India Smart Appliances Market Size, Share, Trends and Forecast by Product, Technology, Distribution Channel, End-User, and Region, 2026-2034

India Smart Appliances Market Size and Share:

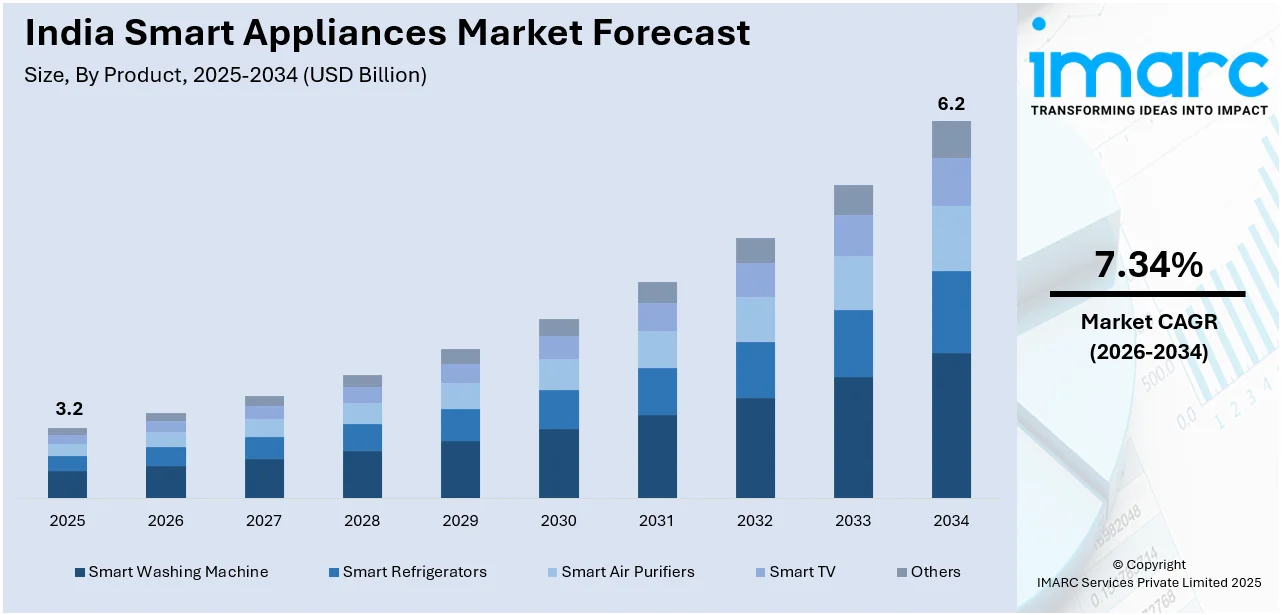

The India smart appliances market size reached USD 3.2 Billion in 2025. The market is expected to reach USD 6.2 Billion by 2034, exhibiting a growth rate (CAGR) of 7.34% during 2026-2034. The market growth can be attributed to the quickly expanding e-commerce sector in India and the rising internet penetration levels, along with implementation of numerous favorable government initiatives promoting energy efficiency across urban and rural areas.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product, the market has been divided into smart washing machine, smart refrigerators, smart air purifiers, smart TV, and others.

- On the basis of technology, the market has been divided into Wi-Fi, Bluetooth, near field communication (NFC), and others.

