India Security Brokerage Market Size, Share, Trends and Forecast by Type of Security, Brokerage Service, Service, and Region, 2026-2034

India Security Brokerage Market Summary:

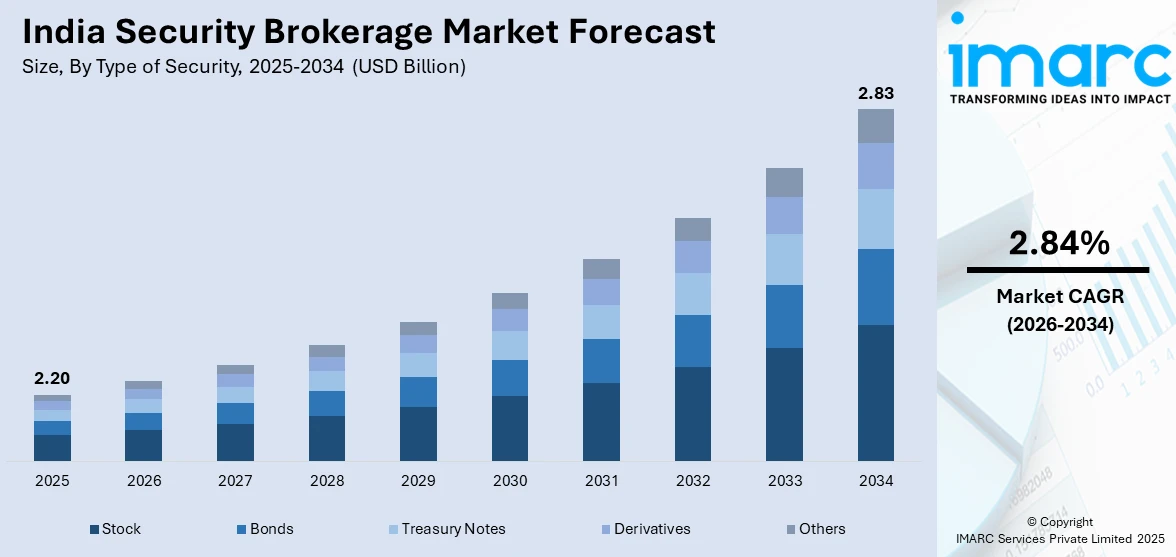

The India security brokerage market size was valued at USD 2.20 Billion in 2025 and is projected to reach USD 2.83 Billion by 2034, growing at a compound annual growth rate of 2.84% from 2026-2034.

India's security brokerage sector is experiencing rapid growth, propelled by retail investor participation surge, regulatory modernization through SEBI frameworks, and digital platform proliferation. Apart from this, the market reflects deepening financial inclusion across tier-two and tier-three cities, with democratized access to equity markets, derivatives trading, and wealth management services reshaping traditional brokerage models and competitive dynamics, thereby expanding the India security brokerage market share.

Key Takeaways and Insights:

- By Type of Security: Stock dominates the market with a share of 41% in 2025, driven by retail equity trading volumes and systematic investment plan adoption across demographic cohorts.

