India Security System Integrators Market Size, Share, Trends and Forecast by Security Type, Organization Size, Industry Vertical, and Region, 2025-2033

India Security System Integrators Market Size and Share:

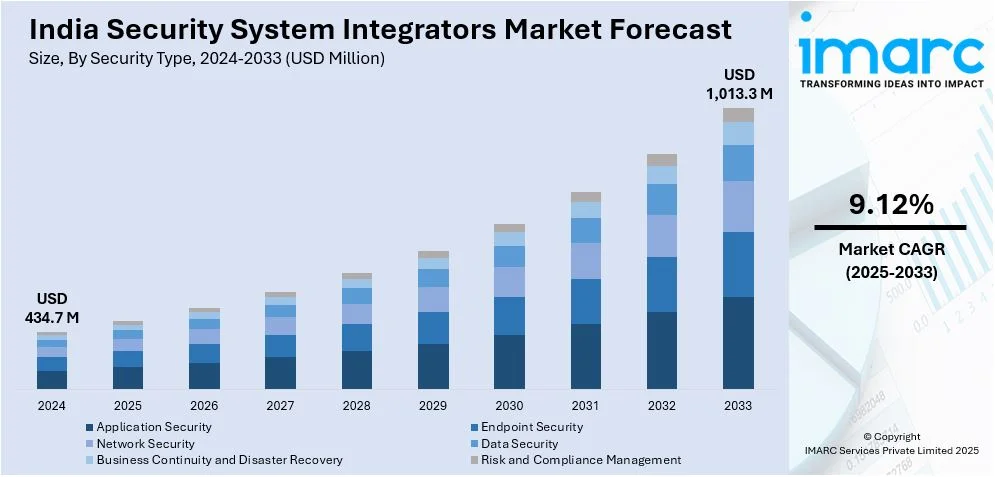

The India security system integrators market size reached USD 434.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,013.3 Million by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033. The market is growing with the increasing adoption of AI-based surveillance, integrated cybersecurity, and IoT-based security frameworks. Concurrently, growing cyber-attacks, smart city programs, and enterprise digitalization are fueling demand for advanced security integration, automation, and real-time threat detection across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 434.7 Million |

| Market Forecast in 2033 | USD 1,013.3 Million |

| Market Growth Rate (2025-2033) | 9.12% |

India Security System Integrators Market Trends:

Rising Adoption of AI-Driven Security

The growing dependence on artificial intelligence in security solutions is revolutionizing the India Security System Integrators industry. Additionally, organizations and government institutions are merging AI-powered surveillance, biometric verification, and autonomous monitoring to streamline security efficiency. AI-based systems provide real-time threat identification, predictive analytics, and automated response to incidents, limiting human intervention and enhancing precision. Similarly, the transition towards AI-driven security is being driven by the need for quicker, data-driven decision-making and preemptive security control in sectors such as banking, retail, and smart cities. For example, in December 2024, IFSEC India showcased AI, IoT, and integrated security technologies, driving growth in India's Security System Integrators market. Featuring over 300 brands and 5,000 solutions, the event enhanced innovation, skill development, and industry collaboration. This breakthrough speeds up the deployment of smart surveillance and cyber security solutions by industries. Further, deployments of AI-driven security systems are anticipated to increase due to companies pursuing scalable, budget-friendly, and automated security platforms. AI-integrated surveillance offers enhanced perimeter defense, crowd behavior management, and real-time anomaly detection. Also, AI-powered cyber security measures are enabling firms to secure delicate data against malware attacks. Correspondingly, rising interest in AI-based security solutions is influencing market demand, prompting security integrators to create advanced AI-powered solutions to meet emerging security threats.

To get more information on this market, Request Sample

Expanding Demand for Integrated Cybersecurity Solutions

Rising advancements in cyber threats are increasing the demand for end-to-end cybersecurity solutions in the India Security System Integrators market. Organizations are prioritizing secure connectivity, threat reduction, and data encryption to protect digital assets. As companies migrate toward cloud-based infrastructures and hybrid workspaces, there is an escalating demand for security architectures that enable unified visibility, threat intelligence, and real-time protection. Meanwhile, integrated security solutions are facilitating companies to automate security operations and build strength against cyber threats. For example, in June 2024, Tata Communications launched its Hosted Secure Access Service Edge (SASE) solution, enhancing India's Security System Integrators market. This innovation integrates SD-WAN and security services, enabling enterprises to strengthen cybersecurity, improve network performance, and streamline secure remote access. The development necessitates unified security solutions that enhance enterprise digital transformation and hybrid workforce security. With increasing cyber threats, companies are focusing on security solutions that merge network security and endpoint security. Moreover, companies are embracing SASE frameworks to support safe data access and regulatory compliance. The growing digitization of businesses is compelling security integrators to deliver sophisticated security solutions that integrate cloud security, identity management, and threat detection using AI. The need for converged cybersecurity solutions will continue to grow, defining the future of enterprise security in India.

