India Robotics in Manufacturing Market Size, Share, Trends and Forecast by Component, Type, End User, and Region, 2025-2033

India Robotics in Manufacturing Market Overview:

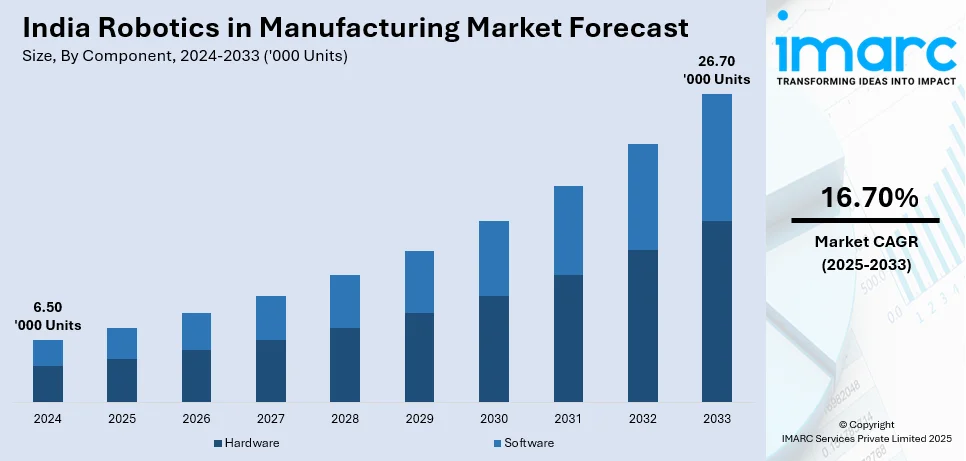

The India robotics in manufacturing market size reached 6.50 Thousand Units in 2024. Looking forward, IMARC Group expects the market to reach 26.70 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 16.70% during 2025-2033. The India robotics in manufacturing market share is fueled by increasing automation demand, labor cost optimization, government initiatives like Make in India, and the need for precision and productivity. Advancements in AI, IoT, and industrial digitization further accelerate robotics adoption across the automotive, electronics, and metal industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 6.50 Thousand Units |

| Market Forecast in 2033 | 26.70 Thousand Units |

| Market Growth Rate 2025-2033 | 16.70% |

India Robotics in Manufacturing Market Trends:

Rising Demand for Automation and Operational Efficiency

Indian manufacturers are increasingly turning to automation to enhance productivity, reduce human error, and streamline operations. Robotics offers consistent performance, faster turnaround times, and lower operational risks, critical advantages in competitive markets, thus driving the India robotics in manufacturing market growth. As global supply chains demand higher quality and quicker delivery, manufacturers are under pressure to improve throughput without compromising precision. Robotics enables scalable and standardized production, making it ideal for sectors like automotive, electronics, and FMCG. Additionally, automation helps manage repetitive and hazardous tasks, improving workplace safety. This drive for efficiency is a major force behind the rapid adoption of robotics in India’s manufacturing landscape. For instance, in February 2025, Delta, a worldwide frontrunner in power management and a supplier of IoT-driven smart green solutions, revealed its involvement in ELECRAMA 2025 under the theme of Smart Manufacturing by introducing its new D-Bot series Collaborative Robots (Cobots) in the Indian market. These 6-axis cobots feature payload capacities reaching 30 kg and speeds of up to 200 degrees per second, intended to enhance industries with smarter and more efficient production processes, including packaging, electronics assembly, materials handling, and welding.

