India Soy Sauce Market Size, Share, Trends and Forecast by Type, Packaging, Distribution, Application, and Region, 2025-2033

India Soy Sauce Market Size and Share:

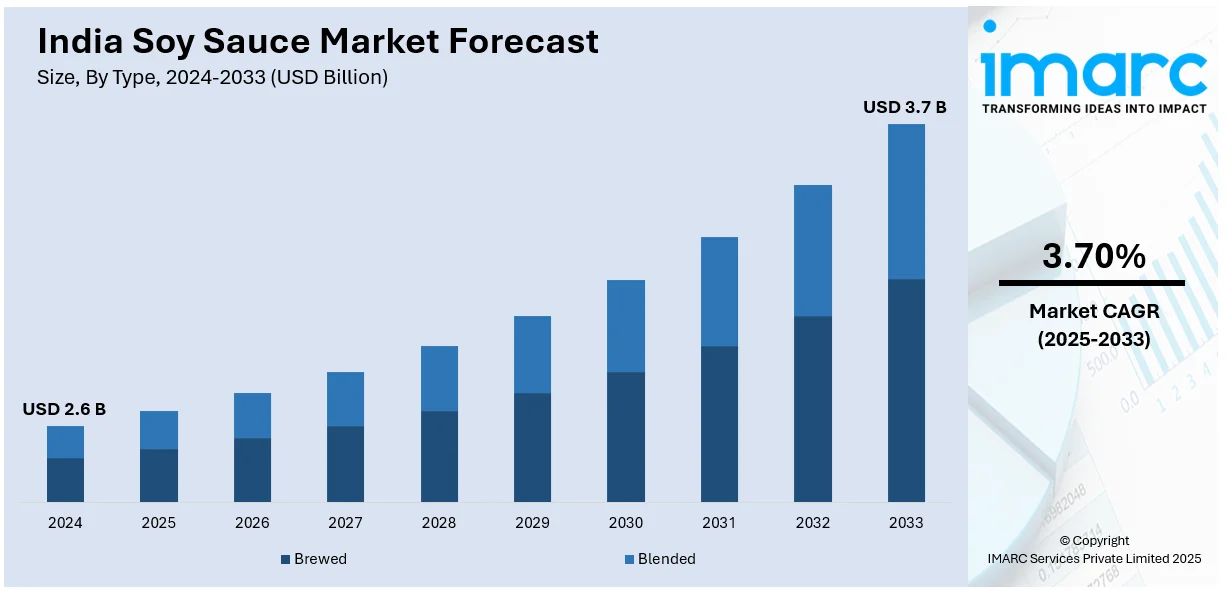

The India soy sauce market size reached USD 2.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The increasing consumer preference for Asian cuisines, rising demand for convenience foods, the expanding foodservice sector, the escalating awareness of soy sauce’s umami flavor, and innovations in low-sodium and organic variants are boosting market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.6 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Market Growth Rate 2025-2033 | 3.70% |

India Soy Sauce Market Trends:

Increasing Popularity of Asian Cuisine and Fusion Foods

The rising demand for Asian cuisine in India is significantly driving the growth of the soy sauce market. As Indian consumers increasingly explore global flavors, soy sauce has become a staple in both household kitchens and restaurant menus. In 2024, the number of pan-Asian restaurants in India surpassed 750, driven by the growing popularity of dishes like sushi, stir-fry, and ramen. This trend is particularly strong in urban centers like Mumbai, Delhi, and Bangalore, where Asian-themed restaurants have seen a rise in customer footfall. Additionally, the growing trend of fusion cuisine, which combines traditional Indian dishes with global flavors, is amplifying the use of soy sauce. For instance, recipes such as soy sauce-infused biryanis, tandoori marinades, and Indo-Chinese dishes are gaining traction. Moreover, the rising demand for ready-to-eat (RTE) food in India, with projections of 64.1 million consumers by 2029, is creating a positive outlook for market expansion. As consumer palates continue to diversify, soy sauce manufacturers are expanding their product lines to cater to regional preferences, including spicy and tangy variants tailored for Indian taste profiles. With the expansion of the fusion food trend, soy sauce sales are set to experience sustained growth.

