India Smart TV Market Size, Share, Trends and Forecast by Resolution Type, Screen Size, Screen Type, Technology, Platform, Distribution Channel, Application, and Region, 2025-2033

India Smart TV Market Size and Share:

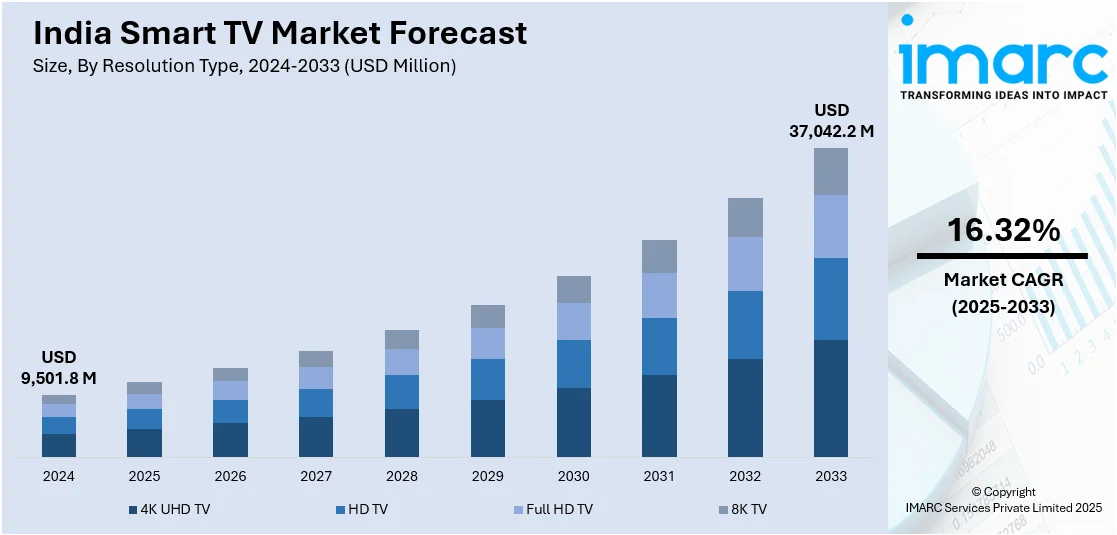

The India smart TV market size reached USD 9,501.8 Million in 2024. The market is expected to reach USD 37,042.2 Million by 2033, exhibiting a growth rate (CAGR) of 16.32% during 2025-2033. The market growth is attributed to the rising demand for television sets with integrated internet connectivity and interactive functionalities, rising internet penetration, increased digital content consumption, growing tech-savvy consumer base, and integration of advanced technologies such as artificial intelligence (AI) and voice recognition.

Market Insights:

- On the basis of regional insights, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of resolution type, the market has been divided into 4K UHD TV, HD TV, Full HD TV, and 8K TV.

- On the basis of screen size, the market has been divided into below 32 inches, 32 to 45 inches, 46 to 55 inches, 56 to 65 inches, and above 65 inches.

- On the basis of screen type, the market has been divided into flat and curved.

- On the basis of technology, the market has been divided into liquid crystal display (LCD), light emitting diode (LED), organic light emitting diode (OLED), and quantum dot light emitting diode (QLED).

- On the basis of platform, the market has been divided into android, roku, webOS, tizen OS, iOS, myhomescreen, and others.