To get more information on this market, Request Sample

Technological Advancements and the Affordability of Robots

Technological progress has made industrial robots smarter, more flexible, and increasingly affordable. Integration with artificial intelligence, machine learning, and vision systems enables robots to handle complex tasks and adapt to dynamic production needs. Collaborative robots (cobots), which can safely work alongside humans, are gaining traction in small and medium enterprises (SMEs). The decreasing cost of robotic components, improved energy efficiency, and customizable configurations make robotics viable for a broader range of industries, which is further creating a positive India robotics in the manufacturing market outlook. These advancements reduce the entry barrier for adoption and also allow even mid-sized manufacturers in India to deploy robotics for quality control, assembly, and packaging. For instance, in November 2024, robotics startup Addverb revealed its plans to introduce a next-gen humanoid robot in 2025, designed to function as an advanced artificial intelligence (AI) agent capable of handling extensive amounts of multi-modal data from visual, auditory, and tactile inputs. Utilizing dynamic, self-learning algorithms, it will traverse complex environments, execute intricate tasks, make real-time decisions, and adjust to various workflows across sectors such as warehouses, defense, and healthcare the company stated.

India Robotics in Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, type, and end user.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Type Insights:

- Industrial Robots

- Collaborative Robots (Cobots)

- SCARA Robots

- Cartesian Robots

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes industrial robots, collaborative robots (Cobots), SCARA robots, and cartesian robots.

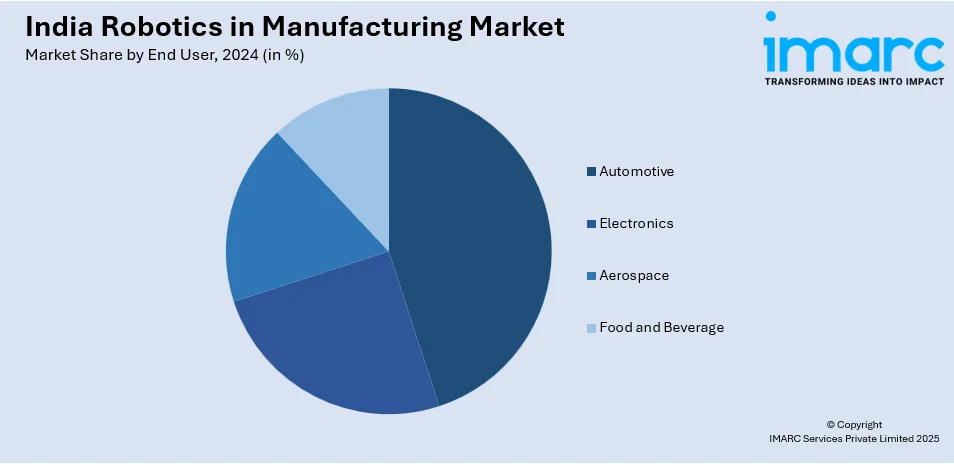

End User Insights:

- Automotive

- Electronics

- Aerospace

- Food and Beverage

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, electronics, aerospace, and food and beverage.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Robotics in Manufacturing Market News:

- In February 2025, Addverb, a worldwide robotics and automation company, introduced three new products at LogiMAT India 2025 in Mumbai. These comprise Trakr 2.0, an innovative quadruped robot; HOCA, a rapid order consolidation and automation system; and Brisk, an intuitive interface for improved picking operations.

- In March 2025, leading robotics solutions supplier IRTI-Robotics partnered with FANUC Robotics India to successfully install 135 industrial robots around India in a ground-breaking alliance that aims to transform industrial automation in the nation. This important milestone represents a huge advancement in the manufacturing sector of India's use of cutting-edge robotics technology.

India Robotics in Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Types Covered | Industrial Robots, Collaborative Robots (Cobots), SCARA Robots, Cartesian Robots |

| End Users Covered | Automotive, Electronics, Aerospace, Food and Beverage |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India robotics in manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India robotics in manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India robotics in manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The robotics in manufacturing market in India reached 6.50 Thousand Units in 2024.

The India robotics in manufacturing market is projected to exhibit a CAGR of 16.70% during 2025-2033, reaching 26.70 Thousand Units by 2033.

Growing government incentives for automation, rising labor costs, the need for precision manufacturing, expanding automotive and electronics sectors, increasing adoption of Industry 4.0 technologies, and global supply chain shifts are driving India’s robotics demand in factories and assembly lines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)