India Renewable Energy Infrastructure Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Renewable Energy Infrastructure Market Overview:

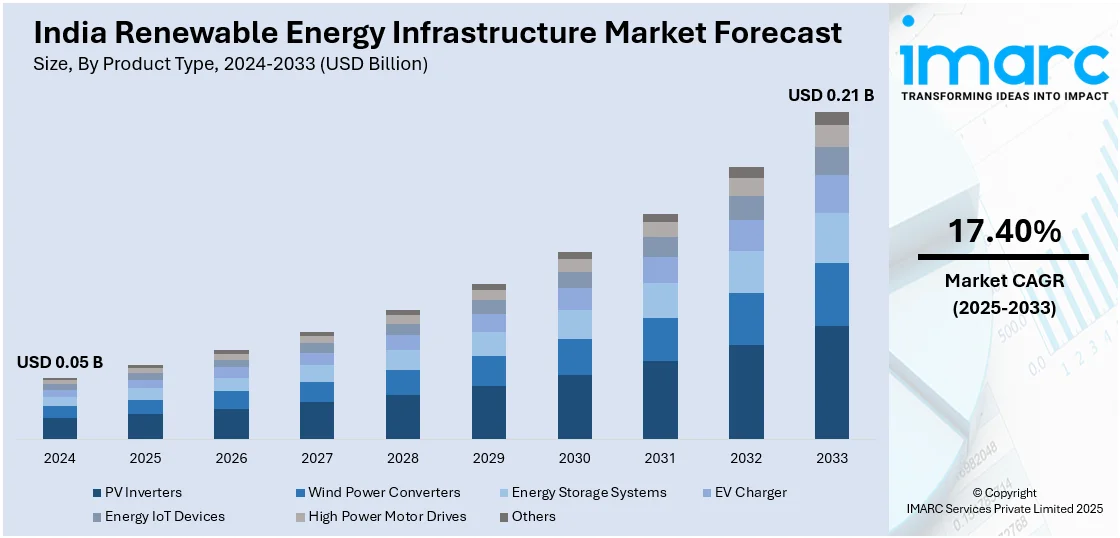

The India renewable energy infrastructure market size reached USD 0.05 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.21 Billion by 2033, exhibiting a growth rate (CAGR) of 17.40% during 2025-2033. The market is driven by government policies, increasing investments, technological advancements, and a growing focus on sustainability. Factors include energy security concerns, rising demand for clean energy, and efforts to reduce carbon emissions, along with global commitments to combat climate change.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.05 Billion |

| Market Forecast in 2033 | USD 0.21 Billion |

| Market Growth Rate (2025-2033) | 17.40% |

India Renewable Energy Infrastructure Market Trends:

Policy Support and Government Initiatives

The Indian government has been actively promoting renewable energy through various policies and incentives. For instance, the Indian government submitted its Nationally Determined Contribution (NDC) under the Paris Agreement. Key targets include achieving 500 GW of non-fossil energy capacity by 2030, sourcing 50% of energy requirements from renewable sources by 2030, reducing projected carbon emissions by one billion tonnes by 2030, lowering the carbon intensity of the economy by 45% by 2030, and reaching Net Zero emissions by 2070. Furthermore, through the National Action Plan on Climate Change (NAPCC), the government has implemented policies in energy, agriculture, water, and sustainability. Besides this, tax incentives for clean energy projects, along with funding from the Green Energy Corridor project to improve grid infrastructure, also help accelerate the deployment of renewable energy infrastructure. Phase 1, underway in Gujarat, Maharashtra, and Tamil Nadu, integrates 24GW of renewable energy. Phase 2, set for completion by 2025, will add 20GW across seven states at an estimated cost of Rs. 12,031 crore, driving India's renewable energy and economic growth. These policy measures are crucial in creating a favorable environment for the expansion of solar, wind, and other renewable sources of energy, ensuring long-term growth in the market.

To get more information on this market, Request Sample

Technological Advancements and Integration

Technological innovations play a pivotal role in the growth of India's renewable energy infrastructure. The use of advanced solar panels, wind turbines, and energy storage solutions has resulted in higher efficiency and lower costs. For instance, in February 2025, Jakson Engineers supplied 100 MW of solar PV modules to Gujarat Industries Power Company Limited (GIPCL) for its renewable energy park near Khavda, Gujarat. The supply includes 190,000 Helia Plus PERC bifacial solar panels. Additionally, Jakson Engineers plans to invest Rs 20 billion in a 2.5 GW solar cell production facility and expand its solar module manufacturing capacity. The company also partnered with Blueleaf Energy to develop 1,000 MW of solar projects in Rajasthan. Furthermore, integration of smart grid technology and artificial intelligence for better load management and grid stability is improving energy distribution across the country. Emerging technologies like floating solar panels, offshore wind farms, and hybrid power systems are also gaining traction, offering additional opportunities for expansion. With technological advancements lowering operational costs and improving the scalability of renewable energy solutions, India is poised to diversify its energy mix and reduce dependency on traditional energy sources.

Private Sector Participation and Investments

Private sector participation has significantly boosted the renewable energy infrastructure market in India. Domestic and international investors are increasingly looking to tap into the growing market for clean energy, driven by long-term stable returns and policy incentives. Major global players, including private equity firms and renewable energy developers, are investing heavily in solar parks, wind farms, and energy storage systems. Additionally, the government's push for public-private partnerships (PPPs) to develop infrastructure is encouraging innovation and faster implementation. Private sector investments not only provide the capital necessary for large-scale projects but also bring technical expertise, improving the overall efficiency of the renewable energy supply chain. This trend is expected to continue as private investment is crucial for meeting India's renewable energy goals. For instance, in February 2025, NTPC Green Energy Limited (NGEL) signed an MoU with Madhya Pradesh Power Generating Company (MPPGCL) to develop 20 GW of green energy projects in Madhya Pradesh. The collaboration will create a joint venture to meet MPPGCL’s renewable generation and the state’s renewable purchase obligations.