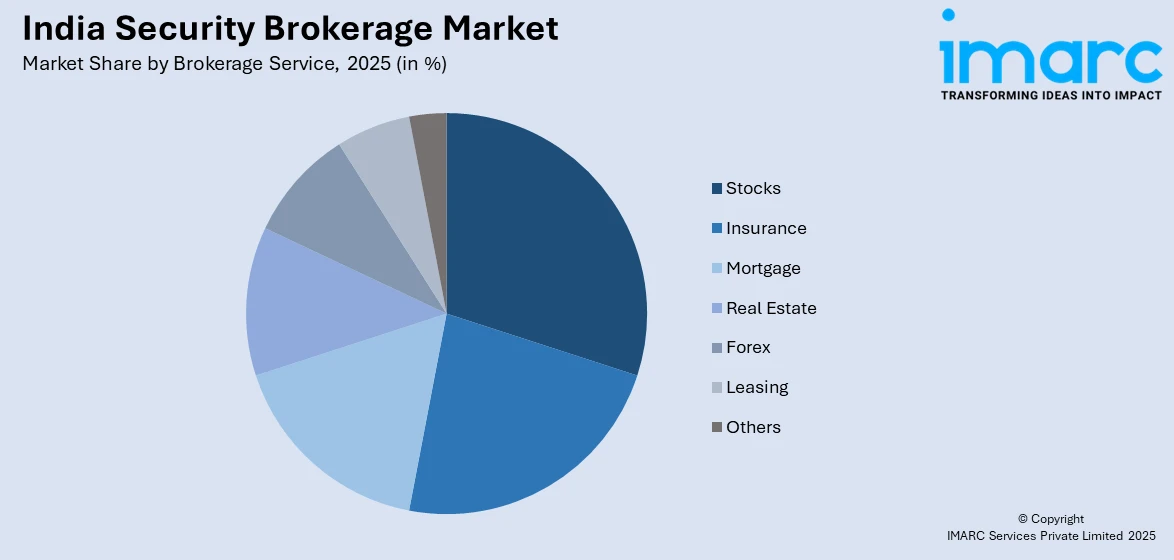

- By Brokerage Service: Stocks lead the market with a share of 30% in 2025, reflecting concentrated trading activity in equity cash and derivatives segments through exchange platforms.

- By Service: Online represents the largest segment with a market share of 32% in 2025, fueled by mobile-first trading applications and zero-commission pricing models.

- By Region: North India exhibits the largest market presence with a share of 29% in 2025, anchored by metropolitan concentration and higher financial literacy rates.

- Key Players: The India security brokerage landscape demonstrates fragmented competition with digital-native discount brokerages disrupting traditional full-service models, while regional players leverage localized advisory services and vernacular interfaces to capture emerging investor segments across diverse geographical markets.

To get more information on this market Request Sample

The country’s brokerage landscape has undergone transformative evolution through digital platform penetration that revolutionized market accessibility. Zero-brokerage equity delivery models pioneered by discount brokers fundamentally altered industry economics, enabling millions of first-time investors to enter capital markets without prohibitive transaction costs. Simplified digital account opening processes reduced onboarding friction from days to mere minutes through instant KYC verification and UPI-integrated fund transfers, while comprehensive educational resources provided by platforms like online learning portals democratized investment knowledge traditionally confined to affluent investor segments. This convergence of technological innovation and regulatory enablement created unprecedented retail participation momentum. Record demat account additions throughout 2024 and early 2025 demonstrated sustained investor enthusiasm despite periodic market corrections and evolving regulatory frameworks, positioning India as a global leader in retail equity market engagement with participation rates accelerating across tier-two and tier-three cities beyond traditional metropolitan strongholds. In 2025, the growth of demat accounts in India experienced a significant decline, despite the total accounts reaching an all-time peak, according to data from the National Securities Depository Ltd (NSDL) and Central Depository Services (India) Ltd (CDSL).

India Security Brokerage Market Trends:

Digital Trading Platform Proliferation

The Indian brokerage sector has witnessed explosive growth of mobile-first trading applications that transformed market access dynamics. Leading discount brokers reported millions of new account additions during fiscal 2025, with platforms providing seamless onboarding experiences through paperless digital processes. These applications integrate real-time market data, advanced charting capabilities, research insights, and instant fund transfer functionality within unified interfaces, enabling retail investors to execute trades, monitor portfolios, and access educational content through smartphones. The democratization of sophisticated trading tools previously available only to institutional investors has intensified competition among brokerages while expanding addressable market segments across diverse demographic cohorts including younger millennials entering investment markets for the first time. In 2025, Groww Mutual Fund has introduced the Groww Nifty India Internet ETF, the inaugural exchange-traded fund designed to follow the Nifty India Internet Index. The New Fund Offer begins on June 13. The fund seeks to invest in internet-driven companies in areas including e-commerce, fintech, online travel, digital payments, stockbroking, and entertainment. These industries are progressively becoming vital to the consumption and service economy.

Unprecedented Demat Account Expansion

India's dematerialized account growth reached historic proportions, representing net additions of 41.1 million accounts during fiscal year 2025 alone. The monthly average of 3.42 million new accounts established unprecedented benchmarks, though the growth rate in percentage terms moderated from prior years due to expanding base effects. This acceleration primarily stemmed from streamlined digital KYC processes eliminating traditional documentation barriers, with tier-two and tier-three cities contributing nearly half of new openings during 2024. Estimates suggest approximately 120 million distinct investors nationwide, indicating multiple account holdings per individual investor as participants diversify across platforms and seek optimal service offerings for different investment strategies and asset allocation requirements.

