Smart TV Market Size, Share, Trends and Forecast by Resolution Type, Screen Size, Screen Type, Technology, Platform, Distribution Channel, Application, and Region, 2026-2034

Smart TV Market Size and Share:

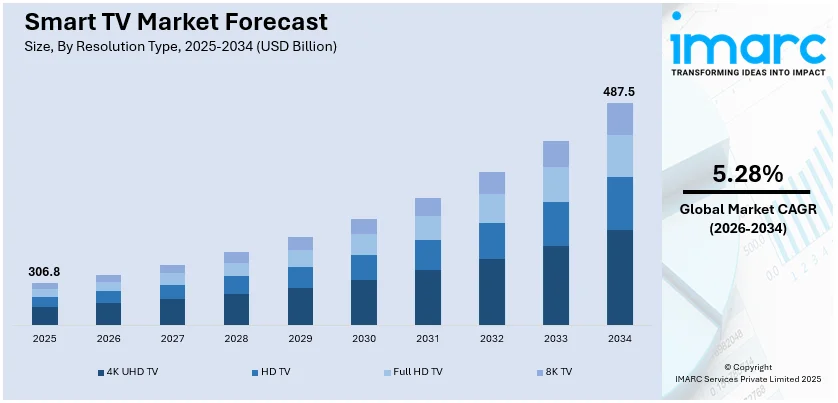

The global smart TV market size was valued at USD 306.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 487.5 Billion by 2034, exhibiting a CAGR of 5.28% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 35.9% in 2025. The market is propelled by growing disposable incomes, rising internet penetration, urbanization, and high demand for advanced home entertainment solutions from consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 306.8 Billion |

|

Market Forecast in 2034

|

USD 487.5 Billion |

| Market Growth Rate 2026-2034 | 5.28% |

Rising popularity for top-tier home entertainment solutions is the biggest driver in the global market for smart TVs. Consumers want innovative features including 4K and 8K resolution, high dynamic range, and greater sound technologies in an effort to upgrade viewing quality. The availability of more and more over-the-top (OTT) streaming sites is also another contributing factor toward use, given the ease by which smart TVs bring digital content online. Moreover, the incorporation of artificial intelligence (AI) and voice control functionality enhances convenience for users, streamlining navigation and content exploration. Increasing penetration of high-speed internet and smart home ecosystems fuels market growth, allowing devices to be seamlessly connected. Technological improvements in display panels such as OLED and QLED technology are also improving picture quality and energy efficiency, positioning smart TVs as an appealing option for customers. For example, in January 2024, Samsung introduced the S95D QD-OLED TV with a glare-free screen, improved gaming capabilities, and rich colors, creating a new standard for premium viewing in bright settings. Furthermore, as patterns of consumption on the Internet develop, global demand for smart TVs keeps on boosting.

To get more information on this market Request Sample

In the US, the rise in popularity of streaming services is a key force behind smart TV market growth with the share of 85.00% in 2024. Consumers are turning away from legacy cable subscriptions and towards digital content platforms that enable flexible, on-demand viewing experiences. Smart TVs act as an aggregator for streaming services, delivering access to thousands of movies, TV programs, and live events through integrated apps. The advent of 5G and fiber-optic internet infrastructure has further driven content delivery speeds, making high-quality streaming with less buffering easier. Furthermore, voice recognition technology improvements have elevated the functionality of smart TVs to enable the control of their devices using voice. The trend towards home automation and smart devices also fosters market growth, as smart TVs work in tandem seamlessly with other Internet of Things (IoT) capable products. As consumers increasingly value personalized, high-definition entertainment, demand for smart TVs in the U.S. keeps rising, defining the future of home entertainment. For instance, in November 2024, Amazon introduced the Fire TV Omni Mini-LED Series with a maximum of 1,344 dimming zones, 1,400 nits peak brightness, 144Hz refresh rate, Dolby Vision IQ, HDR10 Plus Adaptive, and AMD FreeSync Premium Pro.

