India Smart Irrigation Market Size, Share, Trends and Forecast by Component, Technology, Application, System Type, and Region, 2025-2033

India Smart Irrigation Market Overview:

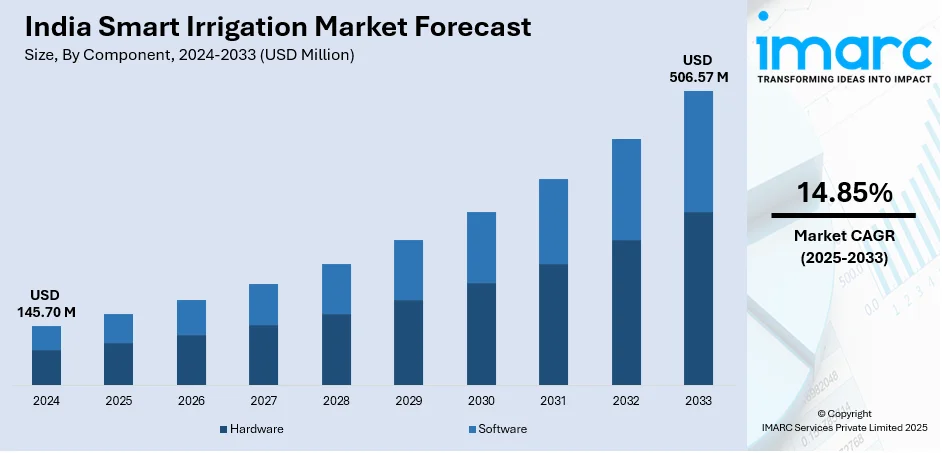

The India smart irrigation market size reached USD 145.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 506.57 Million by 2033, exhibiting a growth rate (CAGR) of 14.85% during 2025-2033. Rising water scarcity, increasing government initiatives for sustainable agriculture, growing adoption of precision farming, expanding IoT and AI integration, higher demand for automated irrigation systems, and subsidies for smart irrigation technologies are augmenting the India smart irrigation market share, enabling efficient water use, cost savings, and improved crop productivity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 145.70 Million |

| Market Forecast in 2033 | USD 506.57 Million |

| Market Growth Rate (2025-2033) | 14.85% |

India Smart Irrigation Market Trends:

Government Initiatives and Subsidies for Water-Efficient Agriculture

The Indian government is implementing multiple programs to promote water conservation through smart irrigation technologies, which is supporting the India smart irrigation market growth. Subsidies and financial incentives under schemes like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) are making micro-irrigation systems, including drip and sprinkler irrigation, more affordable. For instance, the Per Drop More Crop (PDMC) scheme is now part of Rashtriya Krishi Vikas Yojana (RKVY) from 2022-23. It promotes farm-level water efficiency through drip and sprinkler irrigation systems. The government provides financial assistance of 55% for small and marginal farmers and 45% for other farmers for micro-irrigation installation. These subsidies reduce the initial investment burden on farmers, encouraging the adoption of efficient irrigation methods that minimize water wastage. In addition to financial support, the government is promoting public-private partnerships (PPPs) to scale the deployment of smart irrigation technologies. State-level policies are also being introduced to mandate water-efficient irrigation in drought-prone regions. The National Innovations in Climate Resilient Agriculture (NICRA) program further promotes precision irrigation solutions to improve agricultural resilience against climate change. Furthermore, policies incentivizing solar-powered irrigation systems reduce dependence on conventional energy sources, making smart irrigation more sustainable. The regulatory efforts are driving increased adoption of automated and sensor-based irrigation systems, particularly among small and medium-scale farmers seeking cost-effective water management solutions.