SEBI Derivatives Trading Reforms Implementation

Regulatory authorities implemented comprehensive futures and options market reforms throughout 2024 and early 2025, fundamentally reshaping derivatives trading economics. Authorities increased minimum contract sizes from previous ranges to fifteen to twenty lakh rupees, limited weekly expiries to single benchmark indices per exchange commencing November 2024, and introduced two percent Extreme Loss Margins on expiry-day short positions to enhance tail-risk coverage. These measures aimed to curtail excessive retail speculation in derivatives segments where studies revealed that a major percent of individual traders incurred net losses. The regulatory recalibration triggered immediate impacts on brokerage revenues, with futures and options volumes declining substantially and broker profitability compressing significantly across major discount platforms as trading intensity moderated under enhanced margin requirements and reduced contract accessibility for smaller capital participants.

Market Outlook 2026-2034:

The India security brokerage market is poised for steady advancement through 2033 despite near-term regulatory adjustments. Revenue growth will be driven by sustained retail investor additions as financial literacy initiatives expand reach into underserved regions while digital infrastructure penetration deepens across smaller cities. The market generated a revenue of USD 2.20 Billion in 2025 and is projected to reach a revenue of USD 2.83 Billion by 2034, growing at a compound annual growth rate of 2.84% from 2026-2034. Traditional full-service brokers are expected to maintain niche positions serving high-net-worth segments requiring personalized guidance, while robo-advisory platforms will capture growing market share among younger investors preferring automated portfolio management. The competitive landscape will continue evolving as regulatory frameworks balance investor protection imperatives with market development objectives, potentially stabilizing after the comprehensive derivatives reforms implemented during 2024-2025 normalize trading behaviors and brokers adapt business models to emphasize sustainable revenue streams beyond transaction fees.

India Security Brokerage Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type of Security |

Stock |

41% |

|

Brokerage Service |

Stocks |

30% |

|

Service |

Online |

32% |

|

Region |

North India |

29% |

Security Insights:

- Bonds

- Stock

- Treasury Notes

- Derivatives

- Others

Stock dominates with a market share of 41% of the total India security brokerage market in 2025.

Stock trading represents the cornerstone of India's retail brokerage ecosystem, commanding dominant market positioning through concentrated equity cash and derivatives participation. This segment capitalizes on index performance momentum, sectoral rotation opportunities, and intraday speculation strategies that attract diverse participant profiles from conservative investors to active traders. The equity market's accessibility through fractional shares, systematic investment plans, and margin trading facilities enables capital deployment across income brackets, while continuous market depth and liquidity ensure efficient price discovery mechanisms.

Regulatory infrastructure supporting stock trading demonstrates continuous evolution through circuit breaker mechanisms, position limit frameworks, and enhanced surveillance capabilities that maintain market orderliness. The segment benefits from corporate earnings transparency mandates, quarterly disclosure requirements, and governance standards that facilitate informed investment decisions. Exchange technology upgrades reducing latency to microsecond levels enable high-frequency trading strategies, while co-location facilities provide institutional participants with execution advantages that subsequently trickle down through improved overall market efficiency

Brokerage Service Insights:

Access the comprehensive market breakdown Request Sample

- Stocks

- Insurance

- Mortgage

- Real Estate

- Forex

- Leasing

- Others

Stocks lead with a share of 30% of the total India security brokerage market in 2025.

Stocks brokerage services maintain market leadership through concentrated trading volumes across equity cash markets and derivatives segments on recognized exchanges. This dominance stems from established regulatory frameworks governing equity trading, mature clearing and settlement infrastructure, and standardized contract specifications that minimize counterparty risks. Brokerages leverage equity market volatility to generate transaction-based revenues while offering ancillary services including margin financing, securities lending, and portfolio management solutions that enhance client lifetime value.

The equity brokerage vertical demonstrates network effects through liquidity aggregation, where higher participant concentrations improve bid-ask spreads and execution quality. This segment benefits from continuous product innovation including thematic indices, sectoral ETFs, and structured derivative instruments that cater to sophisticated hedging and speculation requirements. Integration with research platforms, earnings call transcripts, and corporate action databases transforms equity brokerages into comprehensive information hubs beyond mere transaction execution channels.

Service Insights:

- Full-Service

- Discount

- Online

- Robo Advisor

- Brokers-Dealers

Online exhibits a clear dominance with a 32% share of the total India security brokerage market in 2025.

Online brokerage platforms revolutionize market access through mobile-first architectures, instantaneous account opening procedures, and zero-commission pricing models that eliminate traditional entry barriers. This segment leverages cloud computing infrastructure to deliver scalable trading experiences supporting millions of concurrent users during peak market hours. Digital interfaces incorporate advanced charting tools, real-time streaming quotes, and one-click order placement functionalities that compress decision-to-execution timeframes while reducing operational costs through automation.

