India Specialty Insurance Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

India Specialty Insurance Market Overview:

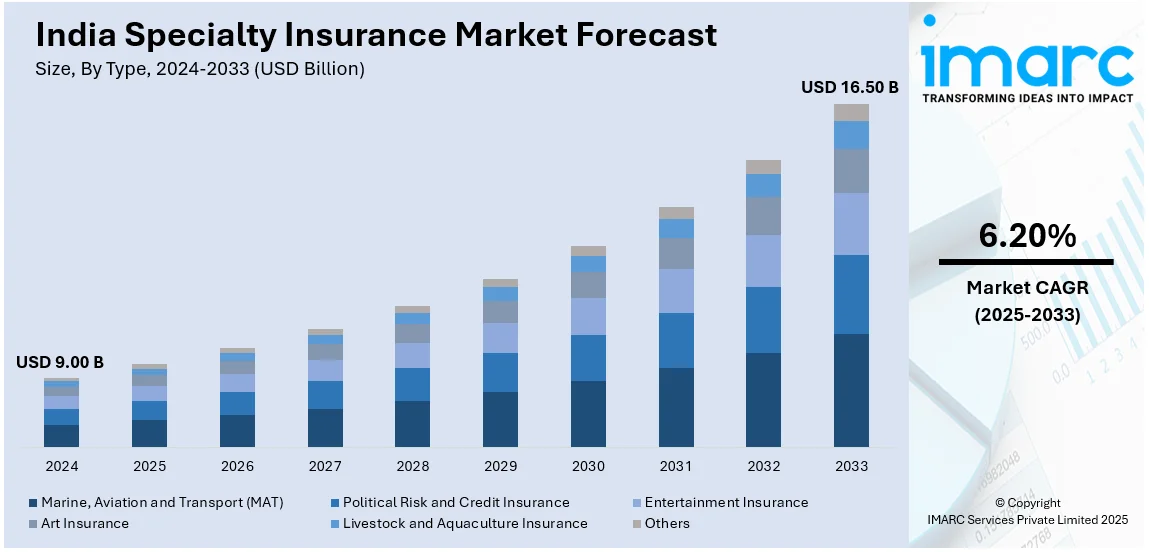

The India specialty insurance market size reached USD 9.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.50 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. Increasing cyber threats, rising demand for parametric insurance, growth in infrastructure projects, regulatory support for innovative policies, expanding healthcare needs, and the surge in tailored risk management solutions for businesses and individuals are expanding the India specialty insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.00 Billion |

| Market Forecast in 2033 | USD 16.50 Billion |

| Market Growth Rate 2025-2033 | 6.20% |

India Specialty Insurance Market Trends:

Growing Demand for Cyber Insurance

The India specialty insurance market growth is driven by an increase in demand for cyber insurance due to the increasing frequency of cyberattacks and data breaches. With the rapid digitization of businesses and the rise of e-commerce platforms, organizations are prioritizing data protection and risk management. Notably, India's Security Operations Center (SOC) was opened in Bengaluru on August 12, 2024, by Kyndryl, the biggest provider of IT infrastructure services worldwide. Using artificial intelligence, including machine learning and integrated automation systems, this SOC provides superior protection and all-encompassing support across the cyber threat lifecycle. In addition to offering incident response and cyber threat intelligence, the facility works around the clock and connects with Kyndryl's global network of cybersecurity specialists. Regulatory mandates on data privacy and compliance are further driving the need for comprehensive cyber insurance policies. Insurers are offering customized coverage for financial losses, legal liabilities, and reputation management. This trend is expected to grow as businesses seek to mitigate risks associated with ransomware attacks, phishing scams, and other cybersecurity threats.

To get more information on this market, Request Sample

Expansion of Parametric Insurance Solutions

Parametric insurance is gaining traction in the Indian specialty insurance market, especially in sectors such as agriculture and climate risk management. For instance, India's first parametric insurance policy based on the Air Quality Index (AQI) was launched on February 25, 2025, by Go Digit General Insurance Limited and K.M. Dastur Reinsurance Brokers. Approximately 6,200 daily wage construction workers in the Delhi-National Capital Region (NCR) will be shielded from revenue loss as a result of government-imposed construction bans brought on by extreme air pollution thanks to this creative approach. When AQI levels rise sharply and work stoppages occur, the project tackles the financial vulnerability these workers confront. Unlike traditional insurance, parametric models offer payouts based on predefined triggers such as weather patterns or seismic activity, providing quicker and more efficient claim settlements. This innovation is particularly beneficial for farmers and infrastructure developers facing unpredictable weather conditions. Insurers are leveraging advanced data analytics and satellite technology to create precise models for risk assessment. With climate change increasing the frequency of natural disasters, the adoption of parametric insurance is expected to expand significantly in the coming years, which, in turn, is positively impacting the India specialty insurance market outlook.

