India Rice Market Size, Share, Trends and Forecast by Product Type, Type, Grain Size, Distribution Channel, Application, and Region, 2026-2034

India Rice Market Summary:

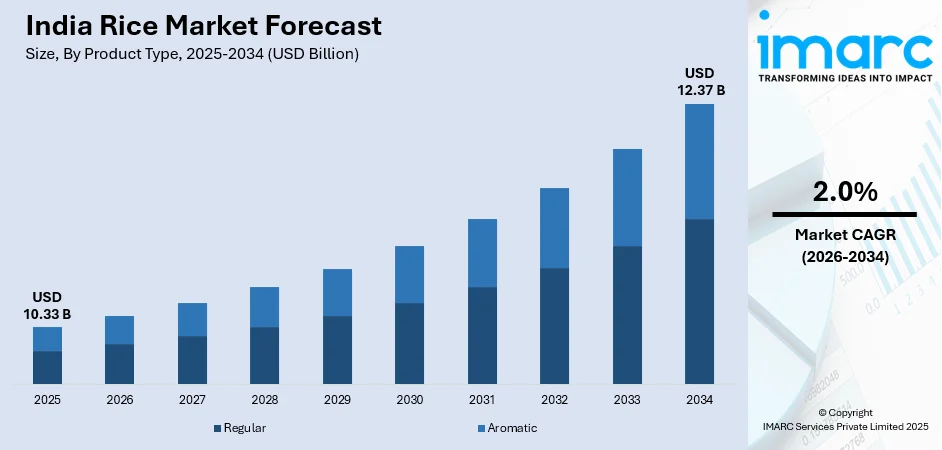

The India rice market size was valued at USD 10.33 Billion in 2025 and is projected to reach USD 12.37 Billion by 2034, growing at a compound annual growth rate of 2.0% from 2026-2034.

The market is driven by the country's massive population base, deep-rooted cultural food preferences, and rice's position as a primary dietary staple across diverse regions. Strong government support through procurement policies, expanding agricultural infrastructure, and favorable climatic conditions in key producing states further propel market expansion. India's dominance in global rice exports strengthens domestic production capabilities, while technological advancements in farming practices enhance yield efficiency, contributing to the India rice market share.

Key Takeaways and Insights:

- By Product Type: Regular dominates the market with a share of 67% in 2025, driven by affordability, widespread availability, strong government procurement support, established processing infrastructure, and its role as the everyday dietary staple.

- By Type: Grain parboiled rice leads the market with a share of 35% in 2025, owing to higher nutritional retention, better shelf stability, regional dietary preference in southern and eastern India, and strong institutional procurement demand.

- By Grain Size: Long grain represents the largest segment with a market share of 65.34% in 2025, driven by strong domestic preference, premium basmati exports, superior cooking characteristics, higher value realization, and favorable agro-climatic conditions in northern states.

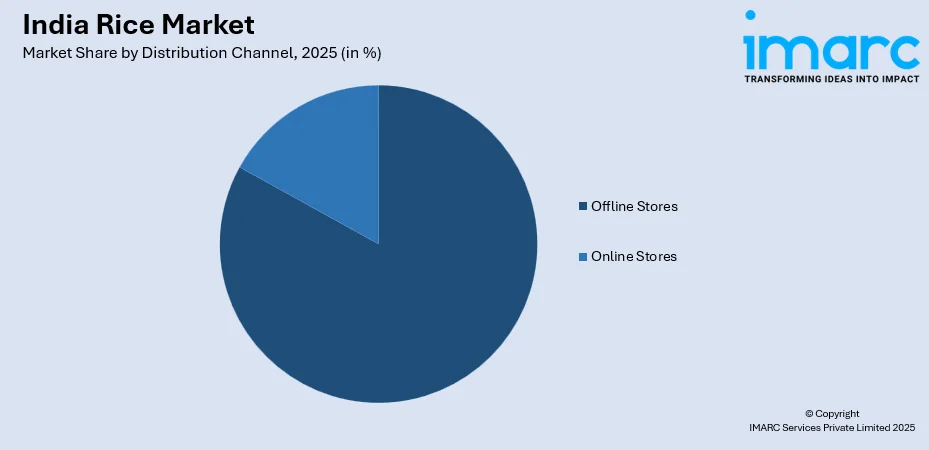

- By Distribution Channel: Offline stores dominate the market with a share of 83.26% in 2025, owing to consumer preference for physical inspection, extensive traditional retail networks, strong wholesale presence, and continued public distribution and auction-based sales.

