India Solvent Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Solvent Market Overview:

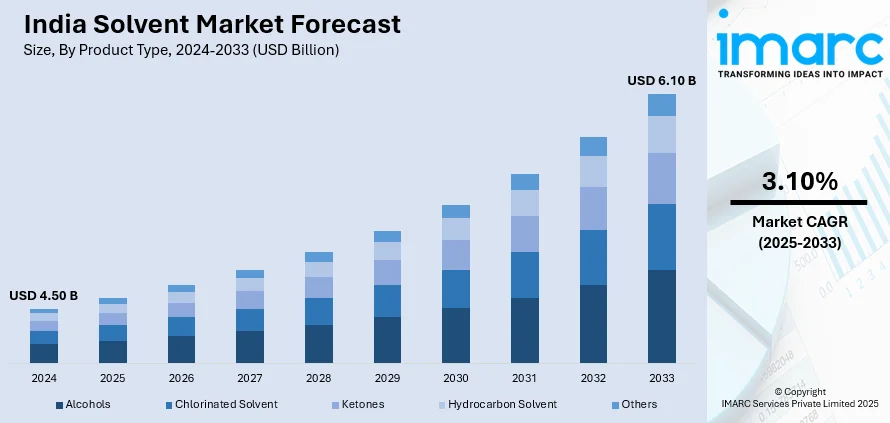

The India solvent market size reached USD 4.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.10 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The demand is fueled by fast industrial growth, particularly in pharmaceuticals, agrochemicals, and paints and coatings, where solvents have an important application in production processes. Increased demand for specialty and high-performance chemicals, combined with increased exports of formulated products, increases solvent usage. Moreover, increasing urbanization, infrastructural growth, and growth in personal care products drive the demand for solvents. Green chemistry regulatory support and the drive towards bio-based solvents also promote innovation and investment, additionally driving India solvent market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.50 Billion |

| Market Forecast in 2033 | USD 6.10 Billion |

| Market Growth Rate 2025-2033 | 3.10% |

India Solvent Market Trends:

Shift Toward Green and Bio-Based Solvents

India is witnessing a significant switch from conventional petroleum-based solvents to greener and bio-based ones. The reason behind this change is increasing environmental awareness, regulatory forces, and greater knowledge about health risks associated with traditional solvents such as toluene or xylene. Pharmaceuticals, paints and coatings, and adhesives are making investments in environmentally friendly solvents from agricultural biomass, such as ethyl lactate and D-limonene. Government efforts towards sustainability and international pressure for cleaner production processes are driving this transition. Moreover, India's vast agricultural sector provides significant raw material for bio-solvent production, which is fueling indigenous supply chains. Although bio-solvents are as of now more costly, technology innovations in production and scaling of operations should make it possible for them to compete. This is part of India's larger effort towards green chemistry and is consistent with international initiatives towards sustainability.

To get more information on this market, Request Sample

Growth in Pharmaceutical and Personal Care Sectors

India's pharmaceutical and personal care sectors are key drivers of rising solvent demand. As of 2023, India is the world’s third-largest drug producer by volume, holding a 20% global share in generic drug exports. Valued at USD 50 billion, the pharmaceutical industry is projected to reach USD 130 billion by 2030. Solvents like acetone, ethanol, and isopropanol are crucial in drug formulation, extraction, and purification. Post-COVID, increased healthcare investments and advanced manufacturing have amplified the need for high-purity solvents. Simultaneously, India’s growing personal care industry boosted by urbanization, higher disposable incomes, and lifestyle changes is spurring demand for cosmetic-grade solvents in products like perfumes, lotions, and hygiene items. This dual-sector expansion is pushing manufacturers to enhance production capacity and solvent quality. As both industries scale, solvent consumption especially of pharmaceutical- and cosmetic-safe variants is expected to grow steadily, aligning with India’s industrial and economic growth trajectory.

