India RF Front End Module Market Size, Share, Trends and Forecast by Component, Application, and Region, 2025-2033

India RF Front End Module Market Overview:

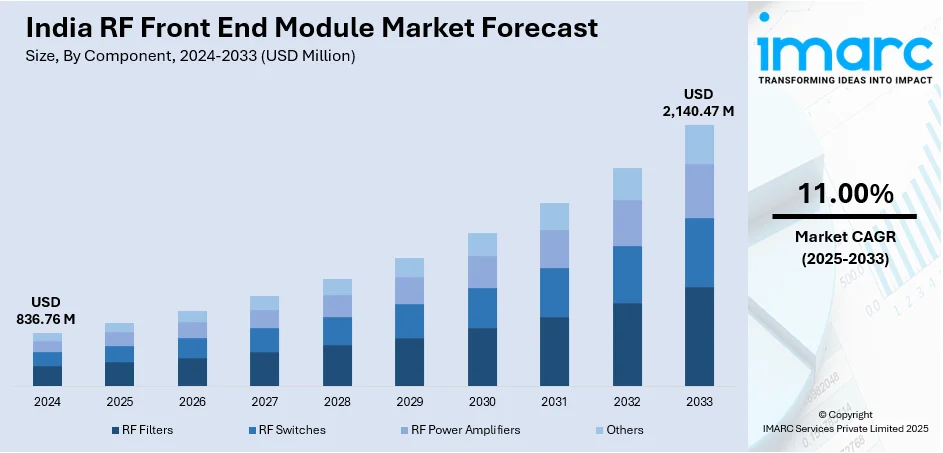

The India RF front end module market size reached USD 836.76 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,140.47 Million by 2033, exhibiting a growth rate (CAGR) of 11.00% during 2025-2033. India RF front-end module market is expanding due to 5G deployment and small cell installations, driving demand for advanced RF components that support higher frequencies, low latency, improved spectral efficiency, and network densification to enhance connectivity and data transmission across urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 836.76 Million |

| Market Forecast in 2033 | USD 2,140.47 Million |

| Market Growth Rate (2025-2033) | 11.00% |

India RF Front End Module Market Trends:

Proliferation of Small Cell Deployments and Network Densification

The rising investment in small cell installations to improve network capacity and coverage is a significant factor contributing to the market growth. As the need for uninterrupted connectivity rises in both urban and rural regions, telecom providers are implementing small cells to enhance spectral efficiency and alleviate network congestion. For instance, in 2024, SAR Televenture collaborated with Vodafone Idea to roll out an extra 4G small cell sites, with the deployment scheduled to start in Q1 2025. The initiative was a component of Vi's wider plan for network growth. SAR intended to allocate INR 42.5 crore for the construction of 1,000 new towers, emphasizing micro sites to enhance localized coverage. These small base stations need high-performance RF front-end modules to enable millimeter-wave (mmWave) frequencies and carrier aggregation. Network densification efforts, focused on managing increased data traffic and enhancing signal strength, are further highlighting the need for sophisticated RF components that offer low insertion loss and high-power efficiency. Furthermore, the deployment of small cell systems in public areas, businesses, and smart city setups is broadening the application of RF front-end technologies. With the ongoing increase in mobile data usage in India, the implementation of small cells is essential in enhancing wireless networks, fueling the demand for high-efficiency RF front-end modules.

To get more information on this market, Request Sample

Rising Deployment of 5G Networks

In 2024, the regulatory authority announced that 5G services had been launched in 779 of 783 districts, with more than 460,000 5G Base Transceiver Stations set up. The government implemented crucial measures, such as spectrum allocation reforms and infrastructure enhancement, to expedite 5G adoption. The swift growth of 5G infrastructure in India is driving the need for radio frequency (RF) front-end modules. Telecom providers are boosting investments in 5G spectrum and network rollout, necessitating sophisticated RF components to facilitate elevated frequencies, reduced latency, and enhanced data transfer speeds. The transition from 4G LTE to 5G requires more intricate RF front-end architectures, incorporating multiple-input, multiple-output (MIMO) technology and carrier aggregation. These developments demand highly efficient power amplifiers, filters, and switches to guarantee uninterrupted connectivity and enhanced network performance. Moreover, spectrum fragmentation and the need for higher frequency bands require RF components with low loss and high linearity, which accelerates advancements in RF front-end module design. The growing number of base stations and small cell installations is catalyzing the demand for high-performance RF front-end solutions. As India progresses toward 5G, the need for RF front-end modules is high for facilitating improved wireless communication and connectivity.

India RF Front End Module Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component and application.

Component Insights:

- RF Filters

- RF Switches

- RF Power Amplifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes RF filters, RF switches, RF power amplifiers, and others.

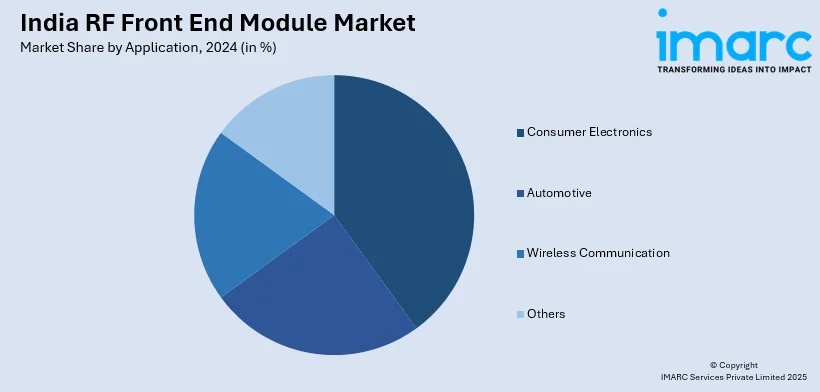

Application Insights:

- Consumer Electronics

- Automotive

- Wireless Communication

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes consumer electronics, automotive, wireless communication, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India RF Front End Module Market News:

- In June 2023, Silizium Circuits, an Indian fabless semiconductor venture, set out to be the leading exporter of analog, RF, and mixed-signal IP by 2030. The firm focused on sectors such as aerospace, 5G, IoT, and automotive. They utilized worldwide partnerships and a customer-focused strategy to attain fast expansion.

India RF Front End Module Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | RF Filters, RF Switches, RF Power Amplifiers, Others |

| Applications Covered | Consumer Electronics, Automotive, Wireless Communication, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India RF front end module market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India RF front end module market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India RF front end module industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The RF front end module market in India was valued at USD 836.76 Million in 2024.

The RF front end module market in India is projected to exhibit a CAGR of 11.00% during 2025-2033, reaching a value of USD 2,140.47 Million by 2033.

India’s RF front end module market is growing because 5G is rapidly rolling out, demand for high-speed connectivity is increasing, also smart devices like smartphones and IoT products are surging. Further growth is fueled via rising mobile data consumption also network infrastructure upgrades. “Make in India” and other government initiatives promote local manufacturing, and advancements in RF component integration and miniaturization improve efficiency. Wireless technologies are being increasingly adopted in automotive, industrial, and in consumer electronics sectors. This sort of adoption also can benefit the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)