To get more information on this market, Request Sample

Rising Adoption of IoT and AI-Enabled Smart Irrigation Systems

The integration of the internet of things (IoT) and artificial intelligence (AI) in smart irrigation systems is transforming agricultural water management in India. According to an industry report, India's water consumption per ton of crop production is 2 to 3 times higher than in other nations, which underscores the urgent need for efficient irrigation solutions. This is further driving the adoption of smart irrigation, promoting drip and sprinkler systems integrated with AI-powered automation. Additionally, IoT-based irrigation systems utilize sensors to collect real-time data on soil moisture, temperature, humidity, and weather conditions. These sensors transmit data to cloud-based platforms, where AI-driven analytics optimize irrigation schedules, ensuring water is applied only when necessary. This reduces water wastage, lowers electricity consumption, and improves crop yields. Also, predictive analytics driven by AI assists farmers in making wise choices by analyzing historical and real-time data to forecast irrigation needs. Machine learning (ML) algorithms detect patterns in weather fluctuations, soil conditions, and crop water requirements, allowing automated adjustments. The rising affordability of IoT sensors and increasing mobile network penetration in rural India are positively impacting the India smart irrigation market outlook. Moreover, increasing government programs and initiatives promoting precision farming encourage widespread adoption. Companies offering AI-integrated irrigation solutions are partnering with agritech startups to expand their market presence, making advanced smart irrigation systems more accessible to Indian farmers, including smallholders with limited resources.

India Smart Irrigation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, technology, application, and system type.

Component Insights:

- Hardware

- Sensors

- Controllers

- Sprinkler Nozzles

- Water Flow Meters

- Others

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (sensors, controllers, sprinkler nozzles, water flow meters, and others) and software.

Technology Insights:

- Evapotranspiration

- Soil Moisture

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes evapotranspiration and soil moisture.

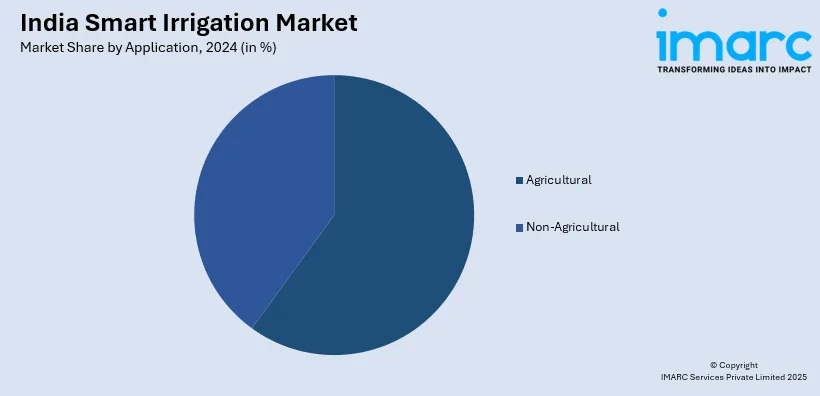

Application Insights:

- Agricultural

- Greenhouse

- Open Field

- Non-Agricultural

- Residential

- Turf and Landscape

- Golf Course

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes agricultural (greenhouse and open field) and non-agricultural (residential, turf and landscape, golf course, and others)

System Type Insights:

- Water-Based System

- Sensor-Based System

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes water-based system and sensor-based system.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Irrigation Market News:

- On March 17, 2025, the Hubballi-Dharwad Municipal Corporation (HDMC) initiated a pilot project implementing a drip irrigation system along Gokul Road to ensure the survival of roadside vegetation during high temperatures. By delivering water straight to the plant's root zones, this technique lowers evaporation and avoids waterlogging, thereby conserving water resources. HDMC plans to evaluate the pilot's effectiveness before expanding the initiative across other major roads in the twin cities, potentially collaborating with local NGOs or securing corporate social responsibility funding for broader implementation.

India Smart Irrigation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Technologies Covered | Evapotranspiration, Soil Moisture |

| Applications Covered |

|

| System Types Covered | Water-Based System, Sensor-Based System |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart irrigation market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart irrigation market on the basis of component?

- What is the breakup of the India smart irrigation market on the basis of technology?

- What is the breakup of the India smart irrigation market on the basis of application?

- What is the breakup of the India smart irrigation market on the basis of system type?

- What is the breakup of the India smart irrigation market on the basis of region?

- What are the various stages in the value chain of the India smart irrigation market?

- What are the key driving factors and challenges in the India smart irrigation market?

- What is the structure of the India smart irrigation market and who are the key players?

- What is the degree of competition in the India smart irrigation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart irrigation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart irrigation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart irrigation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)