Volatility in Raw Material Prices and Supply Chains

One of the largest trends affecting the Indian solvent market is the volatility of raw material prices and the susceptibility of global supply chains. The majority of traditional solvents are petrochemical derivatives, so their pricing is extremely sensitive to crude oil price movements. Global geopolitical tensions, including conflicts within oil-producing countries or trade embargos, have a great effect on feedstock availability and pricing. Furthermore, post-pandemic supply chain disruptions and changing trade policies (e.g., China+1 approach) have prompted several Indian solvent producers to re-evaluate their reliance on imports. In an effort to hedge risks, businesses are localizing supply chains, diversifying raw material sources, and looking into alternative modes of production. The volatility has also accelerated the drive for innovation in solvent recovery and recycling to lower dependence on virgin raw materials thus strengthening the India solvent market growth.

India Solvent Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Alcohols

- Chlorinated Solvent

- Ketones

- Hydrocarbon Solvent

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes alcohols, chlorinated solvent, ketones, hydrocarbon solvent, and others.

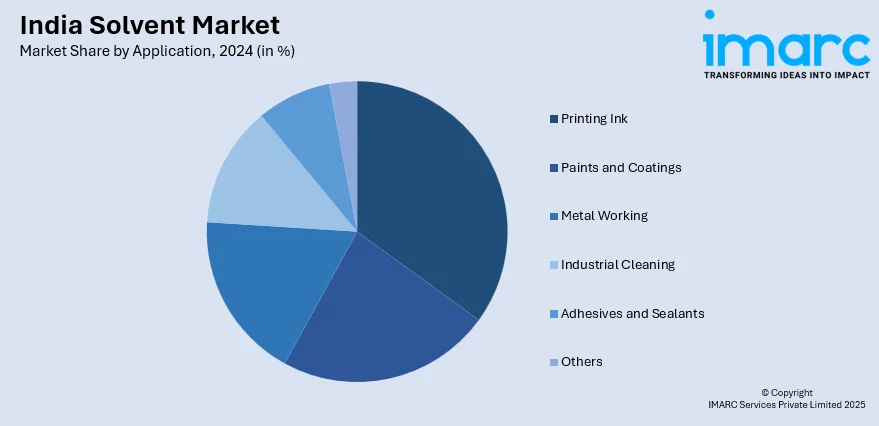

Application Insights:

- Printing Ink

- Paints and Coatings

- Metal Working

- Industrial Cleaning

- Adhesives and Sealants

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes printing ink, paints and coatings, metal working, industrial cleaning, adhesives and sealants, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solvent Market News:

- In May 2025, Bengaluru-based CRDMO Steerlife launched a groundbreaking solvent-free melt fusion technology that eliminates harmful organic solvents in drug production. This continuous processing platform enhances formulation safety, efficiency, and scalability, especially for high-potency and complex molecules. CEO Indu Bhushan highlighted its significance in overcoming long-standing pharmaceutical challenges. Unlike traditional batch processing, the new system simplifies manufacturing from 8–9 steps to just 3–4, marking a major leap in drug development innovation in India.

- In August 2024, Eastman launched a high-purity electronic grade isopropyl alcohol (IPA) as part of its EastaPure solvent portfolio, designed to meet strict semiconductor industry standards. Made in the U.S., this solvent supports wafer fabrication and semiconductor production by providing reliable, contaminant-free cleaning and drying. Eastman’s domestic production ensures consistent quality and supply, reducing reliance on imports, and meeting the growing demand for advanced, high-yield semiconductor manufacturing.

India Solvent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Alcohols, Chlorinated Solvent, Ketones, Hydrocarbon Solvent, Others |

| Applications Covered | Printing Ink, Paints and Coatings, Metal Working, Industrial Cleaning, Adhesives and Sealants, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India solvent market performed so far and how will it perform in the coming years?

- What is the breakup of the India solvent market on the basis of product type?

- What is the breakup of the India solvent market on the basis of application?

- What is the breakup of the India solvent market on the basis of region?

- What are the various stages in the value chain of the India solvent market?

- What are the key driving factors and challenges in the India solvent?

- What is the structure of the India solvent market and who are the key players?

- What is the degree of competition in the India solvent market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solvent market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solvent market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solvent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)