Smart TV Market Trends:

Growing Internet Penetration Boosts Smart TV Market Growth

The rising penetration of high-speed internet is largely encouraging the growth in the smart TV market. Thanks to smooth connectivity, customers have access to TV services on-demand, media streaming, and interactivity. OTT platforms further support this factor by providing entertainment of various sorts, such as movies, TV series, documentaries, and sports, to end-users. Based on market statistics, India's top five metro cities contribute to 55% of smart TV users and tier-one cities account for 34% of viewers. This shows a high degree of correlation between access to the internet and the use of smart TVs. Moreover, connected platforms on smart TVs are simplifying consumption for users by allowing them to stream multiple services from a single device, increasing user experience. As more homes become internet-enabled and online consumption patterns change, the smart TV market is likely to see steady growth as more companies add internet-based features to appeal to tech-conscious consumers.

Device Convergence Fuels Smart TV Market Expansion

Smart TVs are highly becoming the hub of contemporary multimedia entertainment, integrating conventional TV broadcasting with internet connectivity, gaming devices, and smart home compatibility. The capability to easily switch between live TV, streaming platforms, and gaming apps has raised consumer demand. Among the major drivers in market expansion is the integration of AI-based voice assistants, permitting users to change channel with mere voice instructions. A recent market study showed that 89% of customers consider voice assistant compatibility as a top concern when buying smart home products. Further, 85% of the respondents revealed that current smart devices contribute to their voice assistant choice, reflecting a current trend of unified ecosystems. With voice recognition technology making TV use easier—like navigating content, adjusting settings, and opening apps—companies are improving convenience for users. This trend towards more intelligent, voice-controlled entertainment solutions will continue to drive smart TV take-up, incorporating them into the fabric of digital homes.

Technological Innovations Driving Smart TV Adoption

Progress in display resolution, audio clarity, and artificial intelligence are revolutionizing the smart TV industry. Increased demand for ultra-HD displays, high dynamic range (HDR), and quality sound systems has fueled a boom in smart TV sales. AI-based features like auto picture improvement and personalized content suggestions are further enhancing user experiences. One of the main industry developments is LG's $740 million investment to scale its AI-driven webOS platform, which currently operates in more than 180 countries with 4,500+ gaming apps and 3,800+ LG Channels. LG has shipped 220 million smart TVs, while more than 400 brands have embraced webOS, generating ad revenue exceeding KRW 1 trillion. Smart TVs also seamlessly support integration with smartphones, tablets, and other connected smart home products, enabling them to cast material and establish an integrated ecosystem. As IoT and AI technologies remain to improve further, smart TVs are emerging as unavoidable home entertainment centers, and the market keeps growing.

Smart TV Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart TV market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on resolution type, screen size, screen type, technology, platform, distribution channel, and application.

Analysis by Resolution Type:

- 4K UHD TV

- HD TV

- Full HD TV

- 8K TV

The 4K UHD TV industry reached a market share of 40.8% in 2025, driven by increasing consumer interest in high-definition displays and engaging viewing experiences. With streaming services now providing 4K content, consumers are shifting to UHD TVs for improved clarity, rich colors, and better contrast. The market has seen robust adoption in the home segment, especially in the Asia-Pacific region, where urbanization and increasing disposable income are fuelling purchases. Offline physical retail channels are still a preponderant sales channel, with consumers wanting to touch and feel display quality before making a purchase. Top makers are combining AI-powered upscaling and high dynamic range (HDR) tech to improve picture quality. Moreover, decreasing panel costs and sale discounts have improved the affordability of 4K UHD TVs in various segments. As more demand fuels sales, innovation by brands such as OLED and Mini-LED innovation is also concentrating on making offerings stand out even more in a competitive landscape.

Analysis by Screen Size:

- Below 32 Inches

- 32 to 45 Inches

- 46 to 55 Inches

- 56 to 65 Inches

- Above 65 Inches

During 2025, the 46 to 55-inch smart TV category retained a market share of 37.8% on the back of affordability, space saving, and growing smart home penetration. These smart TVs continue to be a staple for urban flats and secondary home screens, especially in Asia-Pacific, where home spaces are small. LED technology remains the best, as it offers power-efficient solutions with greater brightness and contrast. Android-based smart TVs are at the forefront in this segment with uninterrupted app integration and OTT support. Offline selling is still the major channel for distribution as shoppers want physical demonstration before a sale. Most demand comes from the residential sector as consumers opt for affordable feature-studded smart TVs. Smart TVs are also getting bezel-free designs, voice control using artificial intelligence, and enhanced refresh rates to drive more user-friendly devices. While smart TV penetration increases, the segment is anticipated to continue its strong growth with the help of promotional schemes and growing internet penetration.