India Security System Integrators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on security type, organization size, and industry vertical.

Security Type Insights:

- Application Security

- Endpoint Security

- Network Security

- Data Security

- Business Continuity and Disaster Recovery

- Risk and Compliance Management

The report has provided a detailed breakup and analysis of the market based on the security type. This includes application security, endpoint security, network security, data security, business continuity and disaster recovery, and risk and compliance management.

Organization Size Insights:

- Small and Medium-Sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

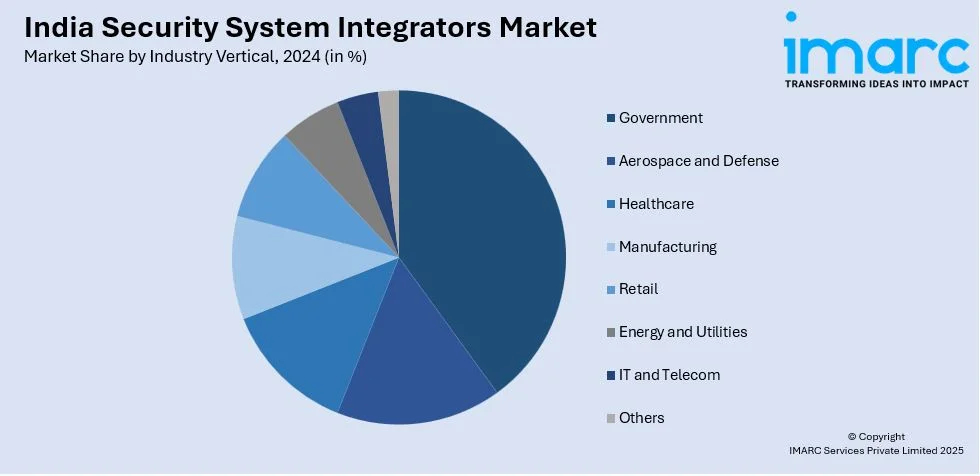

Industry Vertical Insights:

- Government

- Aerospace and Defense

- Healthcare

- Manufacturing

- Retail

- Energy and Utilities

- IT and Telecom

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes government, aerospace and defense, healthcare, manufacturing, retail, energy and utilities, it and telecom, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Security System Integrators Market News:

- November 2024: Sparsh CCTV and Cron AI partnered to integrate LiDAR, 3D perception, and AI-driven edge computing into security systems. This advancement strengthens India’s security system integrators market by enhancing intelligent surveillance, infrastructure automation, and traffic management. The innovation increases demand for advanced security integration, improving real-time monitoring and automated decision-making across industries.

- August 2024: Kyndryl launched a Security Operations Center (SOC) in Bengaluru, enhancing India's cybersecurity infrastructure. This development strengthens the Security System integrators market by expanding advanced threat monitoring, AI-driven automation, and compliance support. The SOC improves cybersecurity resilience, increasing demand for integration services and managed security solutions.

India Security System Integrators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Security Type Covered | Application Security, Endpoint Security, Network Security, Data Security, Business Continuity and Disaster Recovery, Risk and Compliance Management |

| Organization Size Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Industry Vertical Covered | Government, Aerospace and Defense, Healthcare, Manufacturing, Retail, Energy and Utilities, IT and Telecom, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India security system integrators market performed so far and how will it perform in the coming years?

- What is the breakup of the India security system integrators market on the basis of type?

- What is the breakup of the India security system integrators market on the basis of lease type?

- What is the breakup of the India security system integrators market on the basis of service provider type?

- What is the breakup of the India security system integrators market on the basis of tenure?

- What are the various stages in the value chain of the India security system integrators market?

- What are the key driving factors and challenges in the India security system integrators market?

- What is the structure of the India security system integrators market and who are the key players?

- What is the degree of competition in the India security system integrators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India security system integrators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India security system integrators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India security system integrators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)