India Renewable Energy Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, and Region, 2026-2034

India Renewable Energy Equipment Market Overview:

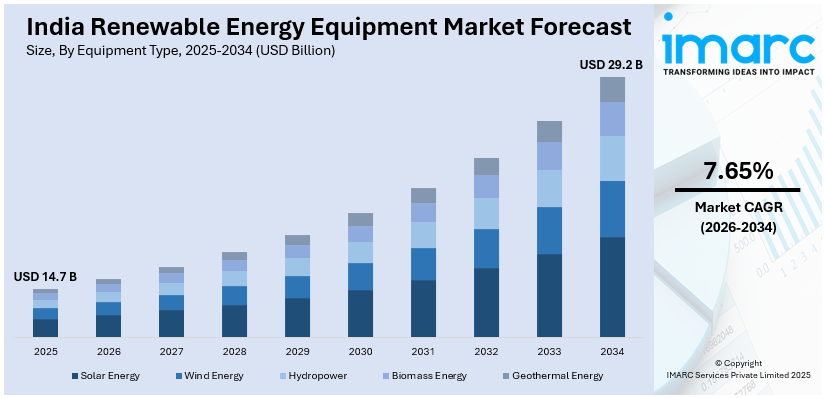

The India renewable energy equipment market size reached USD 14.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 29.2 Billion by 2034, exhibiting a growth rate (CAGR) of 7.65% during 2026-2034. The market is expanding rapidly, fueled by government incentives, rising investments, and growing demand for solar, wind, and bioenergy technologies, while domestic manufacturing and strong policy support are reducing import dependence and accelerating progress toward sustainable energy goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.7 Billion |

| Market Forecast in 2034 | USD 29.2 Billion |

| Market Growth Rate (2026-2034) | 7.65% |

India Renewable Energy Equipment Market Trends:

Surge in Domestic Manufacturing and Supply Chain Localization

The India renewable energy (RE) equipment market outlook is undergoing a major shift toward local manufacturing, driven by the Production-Linked Incentive (PLI) scheme and higher import duties on solar panels and wind components. This is aimed at reducing dependence on imports and strengthening domestic production capabilities. For instance, in 2024, India added 18.5 GW of new utility-scale solar capacity, a nearly 2.8-fold increase compared to 2023. Rajasthan led with 7.09 GW of new installations, followed by Gujarat with 4.32 GW and Tamil Nadu with 1.73 GW, collectively accounting for 71% of the country's utility-scale solar installations. In addition to this, the Atmanirbhar Bharat (self-reliant India) initiative has led companies to establish solar photovoltaic (PV) modules and inverter and wind turbine component and bioenergy equipment production facilities within the country. Moreover, the transfer of production from Chinese imports has established a more reliable supply chain network. Besides this, future manufacturing innovations combined with scaling operations will decrease RE costs to ensure greater market competitiveness. After these transformative changes, additional challenges need resolution since building large manufacturing facilities requires high-quality materials and specialized technical knowledge as well as sufficient financial resources. As a result, the India RE targets depend on domestic companies working together with leading global technology providers to develop superior products, thereby boosting the India renewable energy equipment market share.

To get more information on this market Request Sample

Increasing Investments in Energy Storage and Grid Integration

The increasing investments in energy storage and grid integration are significantly driving the India renewable energy equipment market growth. In line with this, the unpredictable nature of solar and wind generation demands high-end storage technology which includes lithium-ion batteries and pumped hydro storage together with green hydrogen developments. Concurrently, the National Energy Storage Mission serves as a government initiative to enhance battery storage system research along with development and deployment efforts. Moreover, the implementation of smart grids and operation systems enables grid modernization through enhancements of power efficiency and stability. Besides this, the private sector demonstrates increasing interest in establishing large-scale battery production plants together with energy storage facilities. For example, in 2024, LG Energy Solution and India's JSW Energy are negotiating a $1.5 billion joint venture to manufacture batteries for electric vehicles and renewable energy storage, with a proposed plant capacity of 10 GWh. Additionally, the widespread adoption of batteries is supported by decreasing prices and the implementation of programs like viability gap funding for storage projects despite their high initial expenses. Apart from this, India is developing robust energy storage capabilities because the country needs a stable and resilient energy supply to support increasing RE deployment.