Analysis by Screen Type:

- Flat

- Curved

The flat LED TV segment captured 94.2% market share in 2025, which continued to retain its position as the most desired TV type thanks to affordability, longevity, and energy efficiency. LED technology dominates over others such as OLED and QLED technology in the mass market, mainly in the Asia-Pacific region where price-conscious buyers dictate demand. The residential sector is the largest consumer, driven by offline channels of retail in terms of sales. LED flat-screen TVs are favored due to their slimmer profile, making them best suited for wall mounting in contemporary homes. Increased penetration of smart LED TVs with Android-based smart technology has expanded the market size, providing popular streaming services at their fingertips. The manufacturers are updating LED TV models with AI upscaling, higher refresh rates, and advanced HDR support. With ongoing technology improvements and prices falling, LED TVs will be able to continue their grip on the global television market for the next few years.

Analysis by Technology:

- Liquid Crystal Display (LCD)

- Light Emitting Diode (LED)

- Organic Light Emitting Diode (OLED)

- Quantum Dot Light Emitting Diode (QLED)

LED TVs bridge energy efficiency and enhanced brightness and contrast. They are the newer and better LCD technology, valued for their thinner profiles, longevity, and economic price tags. With mass markets and added functionality, LED TVs remain a crowd favorite among both domestic and corporate users owing to 64.4% market share.

Analysis by Platform:

- Android

- Roku

- WebOS

- Tizen OS

- iOS

- MyHomeScreen

- Others

Android smart TV segment crossed 39.6% market share in 2025 owing to easy connectivity’s with OTT platforms, Google services, and smart homes. Android TVs command the homeowner sector, more so in the Asia-Pacific region where customers require inexpensive, rich-in-features entertainment options. Offline retail segments remain essential due to the preferences of customers wanting physical demonstrations before purchases. The 32 to 45-inch range is most in demand, with affordability combined with unrestricted access to Google Play Store applications, voice support, and Chromecast capability. With high broadband penetration, Android TVs allow streaming of high-definition content without difficulty. Companies are optimizing Android TV performance through AI-driven recommendations, customized user interface, and better gaming capabilities. The market continues to grow with more brands releasing budget-friendly Android-powered models featuring high-end features like Dolby Vision, HDR10+, and high refresh rates. With demand skyrocketing, Android TV is still a top pick for customers seeking smart entertainment solutions.

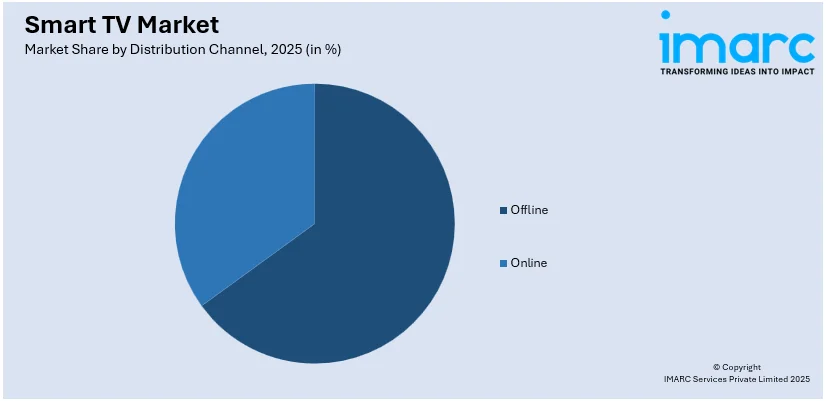

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The offline channel contributed 67.5% of smart TV sales in 2025, reaffirming its dominance in spite of the growth of e-commerce. Customers still favor buying televisions in stores, where they get to experience picture quality, sound performance, and product features before purchasing. Asia-Pacific is the dominant market for offline sales, with high penetration in urban and suburban areas. Offline stores have competitive pricing, bundled offers, and on-location customer support and hence are more popular for purchases of high-value items. While online retail continues to rise, especially in city centers, offline retail holds a strong advantage due to product availability on the spot and installation service. Offline selling is being elevated by manufacturers and retailers with the help of experience stores, display showrooms, and one-to-one recommendations. With the progress in smart TV technology, offline retail will continue to be a significant distribution channel, serving those customers who are keen on product hands-on experience and post-purchase support.