India Specialty Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Marine, Aviation and Transport (MAT)

- Marine Insurance

- Aviation Insurance

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes Marine, Aviation and Transport (MAT) (marine insurance and aviation insurance), political risk and credit insurance, entertainment insurance, art insurance, livestock and aquaculture insurance, and others.

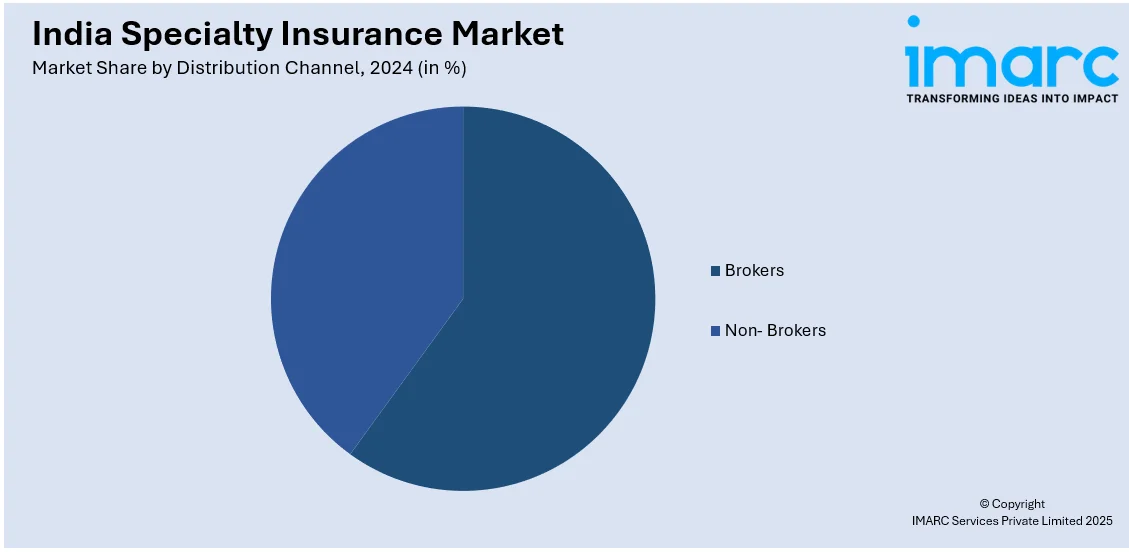

Distribution Channel Insights:

- Brokers

- Non- Brokers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes brokers and non-brokers.

End User Insights:

- Business

- Individuals

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes business and individuals.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Specialty Insurance Market News:

- On December 19, 2024, W. R. Berkley Corporation declared that the International Financial Services Centers Authority (IFSCA) has granted permission to its subsidiary, Berkley Insurance Company, to open a branch in GIFT City, Gujarat, India. Expanding the company's specialist insurance solutions in the Indian market is the goal of this calculated move.

- In August 2024, HDFC ERGO General Insurance, a leading private-sector general insurance company in India, partnered with Xceedance, a global provider of insurance-focused services, to launch Duck Creek Technologies' SaaS core insurance delivery solutions across India. The goal of the project is to modernize and consolidate HDFC ERGO's products, enhancing its market presence and introducing state-of-the-art technology in the India specialty insurance sector.

India Specialty Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Brokers, Non-Brokers |

| End Users Covered | Business, Individuals |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India specialty insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the India specialty insurance market on the basis of type?

- What is the breakup of the India specialty insurance market on the basis of distribution channel?

- What is the breakup of the India specialty insurance market on the basis of end user?

- What is the breakup of the India specialty insurance market on the basis of region?

- What are the various stages in the value chain of the India specialty insurance market?

- What are the key driving factors and challenges in the India specialty insurance market?

- What is the structure of the India specialty insurance market and who are the key players?

- What is the degree of competition in the India specialty insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India specialty insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India specialty insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India specialty insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)