India Renewable Energy Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on equipment type and application.

Equipment Type Insights:

- Solar Energy

- Photovoltaic (PV) Panels

- Solar Inverters

- Solar Batteries/Storage Systems

- Solar Thermal Systems

- Solar Chargers and Controllers

- Wind Energy

- Wind Turbines

- Blades and Towers

- Wind Inverters

- Wind Energy Storage Systems

- Hydropower

- Hydropower Turbines

- Pumped Storage Hydroelectric Systems

- Micro-hydro Generators

- Biomass Energy

- Biomass Boilers

- Biomass Gasifiers

- Biogas Plants

- Bioenergy Conversion Systems

- Geothermal Energy

- Geothermal Heat Pumps

- Geothermal Power Plants

- Steam Turbines and Condensers

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes solar energy (photovoltaic (PV) panels, solar inverters, solar batteries/storage systems, solar thermal systems, solar chargers and controllers), wind energy (wind turbines, blades and towers, wind inverters, wind energy storage systems), hydropower (hydropower turbines, pumped storage hydroelectric systems, micro-hydro generators), biomass energy (biomass boilers, biomass gasifiers, biogas plants, bioenergy conversion systems), and geothermal energy (geothermal heat pumps, geothermal power plants, steam turbines and condensers).

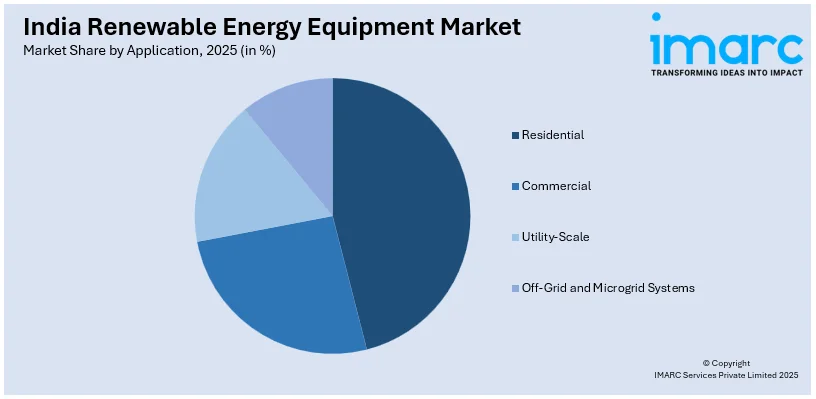

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Utility-Scale

- Off-Grid and Microgrid Systems

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, utility-scale, and off-grid and microgrid systems.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Renewable Energy Equipment Market News:

- In December 2024, South Korea's LG Energy Solution and India's JSW Energy entered into a $1.5 billion joint venture to manufacture batteries for electric vehicles and renewable energy storage. The proposed plant, with a capacity of 10 gigawatt-hours, is expected to bolster India's energy storage infrastructure and support the transition to clean energy.

- In November 2024, The Adani Group announced plans to establish a comprehensive solar manufacturing ecosystem in India, encompassing the production of solar ingots, wafers, cells, and panels. This initiative aims to reduce reliance on Chinese imports and strengthen India's position in the global solar market.

India Renewable Energy Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Applications Covered | Residential, Commercial, Utility-Scale, Off-Grid and Microgrid Systems |

| Regions Covered | North India, south India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India renewable energy equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India renewable energy equipment market on the basis of equipment type?

- What is the breakup of the India renewable energy equipment market on the basis of application?

- What is the breakup of the India renewable energy equipment market on the basis of region?

- What are the various stages in the value chain of the India renewable energy equipment market?

- What are the key driving factors and challenges in the India renewable energy equipment?

- What is the structure of the India renewable energy equipment market and who are the key players?

- What is the degree of competition in the India renewable energy equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India renewable energy equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India renewable energy equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India renewable energy equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)