India Robotics Market Size, Share, Trends and Forecast by Product Type, Application, End Use Industry, and Region, 2026-2034

India Robotics Market Summary:

The India robotics market size was valued at USD 1.98 Billion in 2025 and is projected to reach USD 7.38 Billion by 2034, growing at a compound annual growth rate of 15.74% from 2026-2034.

The India robotics market is experiencing robust expansion, driven by increasing automation adoption across the manufacturing, healthcare, and logistics sectors. Government initiatives aimed at promoting indigenous manufacturing and digital transformation are accelerating the market growth. Rising labor costs and the need for precision manufacturing are encouraging industries to embrace robotic solutions. The expanding service robotics segment, particularly in healthcare and domestic applications, is further propelling market momentum.

Key Takeaways and Insights:

-

By Product Type: Articulated robots dominate the market with a share of 39% in 2025, owing to their superior flexibility, multi-axis movement capabilities, and widespread applicability across welding, assembly, and material handling operations. Their ability to perform complex tasks with high precision makes them indispensable in advanced manufacturing environments.

-

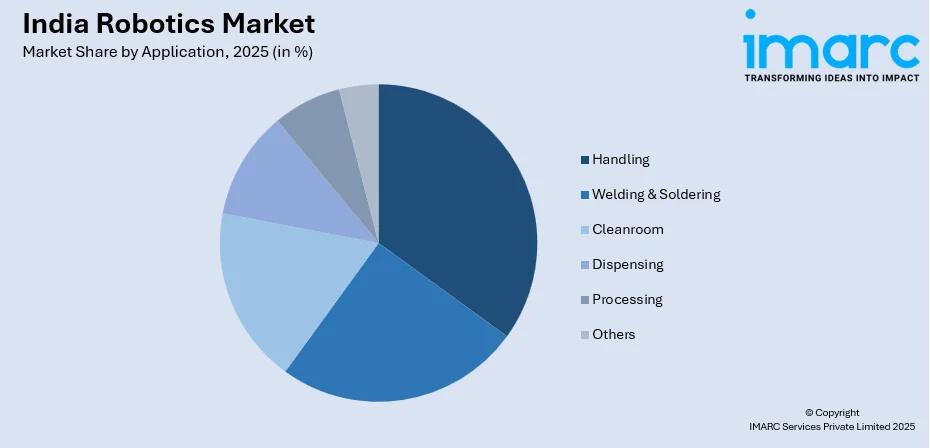

By Application: Handling leads the market with a share of 30% in 2025, This dominance is driven by the increasing need for automated material movement, palletizing, and logistics operations across manufacturing facilities seeking to optimize throughput and minimize manual intervention in repetitive tasks.

-

By End Use Industry: Automotive comprises the largest segment with a market share of 36% in 2025, reflecting the sector's extensive adoption of robotic systems for body welding, painting, assembly line operations, and quality inspection processes that demand consistent precision and high-volume production capabilities.

-

By Region: North India represents the largest region with 32% share in 2025, driven by the concentration of major industrial hubs in Delhi-NCR, significant automotive manufacturing presence, and strong warehousing and logistics infrastructure. The region benefits from proximity to government policy centers and robust technology ecosystem supporting automation adoption.

-

Key Players: Key players drive the India robotics market by introducing advanced automation solutions, expanding manufacturing capabilities, and strengthening distribution networks. Their investments in research and development (R&D) activities, strategic partnerships with technology providers, and focus on cost-effective solutions boost awareness, accelerate adoption, and ensure consistent product availability across diverse industrial segments.

.webp)

To get more information on this market Request Sample

The India robotics market is witnessing remarkable growth, fueled by multiple converging factors that are reshaping the industrial landscape. The push towards manufacturing excellence under government initiatives is encouraging domestic production capabilities while attracting foreign direct investment (FDI) in automation technologies. Industrial sectors, including automotive, electronics, pharmaceuticals, and food processing, are increasingly adopting robotic solutions to enhance productivity, maintain quality standards, and optimize operational efficiency. The country's demographic dividend, combined with rising labor costs in organized sectors, is accelerating the transition towards automated manufacturing processes. According to the International Federation of Robotics (IFR), India installed a record 8,510 industrial robots in 2023, marking a 59% increase from 2022 and positioning the country as the seventh-largest market for annual robot installations worldwide. Service robotics is gaining substantial momentum in healthcare, logistics, and hospitality applications, creating new growth avenues.

