India Shared Mobility Market Size, Share, Trends and Forecast by Service Model, Channel, Vehicle, and Region, 2026-2034

India Shared Mobility Market Overview:

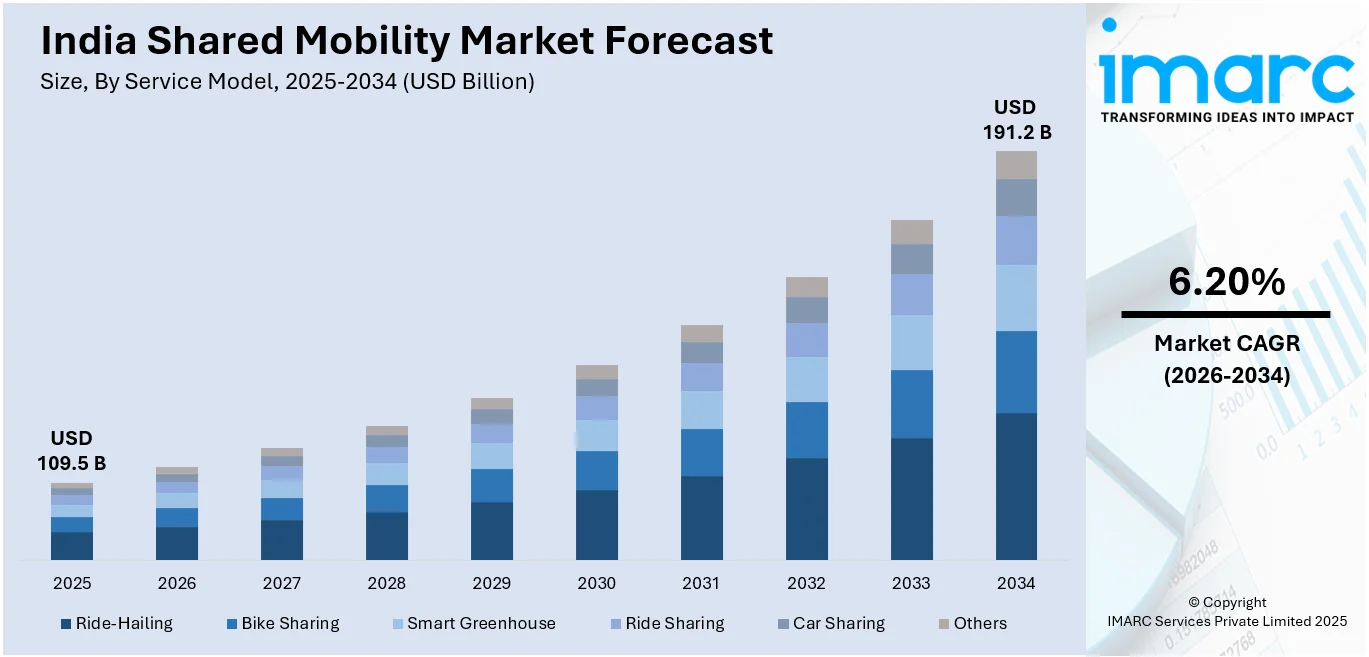

The India shared mobility market size reached USD 109.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 191.2 Billion by 2034, exhibiting a growth rate (CAGR) of 6.20% during 2026-2034. The rising urbanization, increasing smartphone penetration, government support for sustainable transport, high fuel costs, growing environmental awareness, improved digital payment systems, expanding ride-hailing and car-sharing services, and demand for cost-effective, convenient, and flexible transportation solutions are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 109.5 Billion |

| Market Forecast in 2034 | USD 191.2 Billion |

| Market Growth Rate 2026-2034 | 6.20% |

India Shared Mobility Market Trends:

Expansion of Shared Electric Mobility

The shared electric mobility sector is rapidly growing as companies expand their services to emerging urban centers. With a focus on hyperlocal deliveries and last-mile connectivity, electric vehicle-based mobility solutions are gaining traction in densely populated regions. Strategic expansions align with state EV policies, encouraging wider adoption of sustainable transportation. The shift towards franchise-based models is further accelerating deployment, allowing faster scalability across multiple cities. Increasing demand for cost-effective and eco-friendly transportation options is driving investment in electric two-wheelers and fleet operations. As urban infrastructure adapts to accommodate electric mobility, more regions are integrating these solutions into their public and commercial transport networks. The expansion of shared EV services is set to enhance accessibility, efficiency, and sustainability in urban mobility. For example, in September 2024, Yulu, a shared electric vehicle (EV) mobility company, launched its services in Noida, focusing on hyperlocal deliveries. This expansion strengthens Yulu's presence in the Delhi-NCR region and aligns with Uttar Pradesh's EV policy. The company plans to further extend its services to cities like Lucknow, Varanasi, and Agra through its franchise model.

To get more information on this market Request Sample

Government Push for Electric Mobility Adoption

India is accelerating electric vehicle adoption through targeted policy initiatives supporting sustainable transportation. Financial incentives and structured programs are encouraging the transition from conventional fuel-based mobility to electric alternatives, particularly in the two-wheeler and three-wheeler segments. Short-term, high-impact funding strategies are driving large-scale deployment of EVs, enhancing accessibility for urban commuters and commercial fleet operators. By strengthening domestic manufacturing capabilities and fostering industry growth, these initiatives are reducing dependency on fossil fuels while supporting clean energy goals. State-backed efforts are also improving EV infrastructure, ensuring wider adoption across key mobility sectors. As government-backed programs continue to support electrification, the focus remains on affordability, efficiency, and long-term sustainability, shaping the future of urban and shared transportation. For instance, in March 2024, India's Ministry of Heavy Industries launched the Electric Mobility Promotion Scheme 2024 (EMPS 2024) with an INR 500 Crore budget, effective from April 1 to July 31, 2024. The scheme aimed to support 3,72,215 electric vehicles, including 3,33,387 two-wheelers and 38,828 three-wheelers, promoting green mobility and boosting the electric vehicle manufacturing ecosystem in the country.