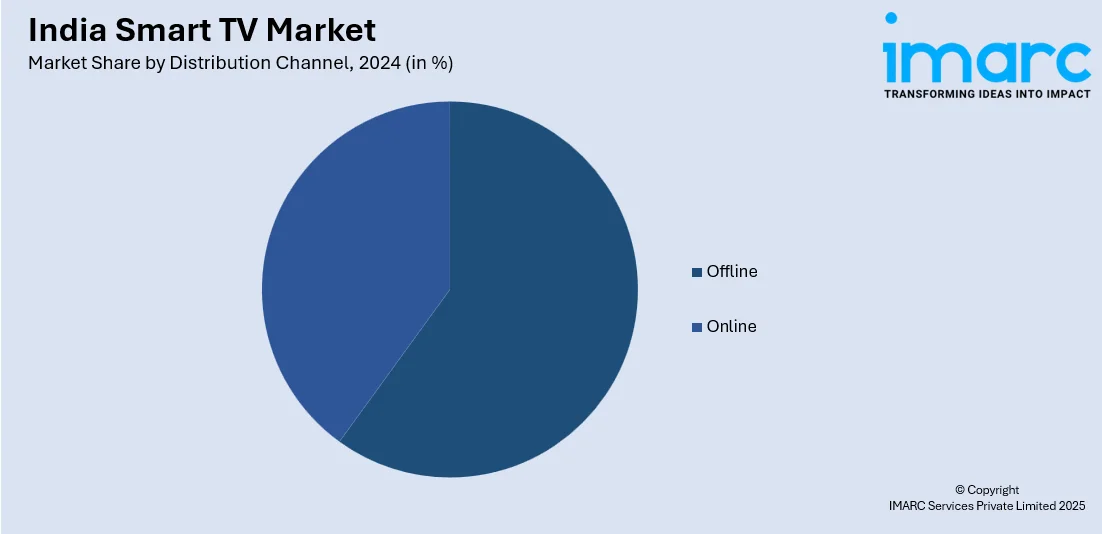

- On the basis of distribution channel, the market has been divided into offline and online.

- On the basis of application, the market has been divided into residential and commercial.

Market Size and Forecast:

- 2024 Market Size: USD 9,501.8 Million

- 2033 Projected Market Size: USD 37,042.2 Million

- CAGR (2025-2033): 16.32%

A smart TV, also referred to as a connected TV, is a television set that incorporates internet connectivity and interactive functionalities. It includes an operating system or a smart platform that functions as the interface for exploring and utilizing diverse features and applications. This device seamlessly merges the conventional television functions with the capabilities akin to those found in computers or smartphones. Featuring built-in Wi-Fi or Ethernet connectivity, smart TVs facilitate internet connection either wirelessly or through a wired setup. This configuration empowers users to directly access a diverse array of online content, streaming services, and applications on their television screens.

To get more information on this market, Request Sample

The smart TV market in India has witnessed significant growth and transformation as consumers increasingly embrace technology that integrates traditional television with advanced interactive features. These devices come equipped with operating systems or smart platforms that serve as user-friendly interfaces, providing access to an extensive range of features and applications. Additionally, with built-in Wi-Fi or Ethernet connectivity, smart TVs in India offer seamless internet connectivity, enabling users to access online content, streaming services, and applications directly on their television screens. Besides this, the growth of the smart TV market in India is fueled by several factors, including the rising internet penetration, increased digital content consumption, and the growing tech-savvy consumer base. Moreover, consumers are drawn to the versatility of smart TVs, which combine the traditional television experience with the capabilities of computers and smartphones. Apart from this, the smart TV market in India is witnessing the integration of advanced technologies such as artificial intelligence (AI) and voice recognition, enhancing the overall user experience. As the demand for smart TVs continues to rise, manufacturers are innovating to offer more features, larger screen sizes, and higher resolutions, contributing to the market's dynamic evolution. Additionally, the India smart TV market is poised for sustained growth, playing a pivotal role in shaping the future of home entertainment in the country.

India Smart TV Market Trends:

Premium and Large Screen TV Adoption

The industry is witnessing a major trend towards premium segments and larger screens as consumers' preferences progress beyond mere functionality. Consumers are increasingly spending on 55-inch and larger screen sizes owing to improved home entertainment experiences and reduced costs of premium technology. OLED and QLED technologies are picking up significant momentum in city markets, with buyers ready to pay a premium for better picture quality, rich colors, and ultra-thin forms. The trend is being driven by increasing disposable incomes in Tier-1 cities as well as the rise of aspirational buying habits among middle-class consumers. Manufacturers are countering by launching more high-end models with improved features like HDR capability, Dolby Vision, and better sound systems. Demand for bigger screens is also fueled by the fact that more and more people are watching streaming content and playing games, for which an immersive experience is very important. Moreover, the fact that easy finance options and EMI plans are available has helped premium smart TVs become affordable for many more consumers. This trend is augmenting the smart tv market share in India.

Integration of Gaming and Interactive Entertainment

Smart TV brands in India are now placing more emphasis on gaming features and interactive entertainment aspects to make their products stand out in the crowded market. New smart TVs are being supported with advanced processors, specialist gaming modes, and compatibility with renowned gaming platforms and cloud gaming services. Combining gaming controllers, low input lag technology, and high refresh rate screens is rendering smart TVs viable substitutes for dedicated gaming consoles. The trend is especially catching on with younger audiences who are looking for multi-purpose entertainment appliances that can be used as both television and gaming systems. Players are aligning with gaming firms and online streaming services in order to pre-install best-selling games and apps and develop all-encompassing entertainment systems. Growing esports and online gaming culture in India are further fueling the demand for smart TVs with better gaming capabilities. Interactive features like fitness apps, learning content, and social media integration are also becoming the norm, turning smart TVs into all-encompassing lifestyle and entertainment centers.