India Robotics Market Trends:

Rising Adoption of Collaborative Robots in Manufacturing

The manufacturing sector is witnessing increased deployment of collaborative robots that can safely work alongside human workers without requiring safety cages. These cobots are gaining traction, particularly among small and medium enterprises (SMEs) due to their affordability, ease of programming, and flexibility in handling diverse tasks. The technology enables manufacturers to automate repetitive processes while maintaining workforce collaboration, improving overall productivity and workplace safety standards across assembly lines and production facilities.

Assimilation of Artificial Intelligence (AI) and Internet of Things (IoT) Technologies

Advanced robotics systems are increasingly incorporating AI, machine learning (ML), and IoT connectivity to enable real-time decision-making and adaptive operations. These smart manufacturing solutions facilitate predictive maintenance, quality control automation, and seamless integration with existing production infrastructure. The convergence of these technologies is driving Industry 4.0 transformation across Indian factories, enabling manufacturers to achieve higher levels of automation sophistication and operational intelligence. As per IMARC Group, the India Industry 4.0 market size reached USD 5.6 Billion in 2024.

Expansion of Service Robotics in Healthcare Applications

Healthcare facilities are increasingly adopting robotic systems for surgical assistance, rehabilitation therapy, patient monitoring, and hospital logistics management. The growing elderly population and increasing demand for minimally invasive surgical procedures are driving adoption of medical robotics across tertiary care hospitals. As per PIB, the number of senior citizens in India is expected to rise to approximately 230 Million by 2036, constituting roughly 15% of the overall population. Telesurgery and teleproctoring capabilities are enabling specialized surgical expertise to reach remote and underserved regions, transforming healthcare accessibility and treatment outcomes throughout the country.

Market Outlook 2026-2034:

The India robotics market is poised for substantial expansion throughout the forecast period, driven by continued government support for manufacturing modernization and digital transformation initiatives. The market generated a revenue of USD 1.98 Billion in 2025 and is projected to reach a revenue of USD 7.38 Billion by 2034, growing at a compound annual growth rate of 15.74% from 2026-2034. The automotive and electronics industries will continue to lead adoption, while emerging applications in agriculture, construction, and retail present significant growth opportunities. Increasing investments in R&D activities, coupled with declining component costs, will make robotic solutions more accessible to SMEs, broadening the market base substantially.

India Robotics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Articulated Robots |

39% |

|

Application |

Handling |

30% |

|

End Use Industry |

Automotive |

36% |

|

Region |

North India |

32% |

Product Type Insights:

- Articulated Robots

- Cartesian Robots

- SCARA Robots

- Cylindrical Robots

- Others

Articulated robots dominate with a market share of 39% of the total India robotics market in 2025.

Articulated robots represent the backbone of industrial automation in India, offering unmatched versatility through their multi-jointed arm configurations that enable complex movements across six or more axes. These systems excel in applications requiring reach, flexibility, and precision, making them essential for automotive manufacturing, welding operations, and assembly processes. Major automotive manufacturers have extensively deployed articulated robots across their production facilities for body welding, painting, and component assembly, significantly improving quality consistency and throughput.

The segment's dominance is reinforced by continuous technological advancements that enhance payload capacities, operational speeds, and programming flexibility. Global robotics leaders maintain strong market presence in India, offering diverse articulated robot portfolios suited for varying industrial requirements. In February 2025, Delta Electronics showcased its D-Bot series collaborative robots at ELECRAMA 2025, in India, featuring payload capacities up to 30 kilograms and operational speeds reaching 200 degrees per second, demonstrating the ongoing evolution of articulated robot capabilities for diverse manufacturing applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Handling

- Welding & Soldering

- Cleanroom

- Dispensing

- Processing

- Others

Handling leads with a share of 30% of the total India robotics market in 2025.

Handling applications encompass a broad spectrum of material movement operations, including pick-and-place, palletizing, machine tending, and logistics automation that form the foundation of modern manufacturing workflows. These applications address critical operational challenges related to labor availability, workplace safety, and throughput optimization across diverse industrial sectors. The growing e-commerce industry and expansion of organized retail have accelerated demand for handling robots in warehouse and distribution center environments where speed and accuracy are paramount.

Indian enterprises are increasingly deploying handling robots to manage repetitive and ergonomically challenging tasks that previously required significant manual labor. Handling robots also offer rapid return on investment (ROI) by improving consistency, reducing error rates, and minimizing production downtime. Their flexibility allows easy reprogramming to accommodate changing product mixes, which is especially valuable for Indian manufacturers serving both domestic and export markets. Rising adoption of Industry 4.0 practices further supports integration of robotic handling systems with conveyor networks, vision systems, and warehouse management software, strengthening operational efficiency and reinforcing the segment’s market leadership.