The online brokerage model demonstrates superior customer acquisition economics through digital marketing channels, referral mechanisms, and social trading features that virally expand user bases. Platform stickiness increases through gamification elements, educational content libraries, and community forums that transform transactional relationships into engaged ecosystems. Integration capabilities with third-party analytics providers, news aggregators, and portfolio tracking applications create comprehensive financial management environments accessible through single authentication credentials.

Regional Insights:

- North India

- South India

- East India

- West India

North India leads with a share of 29% of the total India security brokerage market in 2025.

North India's brokerage market leadership reflects metropolitan concentration in Delhi NCR, higher per capita income levels, and established financial services ecosystems supporting sophisticated investment behaviors. The region benefits from proximity to regulatory headquarters, financial institution concentrations, and professional service networks that facilitate knowledge diffusion regarding market opportunities and risk management strategies. Cultural affinity toward entrepreneurship and business ownership translates into equity market participation rates exceeding national averages.

Educational infrastructure across northern tier-one cities produces financially literate demographics familiar with capital market mechanisms, corporate governance principles, and macroeconomic indicators influencing security valuations. Regional brokerages leverage vernacular Hindi capabilities to penetrate semi-urban markets across Uttar Pradesh, Rajasthan, and Punjab where smartphone penetration outpaces traditional banking access. The zone's trading activity exhibits pronounced momentum during corporate earnings seasons and budget announcements, reflecting engaged participant bases actively monitoring policy developments and economic indicators.

Market Dynamics:

Growth Drivers:

Why is the India Security Brokerage Market Growing?

Retail Investor Democratization Through Regulatory Enablement

The transformation of India's capital market accessibility represents a fundamental driver of brokerage industry expansion, with regulatory authorities implementing comprehensive measures that eliminated traditional participation barriers for retail investors. Digital Know Your Customer processes replaced cumbersome physical documentation requirements, enabling account opening completion within minutes through Aadhaar-based authentication and electronic signature integrations that bypassed prior-generation postal verification delays. In June 2025, the Reserve Bank of India (RBI) declared a significant update to its KYC (Know Your Customer) regulations. According to the updated regulations, banks are required to streamline periodic KYC compliance to ensure that customers, particularly those in rural or underprivileged regions, can conveniently access their funds. Numerous accounts have stayed dormant for years due to lapsed KYC deadlines, resulting in balances being moved to the RBI’s Depositor Education and Awareness (DEA) Fund. These regulatory enablements coincided with reduced minimum capital requirements and fractional share trading capabilities that rendered equity investing accessible to students, young professionals, and middle-class households with modest disposable incomes previously excluded from markets demanding substantial entry thresholds.

Mobile-First Technology Revolution Enabling Seamless Market Access

The proliferation of mobile trading applications revolutionized how Indians interact with capital markets, transforming brokerage from specialist activity requiring desktop access into mainstream behavior embedded within daily smartphone routines. Modern applications provide institutional-grade trading capabilities through intuitive interfaces designed for novice investors, with features including real-time price streaming, advanced charting with technical indicators, instant order execution, and comprehensive portfolio analytics consolidated within unified platforms accessible anywhere with internet connectivity. Educational content integration including video tutorials, market analysis, and interactive learning modules reduced knowledge gaps that historically deterred participation, while push notifications about market events, portfolio performance, and investment opportunities. In 2025, The Reserve Bank of India (RBI) launched mobile application for its Retail Direct Scheme. The application will assist investors in various forms of government securities, including bonds and treasury bills.

Financial Literacy and Awareness Expansion Cultivating Investment Culture

The systematic enhancement of financial literacy across India's population represents a critical enabler of brokerage market expansion, with governmental initiatives, industry programs, and media proliferation collectively elevating investment awareness beyond traditional investor demographics. Educational campaigns by regulatory authorities demystified capital market concepts through simplified explanations accessible to non-specialist audiences, while mandatory investor education modules for derivatives trading ensured participants understood product mechanics before committing capital. Industry associations conducted workshops, seminars, and online programs reaching diverse community segments including women investors, rural populations, and younger students, building foundational knowledge supporting informed investment decisions and reducing susceptibility to fraud or misselling of inappropriate products. The Reserve Bank of India has initiated the Financial Literacy Week 2025. It is a yearly effort designed to enhance financial literacy among individuals. This year, the campaign takes place from February 24 to 28, centered around the theme “Financial Literacy – Women’s Prosperity.”

