India Self-Compacting Concrete Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2025-2033

India Self-Compacting Concrete Market Overview:

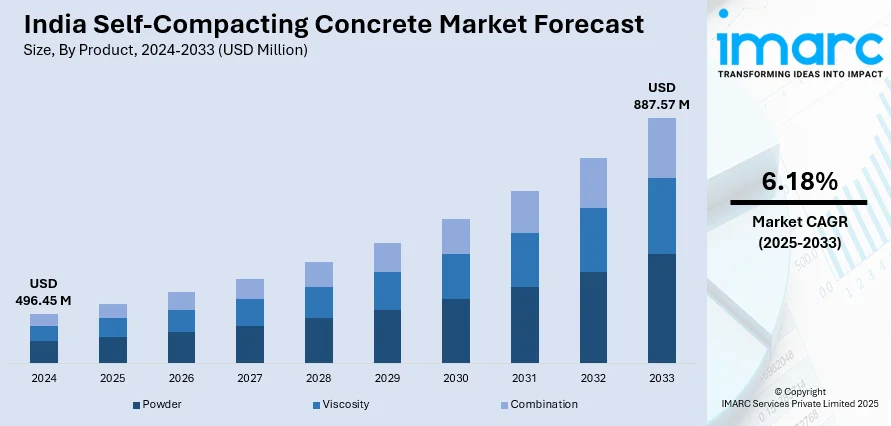

The India self-compacting concrete market size reached USD 496.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 887.57 Million by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is driven by rapid urbanization, government infrastructure initiatives, such as Smart Cities and Bharatmala, and the rising demand for high-performance, labor-efficient construction materials. Moreover, the increasing product adoption in high-rise buildings, bridges, and precast structures is further fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 496.45 Million |

| Market Forecast in 2033 | USD 887.57 Million |

| Market Growth Rate 2025-2033 | 6.18% |

India Self-Compacting Concrete Market Trends:

Growing Product Adoption in High-Rise and Infrastructure Projects

India’s rapid urbanization and infrastructural growth have driven a surge in demand for self-compacting concrete (SCC), especially in high-rise buildings, metro rail projects, and bridges. Its superior flowability eliminates the need for mechanical vibration, making it ideal for complex, densely reinforced structures. With India's urban population expected to hit 600 million by 2030, the construction industry is progressively focusing on high-rise developments. SCC improves productivity, lowers labor costs, and increases concrete durability, making it a preferred material among developers. Furthermore, government efforts, such as the Bharatmala Pariyojana, which aims to build 34,800 km of roads by 2025, and the Smart Cities Mission, which aims to modernize 100 cities, are also encouraging SCC adoption. SCC’s usage in highways, bridges, and precast concrete components is critical to increasing structural integrity and lifespan.

To get more information on this market, Request Sample

Rising Demand for Sustainable and High-Performance Concrete

Growing sustainability concerns and the shift towards eco-friendly construction materials are driving the increased adoption of self-compacting concrete, which is known for its ability to minimize construction waste and lower energy consumption. By eliminating mechanical vibration, SCC reduces noise pollution while improving material efficiency, aligning with the Indian government’s net-zero building initiatives and green construction strategies. Furthermore, incorporating supplementary cementitious materials (SCMs) like fly ash, slag, and silica fume enhances the sustainability of SCC while also improving its workability and strength. With industries striving to cut their carbon footprint, fly ash-based SCC usage is projected to grow substantially in the near-term. Although SCC has a higher initial cost compared to conventional concrete, its superior durability, reduced labor requirements, and minimal maintenance expenses make it a cost-effective long-term solution. As India’s construction sector embraces sustainable and resilient building practices, SCC is poised to play a critical role in shaping modern infrastructure.

India Self-Compacting Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and end use.

Product Insights:

- Powder

- Viscosity

- Combination

The report has provided a detailed breakup and analysis of the market based on the product. This includes powder, viscosity, and combination.

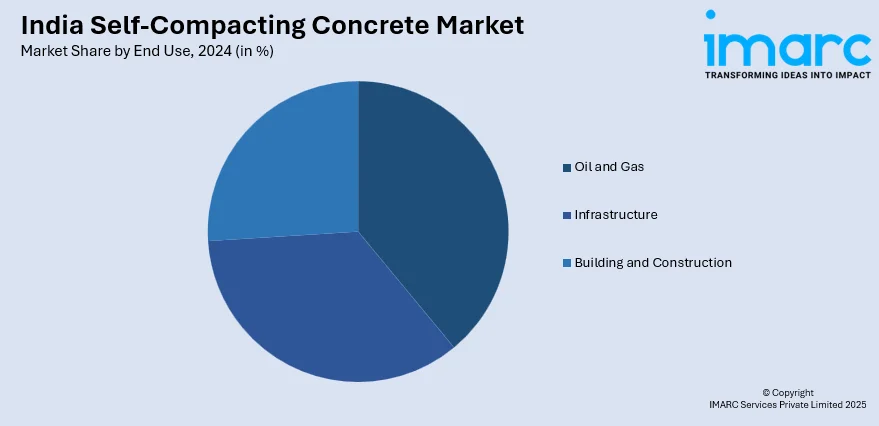

End Use Insights:

- Oil and Gas

- Infrastructure

- Building and Construction

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes oil and gas, infrastructure, and building and construction.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Self-Compacting Concrete Market News:

- March 2025: Ambuja Cements, part of the Adani Group, secured approval to acquire Orient Cement for USD 451 million. This acquisition reflects the ongoing consolidation within India's cement sector.

- December 2024: UltraTech Cement received approval from the Competition Commission to acquire a majority stake in India Cements. This move was valued at approximately USD 472 million.

India Self-Compacting Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Powder, Viscosity, Combination |

| End Uses Covered | Oil and Gas, Infrastructure, Building and Construction |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India self-compacting concrete market performed so far and how will it perform in the coming years?

- What is the breakup of the India self-compacting concrete market on the basis of product?

- What is the breakup of the India self-compacting concrete market on the basis of end use?

- What are the various stages in the value chain of the India self-compacting concrete market?

- What are the key driving factors and challenges in the India self-compacting concrete market?

- What is the structure of the India self-compacting concrete market and who are the key players?

- What is the degree of competition in the India self-compacting concrete market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India self-compacting concrete market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India self-compacting concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India self-compacting concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)