India Shared Mobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on Service Model, Channel, and Vehicle.

Service Model Insights:

- Ride-Hailing

- Bike Sharing

- Ride Sharing

- Car Sharing

- Others

The report has provided a detailed breakup and analysis of the market based on the service model. This includes ride-hailing, bike sharing, ride sharing, car sharing, and others.

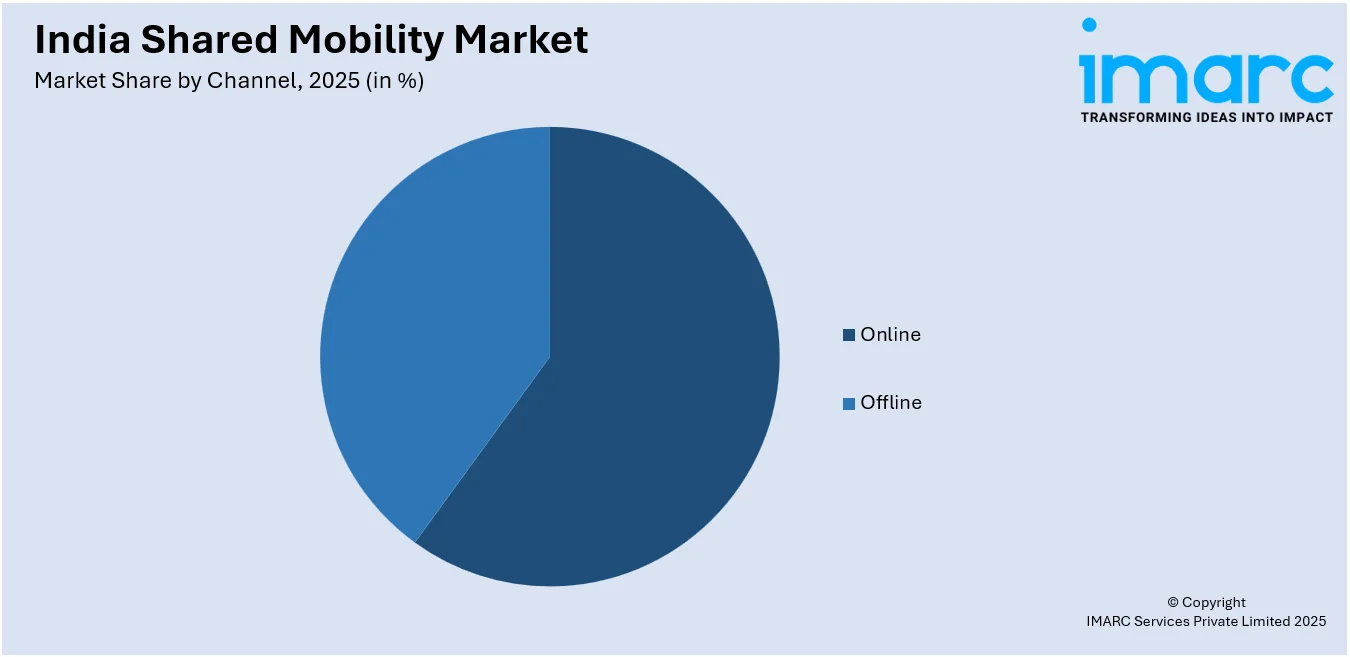

Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the channel have also been provided in the report. This includes online and offline.

Vehicle Insights:

- Cars

- Two-Wheelers

- Others

A detailed breakup and analysis of the market based on the vehicle have also been provided in the report. This includes cars, two-wheelers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Shared Mobility Market News:

- In February 2025, EKA Mobility and KPIT Technologies signed a memorandum of understanding (MoU) to co-develop advanced electric powertrain components, including traction motors, controllers, vehicle control units, and battery management systems. This collaboration aims to enhance efficiency, performance, and sustainability in India's electric commercial vehicle sector, supporting the growth of shared mobility solutions.

- In August 2024, Gentari Green Mobility India launched the Gentari Go app, an integrated platform providing access to over 1,500 electric vehicle chargers nationwide. Collaborating with partners like Numocity, Statiq, and ChargeZone, the app supports India's sustainable transportation goals by facilitating EV adoption and enhancing the shared mobility market.

India Shared Mobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Models Covered | Ride-Hailing, Bike Sharing, Ride Sharing, Car Sharing, Others |

| Channels Covered | Online, Offline |

| Vehicles Covered | Cars, Two-Wheelers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India shared mobility market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India shared mobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India shared mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India shared mobility market was valued at USD 109.5 Billion in 2025.

The India shared mobility market is projected to exhibit a CAGR of 6.20% during 2026-2034, reaching a value of USD 191.2 Billion by 2034.

The India shared mobility market is driven by rapid urbanization, rising traffic congestion, and increasing demand for affordable, eco-friendly transport. Government support for electric vehicles, widespread smartphone use, and digital payments enhance convenience. Growing partnerships and AI-driven fleet management also boost efficiency, fueling the sector’s rapid expansion across cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)