel, 53% were single-night stays, and 47% were group trips across India. Furthermore, millions of devotees undertake spiritual journeys annually to temples, shrines, and holy cities, generating substantial economic activity across transportation, hospitality, and retail sectors. Furthermore, government initiatives promoting pilgrimage circuits and heritage tourism have enhanced infrastructure development and marketing of religious destinations both domestically and internationally, attracting growing visitor numbers seeking meaningful spiritual experiences throughout the year.

This income category demonstrates resilience and consistent demand regardless of economic cycles, as pilgrimage holds deep spiritual importance transcending discretionary spending considerations for most Indian households. Evolving consumer preferences favor organized tour packages offering convenience, safety, and comprehensive services over traditional self-arranged travel arrangements. The emergence of niche pilgrimage experiences, including walking yatras, meditation retreats, and festival-specific tours, has diversified offerings considerably. These developments have attracted new participant demographics to religious travel, expanding the addressable market and revenue potential.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct from Religious Places

- Retail

- Online

Retail exhibits a clear dominance with a 42% share of the total India religious and spiritual market in 2025.

The retail maintains leadership position by providing convenient access to religious merchandise through diverse store formats serving daily worship requirements across India. Specialty religious goods stores offer curated selections of puja items, devotional literature, and spiritual accessories catering to specific faith traditions and regional practices. As per sources, in 2025, BigBasket reported festive sales growth compared to 2024 during Durga Puja and Dussehra: idols rose 36%, dhunuchis 42%, and pooja essentials, including flowers and offerings, increased 128%. Moreover, supermarkets and neighbourhood stores stock essential religious items ensuring widespread availability across urban and rural markets. This accessibility makes retail the preferred purchasing channel for devotees seeking immediate fulfillment of their spiritual needs and ceremonial requirements.

Retail derives from the routine nature of religious practice requiring regular replenishment of consumables like incense, flowers, offerings, and seasonal ceremonial items used in daily worship. Physical retail environments enable product examination, quality assessment, and immediate purchase fulfillment that many devotees prefer for items with spiritual significance and authenticity concerns. Store staff often provide guidance on proper usage, appropriate offerings for specific occasions, and recommendations based on traditional requirements, adding valuable service beyond simple transactions and building customer loyalty.

Religion Insights:

- Hinduism

- Islam

- Sikhism

- Buddhism

- Christianity

- Others

Hinduism leads with a market share of 68% of the total India religious and spiritual market in 2025.

Hinduism commands the largest market share, reflecting the majority religious demographic composition of India and the extensive commercial ecosystem supporting Hindu spiritual practices across the nation. This category encompasses diverse expenditure areas including temple visits, home worship supplies, festival celebrations, life-cycle ceremonies, and pilgrimage activities undertaken by millions annually. In August 2025, quick‑commerce platforms reported Ganesha idol sales jumping 300% compared with last year, driven by urban devotees opting for 10‑minute delivery of festive puja essentials. Moreover, thousands of temples ranging from village shrines to major pilgrimage centers generate substantial economic activity through donations, offerings, and associated services, creating a robust market foundation supporting consistent revenue generation throughout the year.

Hinduism emphasizes regular worship practices, numerous annual festivals, and elaborate ceremonial requirements that sustain consistent demand for religious goods and services throughout the calendar year. Regional variations in practices and deity preferences create localized market opportunities while pan-Indian festivals drive nationwide consumption peaks during auspicious periods. This category benefits from established supply chains for specialized merchandise, trained service providers for ritual requirements, and organizational infrastructure supporting large-scale religious gatherings, ensuring reliable product and service availability for devotees.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 32% of the total India religious and spiritual market in 2025.

North India leads regional market distribution, anchored by numerous sacred destinations holding paramount significance in Hindu, Sikh, Buddhist, and Islamic traditions across multiple states. The region hosts iconic pilgrimage centers including Varanasi, Haridwar, Mathura, Vrindavan, Ayodhya, and the Golden Temple that attract millions of devotees annually from across India and internationally. Historical significance, mythological associations, and spiritual heritage concentrate religious economic activity within this geography, making it the most important regional market for religious goods, services, and pilgrimage-related expenditures.

Infrastructure development including highway networks, railway connectivity, and airport expansions has enhanced accessibility to northern pilgrimage destinations considerably in recent years. Government investments in smart city projects at religious centers have improved visitor amenities, crowd management capabilities, and overall pilgrimage experiences for devotees. The region's diverse religious landscape supporting multiple faith traditions creates year-round pilgrimage seasons as different communities observe festivals and holy periods throughout the calendar, ensuring sustained economic activity and consistent revenue generation across all months.

Market Dynamics:

Growth Drivers:

Why is the India Religious and Spiritual Market Growing?

Rising Spiritual Consciousness Among Urban Populations

The accelerating pace of modern urban life has paradoxically strengthened interest in spiritual practices and religious engagement among city dwellers seeking meaning and balance. As per sources, in January 2026, over 1 Lakh people participated in Gujarat’s mass Surya Namaskar and meditation event, reflecting urban interest in wellness and spiritual practices. Furthermore, stress-related concerns, lifestyle diseases, and mental wellness awareness have driven increasing participation in meditation programs, yoga practices, and spiritual retreats offering respite from demanding routines. Corporate wellness initiatives incorporating mindfulness practices have normalized spiritual engagement within professional contexts, expanding addressable audiences beyond traditionally religious demographics. Urban consumers demonstrate willingness to invest in spiritual experiences, quality religious merchandise, and premium services that accommodate their schedules and preferences while delivering authentic value.