Some of the other market trends are:

- Personalized Entertainment: Sophisticated AI techniques are empowering smart TVs to acquire user tastes and deliver personalized content suggestions on various streaming platforms. Personalization is not limited to content but also encompasses customized UI, preferred app layouts, and targeted ad experiences.

- AI-Driven and Voice-Based Smart TVs: Voice assistants such as Google Assistant, Amazon Alexa, and local language assistants are becoming mainstream offerings in Indian smart TVs. Natural language processing is being developed to accommodate multiple Indian languages and regional dialects to provide improved user access.

- OTT-Fueled Smart TV Adoption: The sudden expansion of OTT services such as Netflix, Amazon Prime, Disney+ Hotstar, and local content providers is driving India smart Tv market demand. Preloaded OTT apps and hassle-free streaming are emerging as differentiators in the overcrowded market.

- Regional and Tier-2/Tier-3 Market Expansion: Smart TV penetration is accelerating in tier-2 and tier-3 cities as well as rural areas with the advent of better internet infrastructure and economy. The manufacturers are creating region-specific models supporting local languages, regional content alliances, and competitive prices for emerging markets. Distribution channels are being widened to cover remote areas via exclusive dealers and web portals with last-mile delivery.

- Hardware and Design Developments: Ultra-thin bezels, frameless TVs, and high-quality materials are becoming mainstream attributes even at mid-range smart TV levels. High-end display features like Mini-LED, Micro-LED, and enhanced HDR support are being made available at competitive prices. Upgradable and modular smart TV designs are making their way to enable users to upgrade individual hardware components without upgrading the whole set.

- Make in India and Domestic Production: Government policies supporting indigenous manufacturing are compelling global brands to set up manufacturing units in India. Domestic production is assisting in lowering costs, enhancing supply chain efficiency, and making smart TVs more accessible to Indian consumers.

- Telecom and Bundled Services: Telecom companies are collaborating with smart TV makers to deliver bundled services such as internet, streaming subscriptions, and smart TV packages. Expansion of fiber broadband is being harnessed to deliver comprehensive home entertainment solutions, integrating connectivity and smart TV hardware.

Growth Drivers of the India Smart TV Market:

The market is primarily driven by the rapid expansion of internet penetration and improving digital infrastructure across the country. The growing tech-savvy consumer base, particularly among millennials and Gen Z demographics, is increasingly demanding advanced entertainment solutions with integrated connectivity features. Rising disposable incomes in urban and semi-urban areas are enabling consumers to invest in premium smart TV technologies with larger screen sizes and enhanced capabilities, thereby propelling the India smart Tv market growth. The proliferation of OTT platforms and streaming services is creating a strong demand for smart TVs that can seamlessly access diverse digital content. Government initiatives promoting digitization and the Make in India program are supporting local manufacturing and making smart TVs more affordable. The integration of artificial intelligence, voice recognition, and smart home connectivity features is attracting consumers seeking comprehensive digital lifestyle solutions.

Market Opportunities in the India Smart TV Market:

Significant opportunities exist in the untapped Tier-2 and Tier-3 cities where smart TV penetration remains relatively low despite growing internet connectivity and smartphone adoption. The development of regional and vernacular language content partnerships presents opportunities for manufacturers to cater to diverse linguistic preferences across different states. Integration with emerging technologies such as 5G connectivity, IoT ecosystems, and smart home automation represents a substantial growth opportunity. The gaming and interactive entertainment segment offers potential for smart TVs to capture market share from traditional gaming consoles. Partnerships with telecom operators for bundled services and innovative financing models can expand market reach to price-sensitive consumer segments. The commercial segment, including hospitality, education, and corporate sectors, presents opportunities for specialized smart TV solutions with enterprise-grade features.

Market Challenges in the India Smart TV Market:

As per the India smart Tv market analysis, intense price competition among domestic and international manufacturers is putting pressure on profit margins and forcing continuous innovation investments. The fragmented market with numerous players makes it challenging for companies to establish dominant market positions and achieve economies of scale. Rapid technological obsolescence requires manufacturers to continuously upgrade product portfolios while managing inventory and development costs. Consumer price sensitivity, particularly in emerging markets, limits the adoption of premium technologies and constrains revenue growth potential. Supply chain disruptions and component shortages can impact production schedules and increase manufacturing costs. The need for extensive after-sales service networks across diverse geographic regions poses logistical and cost challenges for manufacturers.

India Smart TV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on resolution type, screen size, screen type, technology, platform, distribution channel, and application.