Analysis by Application:

- Residential

- Commercial

The residential segment contributed 72.4% of smart TV sales in 2025, driven by increasing adoption of streaming services and integration with smart homes. Users are looking to upgrade to televisions with higher-end features such as high-resolution content, AI-recommended choices, and easy connectivity to other smart devices. Asia-Pacific dominates the market, with urban households contributing significantly towards the demand for mid-range 32 to 45-inch smart TVs. Offline retail continues to be the main sales channel, enabling customers to see display quality and sound performance before buying. The growth of Android-based smart TVs has further boosted demand, offering users access to OTT platforms, Google Assistant, and voice-controlled home automation. Further, falling panel prices and affordable financing have made premium TV models affordable. As digital entertainment is highly adopted by consumers, the home segment will continue to register growth, with the focus from manufacturers being innovation in improving viewing experience and connectivity capabilities.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia-Pacific was the leader in the smart TV market with 35.9% market share in 2025, driven by high-speed urbanization, growing disposable incomes, and accelerating internet penetration. India, China, and the Southeast Asian region have seen good demand for smart TVs, with the mid-size 32 to 45-inch segment being popular. Offline channel is the top distribution channel as consumers like to experience the products before buying them. Android-enabled smart TVs have also picked up considerable momentum with their easy streaming, AI-based suggestions, and smart home integration. 4K UHD TVs are also increasing in demand, fueled by content presence and declining panel prices. Brands are upgrading their product portfolio with bezel-less, high refresh rate, and better HDR support. With advances in technology and competitive pricing strategies, the Asia-Pacific smart TV market is likely to maintain its robust growth pattern, meeting the changing entertainment needs of digital-first consumers.

Key Regional Takeaways:

North America Smart TV Market Analysis

The North American smart TV market is witnessing a steady growth fueled by growing demand for connected entertainment solutions. The high penetration of internet, pervasive use of streaming services, and technological advancements in display technology fuel market growth. Users demand smart TVs with high-resolution displays, advanced audio features, and in-built voice assistants for a richer user experience. Growing popularity of over-the-top (OTT) platforms is fuelling demand for smart TVs with multi-streaming app support. Smart home ecosystem compatibility further enhances adoption as consumers desire smooth integration with other connected devices. Drivers of growth include features such as artificial intelligence (AI), high dynamic range (HDR), and gaming-based features. There is also movement towards higher screen sizes and power-saving models. Also, the expansion of online shopping channels and promotional discounts stimulates increased adoption levels. The growing demand for immersive entertainment and home automation solutions continues to influence market trends.

United States Smart TV Market Analysis

The US smart TV market is growing because of the growing demand among consumers for streaming and high-definition content. Industry research suggests that by 2026, more than half of the population in the U.S. will consume ad-supported streaming platforms, while 55.8% of the internet user base uses AVOD services. In the same vein, easy availability of high-speed internet and 5G allows smooth streaming, thereby supporting higher adoption of the product. The gradual transition from conventional cable to OTT platforms is fueling the demand for internet-enabled televisions with sophisticated operating systems. In addition, the growing trend of home automation and voice assistant integration is promoting the adoption of AI-driven smart TVs. Companies are also taking advantage of premium display technologies, including OLED, QLED, and Mini-LED, to improve picture quality, appealing to consumers who value better viewing experiences. Additionally, the growing accessibility of big-screen televisions, fueled by aggressive price competition, is fueling the market.