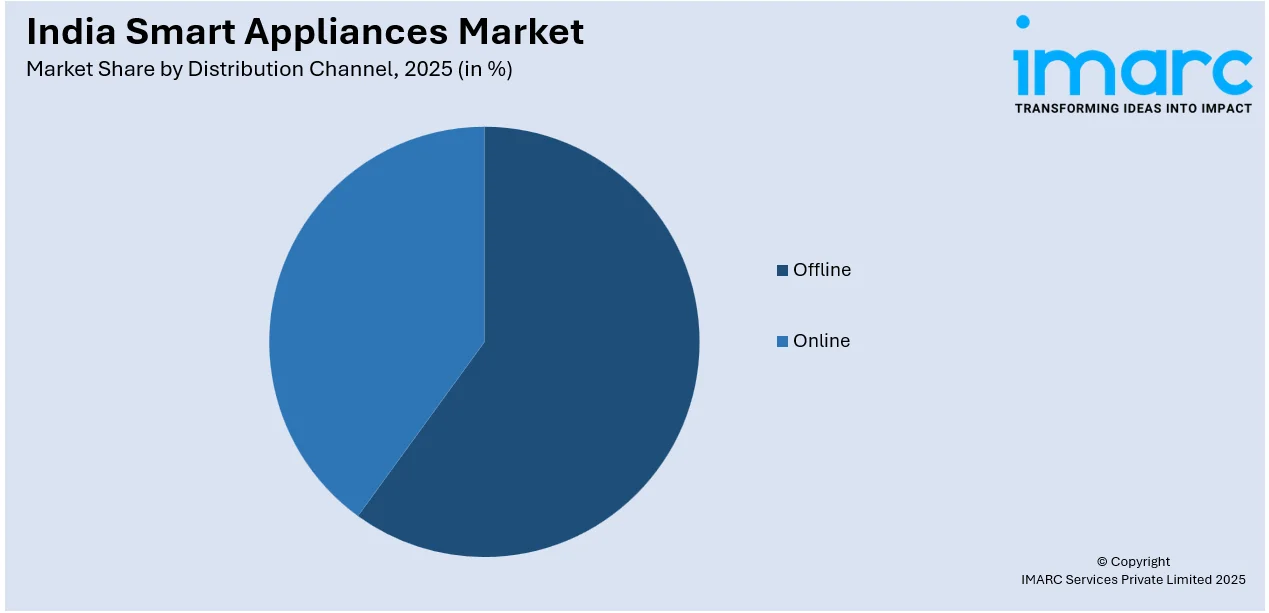

- On the basis of distribution channel, the market has been divided into offline and online.

- On the basis of end-user, the market has been divided into residential and commercial.

Market Size and Forecast:

- 2025 Market Size: USD 3.2 Billion

- 2034 Projected Market Size: USD 6.2 Billion

- CAGR (2026-2034): 7.34%

India Smart Appliances Market Trends:

Growing e-commerce and retail channels

Expanding e-commerce and retail channels are driving the India smart appliances market outlook by increasing product accessibility. The Indian e-commerce market is expected to grow from US$ 123 billion in 2024 to US$ 292.3 billion by 2028, registering a CAGR of 18.7%, fueling smart appliance adoption. Online platforms are offering diverse smart appliances with competitive pricing, attracting cost-conscious and tech-savvy buyers. Retailers are integrating omnichannel strategies, allowing customers to browse online and purchase through preferred channels. Widespread internet penetration is enabling seamless digital transactions, simplifying the smart appliance buying process for Indian customers. E-commerce giants are collaborating with smart appliance brands, providing exclusive deals, discounts, and easy financing options. India smart appliances market forecast indicates continued growth as online marketplaces are leveraging AI-driven recommendations, helping shoppers find relevant smart appliances based on preferences. Fast-growing quick-commerce platforms are reducing delivery times, ensuring faster access to smart appliances in urban areas. Expanding physical retail stores are offering hands-on product experiences, building customer trust in smart technology. As e-commerce continues its rapid growth, increasing accessibility and convenience are set to further accelerate the India smart appliances market growth.

To get more information on this market Request Sample

Increasing internet penetration

The growing internet penetration is fueling the India smart appliances market growth by enabling seamless connectivity and remote control. As per data published by PIB, total internet subscribers grew from 251.59 Billion in March 2014 to 954.40 Billion in March 2024, significantly expanding digital access. Widespread internet availability is allowing customers to integrate smart appliances into connected home ecosystems effortlessly. Increasing smartphone adoption is further enhancing accessibility, enabling users to control appliances through mobile applications conveniently. High-speed internet is improving smart appliance functionality, ensuring smooth operation of AI-driven and IoT-enabled devices. Expanding 5G networks are enhancing real-time connectivity, enabling faster communication between smart appliances and user interfaces. India smart appliances market outlook demonstrates promising growth as rising broadband penetration in urban and rural areas is further extending smart appliance adoption across different customer segments. Online tutorials and digital marketing campaigns are generating awareness, educating people about smart appliance benefits. Cloud-based services are enhancing data storage and analytics, optimizing the efficiency of connected home appliances. As digital infrastructure strengthens further, the growing internet penetration is set to accelerate the smart appliances market in India significantly.

Rising Consumer Affluence and Lifestyle Transformation

The expanding middle-class population and increasing disposable income levels are fundamentally transforming consumer preferences toward premium smart appliances in the India smart appliances market research report findings indicate. As per the India smart appliances market research report, Urban millennials and Gen-Z consumers, representing over 40% of the population, are driving demand for connected appliances that offer convenience, status, and technological sophistication. The work-from-home culture, accelerated by the pandemic, has made consumers more conscious of their living environments and willing to invest in appliances that enhance comfort and productivity. Rising dual-income households are prioritizing time-saving smart appliances that can be controlled remotely, allowing efficient household management despite busy schedules. Aspirational consumption patterns, influenced by social media and lifestyle exposure, are encouraging consumers to upgrade from conventional appliances to smart alternatives. Premium housing projects and smart city developments are creating infrastructure-ready environments that support smart appliance adoption. The growing preference for branded, reliable products with advanced features is driving consumers toward established manufacturers offering comprehensive smart home ecosystems and after-sales support services.