To get more information on this market, Request Sample

Growing Demand for Health-Conscious and Specialty Soy Sauces

Health-conscious consumer behavior is reshaping the India soy sauce market, driving demand for low-sodium, gluten-free, and organic soy sauce options. A 2024 survey revealed that 73% of Indians review ingredient lists and nutritional values before purchasing snacks, with 93% willing to opt for healthier alternatives despite higher costs. As awareness of sodium-related health concerns grows, consumers are actively seeking healthier alternatives that maintain flavor without compromising dietary goals. The demand for low-sodium soy sauce in India is surging, while gluten-free variants saw a robust rise. Manufacturers are responding by developing soy sauces fortified with probiotics, reduced preservatives, and clean-label formulations to cater to wellness-focused consumers. Organic soy sauce, made from non-GMO soybeans and natural fermentation processes, has seen a notable surge in popularity, contributing to the market growth. Furthermore, premium soy sauce companies are gaining popularity, particularly in urban areas where affluent consumers are ready to spend more on real, artisanal items. Brands that prioritize sustainable production practices and eco-friendly packaging are also appealing to environmentally sensitive consumers. As the Indian population continues to adopt better diets, the demand for specialized soy sauces is expected to rise substantially.

India Soy Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, packaging, distribution, and application.

Type Insights:

- Brewed

- Blended

The report has provided a detailed breakup and analysis of the market based on the type. This includes brewed and blended.

Packaging Insights:

- Glass Jars

- Flexible Packs

- Plastic Jars

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes glass jars, flexible packs, plastic jars, and others.

Distribution Insights:

- Direct Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes direct sales, supermarkets and hypermarkets, convenience stores, online stores, and others.

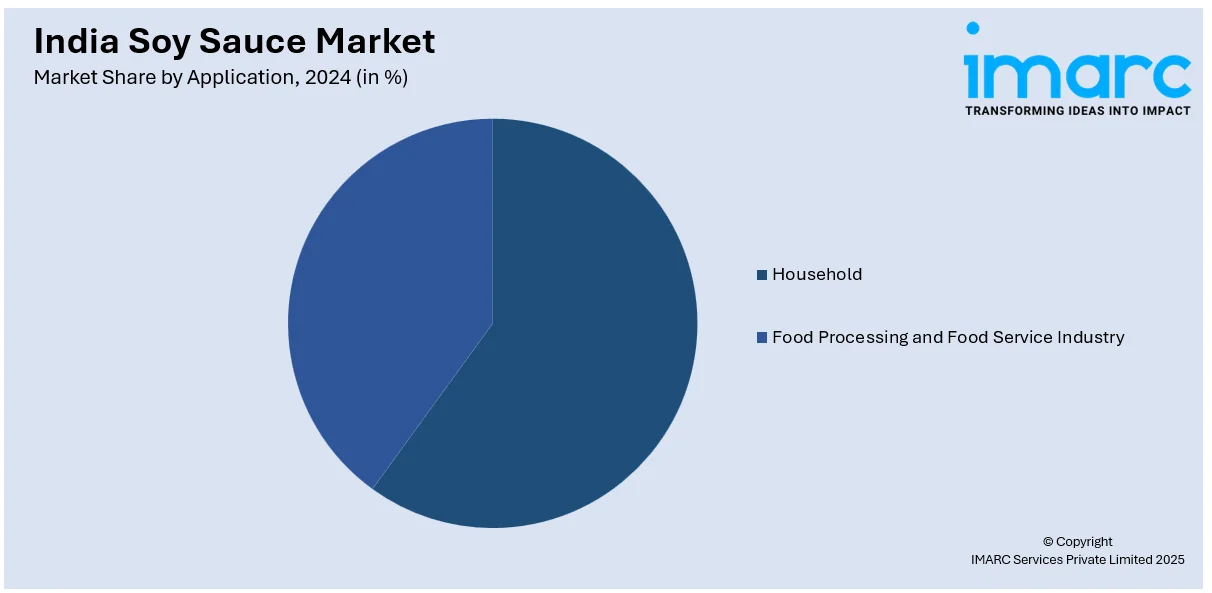

Application Insights:

- Household

- Food Processing and Food Service Industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and food processing and food service industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Soy Sauce Market News:

- October 2024: The Japan International Cooperation Agency (JICA) partnered with Japanese restaurant Kampai to produce India's first locally made authentic Japanese soy sauce, promoting sustainable development and supporting local enterprises with Japanese food processing expertise.

- January 2024: Kikkoman, a Japanese company, introduced its first dark soy sauce tailored for the Indian market after four years of R&D, offering a natural product, free from chemicals and artificial seasonings, available in 440g and 900g variants.

India Soy Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brewed, Blended |

| Packagings Covered | Glass Jars, Flexible Packs, Plastic Jars, Others |

| Distributions Covered | Direct Sales, Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Household, Food Processing and Food Service Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India soy sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India soy sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India soy sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soy sauce market in India was valued at USD 2.6 Billion in 2024.

The India soy sauce market is projected to exhibit a CAGR of 3.70% during 2025-2033, reaching a value of USD 3.7 Billion by 2033.

The India soy sauce market is driven by rising demand for Asian cuisines and the increasing popularity of quick-service restaurants. Additionally, expanding retail channels and consumer preference for convenient, flavorful condiments are fueling market growth across both urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)