Europe Smart TV Market Analysis

Europe's market is expanding gradually through rising digitalization, state-supported broadband penetration, and the emerging smart home ecosystems. 73% of Europeans report that digitalization simplifies life, according to a survey, and 83% of them consider digitalization essential for online connections and public services by 2030. Also, 80% are convinced that high-speed internet will drive digital adoption, and 88% highlight the role of human support in digital transformation. At the same time, a further industry analysis points out that since 2019, three or more smart home devices per household have doubled to 38%, with 80% of consumers having one and close to 40% having over three, increasing to over 50% for the under-35s. What's more, consumers in mature markets such as Germany, the UK, and France favor connected TVs that integrate linear broadcasting and on-demand streaming. European Broadcasting Union's Hybrid Broadcast Broadband TV (HbbTV) initiative enhancing functionality is also energizing the market demand. Additionally, new sustainability trends and energy policies are encouraging manufacturers to develop eco-friendly products, while 8K resolution and AI imaging are drawing premium consumers to the market. In addition to this, collaborations among TV brands and streaming services are also increasing content availability, making smart TVs the focal point of contemporary entertainment.

Asia Pacific Smart TV Market Analysis

Asia Pacific is the fastest-growing smart TV market, led by high-speed urbanization, rising disposable incomes, and enhanced internet connectivity. The region houses 60% of the world's population, about 4.3 Billion people, comprising very densely populated countries like China and India, according to the UNFPA. This is huge growth potential for smart TVs. As per this, countries like China, India, and South Korea are witnessing rapid growth with leading manufacturers, who continue to introduce feature-rich smart TVs. Further, increasing government efforts to accelerate digitalization and smart city initiatives are propelling rising product uptake. Similarly, the increasing popularity of local streaming platforms driving demand for local content is propelling the market. The growth of low-cost Chinese brands, attracting price-sensitive buyers, is propelling the market growth. Further, growing AI integration, voice assistants, and cloud gaming offerings are attracting the younger generations, while 5G adoption enhances streaming quality and interactive experiences, solidifying the market demand.

Latin America Smart TV Market Analysis

The Latin American market is growing with increased broadband penetration, changing consumer tastes, and the growing adoption of streaming services. As per an industry survey, 67% of Mexican, 61% of Argentine and Chilean, and 63% of Brazilian viewers watch Connected TV (CTV) on a daily basis, and 95% of connected homes make use of AVOD services. In addition, economic rebound and expanding middle class are fueling premium smart TV demand, especially in Brazil, Mexico, and Argentina. Likewise, retailers' and brands' flexible financing packages are easing upgrades in the market. With the increased use of Android-based smart TVs enabling more app customization, and telecom alliances providing bundled pricing to the manufacturers, the competition is giving way to profitability. In addition to this, AI-driven upscaling and voice support functions improve user experience, driving market expansion.

Middle East and Africa Smart TV Market Analysis

Middle East and Africa's smart TV market is expanding due to expanding internet penetration, surging demand for entertainment services, and a burgeoning tech-conscious consumer base. Additionally, the UAE and Saudi Arabia are seeing high adoption of smart TVs on the back of strong purchasing power and demand for premium home entertainment. In addition, 5G and fiber-optic rollouts in cities are enhancing streaming ability and driving the market. As per market reports, the GCC nations was expected to achieve 47% 5G subscription penetration by the close of 2024, fueling smart speaker growth with widespread high-speed connectivity. However, African markets such as South Africa and Nigeria are developing because of smart TV affordability and domestic streaming platforms. Additionally, government-run digital migration programs are further stimulating digital broadcasting and smart TV adoption.

Competitive Landscape:

The market for smart TVs is marked by a competitive and dynamic environment with several players emphasizing innovation, product differentiation, and integration of cutting-edge technology. Brands compete based on high-resolution screens, AI-driven interfaces, and smart home connectivity to woo consumers. Voice control, streaming services integrated within the TV, and gaming optimization are differentiators. Industry leaders are also betting on research and development to further enhance display technology, such as OLED, QLED, and Mini-LED, for greater picture quality and power efficiency. Strategic alliances with content and application developers are creating wider distribution opportunities for exclusive streaming services. Budget-friendly to premium models, across various price levels, suit differing consumer segments. Retail penetration online and offline widens accessibility. Ongoing developments in smart capabilities, intuitive interfaces, and connectivity features drive market expansion. Growing demand for rich home entertainment experiences is also fueling competition, with companies competing to provide innovative and feature-packed products.