Government Digital Initiatives and Smart City Development

Government-led digital transformation initiatives and smart city development programs are creating a conducive ecosystem for India smart appliances market analysis and widespread adoption across the country. The Digital India campaign has significantly improved digital infrastructure, with internet penetration reaching rural areas and enabling smart appliance connectivity even in smaller towns and villages. Smart Cities Mission, covering 100 cities, is promoting integrated urban planning that includes smart housing projects equipped with IoT-enabled appliances and home automation systems. The Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) is enhancing digital literacy, making consumers more comfortable with smart technology adoption and usage and augmenting the India smart appliances market share. Bureau of Energy Efficiency (BEE) star rating programs are being extended to smart appliances, encouraging energy-efficient product development and consumer awareness. Government subsidies and tax incentives for energy-efficient appliances are reducing the cost burden on consumers, making smart appliances more affordable and accessible. The National Mission for Enhanced Energy Efficiency (NMEEE) is promoting demand-side management through smart appliances that optimize energy consumption. PLI (Production Linked Incentive) schemes for electronics manufacturing are encouraging domestic production of smart appliances, reducing import dependency and making products more cost-competitive. These coordinated government efforts are creating a synergistic environment that supports both supply-side development and demand-side adoption in the smart appliances market in India.

Growth, Opportunities, and Challenges in the India Smart Appliances Market:

- Growth Drivers of the India smart appliances market: The market is primarily driven by expanding e-commerce platforms and rising internet penetration that enables seamless connectivity and remote control capabilities. Government initiatives promoting energy efficiency and digital infrastructure development create favorable conditions for smart appliance adoption across urban and rural areas. Growing consumer affluence, lifestyle transformation, and increasing awareness about smart home technologies further accelerate market expansion.

- Opportunities in the India smart appliances market: Significant opportunities exist in rural market penetration where internet connectivity is rapidly expanding and consumer purchasing power is growing steadily. Integration with renewable energy systems and smart grid infrastructure presents new revenue streams for manufacturers seeking sustainable product positioning. Strategic partnerships with real estate developers, e-commerce platforms, and telecommunications providers offer enhanced distribution channels and customer acquisition possibilities.

- Challenges in the India smart appliances market: High initial costs and price sensitivity among middle-income consumers pose significant adoption barriers, particularly in price-conscious market segments with limited purchasing power. Technical infrastructure limitations and inconsistent internet connectivity in some regions create operational challenges for optimal smart appliance functionality and user experience. Privacy concerns and data security issues regarding connected devices remain substantial obstacles to widespread consumer acceptance and market penetration.

India Smart Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product, technology, distribution channel, and end-user.

Product Insights:

- Smart Washing Machine

- Smart Refrigerators

- Smart Air Purifiers

- Smart TV

- Others

The report has provided a detailed breakup and analysis of the market based on the products. This includes smart washing machine, smart refrigerators, smart air purifiers, smart TV, and others.

Technology Insights:

- Wi-Fi

- Bluetooth

- Near Field Communication (NFC)

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes Wi-Fi, Bluetooth, near field communication (NFC), and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

End-User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Appliances Market News:

- In September 2025, Upliance.ai launched Upliance 2.0, a smart kitchen appliance designed to cater to the evolving needs of Indian households. Priced at Rs 39,999, it offers advanced features like faster cooking, health-focused cooking modes, AI-powered recipe generation, and enhanced usability, making it ideal for health-conscious consumers.

- In June 2025, Samsung launched its 2025 Bespoke AI appliance lineup in India, including the Bespoke AI Laundry Combo, AI refrigerators, and WindFree air conditioners. These appliances feature AI-powered customization, energy savings, and advanced security features, aiming to revolutionize smart home experiences for Indian households.

- In June 2025, EBG Group partnered with Daewoo to launch a range of premium, IoT-enabled, energy-efficient home appliances in India. The collaboration focuses on bringing smart, sustainable solutions to modern Indian households, alongside a unique franchise model to empower local entrepreneurs and enhance retail presence.

- In February 2025, Infinix introduced the 40Y1V QLED TV in India, featuring a 40-inch Full HD display with a 60Hz refresh rate and 300 nits peak brightness. Powered by a quad-core processor and Mali-G31 GPU, it includes 4GB of internal storage. With Dolby Audio and dual 16W stereo speakers, it comes preloaded with popular streaming apps.

- In February 2025, Circuit House Technologies, a consumer tech startup founded by former Xiaomi and Flipkart executives, launched Lumio, a smart TV brand focused on quality and innovation. Manufactured by Dixon Technologies and integrated with Google TV, it caters to India’s growing demand for premium home entertainment.

India Smart Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smart Washing Machine, Smart Refrigerators, Smart Air Purifiers, Smart TV, Others |

| Technologies Covered | Wi-Fi, Bluetooth, Near Field Communication (NFC), Others |

| Distribution Channels Covered | Offline, Online |

| End-Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart appliances market on the basis of product?

- What is the breakup of the India smart appliances market on the basis of technology?

- What is the breakup of the India smart appliances market on the basis of distribution channel?

- What is the breakup of the India smart appliances market on the basis of end-user?

- What are the various stages in the value chain of the India smart appliances market?

- What are the key driving factors and challenges in the India smart appliances market?

- What is the structure of the India smart appliances market and who are the key players?

- What is the degree of competition in the India smart appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart appliances market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)