India Solar Control Glass Market Size, Share, Trends and Forecast by Technology, Application, Distribution Channel, and Region, 2025-2033

Market Overview:

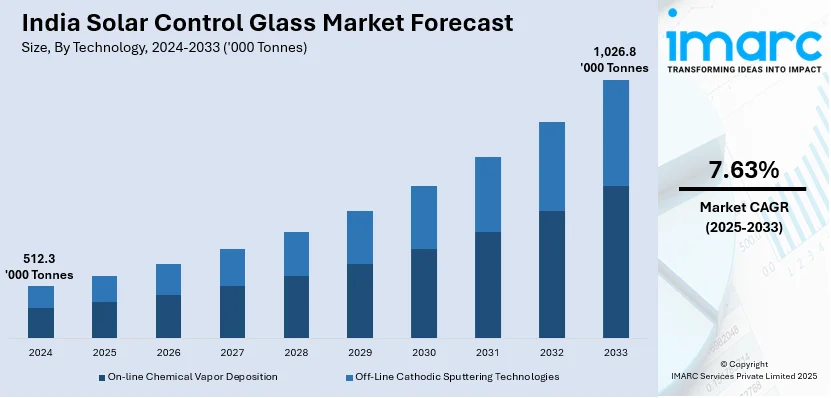

The India solar control glass market size reached 512.3 Thousand Tonnes in 2024. Looking forward, IMARC Group expects the market to reach 1,026.8 Thousand Tonnes by 2033, exhibiting a growth rate (CAGR) of 7.63% during 2025-2033. The rising applications of solar control glass in numerous construction and infrastructure development projects, the prevalence of tropical climate in India, and continual technological advancements in the manufacturing of solar control glass represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

512.3 Thousand Tonnes |

|

Market Forecast in 2033

|

1,026.8 Thousand Tonnes |

| Market Growth Rate (2025-2033) | 7.63% |

Solar control glass is a specialized glass that has been designed to reduce the amount of solar radiation entering a building, while still allowing natural light to penetrate. This type of glass is coated with a thin metallic oxide layer that reflects and absorbs the sun rays, effectively reducing heat and glare transmission. Consequently, solar control glass can enhance the indoor comfort levels and reduce cooling costs by decreasing the amount of heat that enters the building. Additionally, the glass provides high levels of impact resistance, shatter resistance and ultraviolet (UV) protection, that protects furnishings and interior finishes from fading and damage. While reflecting the sunlight, solar control glass still maintains low reflectivity, ensuring that sufficient natural light penetrates. It comes in different colors and coatings, enabling architects and designers to create unique and aesthetically pleasing building facades. Some of the advantages of solar control glass include low maintenance, design flexibility, increased privacy and sustainability.

To get more information on this market, Request Sample

India Solar Control Glass Market Trends:

The market in India is primarily driven by the rising applications of solar control glass in numerous infrastructure development projects. This can be attributed to the augmenting demand for energy efficiency in residential as well as commercial construction applications. In line with this, rapid urbanization in India is driving the demand for solar control glass in residential properties to reduce the amount of energy required for HVAC appliances. Moreover, the prevalence of tropical climate in India is resulting in higher product sales, making it an ideal market for solar control glass. In addition to this, continual technological advancements in the manufacturing of solar control glass, resulting in the development of more efficient, aesthetically pleasing and affordable product variants are impacting the market positively. The market is further driven by the escalating demand for various green building certifications, leading to higher installations of solar control glasses in buildings. Apart from this, the rapid utilization of solar energy as an essential component in the country's energy security strategy is creating a positive outlook for the market. Furthermore, the introduction of various incentives such as tax exemptions and subsidies by the Indian government promoting the adoption of solar control glass, is propelling the market. Some of the other factors contributing to the market include rapid industrialization, rising environmental concerns, considerable rise in foreign investment for solar control glass production, and extensive research and development (R&D) activities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India solar control glass market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on technology, application and distribution channel.

Technology Insights:

- On-line Chemical Vapor Deposition

- Off-Line Cathodic Sputtering Technologies

The report has provided a detailed breakup and analysis of the India solar control glass market based on the technology. This includes on-line chemical vapor deposition and off-line cathodic sputtering technologies. According to the report, on-line chemical vapor deposition represented the largest segment.

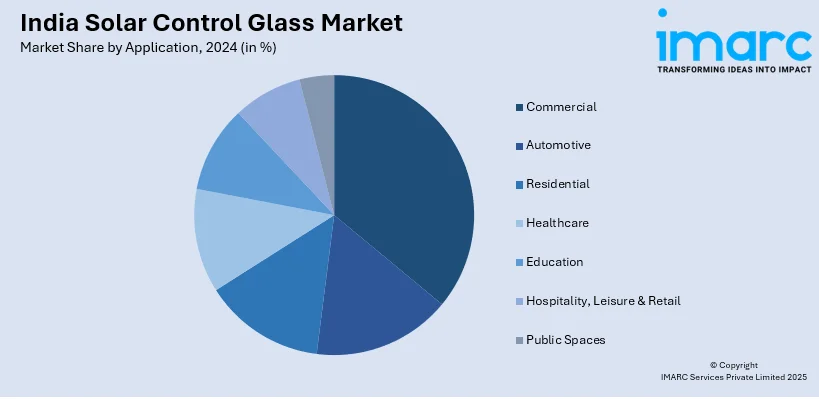

Application Insights:

- Commercial

- Automotive

- Residential

- Healthcare

- Education

- Hospitality, Leisure & Retail

- Public Spaces

The report has provided a detailed breakup and analysis of the India solar control glass market based on the application. This includes commercial, automotive, residential, healthcare, education, hospitality, leisure & retail, and public spaces. According to the report, commercial represented the largest segment.

Distribution Channel Insights:

- Trade Channels

- Processing Channels

A detailed breakup and analysis of the India solar control glass market based on the distribution channel has also been provided in the report. This includes trade channels and processing channels. According to the report, trade channel accounted for the largest market share.

Regional Insights:

- South India

- North India

- West and Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, East India. According to the report, West and Central India was the largest market for India solar control glass. Some of the factors driving the West and Central India solar control glass market included continual technological advancements, increasing number of green building projects, rising environmental concerns, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India solar control glass market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Asahi India Glass Limited, Gold Plus Glass Industry Limited, Gujarat Guardian Limited, Lingel Windows & Doors Technologies Pvt. Ltd., Saint Gobain India Private Limited, Sisecam, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tonnes |

| Segment Coverage | Technology, Application, Distribution Channel, Region |

| Region Covered | South India, North India, West and Central India, East India |

| Companies Covered | Asahi India Glass Limited, Gold Plus Glass Industry Limited, Gujarat Guardian Limited, Lingel Windows & Doors Technologies Pvt. Ltd., Saint Gobain India Private Limited and Sisecam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India solar control glass market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India solar control glass market?

- What is the impact of each driver, restraint, and opportunity on the India solar control glass market?

- What are the key regional markets?

- Which countries represent the most attractive India solar control glass market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the India solar control glass market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the India solar control glass market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the India solar control glass market?

- What is the competitive structure of the India solar control glass market?

- Who are the key players/companies in the India solar control glass market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar control glass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India solar control glass market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar control glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)