India Rental Housing Market Size, Share, Trends and Forecast by Type, Size of Unit, Property Type, and Region, 2025-2033

India Rental Housing Market Overview:

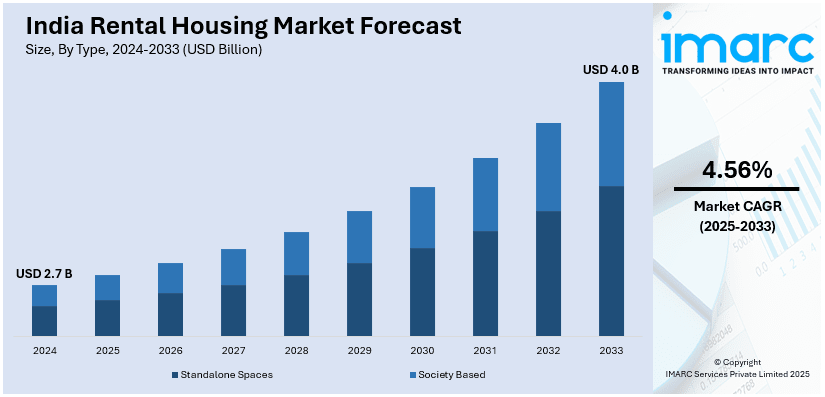

The India rental housing market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.56% during 2025-2033. The market is driven by rapid urbanization, migration, rising property prices, and increasing demand for affordable housing, including apartments, independent houses, co-living spaces, and PG accommodations, catering to professionals, students, and families across income segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.7 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Market Growth Rate (2025-2033) | 4.56% |

India Rental Housing Market Trends:

Rapid Urbanization and Migration

India is experiencing rapid urbanization, with millions migrating to cities for better job opportunities, education, and lifestyle improvements. According to the World Bank Group, by 2036, 600 million people in India, or 40% of the population, will reside in towns and cities, up from 31% in 2011, and over 70% of the nation's GDP will come from urban areas. The increased inflow of people has created an enormous rise in rental house demand throughout metro areas and all cities falling within Tier-1 and Tier-2 categories. Most working professionals, along with students find renting more appealing than buying because properties remain expensive while jobs shift frequently. Industrial areas, IT parks, and corporate office parks have boosted the demand for rental accommodation. Additionally, government initiatives like Smart Cities Mission and infrastructure development projects are attracting more people to urban areas, strengthening the India rental housing market share.

To get more information on this market, Request Sample

Rising Property Prices and Affordability Issues

The increasing cost of homeownership in major cities has made renting a more viable option for many individuals and families. Property prices in metros like Mumbai, Delhi, Bangalore, and Hyderabad are beyond the reach of middle-class and lower-income groups, leading them to opt for rental housing. According to industry reports, average capital values in the National Capital Region (NCR) increased by 128% to Rs 13,000 per square foot last year from Rs 5,700 per square foot three years prior. The average capital values of Sohna Road in Gurugram, another developing prominent area in the NCR, increased by 59% from Rs 6,600 per square foot at the end of 2021 to Rs 10,500 per square foot by the end of 2024. Additionally, high down payments, home loan interest rates, and maintenance costs discourage homeownership further drives the India rental housing market growth. Rental housing provides a cost-effective, flexible alternative, especially for young professionals and students who prefer short-term commitments before investing in property. The affordability factor continues to drive demand in both premium and affordable rental segments.

Government Policies and Housing Schemes

Government initiatives like the Model Tenancy Act, Pradhan Mantri Awas Yojana (PMAY), and Smart Cities Mission aim to streamline rental agreements, boost affordable housing, and encourage private sector participation in the rental market. The Model Tenancy Act promotes a structured rental framework, protecting landlords and tenants, thus reducing disputes and encouraging investments in rental properties. Additionally, incentives for rental housing development and policies supporting migrant workers' accommodation are creating a positive India rental housing market outlook. With an increasing focus on affordable rental housing complexes (ARHCs), the market is set to expand further in urban and semi-urban regions. For instance, in December 2024, nearly four and a half years after the Affordable Rental Housing Complex (ARHC) program was introduced during the COVID-19 pandemic, only 5,648 government-funded unoccupied homes had been distributed to migrant workers. When the Cabinet approved the plan, 83,534 homes were identified for it; this represents less than 7% of those homes.

India Rental Housing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, size of unit, and property type.

Type Insights:

- Standalone Spaces

- Society Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes standalone spaces, society based.

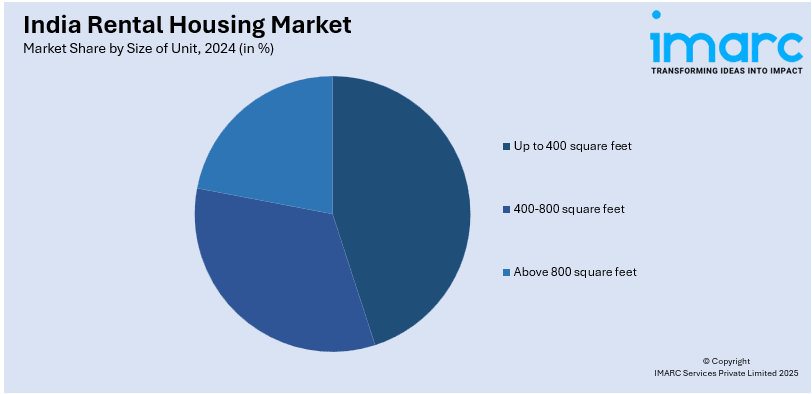

Size of Unit Insights:

- Up to 400 square feet

- 400-800 square feet

- Above 800 square feet

A detailed breakup and analysis of the market based on the size of have also been provided in the report. This includes up to 400 square feet, 400-800 square feet, and above 800 square feet.

Property Type Insights:

- Fully Furnished

- Semi-Furnished

- Unfurnished

A detailed breakup and analysis of the market based on the property type have also been provided in the report. This includes fully furnished, semi-furnished, and unfurnished.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Rental Housing Market News:

- In March 2025, The Haryana government launched the Affordable Rental Housing Scheme as part of PMAY (Urban) 2.0 to offer clean and budget-friendly rental accommodations for EWS and informal workers. A pilot initiative will lease 1,600 apartments in Sonipat at discounted prices. The scheme has been allocated Rs 2444.27 crore in the budget for 2025-26.

- In February 2024, the Government of India revealed its intentions to introduce a program aimed at assisting segments of the middle class in purchasing or constructing homes. During her address regarding the interim budget for 2024-25, Union Finance Minister Nirmala Sitharaman mentioned that the program will be introduced for middle-class segments residing in rented homes, slums, chawls, or unapproved colonies.

India Rental Housing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Standalone Spaces, Society Based |

| Size of Units Covered | Up To 400 Square Feet, 400-800 Square Feet, Above 800 Square Feet |

| Property Types Covered | Fully Furnished, Semi-Furnished, Unfurnished |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India rental housing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India rental housing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India rental housing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India rental housing market was valued at USD 2.7 Billion in 2024.

The India Rental Housing market is projected to exhibit a CAGR of 4.56% during 2025-2033, reaching a value of USD 4.0 Billion by 2033.

The market is driven by rapid urbanization, migration, rising property prices, and increasing demand for affordable housing, including apartments, independent houses, co-living spaces, and PG accommodations. Government policies and housing schemes also play a key role in supporting growth in rental housing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)