India Sewing Machine Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

India Sewing Machine Market Size and Share:

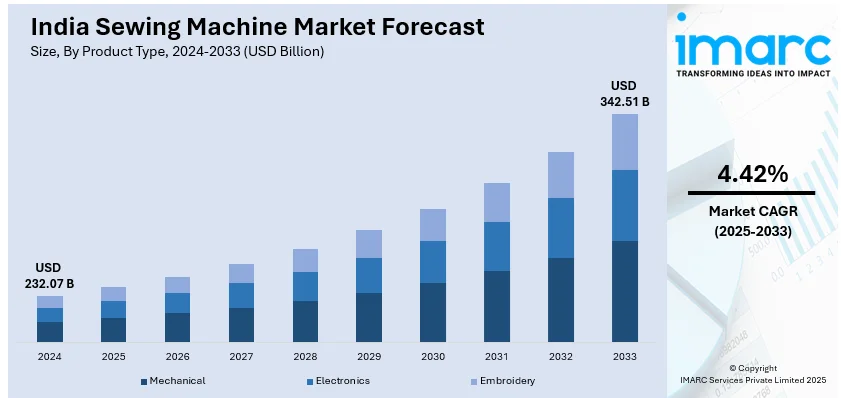

The India sewing machine market size reached USD 232.07 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 342.51 Billion by 2033, exhibiting a growth rate (CAGR) of 4.42% during 2025-2033. The industry is growing as a result of increased textile manufacturing, local tailoring business demand, and technological advancements with automation, power-saving models, and online stores driving growth through domestic and industrial sectors in cities and rural landscapes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 232.07 Billion |

| Market Forecast in 2033 | USD 342.51 Billion |

| Market Growth Rate (2025-2033) | 4.42% |

India Sewing Machine Market Trends:

Rising Demand for Computerized and Automated Sewing Machines

The use of computerized and automated sewing machines is on the rise in India, with the push being provided by technology growth and the need for accuracy in garment manufacturing. These machines come equipped with capabilities, such as pre-programmed stitch designs, touch-control interfaces, and automatic cutting of threads, which makes them suitable for industrial as well as residential use. For instance, in November 2024, Singer launched PFAFF and Husqvarna Viking sewing machines in India, equipped with interactive color touch screens, embroidery design positioning, internet-enabled updates, and 100+ stitch choices. Moreover, in textile and apparel manufacturing, automation accelerates productivity while minimizing human mistakes and speeding up production. Increased demand for bespoke clothing and small boutiques has also promoted demand for intuitive, cutting-edge sewing machines capable of fine embroidery and customization of designs. More so, makers are incorporating artificial intelligence (AI) technology to enhance consistency of stitches, manage material, and monitor production. Use of the machines is further likely to expand as companies seek to streamline labor expenses and the quality of production. Household consumers are also moving towards automatic models for convenience and time-saving advantages.

To get more information on this market, Request Sample

Growing Preference for Energy-Efficient and Eco-Friendly Sewing Machines

Energy efficiency has emerged as a key driver in the Indian sewing machine industry, with more and more consumers purchasing environmentally friendly models that consume less power. Sewing machines in the industrial sector are now being designed with energy-saving motors and auto-off features, allowing companies to reduce electricity bills while retaining productivity. The transition to sustainable textile production is also driving the need for sewing machines that reduce fabric waste and maximize material efficiency. Government policies encouraging sustainable industrial processes and heightening environmental consciousness among consumers are also affecting buying behavior. Local consumers are opting for small, light, and low-energy sewing machines that meet contemporary household efficiency requirements. The use of solar-powered sewing machines in rural setups has also boosted, providing an economical and environmental-friendly solution to small-scale entrepreneurs and home tailors. Innovation in low-power, high-performance sewing machines, as sustainability assumes center stage, is poised to amplify.

Expansion of the E-Commerce Market for Sewing Machines

The India sewing machine industry is being redefined by the e-commerce space, providing increased accessibility to products ranging from the basic entry-level models to heavy-duty industrial-grade machines. Stimulated online marketplace usage and direct sales to consumers have allowed manufacturers and retailers to cover a larger demographic without being strictly dependent on traditional retail outlets. Buyers are helped with in-depth product descriptions, video guides, reviews from customers, and comparison tools, enabling them to make educated buying decisions. Moreover, the presence of convenient financing options, EMI plans, and doorstep delivery has been a driving factor for online transactions. Small entrepreneurs, tailoring professionals, and hobbyists now have access to a range of sewing machines of varying features and prices, addressing their individual needs. For example, in September 2024, Brother India launched flatbed and multi-needle machines that were suitable for small businesses, fashion students, and boutiques. The machines improve monogramming and custom designs with accuracy. Furthermore, the social media-led marketing and endorsement trend is also propelling demand as would-be customers demand demonstrations and endorsements before they buy.

India Sewing Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, application and distribution channel.

Product Type Insights:

- Mechanical

- Electronics

- Embroidery

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mechanical, electronics and embroidery.

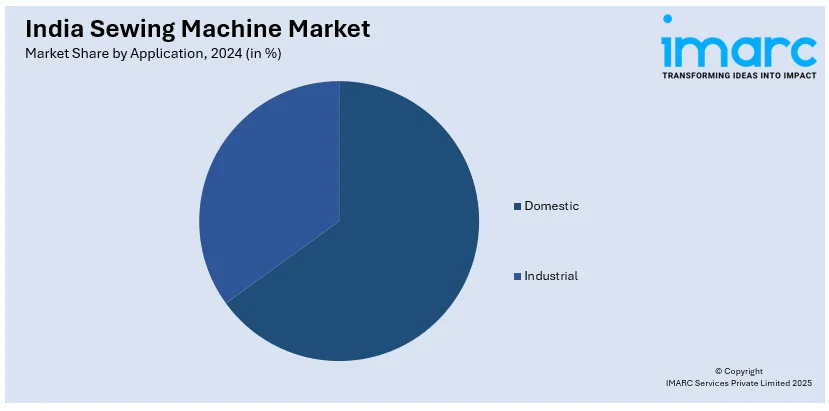

Application Insights:

- Domestic

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes domestic and industrial.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sewing Machine Market News:

- In September 2024, Krishna Sewing Solutions launched high-end sewing and embroidery machines, such as Ricoma models, that offer high accuracy and efficiency. These machines aim to boost productivity by incorporating cutting-edge automation and revolutionary stitching technology to address the changing needs of the industry.

- In January 2024, Singer India launched the M3330 sewing machine with 97 stitch uses, a motor of 70W, and 800 stitches per minute. The model features an iconic blue color, offering smooth fabric operation, durability, and simplicity to suit India's increasing DIY and crafting market.

India Sewing Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mechanical, Electronics, Embroidery |

| Applications Covered | Domestic, Industrial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India sewing machine market performed so far and how will it perform in the coming years?

- What is the breakup of the India sewing machine market on the basis of product type?

- What is the breakup of the India sewing machine market on the basis of application?

- What is the breakup of the India sewing machine market on the basis of distribution channel?

- What is the breakup of the India sewing machine market on the basis of region?

- What are the various stages in the value chain of the India sewing machine market?

- What are the key driving factors and challenges in the India sewing machine?

- What is the structure of the India sewing machine market and who are the key players?

- What is the degree of competition in the India sewing machine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sewing machine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sewing machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sewing machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)