India Smart Building Market Size, Share, Trends and Forecast by Component, Technology, End User, and Region, 2025-2033

India Smart Building Market size and Share:

The India smart building market size reached USD 12.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 109.10 Billion by 2033, exhibiting a growth rate (CAGR) of 24.20% during 2025-2033. Favorable government initiatives like Smart Cities Mission, rising energy efficiency demands, increased adoption of the Internet of Things (IoT) and artificial intelligence (AI)-driven automation, escalating concerns over sustainability, and stringent regulations for energy management are propelling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.50 Billion |

| Market Forecast in 2033 | USD 109.10 Billion |

| Market Growth Rate 2025-2033 | 24.20% |

India Smart Building Market Trends:

Integration of AI and IoT for Smart Automation

The integration of AI and IoT is one of the most recent trends driving the India smart building market. Buildings are becoming more energy-efficient, secure, and cost-effective as AI-driven automation and IoT-enabled smart infrastructure gain traction. Furthermore, AI-powered energy management systems use real-time data from IoT sensors to optimize electricity consumption, resulting in substantial energy savings. AI-enabled energy solutions can cut power consumption in commercial buildings by 20-30%. Additionally, the Indian Green Building Council (IGBC) estimates that smart automation can enhance overall building efficiency by 40%. In line with this, IoT sensors are being extensively deployed for predictive maintenance, reducing downtime and operational costs. By 2025, the Indian smart building sector is expected to see a 40% increase in predictive maintenance adoption. This proactive approach minimizes equipment failures and extends asset lifespan. Furthermore, the demand for smart homes and offices equipped with IoT-driven automation is surging. By 2025, over 75 million IoT devices will be installed in Indian buildings, enhancing real-time monitoring and control. This trend is driven by increasing consumer demand for convenience, security, and energy efficiency.

.webp)

To get more information on this market, Request Sample

Expansion of Green and Net-Zero Energy Buildings

The increased emphasis on sustainability and energy efficiency is propelling the development of green and net-zero energy buildings in India. The Indian government, in collaboration with commercial firms, is advocating for stronger laws and incentives to promote ecologically friendly building methods. Furthermore, green buildings in India are rapidly expanding, with the industry projected to reach 10 billion square feet of certified green building area by 2025 (IGBC 2023). The implementation of the Energy Conservation Building Code (ECBC) has made energy efficiency a key focus for new and existing infrastructures. In confluence with this, the concept of net-zero energy buildings (NZEBs) structures that generate as much energy as they consume is gaining momentum. The Bureau of Energy Efficiency (BEE) projects that by 2025, 25% of new commercial buildings in India will be NZEB-certified. Additionally, smart buildings integrated with solar panels and energy storage solutions are expected to contribute to a 30% reduction in carbon emissions. Furthermore, the Smart Cities Mission and the National Solar Mission are promoting the use of renewable energy solutions in buildings. Companies such as Infosys and ITC have already built net-zero campuses, establishing the standard for sustainable development. Green funding and incentives, such as tax breaks for eco-friendly development, amplify this trend.

India Smart Building Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, technology, and end user.

Component Insights:

- Hardware

- Software

- Service

- Professional Service

- Managed Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and service (professional and managed services).

Technology Insights:

- Building Infrastructure Management (BIM)

- Parking Management System

- Smart Water Management System

- Elevators and Escalators Management System

- Security and Emergency Management

- Access Control System

- Video Surveillance System

- Safety System

- Energy Management

- HVAC Control System

- Lighting System

- Network & Communication Management

- Workforce Management

- Others

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes building infrastructure management (BIM) (parking management system, smart water management system, and elevators and escalators management system), security and emergency management (access control system, video surveillance system, and safety system), energy management (HVAC control system and lighting system), network & communication management, workforce management, and others.

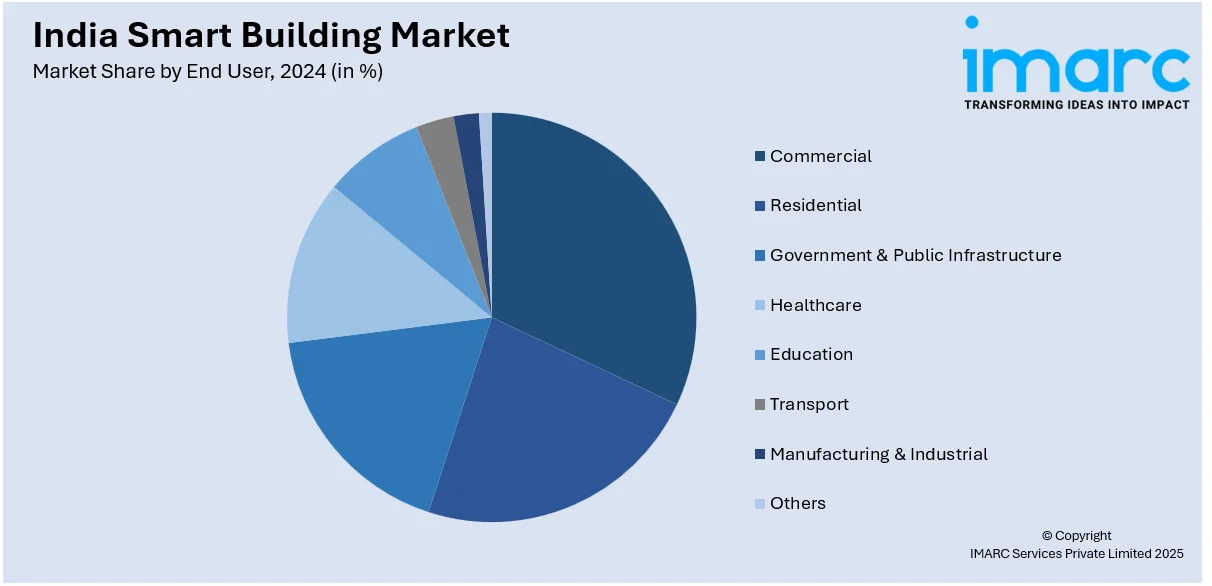

End User Insights:

- Commercial

- Residential

- Government & Public Infrastructure

- Healthcare

- Education

- Transport

- Manufacturing & Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial, residential, government & public infrastructure, healthcare, education, transport, manufacturing & industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Building Market News:

- September 2024: UnaBiz, one of the leading providers and integrators of Massive Internet of Things (IoT) solutions, unveiled a range of smart building technologies at BEX Asia 2024. These solutions are designed to streamline monitoring, improve operational efficiency, and support building owners in achieving sustainability objectives by reducing waste and optimizing resource utilization.

- July 2024: Indian smart building startup NHance.ai raised USD 1.5 Million in seed funding from high-net-worth individuals to accelerate expansion and improve its digital twin platform for smart buildings. Using machine learning and artificial intelligence, the platform provides businesses with real-time visibility into building performance and actionable insights for optimization.

India Smart Building Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Technologies Covered |

|

| End Users Covered | Commercial, Residential, Government & Public Infrastructure, Healthcare, Education, Transport, Manufacturing & Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart building market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart building market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart building industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart building market in India was valued at USD 12.50 Billion in 2024.

The India smart building market is projected to exhibit a CAGR of 24.20% during 2025-2033, reaching a value of USD 109.10 Billion by 2033.

Rapid urbanization and infrastructure growth are accelerating demand for intelligent building systems. Government initiatives promoting energy efficiency and sustainability further support adoption. Advancements in IoT, AI, and connectivity enabling automation and improved occupant comfort, and rising corporate awareness about operational cost savings also propels market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)