India Self Testing Kits Market Size, Share, Trends and Forecast by Test Type, Sample, Usage, Distribution Channel, and Region, 2025-2033

India Self Testing Kits Market Overview:

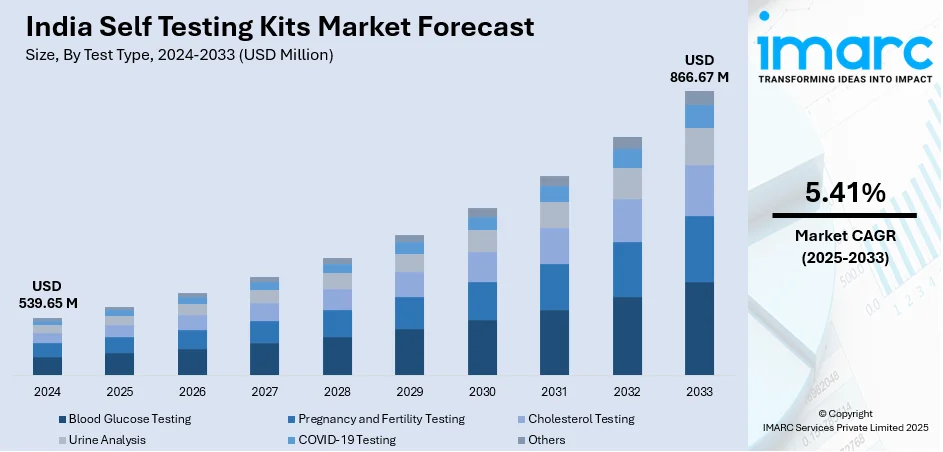

The India self testing kits market size reached USD 539.65 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 866.67 Million by 2033, exhibiting a growth rate (CAGR) of 5.41% during 2025-2033. The increase in the prevalence of chronic and infectious diseases, the growing demand for convenient, rapid diagnostic solutions, government initiatives promoting home-based testing, technological advancements enhancing accuracy, and the expansion of e-commerce platforms are contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 539.65 Million |

| Market Forecast in 2033 | USD 866.67 Million |

| Market Growth Rate 2025-2033 | 5.41% |

India Self Testing Kits Market Trends:

Growing Adoption of At-Home Diagnostics

The rising prevalence of lifestyle diseases like diabetes and hypertension, coupled with the increasing incidence of infectious ailments, is driving the demand for self-testing kits in India. With over 77 million diabetics in the country, glucose monitoring kits have emerged as a key segment, witnessing a growing adoption of glucometers and HbA1c testing kits for convenient at-home monitoring. The self-testing market has also expanded beyond chronic disease management, fueled by the demand for rapid diagnostic kits for infectious diseases. While COVID-19 accelerated the adoption of self-tests, the trend has continued post-pandemic, particularly for diseases like dengue, malaria, and tuberculosis. Government initiatives promoting early diagnosis, combined with the affordability and accessibility of self-testing solutions, are further mainstreaming at-home diagnostics and reducing dependence on traditional laboratory testing. As a result, India’s self-testing market is poised for sustained growth, catering to the need for faster, more convenient healthcare solutions.

To get more information on this market, Request Sample

E-Commerce and Telemedicine Driving Accessibility & Adoption

The rapid growth of online healthcare platforms and e-commerce is significantly boosting the accessibility and adoption of self-testing kits in India. Leading digital health platforms such as Tata 1mg, PharmEasy, and Netmeds reported a 30-40% surge in self-testing kit sales in 2023, reflecting a shift toward convenient at-home diagnostics. E-commerce is also bridging the accessibility gap in Tier 2 and Tier 3 cities, enabling wider rural penetration of self-testing solutions. Additionally, the integration of self-testing kits with telemedicine services is revolutionizing healthcare delivery. Many online healthcare providers now bundle diagnostic kits with virtual doctor consultations, ensuring immediate medical guidance post-testing. This hybrid approach has led to a 35% rise in self-testing adoption among urban consumers. As India’s digital healthcare ecosystem continues to expand, e-commerce and telemedicine will remain critical drivers in making self-testing more accessible, convenient, and widely accepted, ultimately transforming the country’s diagnostic landscape.