Resolution Type Insights:

- 4K UHD TV

- HD TV

- Full HD TV

- 8K TV

The report has provided a detailed breakup and analysis of the market based on the resolution type. This includes 4K UHD TV, HD TV, full HD TV, and 8K TV.

Screen Size Insights:

- Below 32 Inches

- 32 to 45 Inches

- 46 to 55 Inches

- 56 to 65 Inches

- Above 65 Inches

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes below 32 inches, 32 to 45 inches, 46 to 55 inches, 56 to 65 inches, and above 65 inches.

Screen Type Insights:

- Flat

- Curved

The report has provided a detailed breakup and analysis of the market based on the screen type. This includes flat and curved.

Technology Insights:

- Liquid Crystal Display (LCD)

- Light Emitting Diode (LED)

- Organic Light Emitting Diode (OLED)

- Quantum Dot Light Emitting Diode (QLED)

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes liquid crystal display (LCD), light emitting diode (LED), organic light emitting diode (OLED), and quantum dot light emitting diode (QLED).

Platform Insights:

- Android

- Roku

- WebOS

- Tizen OS

- iOS

- MyHomeScreen

- Others

The report has provided a detailed breakup and analysis of the market based on the platform. This includes android, roku, webOS, tizen OS, iOS, myhomescreen, and others.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, Dish TV India introduced its VZY Smart TV lineup in India, integrating built-in DTH set-top boxes and support for multiple OTT platforms. The range includes models from 32-inch HD to 55-inch 4K QLED, all powered by Google TV 5 based on Android 14, featuring Dolby Vision, HDR10, and Dolby Audio. Priced between INR 12,000 and INR 45,000, the VZY TVs come with preloaded content and bundled subscriptions, targeting mid-premium Indian households seeking a hybrid entertainment experience.

- In September 2025, Sony launched its BRAVIA 5 Series Smart Mini LED 4K TVs in India, featuring models ranging from 55" to 98" in size. These televisions are equipped with Sony's XR Processor, XR Triluminos Pro, and XR Backlight Master Drive technologies, delivering enhanced brightness, contrast, and color accuracy. Additionally, they support Dolby Vision, Dolby Atmos, and IMAX Enhanced for an immersive viewing experience.

- In August 2025, Panasonic launched its Shinobi Pro Mini LED 4K Smart TV series in India, featuring 21 models ranging from 32 to 75 inches. The flagship models incorporate a 120Hz refresh rate with MEMC, Dolby Vision, HDR10+, and Quantum Dot technology, delivering enhanced picture quality. All models run on Google TV, supporting Dolby Atmos audio, Auto Low Latency Mode (ALLM) for gaming, and come with a sleek 8.13 cm ultra-slim design. Prices range from INR 17,990 to INR 3,99,990, with availability through Panasonic's authorized retailers, e-commerce platforms, and its direct-to-consumer website.

- In August 2025, Blaupunkt launched its premium Mini LED smart TVs in India. The lineup includes 65-inch and 75-inch models. These TVs offer 1.1 billion color reproduction, 1500 nits’ peak brightness, and a 100,000:1 contrast ratio with local dimming. Audio is delivered through a 108W Dolby Atmos-certified system with six speakers, including two subwoofers. Connectivity options encompass Bluetooth 5.0, dual-band Wi-Fi, Chromecast, and Apple AirPlay. The 65-inch model is priced at INR 94,999, while the 75-inch model is priced at INR 1,49,999.

India Smart TV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resolution Types Covered | 4K UHD TV, HD TV, Full HD TV, 8K TV |

| Screen Sizes Covered | Below 32 Inches, 32 to 45 Inches, 46 to 55 Inches, 56 to 65 Inches, Above 65 Inches |

| Screen Types Covered | Flat, Curved |

| Technologies Covered | Liquid Crystal Display (LCD), Light Emitting Diode (LED), Organic Light Emitting Diode (OLED), Quantum Dot Light Emitting Diode (QLED) |

| Platforms Covered | Android, Roku, WebOS, Tizen OS, iOS, MyHomeScreen, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Residential, Commercial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart TV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart TV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart TV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart TV market in the India was valued at USD 9,501.8 Million in 2024.

The India smart TV market is projected to exhibit a CAGR of 16.32% during 2025-2033, reaching a value of USD 37,042.2 Million by 2033.

Key factors driving the India smart TV market include rising disposable incomes, increasing internet penetration, and a growing demand for entertainment content, such as streaming services. The popularity of affordable smart TV options, advancements in technology like 4K and AI integration, and a shift towards home entertainment also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)