- By Application: Food leads the market with a share of 90% in 2025, driven by rice’s staple dietary role, cultural significance, widespread household consumption, institutional demand, and government-supported fortified rice distribution programs.

- By Region: North India dominates the market with a share of 30% in 2025, owing to high production in Punjab, Haryana, and Uttar Pradesh, strong irrigation infrastructure, processing clusters, export orientation, and large urban consumption centers.

- Key Players: The India rice market exhibits a fragmented competitive landscape, with numerous regional processors, traditional millers, and organized players competing across value-added and commodity segments. Market participants focus on brand differentiation, quality certifications, and distribution network expansion to capture consumer loyalty.

To get more information on this market Request Sample

The India rice market is propelled by a confluence of structural and policy-driven factors that reinforce its position as a critical component of the national food ecosystem. The country's vast population, with rice consumption deeply embedded in cultural and dietary traditions, creates sustained baseline demand across all socioeconomic segments. Government interventions through minimum support price mechanisms incentivize farmers to maintain production levels while ensuring stable supply availability. Agricultural modernization initiatives, including improved seed varieties, mechanized farming equipment, and enhanced irrigation infrastructure, contribute to higher yields and quality improvements. As per sources in 2025, the Bharat International Rice Conference in New Delhi marked the launch of India’s first AI-based rice sorting system, supported by APEDA-facilitated MoUs exceeding ₹3,000 crore. Moreover, the expansion of organized retail and e-commerce platforms facilitates broader market access, while India's growing prominence in global rice trade strengthens domestic processing capabilities and export-oriented production.

India Rice Market Trends:

Rising Consumer Preference for Premium and Specialty Rice Varieties

Indian consumers are increasingly gravitating toward premium, organic, and specialty rice varieties as health consciousness rises across urban and semi-urban demographics. According to sources, in June 2025, Koraput district flagged off the first supply of GI-tagged organic Kalajeera rice to the Jagannath Temple under the Amrut Anna Yojana, promoting specialty rice and supporting tribal farmers. Furthermore, this shift reflects growing awareness about nutritional benefits, with consumers seeking options like brown rice, black rice, and fortified variants that offer enhanced protein, fiber, and micronutrient content. The premiumization trend is particularly pronounced among younger, urban consumers who prioritize quality over price and demonstrate willingness to pay higher amounts for perceived health benefits and superior taste profiles.

Technological Integration in Rice Cultivation and Processing

Advanced agricultural technologies are transforming India's rice cultivation landscape, with precision farming techniques gaining traction among progressive farmers. As per sources, in 2025, Uttar Pradesh announced the launch of a Kalanamak rice research centre with IRRI in Siddharthnagar to develop pest-resistant varieties, improve seed quality, and boost exports of the premium aromatic grain. Moreover, drone-based crop monitoring, satellite imagery for yield prediction, and sensor-driven irrigation systems are enabling more efficient resource utilization and improved crop management decisions. In the processing segment, automated milling equipment, sophisticated sorting technologies, and quality control systems are enhancing product consistency and reducing post-harvest losses. These technological investments support higher value realization across the supply chain while improving traceability capabilities that are increasingly demanded by export markets and quality-conscious domestic consumers.

Expansion of Organized Distribution and Direct-to-Consumer Channels

The rice distribution landscape in India is witnessing structural transformation as organized retail chains and digital commerce platforms expand their presence in food staples. In May 2025, DRRK Foods announced plans to expand its domestic distributor network by 50 % to strengthen urban and emerging market reach for its flagship Crown Basmati Rice brand. Furthermore, modern trade formats offer consumers curated rice assortments with transparent quality indicators and convenient purchasing experiences. Simultaneously, direct-to-consumer models are emerging, connecting farmers and processors directly with end consumers through digital platforms, thereby reducing intermediary costs and enabling better price realization. This channel evolution is accompanied by innovations in packaging formats, including smaller pack sizes suited for urban households and bulk options for institutional buyers, creating differentiated value propositions across consumer segments.

Market Outlook 2026-2034:

The India rice market is expected to witness steady revenue growth during the forecast period, driven by strong domestic consumption, expanding export competitiveness, and ongoing improvements in agricultural productivity. Population growth in key rice-consuming regions will sustain demand, while rising incomes simultaneously support premiumization across value-added segments. Government initiatives focused on farmer welfare, irrigation, and infrastructure development will enhance production efficiency. Technological advancements in cultivation, milling, and processing will improve quality standards. Additionally, favorable monsoon conditions, diversified consumer preferences, and India’s strengthening position in global rice trade will further support long-term market expansion.The market generated a revenue of USD 10.33 Billion in 2025 and is projected to reach a revenue of USD 12.37 Billion by 2034, growing at a compound annual growth rate of 2.0% from 2026-2034.

