India Repair and Rehabilitation Market Size, Share, Trends and Forecast by Service Type, Application, Material Type, End Use, and Region, 2026-2034

India Repair and Rehabilitation Market Overview:

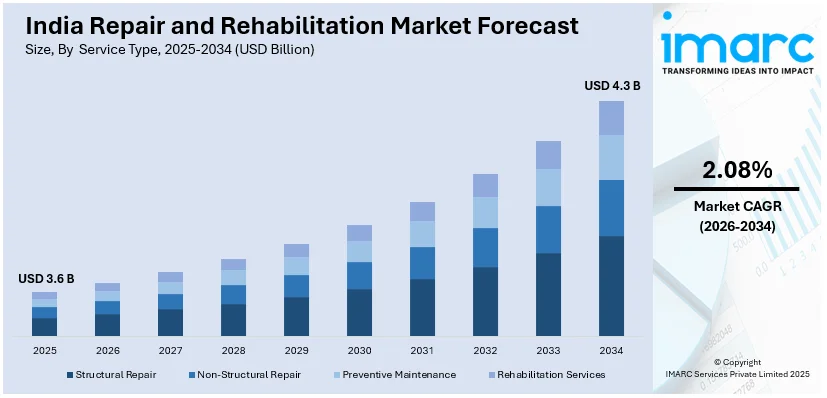

The India repair and rehabilitation market size reached USD 3.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2034, exhibiting a growth rate (CAGR) of 2.08% during 2026-2034. A gradual deterioration of existing infrastructure assets, especially in the transportation, energy, and public utility spaces, is propelling the market growth. This trend, along with the improved emphasis on sustainability and resource efficiency, is positively influencing the market in the country. Additionally, the focus on infrastructure development is expanding the India repair and rehabilitation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.6 Billion |

| Market Forecast in 2034 | USD 4.3 Billion |

| Market Growth Rate 2026-2034 | 2.08% |

India Repair and Rehabilitation Market Trends:

Aging Infrastructure Across Sectors

The Indian repair and rehabilitation sector is driven by the gradual deterioration of existing infrastructure assets, especially in the transportation, energy, and public utility spaces. Many highways, bridges, dams, and buildings established decades ago are now reaching or exceeding their planned design lifespans. Since these facilities are aging, they are acquiring signs of material degradation, cracking, corrosion, and structural fatigue, which requires timely interventions to make them safe and functional. Government authorities and private infrastructure owners are investing in the retrofitting and structural evaluation of these facilities, thus catalyzing the demand for specialized repair materials and technologies. Furthermore, urban developments in the country are putting more pressure on aging infrastructure, causing wear and tear to speed up. With budgetary limits frequently constraining new buildings, public and private investors are finding it more beneficial to prolong the life of installed base assets with systematic rehabilitation initiatives.

To get more information on this market Request Sample

Growing Emphasis on Sustainability and Resource Efficiency

Sustainability imperatives are impelling the India repair and rehabilitation market growth. Industry stakeholders in the construction and infrastructure sectors are embracing repair and retrofitting solutions to reduce resource use, minimize waste production, and decrease carbon emissions. This transition is in sync with larger national agendas like the Smart Cities Mission and India's goal of net-zero emissions by 2070. The Government of India sanctioned 12 new industrial smart city projects on 28th August 2024 with a total project cost of Rs. 28,602 crores (including land cost) for development of trunk infrastructure packages. According to the sanctioned institutional & financial framework of Industrial Corridor Programme, State Govt provides land and Government of India through National Industrial Corridor Development and Implementation Trust (NICDIT) provides the equity for development of internal trunk infrastructure components.

Focus on Infrastructure Expansion

India’s focus on infrastructure expansion is accelerating, encouraging governments and developers to not only construct new infrastructure but also maintain and enhance existing urban asset. As cities are focussing on development, the strain on essential infrastructure, such as water supply networks, sewage systems, roads, and residential buildings, is intensifying. This is leading to a higher frequency of maintenance interventions, thereby driving the need for repair and rehabilitation services. Municipal bodies and urban local governments are increasingly undertaking proactive infrastructure audits and deploying capital towards long-term refurbishment strategies. In the 2025-26 Union Budget, a total of INR 96,777 crore (almost 1,000 billion) has been earmarked for urban development. This represents a 17 percent increase compared to last year's budgeted figure of INR 82,576 crore (or INR 825.7 billion). This heightened focus on urban development is also creating opportunities for private contractors and technology providers specializing in structural restoration, concrete protection, and corrosion control, who are capitalizing on the need for resilient and sustainable urban infrastructure.

India Repair and Rehabilitation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service type, application, material type, and end use.

Service Type Insights:

- Structural Repair

- Non-Structural Repair

- Preventive Maintenance

- Rehabilitation Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes structural repair, non-structural repair, preventive maintenance, and rehabilitation services.

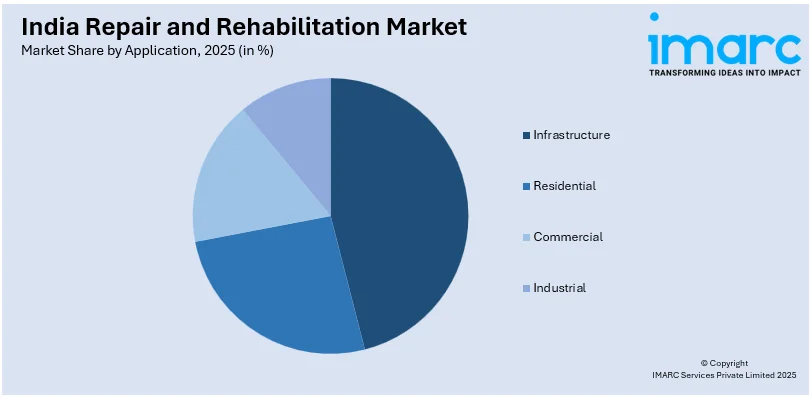

Application Insights:

Access the comprehensive market breakdown Request Sample

- Infrastructure

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes infrastructure, residential, commercial, and industrial.

Material Type Insights:

- Concrete

- Steel

- Asphalt

- Composite Materials

The report has provided a detailed breakup and analysis of the market based on the material type. This includes concrete, steel, asphalt, and composite materials.

End Use Insights:

- Public Sector

- Private Sector

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes public sector and private sector.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Repair and Rehabilitation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Structural Repair, Non-Structural Repair, Preventive Maintenance, Rehabilitation Services |

| Applications Covered | Infrastructure, Residential, Commercial, Industrial |

| Material Types Covered | Concrete, Steel, Asphalt, Composite Materials |

| End Uses Covered | Public Sector, Private Sector |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India repair and rehabilitation market performed so far and how will it perform in the coming years?

- What is the breakup of the India repair and rehabilitation market on the basis of service type?

- What is the breakup of the India repair and rehabilitation market on the basis of application?

- What is the breakup of the India repair and rehabilitation market on the basis of material type?

- What is the breakup of the India repair and rehabilitation market on the basis of end use?

- What is the breakup of the India repair and rehabilitation market on the basis of region?

- What are the various stages in the value chain of the India repair and rehabilitation market?

- What are the key driving factors and challenges in the India repair and rehabilitation market?

- What is the structure of the India repair and rehabilitation market and who are the key players?

- What is the degree of competition in the India repair and rehabilitation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India repair and rehabilitation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India repair and rehabilitation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India repair and rehabilitation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)