India Set-Top Box Market Size, Share, Trends and Forecast by Type, Resolution, End User, Service Type, Distribution, and Region, 2025-2033

Market Overview:

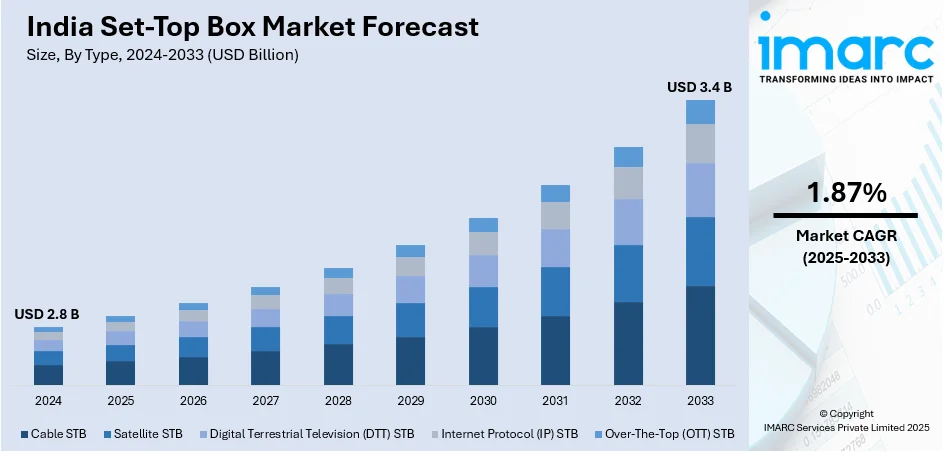

The India set-top box market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 1.87% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.8 Billion |

|

Market Forecast in 2033

|

USD 3.4 Billion |

| Market Growth Rate (2025-2033) | 1.87% |

A set-top box (STB) is a device attached to a television (TV) to support digital broadcasting. It receives signals via a cable or telephone connection and converts them into visuals. It includes a RAM, web browser, MPEG decoder chip and an operating system, and supports video conferencing, home networking, video-on-demand and internet protocol (IP) telephony. Consequently, it is utilized in cable, satellite and over-the-air (OTA) television systems in India.

To get more information on this market, Request Sample

The increasing digitization of cable TV networks, along with advancements in digital broadcasting technologies, represents one of the key factors bolstering the market growth in India. Apart from this, rapid urbanization, inflating disposable incomes and improving living standards of individuals are increasing the adoption of direct-to-home (DTH) services and smart TVs, which, in turn, is stimulating the market growth. Furthermore, the growing popularity of on-demand entertainment services, including movies, music, videos and games, along with the rising utilization of Over the Top (OTT) media services, is another factor contributing to the market growth. Moreover, the leading players are offering product variants with varying storage options that allow access to online video streaming platforms and social media. Besides this, the escalating demand for media and entertainment services due to the outbreak of the coronavirus disease (COVID-19) and the consequently increasing time spent indoors is positively influencing the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India set-top box market report, along with forecasts at the country level from 2025-2033. Our report has categorized the market based on type, resolution, end user, service type, and distribution.

Breakup by Type:

- Cable STB

- Satellite STB

- Digital Terrestrial Television (DTT) STB

- Internet Protocol (IP) STB

- Over-The-Top (OTT) STB

Breakup by Resolution:

- HD (High Definition)

- SD (Standard Definition)

- UHD (Ultra-High Definition)

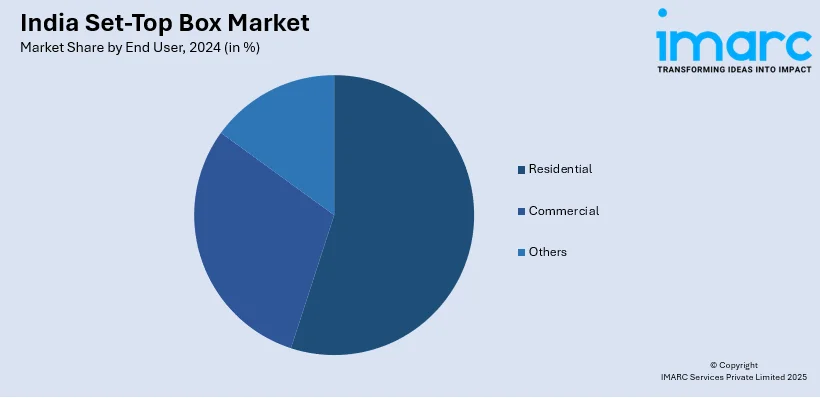

Breakup by End User:

- Residential

- Commercial

- Others

Breakup by Service Type:

- Pay TV

- Free-to-Air

Breakup by Distribution:

- Online Distribution

- Offline Distribution

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Resolution, End User, Service Type, Distribution, Region |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India set-top box market was valued at USD 2.8 Billion in 2024.

We expect the India set-top box market to exhibit a CAGR of 1.87% during 2025-2033.

The continuous development of advanced set-top box variants that can perform several complex functions, including video conferencing, home networking, video-on-demand, and Internet Protocol (IP) telephony, is primarily driving the India set-top box market.

The sudden outbreak of the COVID-19 pandemic to the rising demand for set-top box as a means of indoor entertainment, during the lockdown scenario across the nation.

Based on the type, the India set-top box market can be segmented into cable STB, satellite STB, Digital Terrestrial Television (DTT) STB, Internet Protocol (IP) STB, and Over-The-Top (OTT) STB. Currently, satellite STB holds the majority of the total market share.

Based on the resolution, the India set-top box market has been divided into HD (High Definition), SD (Standard Definition), and UHD (Ultra-High Definition). Among these, HD (High Definition) currently exhibits a clear dominance in the market.

Based on the end user, the India set-top box market can be categorized into residential, commercial, and others. Currently, residential accounts for the majority of the total market share.

Based on the service type, the India set-top box market has been segregated into pay TV and free-to-air, where pay TV currently exhibits a clear dominance in the market.

Based on the distribution, the India set-top box market can be bifurcated into online distribution and offline distribution. Currently, offline distribution holds the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)