India Self Testing Kits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on test type, sample, usage, and distribution channel.

Test Type Insights:

- Blood Glucose Testing

- Pregnancy and Fertility Testing

- Cholesterol Testing

- Urine Analysis

- COVID-19 Testing

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes blood glucose testing, pregnancy and fertility testing, cholesterol testing, urine analysis, COVID-19 testing, and others.

Sample Insights:

- Blood

- Urine

- Saliva/Swab

A detailed breakup and analysis of the market based on the sample have also been provided in the report. This includes blood, urine, and saliva/swab.

Usage Insights:

- Disposable

- Reusable

The report has provided a detailed breakup and analysis of the market based on the usage. This includes disposable and reusable.

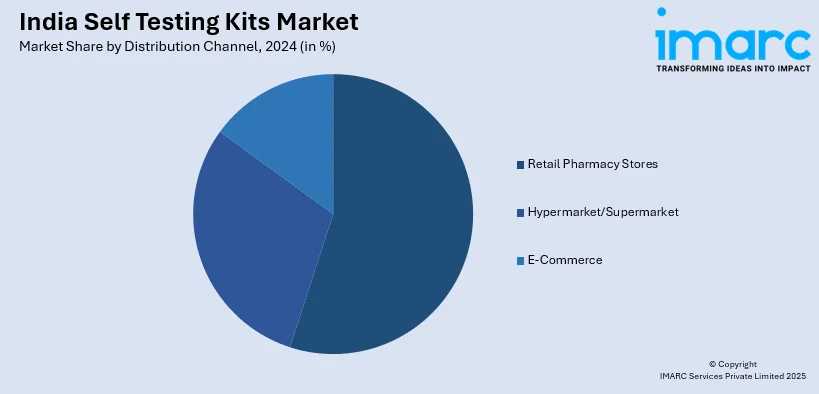

Distribution Channel Insights:

- Retail Pharmacy Stores

- Hypermarket/Supermarket

- E-Commerce

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail pharmacy stores, hypermarket/supermarket, and e-commerce.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Self Testing Kits Market News:

- October 2024: The Indian Council of Medical Research National Institute of Virology (ICMR-NIV) developed India's first rapid monkeypox diagnostic kit. This kit is expected to reduce both the cost and turnaround time for diagnosing monkeypox (Mpox) by 60-70%. The kit, which costs between Rs350 and Rs400, would provide findings in an hour.

- September 2024: Mankind Pharma unveiled RAPID NEWS self-test kits to address key health concerns in India. Individuals around the country will benefit from the kits' easy, discreet, and speedy testing options. The kits provide a rapid, confidential, and dependable method of testing from the comfort of the user's home. The kits identify dengue, UTIs, and menopause, allowing people to conduct testing in the comfort and privacy of their own homes.

India Self Testing Kits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Blood Glucose Testing, Pregnancy and Fertility Testing, Cholesterol Testing, Urine Analysis, COVID-19 Testing, Others |

| Samples Covered | Blood, Urine, Saliva/Swab |

| Usages Covered | Disposable, Reusable |

| Distribution Channels Covered | Retail Pharmacy Stores, Hypermarket/Supermarket, E-Commerce |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India self testing kits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India self testing kits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India self testing kits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The self testing kits market in India was valued at USD 539.65 Million in 2024.

The India self testing kits market is projected to exhibit a (CAGR) of 5.41% during 2025-2033, reaching a value of USD 866.67 Million by 2033.

Some of the key drivers of the India self-testing kits market are growing health consciousness, high demand for convenient and quick diagnostic tests, and growing telemedicine service offerings. Preventive healthcare promotion efforts by governments, coupled with technological innovations supporting accurate home-based testing, also contribute to increased adoption. Growing urbanization and enhanced digital connectivity further facilitate deeper penetration within various segments of the population.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)