India Renewable Energy Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- PV Inverters

- Wind Power Converters

- Energy Storage Systems

- EV Charger

- Energy IoT Devices

- High Power Motor Drives

- Others

A detailed breakup and analysis of the market based on the product type have been provided in the report. This includes PV inverters, wind power converters, energy storage systems, EV charger, energy IoT devices, high power motor drives, and others.

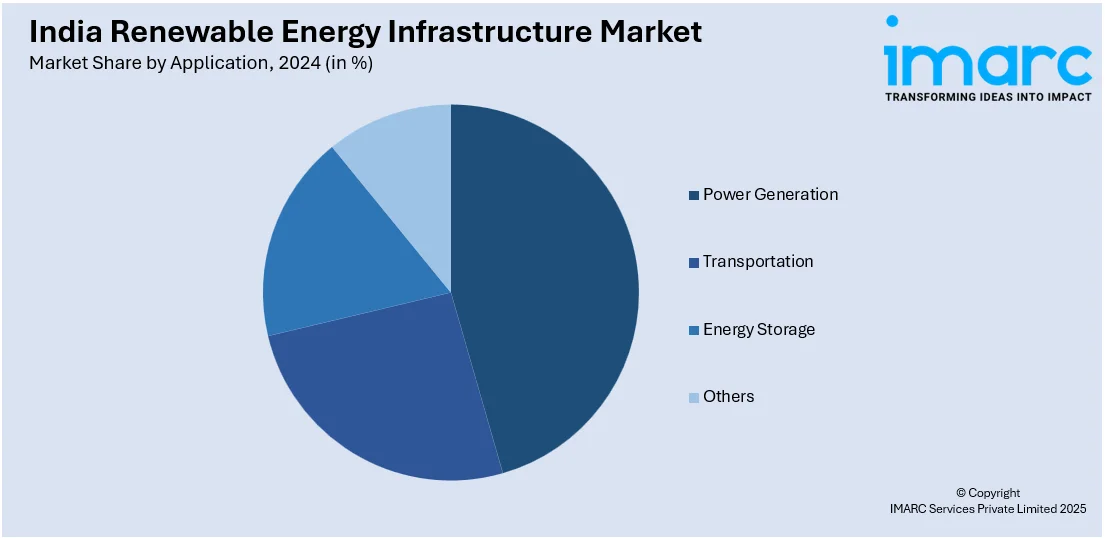

Application Insights:

- Power Generation

- Transportation

- Energy Storage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, transportation, energy storage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Renewable Energy Infrastructure Market News:

- In February 2025, the Solar Energy Corporation of India (SECI) signed an MoU with the Madhya Pradesh government for a 200 MW solar and 1,000 MWh battery storage project in Dhar. This is part of a 500 MW agreement with MP Power Management Company Limited. SECI will invest Rs 25 billion for these projects, helping MP meet its clean energy goals.

- In February 2025, Waaree Energies Limited announced that it has secured a 410 MW solar module supply order from Aditya Birla Renewables' subsidiary, Aditya Birla Renewables EPC Limited. The modules will be delivered across multiple project locations in Gujarat, Rajasthan, and Maharashtra between May and September. This order will support commercial and industrial solar projects, boosting energy efficiency and sustainability. Waaree Energies had previously received a 362.5 MWp solar module order, with deliveries set for the 2025-2026 financial year.

- In February 2025, Tata Power signed an MoU with the Government of Assam to develop 5 GW of renewable energy projects, including solar, wind, and hydro, with a Rs 300 billion investment over five years. The projects will benefit from 20,000 acres of government land and support from Assam's infrastructure. Tata Power aims to promote renewable energy adoption, particularly rooftop solar, under the Pradhan Mantri Surya Ghar Muft Bijli Yojana, creating 3,000 job opportunities. The agreement also includes infrastructure development and financial incentives for project execution and operation. Additionally, Tata Power’s subsidiary has partnered with Assam Power Distribution Company to further enhance energy efficiency across the state.

- In February 2025, Avaada Group revealed that they have committed to investing Rs 500 billion in renewable energy and storage projects in Madhya Pradesh (MP), under a formal MoU with the state government. The plans include 6,000 MW of solar, 700 MW of wind power, 2,100 MW of battery energy storage systems, and 2,000 MW of pumped storage projects.

- In February 2025, Unilever has partnered with collaborative manufacturers in India to launch a power purchase agreement (PPA) aimed at increasing renewable energy use. This deal will supply 45 MW of solar electricity to 32 sites across 15 states, including 10 manufacturers, helping Unilever meet 25% of its operational electricity demand in India. The project, expected to reduce 28,000 tonnes of CO2 emissions annually, also offers a 25% cost savings on electricity over 20 years.

India Renewable Energy Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | PV Inverters, Wind Power Converters, Energy Storage Systems, EV Charger, Energy IoT Devices, High Power Motor Drives, Others |

| Applications Covered | Power Generation, Transportation, Energy Storage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India renewable energy infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India renewable energy infrastructure market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India renewable energy infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The renewable energy infrastructure market in India was valued at USD 0.05 Billion in 2024.

The India renewable energy infrastructure market is projected to exhibit a CAGR of 17.40% during 2025-2033, reaching a value of USD 0.21 Billion by 2033.

India’s renewable energy infrastructure market is driven by strong government support, ambitious clean energy targets, and favorable policy frameworks. Declining costs of solar and wind technologies, along with growing private and foreign investments, are accelerating project development. Expanding grid capacity and focus on sustainability further fuel market growth across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)