End Use Industry Insights:

- Automotive

- Electrical/Electronics

- Metal/Heavy Machinery

- Chemicals

- Food & beverages

- Others

Automotive exhibits a clear dominance with a 36% share of the total India robotics market in 2025.

The automotive sector has historically led robotic adoption in India, leveraging automation to achieve the precision, consistency, and production volumes demanded by modern vehicle manufacturing. Robots perform critical functions across body shops, paint lines, and final assembly stations where quality tolerances are stringent and production targets are demanding. Automation also helps automotive manufacturers manage labor variability while maintaining consistent output during peak demand cycles. Integration of robotics with advanced quality inspection and data analytics systems further improves operational visibility and manufacturing efficiency.

The transition towards electric vehicle (EV) production is creating additional robotics demand, as manufacturers establish new battery assembly lines and electric powertrain facilities requiring specialized automation solutions. As per industry reports, Indian electric car and SUV manufacturers are poised for unprecedented sales of 175,000 Units in CY2025. Growing localization of automotive components under domestic manufacturing initiatives is further expanding robot installations across tier-1 and tier-2 supplier facilities. Increased focus on worker safety and ergonomic improvement is also driving substitution of manual processes with robotic systems.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 32% share of the total India robotics market in 2025.

North India leads the robotics market owing to its well-established industrial infrastructure, concentration of automotive manufacturing hubs, and strong presence of technology companies in the Delhi-NCR corridor. The region benefits from proximity to policy centers, enabling faster adoption of government initiatives aimed at promoting automation and digital transformation. Major robotics companies have established headquarters and manufacturing facilities in Noida and Gurugram, creating a robust ecosystem for technology development. In November 2024, Noida-based Addverb Technologies announced plans to launch its first humanoid robot by 2025, backed by Reliance Industries.

The warehousing and logistics sector in North India is witnessing rapid automation adoption driven by e-commerce expansion and the need for efficient supply chain operations. Manufacturing industries, including automotive components, electronics, and pharmaceuticals, are increasingly deploying industrial robots to enhance production efficiency and maintain quality standards. The region's skilled workforce availability and educational institutions producing engineering talent further support the robotics ecosystem. Government infrastructure investments and industrial corridor development initiatives continue to strengthen the region's position as the leading robotics market.

Market Dynamics:

Growth Drivers:

Why is the India Robotics Market Growing?

Government Initiatives Supporting Manufacturing Automation

The Indian government's comprehensive policy framework aimed at transforming the manufacturing landscape is significantly driving robotics adoption across industrial sectors. Flagship programs aimed at promoting indigenous manufacturing are encouraging domestic production capabilities while attracting FDI in automation technologies. Production linked incentive schemes are providing financial rewards to companies investing in cutting-edge technologies, including robotics, reducing the capital investment burden for manufacturers. These initiatives are enhancing the manufacturing sector's contribution to the economy while creating an enabling environment for automation adoption. Digital transformation programs are promoting the integration of advanced technologies, including robotics, AI, and IoT, across industrial operations. As per IMARC Group, the India IoT market size was valued at USD 1.4 Billion in 2024. Skill development initiatives are addressing workforce capability gaps by training workers in automation technologies and robotic systems operation. The policy push towards smart manufacturing and Industry 4.0 adoption is accelerating the transition from manual to automated processes across diverse industrial applications.

Rising Labor Costs and Demand for Operational Efficiency

The increasing cost of labor in organized manufacturing sectors, combined with growing demand for consistent quality and productivity, is compelling industries to adopt robotic solutions. Manufacturers face mounting pressure to reduce operational costs, improve output quality, and enhance workplace safety while remaining competitive in global markets. Robotic systems offer consistent performance, faster processing times, and lower operational risks compared to manual labor for repetitive and precision-critical tasks. The need for round-the-clock operations without productivity decline during night shifts makes automation an attractive proposition for continuous manufacturing processes. Industries, including automotive, electronic, and pharmaceutical, are deploying robots for tasks requiring high precision and repeatability where human error can result in significant quality issues and wastage. As per IBEF, the automotive sector led in industrial robot usage in India, representing 42% of the overall market share, with installations rising by 139% to reach 3,551 units in 2023. The labor shortage in certain specialized manufacturing operations is further accelerating the shift towards automated solutions capable of performing complex tasks with minimal supervision.