The report provides a comprehensive analysis of the competitive landscape in the smart TV market with detailed profiles of all major companies, including:

- LG Electronics, Inc.

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Panasonic Corporation

- Vizio Inc.

- Apple Inc.

- Hisense Group Co. Ltd.

- Koninklijke Philips NV

- TCL Corporation

- Insignia Systems Inc.

- Haier Group Corporation

- Hitachi Ltd.

- Westinghouse Electric Corporation

Latest News and Developments:

- February 2025: Lumio, a venture founded by former Xiaomi and Flipkart executives, made its foray into India's 4K smart TV segment. In partnership with Google, Amazon, and Dixon Technologies, Lumio is poised to reinvent customer aspirations. Supported by USD 4.3 Million in funding, its products will be out in March, focusing on high-end 4K demand.

- September 2024: TiVo broadened its smart TV presence in 15 European countries, collaborating with 17 OEM brands like Panasonic, Sharp, and Vestel. Incorporating cutting-edge content aggregation, AI-powered recommendations, and voice navigation, TiVo OS is projecting to reach two million active devices by the end of the year, improving user experience and targeted advertising.

- July 2024: Hisense introduced its 2024 smart TV series in India with Mini LED, QLED, and 4K Google TVs. The models are Q7N, U7N, U6N Pro, and E68N, with Dolby Vision, Atmos, and AI-based features. The prices begin at INR 31,999, and they will be available on Amazon and Flipkart from July 19.

- May 2024: Sony India introduced the BRAVIA 2 Series Google TV-enabled smart TVs with X1 4K Processor, Dolby Audio, and AI-powered gaming for PS5 (S25 model). Features a voice remote, Apple AirPlay, X-Pro Protection PRO for ruggedness, and Motionflow XR for smooth motion. Offered in 43-65 inches.

- May 2024: LG introduced 55 AI-driven smart TV models in India between 43 inches and 97 inches with a five-year WebOS upgrade guarantee. With 25-30% growth targeting, LG brings AI-driven picture and sound, Chromecast, and Apple AirPlay together with premiumization and tier 1, tier 2, and rural market expansion.

Smart TV Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Resolution Types Covered | 4K UHD TV, HD TV, Full HD TV, 8K TV |

| Screen Sizes Covered | Below 32 Inches, 32 to 45 Inches, 46 to 55 Inches, 56 to 65 Inches, Above 65 Inches |

| Screen Types Covered | Flat, Curved |

| Technologies Covered | Liquid Crystal Display (LCD), LED (Light Emitting Diode), Organic Light Emitting Diode (OLED ), QLED (Quantum Dot Light Emitting Diode) |

| Platforms Covered | Android, Roku, WebOS, Tizen OS, iOS, MyHomeScreen, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | LG Electronics, Inc., Samsung Electronics Co. Ltd., Sony Corporation, Panasonic Corporation, Vizio Inc., Apple Inc., Hisense Group Co. Ltd., Koninklijke Philips NV, TCL Corporation, Insignia Systems Inc., Haier Group Corporation, Hitachi Ltd., Westinghouse Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart TV market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart TV market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart TV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart TV market was valued at USD 306.8 Billion in 2025.

The smart TV market is projected to exhibit a CAGR of 5.28% during 2026-2034, reaching a value of USD 487.5 Billion by 2034.

The market is fueled by rising consumer demand for high-definition screens, expanding internet penetration, increasing use of OTT platforms, improvements in AI and voice recognition, hassle-free connectivity with smart home appliances, and the presence of low-cost models with advanced features, enhancing accessibility across different income segments.

Asia Pacific currently dominates the smart TV market, accounting for a share of 35.9%. The market is driven by growing disposable incomes, broader internet penetration, higher demand for high-resolution displays, urbanization at a great pace, and robust adoption of streaming services within emerging economies.

Some of the major players in the smart TV market include LG Electronics, Inc., Samsung Electronics Co. Ltd., Sony Corporation, Panasonic Corporation, Vizio Inc., Apple Inc., Hisense Group Co. Ltd., Koninklijke Philips NV, TCL Corporation, Insignia Systems Inc., Haier Group Corporation, Hitachi Ltd., Westinghouse Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)