India Snack Bar Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel, and Region, 2025-2033

India Snack Bar Market Overview:

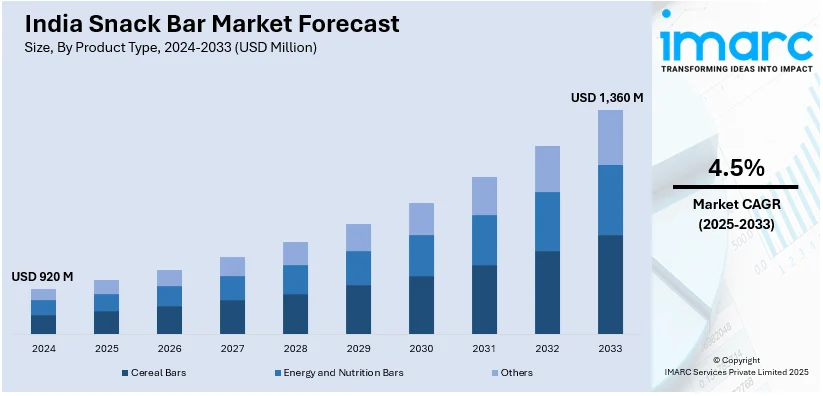

The India snack bar market size reached USD 920 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,360 Million by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for protein and functional snack bars and growing popularity of plant-based and clean-based snack bars.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 920 Million |

| Market Forecast in 2033 | USD 1,360 Million |

| Market Growth Rate 2025-2033 | 4.5% |

India Snack Bar Market Trends:

Rising Demand for Protein and Functional Snack Bars

In the Indian market for snack bars, demand for protein-rich and functional bars has increased due to consumers' growing health consciousness. The increased prevalence of lifestyle diseases such as obesity, diabetes, and cardiovascular diseases are leading people to demand wholesome, on-the-go food items. The protein bars charged with whey protein, plant-based proteins (pea, soy, and rice), and superfoods like chia seeds and flaxseeds are becoming popular among fitness enthusiasts, working professionals, and athletes. Furthermore, functional snack bars that offer more than basic nutrition by powering immunity, gut health, and energy enhancement are witnessing a leap in adoption. With consumers setting the bar higher for convenience options that complement their wellness goals, probiotic, prebiotic, fiber, and vitamin-enriched products are becoming quite mainstream. For instance, in November 2024, SuperYou announced the launch of India’s first protein wafer bar using fermented yeast protein. With 10g protein, 3g fiber, and no added sugar, it offers nutritious, flavorful snack options. Companies are innovating by incorporating natural sweeteners, gluten-free formulations, and clean-label ingredients to cater to evolving preferences. The growing influence of digital marketing, coupled with expanding distribution networks, including e-commerce platforms and specialty health stores, is further supporting market expansion. With urbanization and a shift towards healthier snacking habits, the demand for protein and functional snack bars is expected to remain strong in the coming years.

To get more information on this market, Request Sample

Growing Popularity of Plant-Based and Clean-Label Snack Bars

The increasing preference for plant-based and clean-label products is shaping the India snack bar market. Consumers are becoming more ingredient-conscious, favoring products free from artificial additives, preservatives, and refined sugars. This trend is particularly evident among millennials and Gen Z consumers, who actively seek transparency in product sourcing and formulation. For instance, in August 2024, ITC Ltd. announced the acquisition of a 40% stake in Yoga Bars, valuing it at ₹175 crore, boosting the clean-label protein bar brand with financial support, ITC’s distribution network, and market expertise for expansion and growth. The shift towards plant-based diets, fueled by concerns over health, sustainability, and ethical consumption, has led to a surge in demand for snack bars formulated with natural, plant-derived ingredients. Brands are responding by introducing snack bars made with nuts, seeds, dried fruits, oats, and plant proteins such as pea, hemp, and brown rice protein. Additionally, sugar alternatives like dates, jaggery, and coconut sugar are being used to appeal to health-conscious consumers. The rising popularity of vegan and gluten-free certifications is further driving market growth. E-commerce platforms, health and wellness retail chains, and specialty stores are playing a significant role in increasing the accessibility of these products. As awareness regarding food ingredients and sustainability continues to grow, the plant-based and clean-label snack bar segment is expected to witness sustained expansion in India’s evolving snacking landscape.

India Snack Bar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, ingredient, and distribution channel.

Product Type Insights:

- Cereal Bars

- Granola/Muesli Bars

- Others

- Energy and Nutrition Bars

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cereal bars (granola/muesli bars and others), energy and nutrition bars, and others.

Ingredient Insights:

- Nuts

- Whole Grains

- Dried Fruits

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes nuts, whole grains, dried fruits, and others.

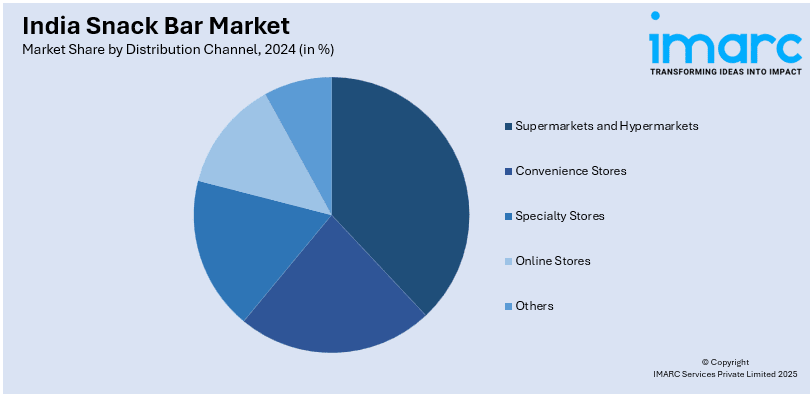

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Snack Bar Market News:

- In February 2025, The Whole Truth (TWT), a snack bar brand located in Mumbai, announced raising $15 million in its Series C round led by Sofina with participation from Z47, Peak XV Partners, and Sauce.VC. Known for its clean-label protein bars and snacks, TWT has also seen investments from Nithin Kamath (Zerodha), Sriharsha Majety (Swiggy), and Jaydeep Burman (Rebel Foods) in a further push toward consolidating its position in India's health snacks segment.

- In October 2024, Zydus Wellness announced the acquisition of Naturell, the maker of Ritebite Max Protein bars, for ₹390 crore, strengthening its presence in the healthy snacking market. Naturell reported ₹129 crore in revenue for FY24. The acquisition is expected to enhance Zydus’ earnings from next year, leveraging the growing demand for protein-based snacks.

India Snack Bar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Nuts, Whole Grains, Dried Fruits, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India snack bar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India snack bar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India snack bar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India snack bar market was valued at USD 920 Million in 2024.

The snack bar market in India is projected to exhibit a CAGR of 4.5% during 2025-2033, reaching a value of USD 1,360 Million by 2033.

The snack bar market in India is driven by growing health awareness, busy urban lifestyles, and rising demand for convenient, nutritious snacks. Increased e-commerce penetration and product innovations with added health benefits further boost growth. Additionally, concerns over lifestyle diseases encourage consumers to choose healthier snacking options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)