India Rice Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Regular | 67% |

| Type | Grain Parboiled Rice | 35% |

| Grain Size | Long Grain | 65.34% |

| Distribution Channel | Offline Stores | 83.26% |

| Application | Food | 90% |

| Region | North India | 30% |

Product Type Insights:

- Regular

- Aromatic

Regular dominates with a market share of 67% of the total India rice market in 2025.

Regular maintains its dominant position in India's rice market, accounting for the largest revenue share among product categories. This variety encompasses non-aromatic, conventionally processed rice that serves as the everyday staple across Indian households regardless of economic status or regional location. Its widespread acceptance stems from affordability, making it accessible to price-sensitive consumers who constitute the majority of the population, combined with consistent availability through established supply chains spanning urban and rural retail networks.

The segment's enduring strength reflects the fundamental role of regular rice in Indian food culture, where it accompanies diverse regional cuisines and serves as the primary carbohydrate source for daily meals. Manufacturing and processing infrastructure across major rice-producing states is optimized for regular rice varieties, ensuring economies of scale that maintain competitive pricing. Government procurement programs predominantly focus on regular rice varieties, creating stable demand signals for farmers and ensuring buffer stock availability for food security programs. According to sources, India’s rice procurement reached 45.84 Million Tonnes (mt) as of February 28, a 5 % increase from last year, supporting food security and stable buffer stocks across key states.

Type Insights:

- Red Rice

- Arborio Rice

- Black Rice

- Grain Fragrance Rice

- Brown Rice

- Rosematta Rice

- Grain Parboiled Rice

- Sushi Rice

- Others

Grain parboiled rice leads with a share of 35% of the total India rice market in 2025.

Grain parboiled rice commands the leading position among rice types, driven by its distinctive processing method that involves partial boiling of paddy before milling. This technique enhances the grain's nutritional retention, particularly B-vitamins and minerals that migrate from the bran layer into the endosperm during steaming. The resulting product offers improved cooking characteristics including reduced stickiness, better grain separation, and extended shelf stability, making it particularly valued in regions with challenging storage conditions.

Southern and eastern Indian states demonstrate particularly strong preference for grain parboiled rice, where it forms the traditional dietary base and is integral to regional cuisine preparation methods. According to sources, in 2025, the Food Corporation of India announced procurement of 5 lakh Metric Tonnes of parboiled rice from Punjab for TPDS and welfare schemes during the 2024-25 kharif marketing season. Moreover, the segment benefits from established processing infrastructure concentrated in major producing regions, with skilled operators maintaining quality consistency. Consumer loyalty in traditional markets remains robust, while growing awareness of nutritional advantages is expanding acceptance in newer geographies where parboiled rice was previously less common.

Grain Size Insights:

- Long Grain

- Medium Grain

- Short Grain

Long grain exhibits a clear dominance with a 65.34% share of the total India rice market in 2025.

Long grain dominates the grain size segmentation, reflecting strong consumer preference for its characteristic fluffy texture and individual grain separation when cooked. This variety encompasses premium basmati varieties highly valued in both domestic consumption and export markets, as well as non-basmati long grain types that offer similar cooking properties at more accessible price points. In June 2025, Indian basmati rice exports increased in value by ₹1,923 crore during the 2024‑25 fiscal year compared with the previous year, highlighting strong demand for premium long‑grain varieties. Moreover, the elongation characteristics and aromatic properties of certain long grain varieties command significant premiums in quality-conscious consumer segments.

Production of long grain rice is concentrated in northern Indian states where agro-climatic conditions favor cultivation of these varieties. The segment's export orientation drives quality consciousness among producers, with grading and certification systems ensuring consistency for international markets. Domestic demand continues strengthening as rising incomes enable consumers to trade up from medium and short grain alternatives, while the hospitality industry's expansion creates institutional demand for premium long grain varieties.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline Stores

- Online Stores

Offline stores dominate with a market share of 83.26% of the total India rice market in 2025.