Technological Advancements Reducing Implementation Barriers

Continuous technological advancements in robotics are making automation solutions more accessible, affordable, and easier to implement across diverse industrial applications. The declining cost of robotic components, including sensors, actuators, and control systems, is reducing the capital investment required for automation implementation. Advanced AI and ML capabilities are enabling robots to handle complex tasks, adapt to changing environments, and collaborate safely with human workers. Collaborative robot technology has lowered barriers to automation adoption by eliminating the need for extensive safety infrastructure and enabling flexible deployment across different applications. Improved programming interfaces and intuitive user experiences are reducing the technical expertise required for robot operation and maintenance. Cloud connectivity and remote monitoring capabilities are enabling better system management and predictive maintenance, improving operational efficiency and reducing downtime. These technological improvements are making robotics viable for SMEs that previously found automation economically unfeasible.

Market Restraints:

High Initial Capital Investment Requirements

The substantial upfront investment required for implementing robotic systems remains a significant barrier to widespread adoption, particularly among SMEs with limited financial resources. The total cost of ownership, including equipment acquisition, integration, training, and maintenance, can strain budgets and extend payback periods. Many manufacturers, especially in price-sensitive segments, continue to hesitate to commit substantial capital towards automation despite the long-term operational benefits.

Shortage of Skilled Workforce for Robotic Systems

The lack of adequately trained personnel capable of operating, programming, and maintaining advanced robotic systems presents a significant challenge to market expansion. Educational institutions and training programs have not kept pace with rapidly evolving robotics technologies, creating a skills gap in the workforce. Companies often face difficulties finding qualified technicians and engineers with specialized robotics expertise, potentially affecting system utilization and maintenance quality.

Integration Challenges with Existing Infrastructure

Many manufacturing facilities in India operate with legacy equipment and outdated infrastructure that pose compatibility challenges for modern robotic systems integration. Retrofitting existing production lines with automation technology often requires significant modifications and can disrupt ongoing operations. The complexity of integrating robots with existing enterprise systems, including manufacturing execution systems and quality management platforms, adds to implementation timelines and costs.

Competitive Landscape:

The India robotics market features a diverse competitive landscape, comprising established multinational corporations and emerging domestic players competing across industrial and service robotics segments. Market participants are focusing on expanding their product portfolios, establishing local manufacturing and service capabilities, and developing cost-effective solutions tailored to Indian market requirements. Strategic partnerships between global technology leaders and domestic companies are enabling knowledge transfer and localized solution development. Companies are investing significantly in R&D activities to introduce innovative products featuring advanced AI, improved human-robot collaboration capabilities, and enhanced operational efficiency. Distribution network expansion and after-sales service infrastructure development are key competitive differentiators as customers increasingly prioritize total cost of ownership and technical support accessibility. The growing emphasis on indigenous manufacturing under national initiatives is creating opportunities for domestic players to strengthen their market position through locally developed solutions.

Recent Developments:

-

In October 2025, the Indian Space Research Organization (ISRO) revealed plans to launch its inaugural humanoid robot into space by December, to assist with exploration and evaluate conditions prior to sending human crews. Vyommitra is the first humanoid robot from India designed by ISRO to aid in human space missions. Featuring human-like expressions, speech, and intelligence, Vyommitra is central to Gaganyaan, India's first human spaceflight initiative.

India Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Articulated Robots, Cartesian Robots SCARA Robots, Cylindrical Robots, Others |

| Application Covered | Handling, Welding & Soldering Cleanroom, Dispensing. Processing, Others |

| End Use Industry Covered | Automotive, Electrical/Electronics, Metal/Heavy Machinery, Chemicals, Food & beverages, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India robotics market size was valued at USD 1.98 Billion in 2025.

The India robotics market is expected to grow at a compound annual growth rate of 15.74% from 2026-2034 to reach USD 7.38 Billion by 2034.

Articulated robots dominated the market with a share of 39%, driven by their versatility, multi-axis flexibility, and widespread applicability across welding, assembly, material handling, and painting operations in automotive and manufacturing sectors.

Key factors driving the India robotics market include government initiatives aimed at promoting manufacturing automation, rising labor costs compelling industries towards automation, technological advancements reducing implementation barriers, and growing demand for service robots across the healthcare and logistics sectors.

Major challenges include high initial capital investment requirements, shortage of skilled workforce capable of operating and maintaining advanced robotic systems, integration challenges with existing legacy infrastructure, limited awareness among small enterprises, and the need for comprehensive technical support infrastructure across diverse geographic regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)