India Smart Textiles Market Size, Share, Trends and Forecast by Type, Functionality, End Use Sector, and Region, 2025-2033

India Smart Textiles Market Size and Share:

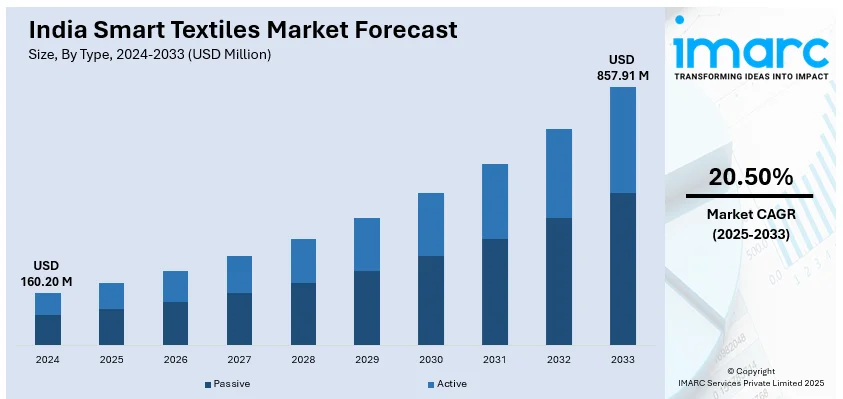

The India smart textiles market size reached USD 160.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 857.91 Million by 2033, exhibiting a growth rate (CAGR) of 20.50% during 2025-2033. Smart textiles in India are innovative fabrics integrated with technology to enhance functionality, comfort, and performance. These textiles respond to environmental stimuli like temperature, pressure, or moisture. In India, they are gaining traction in healthcare, defense, and sports sectors, promoting sustainable, tech-driven solutions for evolving consumer needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 160.20 Million |

| Market Forecast in 2033 | USD 857.91 Million |

| Market Growth Rate (2025-2033) | 20.50% |

India Smart Textiles Market Trends:

Integration of Wearable Technology in Apparel

One of the most prominent trends in India's smart textile sector is the integration of wearable technology into everyday clothing, aligning with the national mission to boost exports of technical textiles. Smart garments embedded with sensors are gaining popularity across healthcare, fitness, and elderly care by monitoring vital signs such as heart rate, body temperature, respiration, and posture. This growing adoption supports the government’s aim to increase exports from Rs. 14,000 Crores to Rs. 20,000 Crores by 2021–22 and sustain 10% annual growth till 2023–24. Startups and research institutions in India are innovating wearable fabrics to improve health outcomes, while collaborations between tech firms and textile manufacturers are accelerating large-scale commercialization. This convergence is strengthening India’s position in the global smart textile market.

To get more information on this market, Request Sample

Applications in Defense and Military of Smart Textiles

The Indian defense industry is increasingly embracing smart textiles to improve soldier protection and operational effectiveness. Smart textiles are being engineered to offer thermal regulation, camouflage, chemical protection, and even biometric sensing in battlefield conditions. Shape-memory fabrics, conductive fabrics, and energy-harvesting clothing are being incorporated into military uniforms and equipment. The Defense Research and Development Organization (DRDO) and other defense organizations are going for cutting-edge textile R&D to address changing requirements of advanced warfare. It is in alignment with India's self-reliance in defense production (Atmanirbhar Bharat) and inducing a robust pull for indigenous smart textile innovations addressing rugged and high-performance military application needs.

Sustainable and Eco-friendly Smart Textiles

Sustainability is emerging as a key trend shaping the smart textiles market in India, driven by growing environmental concerns and consumer consciousness. Traditional textile production is resource-intensive, with estimates suggesting that a single cotton T-shirt requires 2,700 litres of water enough to meet one person’s drinking needs for 2.5 years. Globally, the textile sector ranked third in water degradation and land use in 2020, using nine cubic metres of water, 400 square metres of land, and 391 kilograms of raw materials per EU citizen. In response, Indian manufacturers are adopting eco-friendly innovations such as biodegradable conductive yarns, recyclable fabrics, and energy-efficient processes. Green smart textiles that reduce energy and water usage like self-cleaning or temperature-regulating garments are gaining traction, aligning with global sustainability standards and boosting India’s potential in eco-conscious textile exports.

India Smart Textiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, functionality, and end use sector.

Type Insights:

- Passive

- Active

The report has provided a detailed breakup and analysis of the market based on the type. This includes passive, and active.

Functionality Insights:

- Sensing

- Energy Harvesting

- Luminescence and Aesthetics

- Thermoelectricity

- Others

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes sensing, energy harvesting, luminescence and aesthetics, thermoelectricity, and others.

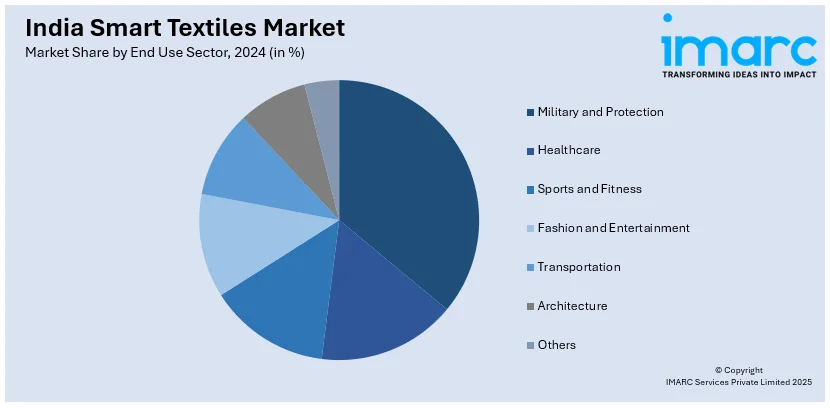

End Use Sector Insights:

- Military and Protection

- Healthcare

- Sports and Fitness

- Fashion and Entertainment

- Transportation

- Architecture

- Others

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes military and protection, healthcare, sports and fitness, fashion and entertainment, transportation, architecture, and others

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Textiles Market News:

- In February 2025, The Union Ministry of Textiles launched the Bharat Tex 2025 app and a revamped website to boost engagement for India’s largest textile event. Launched by Secretary Neelam Shami Rao, the initiative aims to position India as a global textile hub. Available on Apple App Store and Google Play Store, the app offers exhibitors, buyers, and visitors easy access to event details, networking opportunities, and efficient planning tools for better participation.

- In September 2024, The Ministry of Textiles launched NIFT’s VisioNxt Fashion Forecasting Initiative, introducing India-specific, real-time fashion trend insights. The launch included the ‘Paridhi 24×25’ trend book, a bilingual web portal, and an AI Taxonomy e-book. Inaugurated by Minister Giriraj Singh, the initiative addresses the industry's need for localized forecasting. Developed at NIFT’s Delhi and Chennai labs, VisioNxt offers consultancy, courses, and workshops to support India’s fashion and retail sectors.

India Smart Textiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passive, Active |

| Functionalities Covered | Sensing, Energy Harvesting, Luminescence and Aesthetics, Thermoelectricity, Others |

| End Use Sectors Covered | Military and Protection, Healthcare, Sports and Fitness, Fashion and Entertainment, Transportation, Architecture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart textiles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart textiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India smart textiles market size reached USD 160.20 Million in 2024.

The India smart textiles market is expected to reach USD 857.91 Million by 2033, growing at a CAGR of 20.50% during 2025-2033.

Growth is driven by rising wearable tech adoption, advancements in e-textiles, demand from sports, defense, and healthcare sectors, and increasing R&D investment in smart fabric innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)