Offline stores dominate rice distribution in India, encompassing traditional grocery stores, supermarkets, hypermarkets, and wholesale outlets that collectively serve many consumer purchases. As per sources, FCI sold 128,000 tonnes of rice through open market auctions under the 2025-26 (Apr–Mar) scheme, continuing physical distribution amid surplus stock management. Moreover, this channel predominance reflects deeply ingrained shopping behaviors where consumers prefer physical inspection of rice quality, including grain appearance, aroma, and absence of impurities, before making purchase decisions. The extensive geographic reach of traditional retail networks ensures accessibility across urban and rural markets.

Modern trade formats are gaining incremental share within the offline stores, offering consumers organized shopping environments with standardized quality assurances and promotional offers. These outlets typically stock broader assortments spanning multiple price points and specialty varieties, catering to evolving consumer preferences. Wholesale channels remain significant for bulk purchases by institutional buyers and small retailers, with established commission agent networks facilitating transactions in major market centers.

Application Insights:

- Food

- Feed

- Others

Food leads with a share of 90% of the total India rice market in 2025.

Food dominates rice utilization in India, reflecting the grain's fundamental role as the primary staple in Indian dietary patterns. Rice consumption spans all meal occasions, serving as the carbohydrate base for everyday meals across diverse regional cuisines, from south Indian preparations like idli and dosa to north Indian biryanis and pulaos. Religious and cultural significance further reinforces food demand, with rice featuring prominently in festivals, ceremonies, and traditional hospitality practices.

This segment encompasses diverse preparation methods and product formats, including whole grain rice for home cooking, processed ready-to-cook products, and rice-based ingredients for food service and industrial manufacturing. Urbanization and changing lifestyles are driving demand for convenient rice products that reduce preparation time while maintaining traditional taste profiles. Growing health awareness is creating opportunities for fortified rice and specialty varieties that address specific nutritional requirements. In October 2025, the Union Cabinet approved the continuation of universal fortified rice supply under PMGKAY and other welfare schemes from July 2024 to December 2028 to address anaemia and micronutrient deficiencies.

Regional Insights:

- South India

- North India

- West and Central India

- East India

North India dominates with a market share of 30% of the total India rice market in 2025.

North India leads regional market share, benefiting from extensive rice cultivation in Punjab, Haryana, and Uttar Pradesh, which collectively constitute the country's primary rice bowl. The region's fertile Indo-Gangetic plains, supported by established irrigation infrastructure and favorable climatic conditions, enable high-yield production that serves both domestic consumption and export requirements. Proximity to major milling and processing clusters ensures efficient post-harvest handling and value addition.

The region's market prominence extends beyond production to encompass significant consumption demand from its large population base. Urban centers including Delhi-NCR represent major consumption hubs with diverse demand spanning value and premium segments. The concentration of organized retail chains and e-commerce fulfillment infrastructure in northern metros facilitates modern distribution, while traditional wholesale markets continue serving extensive rural hinterlands through established trading networks.

Market Dynamics:

Growth Drivers:

Why is the India Rice Market Growing?

Expanding Population Base and Rising Domestic Consumption

India's substantial and growing population provides foundational demand support for the rice market, with rice consumption deeply embedded in dietary habits across the country's diverse regions and communities. As the population continues expanding, particularly in rice-consuming states across southern, eastern, and western regions, baseline demand for rice as the primary staple grain strengthens correspondingly. Urbanization trends are shifting consumption patterns without diminishing overall rice demand, as urban consumers maintain rice-centric diets while demonstrating willingness to explore premium and specialty varieties. Rising household formation rates, particularly among younger demographics establishing independent households, create incremental consumption occasions that sustain market growth momentum.

Government Support Through Agricultural Policies and Procurement Programs

Comprehensive government interventions provide robust support mechanisms for India's rice market, encompassing production incentives, procurement guarantees, and distribution programs that stabilize supply-demand dynamics. Minimum support price policies ensure farmers receive remunerative returns for their produce, encouraging sustained cultivation and investment in productivity improvements. Public procurement operations create dependable demand channels while building buffer stocks that address food security requirements and moderate price volatility. As per sources, in 2025, The Department of Food and Public Distribution (DFPD) set a central rice procurement target of 463.50 lakh Metric Tonnes for Kharif Marketing Season 2025‑26, also promoting millet procurement to support crop diversification and nutritional security. Moreover, subsidized distribution through the public distribution system ensures affordable rice access for economically disadvantaged populations while maintaining steady demand flows. Infrastructure development initiatives targeting irrigation expansion, storage facilities, and rural connectivity further strengthen the agricultural ecosystem supporting rice production.