Market Restraints:

What Challenges the India Security Brokerage Market is Facing?

Market Volatility and Investor Sentiment Fluctuations

Brokerage revenue streams demonstrate cyclical vulnerability to market volatility patterns, with trading volumes contracting sharply during prolonged bearish phases or sideways market movements that discourage active participation. Investor sentiment shifts responding to macroeconomic uncertainties, geopolitical tensions, or corporate earnings disappointments create unpredictable revenue trajectories that complicate capacity planning and resource allocation decisions. Retail participants exhibit pronounced behavior biases including panic selling during corrections and excessive risk-taking during bull runs, generating operational challenges in margin management and client advisory responsibilities.

Technological Disruption and Platform Differentiation Challenges

The brokerage industry faces continuous technological obsolescence risks as participant expectations evolve toward sophisticated features including social trading, automated strategies, and integrated financial planning tools. Platform differentiation becomes increasingly difficult as core trading functionalities commoditize, forcing brokerages into expensive technology upgrade cycles and feature parity races that compress profit margins. Cybersecurity vulnerabilities and system downtime incidents during critical trading hours inflict reputational damages that erode hard-won customer trust and trigger regulatory scrutiny.

Regulatory Compliance Burden and Operational Cost Escalation

Evolving regulatory requirements impose substantial compliance infrastructure investments covering surveillance systems, audit trails, client documentation, and periodic reporting obligations that disproportionately burden smaller brokerage entities. Know-your-customer verification processes, anti-money laundering protocols, and beneficial ownership disclosure mandates increase customer onboarding friction and operational complexity. Frequent regulatory framework modifications require continuous legal interpretations, system reconfigurations, and staff training programs that divert resources from customer-facing initiatives and product development efforts.

Competitive Landscape:

India's security brokerage competitive environment exhibits clear bifurcation between digital-native discount brokerages leveraging technology scalability and traditional full-service firms maintaining relationship-driven advisory models. Apart from this, discount platforms compete aggressively through zero-commission pricing, superior mobile experiences, and rapid feature deployment cycles that attract cost-conscious millennials and active traders. Full-service brokerages differentiate through personalized wealth management, research advisory capabilities, and cross-product bundling across insurance, mutual funds, and alternative investments targeting high-net-worth segments. Regional players carve specialized niches through vernacular interfaces, localized customer service, and community-based investor education programs penetrating tier-two and tier-three markets where national brands demonstrate limited presence.

Recent Developments:

- In July 2025, MobiKwik Securities Broking (MSBPL), a fully-owned subsidiary of the fintech company MobiKwik, announced that it has obtained regulatory approval from the Securities and Exchange Board of India (SEBI) to operate as a stock broker and clearing member. The company stated that SEBI granted the certification of registration to the firm on 1 July. This now enables MSBPL to perform tasks like purchasing, selling, trading, clearing, and settling equity transactions.

- In June 2025, Jio BlackRock Broking Pvt. Ltd., a fully owned subsidiary of Jio BlackRock Investment Advisers Pvt. Ltd., has obtained regulatory clearance from the Securities and Exchange Board of India (SEBI) to begin functioning as a brokerage firm.

India Security Brokerage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Securities Covered | Bonds, Stock, Treasury Notes, Derivatives, Others |

| Brokerage Services Covered | Stocks, Insurance, Mortgage, Real Estate, Forex, Leasing, Others |

| Services Covered | Full-Service, Discount, Online, Robo Advisor, Brokers-Dealers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India security brokerage market size was valued at USD 2.20 Billion in 2025.

The India security brokerage market is expected to grow at a compound annual growth rate of 2.84% from 2026-2034 to reach USD 2.83 Billion by 2034.

Stock dominates with 41% market share due to retail investor preference for equity investments and record initial public offering activity that expanded participation opportunities through simplified digital account access platforms.

Key factors driving the India Security Brokerage market include retail investor democratization through regulatory enablement that eliminated traditional participation barriers, mobile-first technology revolution enabling seamless market access via smartphone applications, and financial literacy expansion cultivating investment culture across demographic segments.

Major challenges include market volatility creating unpredictable revenue streams during bearish phases, technological disruption requiring continuous platform upgrades amid feature commoditization, regulatory compliance burden escalating operational costs, cybersecurity vulnerabilities threatening client trust, and intense price competition compressing profit margins across discount brokerage segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)