India Self-Healing Grids Market Size, Share, Trends and Forecast by Component, Application, End User, and Region, 2025-2033

India Self-Healing Grids Market Overview:

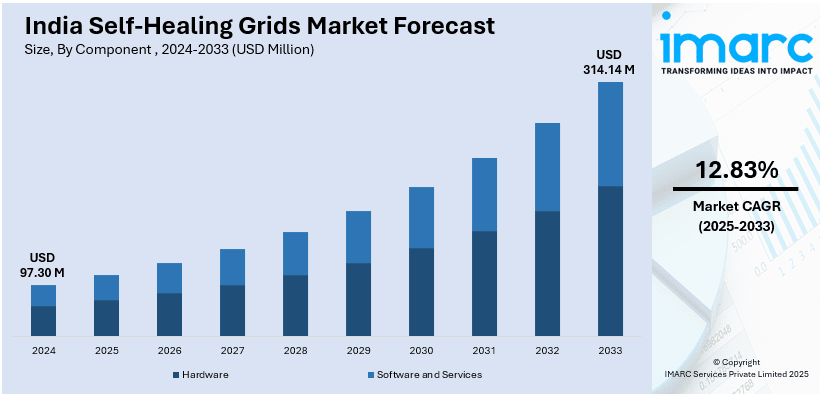

The India self-healing grids market size reached USD 97.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 314.14 Million by 2033, exhibiting a growth rate (CAGR) of 12.83% during 2025-2033. The India self-healing grids market share is expanding, driven by the growing execution of government initiatives that support the installation of smart grids, along with the rising adoption of artificial intelligence (AI) that helps to balance power supply fluctuations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.30 Million |

| Market Forecast in 2033 | USD 314.14 Million |

| Market Growth Rate 2025-2033 | 12.83% |

India Self-Healing Grids Market Trends:

Rising integration of renewable energy resources

The increasing adoption of renewable energy resources is offering a favorable India self-healing grids market outlook. As per the information provided on the official website of the PIB, by December 2024, India achieved a total renewable energy installed capacity of 209.44 GW, reflecting a notable 15.84% rise from 180.80 GW in December 2023. Unlike traditional power grids, which rely on a stable flow of electricity from fossil fuel plants, renewable energy generation fluctuates based on weather conditions, creating challenges in maintaining a consistent power supply. Self-healing grids use automation and sensors to detect disruptions, reroute power, and balance loads efficiently, making them essential for integrating renewables into the energy mix. With India promoting large-scale renewable energy utilization to meet its sustainability goals, the need for self-healing grids is increasing to ensure grid stability and minimize power outages. Additionally, self-healing grids support decentralized energy systems, where homes and businesses with solar panels or wind turbines can contribute power back to the grid. Government initiatives promoting smart grids and clean energy, along with investments in grid modernization, are further accelerating the employment of self-healing grids in India, helping the country to transition towards a more resilient and sustainable energy future.

To get more information on this market, Request Sample

Growing usage of AI

The rising utilization of AI is impelling the India self-healing grids market growth. According to the BCG-NASSCOM Report, India’s AI sector was expected to expand at a CAGR of 25-35% in 2024, highlighting its capacity for innovations and job opportunities. Power utilities increasingly rely on smart technology to detect and resolve grid failures in real time. AI-based self-healing grids can analyze vast amounts of data, identify patterns, and make instant decisions to restore electricity without manual intervention. AI assists in predicting equipment failures before they happen, allowing maintenance teams to act proactively and reduce downtime. AI-oriented self-healing grids are becoming essential to balance power supply fluctuations. These intelligent grids can also improve energy efficiency by automatically rerouting electricity through the most optimal paths, lowering transmission losses and enhancing grid stability. Moreover, government initiatives supporting digital transformation in the energy sector are encouraging AI adoption. As India modernizes its power infrastructure, AI-focused self-healing grids are playing a crucial role in making the electricity network more reliable and resilient.

India Self-Healing Grids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, application, and end user.

Component Insights:

- Hardware

- Software and Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software and services.

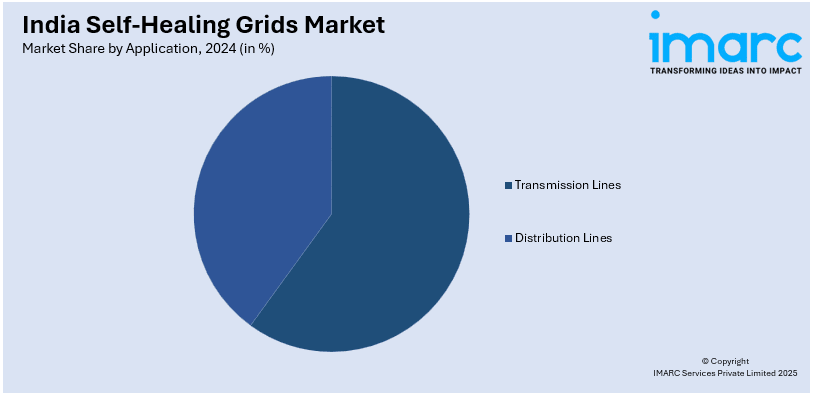

Application Insights:

- Transmission Lines

- Distribution Lines

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transmission lines and distribution lines.

End User Insights:

- Public Utility

- Private Utility

The report has provided a detailed breakup and analysis of the market based on the end user. This includes public utility and private utility.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Self-Healing Grids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software and Services |

| Applications Covered | Transmission Lines, Distribution Lines |

| End Users Covered | Public Utility, Private Utility |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India self-healing grids market performed so far and how will it perform in the coming years?

- What is the breakup of the India self-healing grids market on the basis of component?

- What is the breakup of the India self-healing grids market on the basis of application?

- What is the breakup of the India self-healing grids market on the basis of end user?

- What is the breakup of the India self-healing grids market on the basis of region?

- What are the various stages in the value chain of the India self-healing grids market?

- What are the key driving factors and challenges in the India self-healing grids market?

- What is the structure of the India self-healing grids market and who are the key players?

- What is the degree of competition in the India self-healing grids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India self-healing grids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India self-healing grids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India self-healing grids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)