Technological Advancement and Agricultural Modernization

Continuous technological progress in rice cultivation and processing is enhancing market capabilities across productivity, quality, and efficiency dimensions. Improved seed varieties developed through conventional breeding and advanced biotechnology offer higher yields, disease resistance, and tolerance to environmental stresses, enabling farmers to maintain production levels despite climatic variability. In May 2025, India released two genome-edited rice varieties, Kamala (DRR Dhan‑100) and Pusa DST Rice 1, promising up to 30% higher yields, reduced water use, and lower greenhouse gas emissions. Furthermore, mechanization of farming operations reduces labor requirements and improves operational timeliness, while precision agriculture techniques optimize input utilization and resource efficiency. Processing technology advancements enhance milling recovery rates, product quality consistency, and value addition possibilities. These technological investments strengthen India's competitive position in global rice trade while improving farmer profitability and supply chain efficiency.

Market Restraints:

What Challenges the India Rice Market is Facing?

Climate Variability and Water Resource Constraints

Rice cultivation's heavy dependence on monsoon rainfall and irrigation water availability exposes the market to significant climate-related risks. Erratic precipitation patterns, including delayed monsoons, uneven distribution, and extreme weather events, can adversely impact planted acreage and crop yields across major producing regions. Groundwater depletion in intensively cultivated areas raises sustainability concerns and may constrain future production expansion.

Fragmented Supply Chain and Post-Harvest Losses

India's rice supply chain remains characterized by numerous intermediaries, inadequate storage infrastructure, and inefficient logistics that contribute to significant value erosion between farm and consumer. Post-harvest losses arising from improper handling, storage pest infestation, and transportation damage reduce effective supply availability while increasing costs throughout the distribution chain. Quality inconsistency resulting from fragmented processing sector hampers brand building efforts and limits premium realization potential.

Price Volatility and Input Cost Pressures

Market participants face uncertainty from price fluctuations driven by production variability, policy changes, and global market dynamics. Farmers experience income instability when market prices diverge significantly from production costs, potentially discouraging cultivation investment in subsequent seasons. Rising input costs, including fertilizers, fuel, and labor, compress margins across the value chain, with limited ability to pass through cost increases to price-sensitive consumers.

Competitive Landscape:

The India rice market demonstrates a highly fragmented competitive landscape, marked by the presence of numerous unorganized regional players alongside a limited number of organized, branded participants. Traditional rice millers and local processors dominate volume sales by leveraging proximity to cultivation zones and strong relationships with farmer networks, primarily competing on price within regional markets. In contrast, organized players differentiate through brand development, quality certifications, and wider distribution networks that enable national reach. These players invest in advanced processing technologies, quality assurance systems, and marketing capabilities to command premium pricing. The market is gradually consolidating, supported by acquisitions, geographic expansion, product diversification into specialty and value-added rice, digital channel penetration, and integrated supply chain strategies aimed at improving consistency, efficiency, and long-term competitiveness.

Recent Developments:

- In December 2024, LT Foods launched DAAWAT Jasmine Thai Rice, a Non-GMO certified gourmet variety for Indian consumers. Known for its natural fragrance and soft texture, the launch reflects the company’s focus on global culinary experiences, product diversification, and enhancing value through quality-focused rice offerings.

India Rice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Regular, Aromatic |

| Types Covered | Red Rice, Arborio Rice, Black Rice, Grain Fragrance Rice, Brown Rice, Rosematta Rice, Grain Parboiled Rice, Sushi Rice, Others |

| Grain Sizes Covered | Long Grain, Medium Grain, Short Grain |

| Distribution Channels Covered | Offline Stores, Online Stores |

| Applications Covered | Food, Feed, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India rice market size was valued at USD 10.33 Billion in 2025.

The India rice market is expected to grow at a compound annual growth rate of 2.0% from 2026-2034 to reach USD 12.37 Billion by 2034.

Regular held the largest market share, driven by its affordability, widespread availability, and fundamental role as the everyday staple across Indian households spanning all economic segments and regional preferences.

Key factors driving the India rice market include expanding population base and rising domestic consumption, strong government support through procurement policies and minimum support prices, technological advancement in farming practices, favorable agro-climatic conditions, and growing export competitiveness in global markets.

Major challenges include climate variability and erratic monsoon patterns, depleting groundwater resources, fragmented supply chains with significant post-harvest losses, price volatility, rising input costs, storage infrastructure gaps, and policy uncertainties affecting export markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)