Government Infrastructure Development Initiatives

Sustained government investment in religious tourism infrastructure has significantly enhanced the accessibility, capacity, and appeal of pilgrimage destinations across India. Initiatives including the prasad scheme and swadesh darshan program have funded facility upgrades, transportation improvements, and destination development at prominent religious sites. According to reports, in December 2025, the Ministry of Tourism sanctioned 36 projects under Swadesh Darshan 2.0 and CBDD, with ₹1900 Crore budgeted for sustainable tourism development across India. Moreover, highway construction projects connecting pilgrimage circuits have reduced travel times and improved journey comfort for devotees. Airport development, railway station modernization, and last-mile connectivity solutions have opened previously challenging destinations to broader visitor segments, including elderly devotees and families seeking convenient travel options.

Digital Enablement of Religious Services

Technological advancement has created new channels for religious engagement, service delivery, and merchandise distribution that expand market reach and convenience. Temple administrations have implemented online booking systems for special darshans, donation management, and prasad delivery enabling remote participation in religious activities. Moreover, mobile applications provide comprehensive pilgrimage planning resources, navigation assistance, and real-time information enhancing visitor experiences. Live streaming capabilities allow virtual participation in ceremonies and festivals, engaging diaspora communities and devotees unable to travel physically while generating alternative revenue streams through digital offerings.

Market Restraints:

What Challenges the India Religious and Spiritual Market is Facing?

Fragmented and Unorganized Market Structure

The predominance of unorganized operators in significant market segments creates challenges for standardization, quality assurance, and consumer protection. Small-scale vendors and informal service providers operate without regulatory oversight, resulting in inconsistent product quality and service delivery. This fragmentation complicates market development efforts and limits scalability opportunities for professional operators seeking structured growth pathways.

Infrastructure Limitations at Secondary Destinations

While major pilgrimage centers have received substantial development attention, numerous secondary religious destinations continue facing inadequate infrastructure constraining visitor capacity and experience quality. Limited accommodation options, poor sanitation facilities, and insufficient transportation connectivity deter potential visitors from exploring lesser-known spiritual sites. These constraints concentrate pilgrimage activity at established destinations while underdeveloped sites remain underutilized.

Seasonal Demand Fluctuations

The concentration of religious activities around specific festivals, auspicious periods, and seasonal pilgrimage windows creates significant demand variability throughout the year. Service providers and retailers face challenges managing capacity, inventory, and workforce during alternating peak and lean periods. This seasonality impacts business sustainability and investment decisions, particularly for operators in pilgrimage-dependent locations experiencing extended off-peak periods.

Competitive Landscape:

The India religious and spiritual market features a diverse competitive environment characterized by the coexistence of traditional religious institutions, charitable trusts, and emerging commercial enterprises across multiple service categories. Established temple administrations and religious organizations maintain dominant positions in destination-based activities, leveraging historical significance, devotee loyalty, and accumulated trust over generations. The retail segment demonstrates fragmentation with numerous local and regional players serving community-specific requirements alongside organized retail chains offering standardized religious merchandise selections. Digital platforms have introduced new competitive dynamics, enabling technology-enabled entrants to capture market share through innovative service delivery models and enhanced consumer convenience.

Recent Developments:

- In April 2025, Pujashree Products Global Pvt Ltd raised INR 12 Crore seed capital to scale spiritual commerce in India. Offering Shastra-compliant puja kits and ritual products via online platforms and select stores, the company aims for INR 100 Crore revenue in its first year, highlighting rising demand for authentic, tech-enabled devotional offerings.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Organised, Unorganised |

| Income Sources Covered | Religious Tourism, Donations, Media and Music, Religious Items and Merchandise, Construction and Infrastructure, Others |

| Distribution Channels Covered | Direct from Religious Places, Retail, Online |

| Religions Covered | Hinduism, Islam, Sikhism, Buddhism,Christianity, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India religious and spiritual market size was valued at USD 70.14 Billion in 2025.

The India religious and spiritual market is expected to grow at a compound annual growth rate of 7.58% from 2026-2034 to reach USD 135.41 Billion by 2034.

Organised held the largest market share, driven by professionally managed temples, registered religious trusts, standardized service delivery, transparent financial operations, digital booking systems, and modern visitor management technologies enhancing devotee experiences and operational efficiency.

Key factors driving the India religious and spiritual market include rising spiritual consciousness among urban populations, government infrastructure development at pilgrimage destinations, digital enablement of religious services, increasing disposable incomes, and growing preference for organized pilgrimage experiences.

Major challenges include fragmented and unorganized market structure limiting standardization, infrastructure limitations at secondary pilgrimage destinations, seasonal demand fluctuations affecting business sustainability, quality inconsistency among informal service providers, and regulatory complexities governing religious commerce activities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)