India Steam Turbines Market Size, Share, Trends and Forecast by Type, Rated Capacity, Exhaust Type, Fuel Type, and Region, 2025-2033

India Steam Turbines Market Overview:

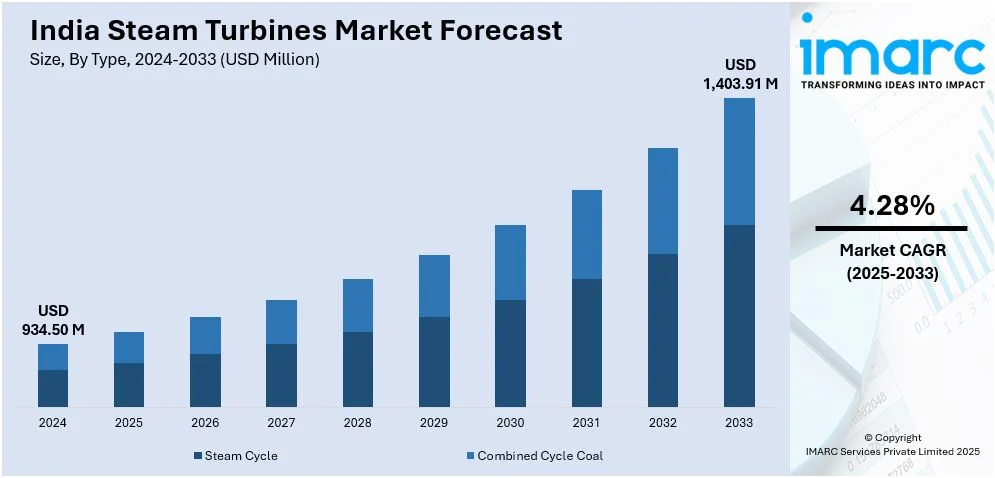

The India steam turbines market size reached USD 934.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,403.91 Million by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033. The market is driven by rising industrialization and power sector expansion, increasing adoption of renewable energy and waste heat recovery systems, and advancements in turbine efficiency. Growing demand for cogeneration, government incentives for sustainable energy, and technological innovations in high-efficiency turbines further accelerate market growth across various industrial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 934.50 Million |

| Market Forecast in 2033 | USD 1,403.91 Million |

| Market Growth Rate 2025-2033 | 4.28% |

India Steam Turbines Market Trends:

Expanding Industrial and Power Generation Sectors

India's growing electricity demand, driven by industrialization and urbanization, is strengthening the steam turbine market. Thermal power remains a key energy source, contributing 61% of the total installed capacity and 77% of power generation in 2023. The country’s reliance on coal-based plants continues to drive demand for steam turbines. Expanding industries like steel, cement, and petrochemicals are adopting cogeneration systems, while manufacturing units invest in captive power plants to improve energy efficiency and reduce grid dependency. Government initiatives supporting power sector investments further boost the market. Technological advancements in high-efficiency turbines enable optimized fuel usage and lower operational costs, reinforcing steam turbines as a crucial solution for India's evolving energy needs.

To get more information on this market, Request Sample

Rising Adoption of Renewable and Waste Heat Recovery Systems

The growing emphasis on energy efficiency and sustainability has prompted a heightened adoption of renewable energy and waste heat recovery systems with the integration of steam turbines. Industries are increasingly adopting power generation systems based on biomass, municipal solid waste, and waste heat recovery, which need steam turbines to produce electricity from thermal energy. In addition, combined heat and power (CHP) and cogeneration plants are increasingly popular in industries such as sugar, textiles, and food processing, where steam turbines maximize energy use. Favorable policies, such as subsidies and incentives for industrial and renewable cogeneration schemes, are promoting investments in steam turbine technology. This shift towards efficient and cleaner energy solutions is driving market demand, particularly in industries that aim to minimize carbon emissions.

Technological Advancements and Efficiency Improvements

Ongoing technological advancements in steam turbine design are propelling market growth in India, with innovations in advanced metallurgy, blade aerodynamics, and digital monitoring enhancing efficiency and durability. Super-efficient supercritical and ultra-supercritical turbines are becoming popular, maximizing fuel efficiency and operational performance. Predictive maintenance and automation technologies are assisting industries in reducing downtime and maintenance expenses, while digital twins and smart sensors allow real-time performance analysis. In 2022, the India steam turbine market for sub-100 MW range grew by 15% in megawatt terms, with the sub-30 MW segment expanding by 22%, driven by industrial demand for heat and power. As industries prioritize energy efficiency and compliance with environmental norms, these technological advancements are making steam turbines more competitive across power generation and industrial applications.

India Steam Turbines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, rated capacity, exhaust type and fuel type.

Type Insights:

- Steam Cycle

- Combined Cycle Coal

The report has provided a detailed breakup and analysis of the market based on the type. This includes steam cycle, and combined cycle coal.

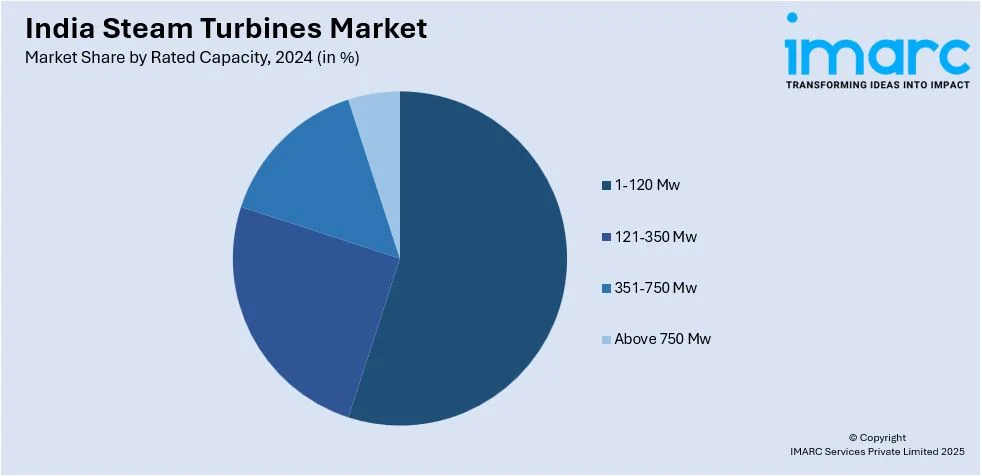

Rated Capacity Insights:

- 1-120 Mw

- 121-350 Mw

- 351-750 Mw

- Above 750 Mw

A detailed breakup and analysis of the market based on the rated capacity have also been provided in the report. This includes 1-120 Mw, 121-350 Mw, 351-750 Mw, and above 750 Mw.

Exhaust Type Insights:

- Condensing

- Non-Condensing

The report has provided a detailed breakup and analysis of the market based on the exhaust type. This includes condensing, and non-condensing.

Fuel Type Insights:

- Coal

- Biomass

- Nuclear

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes coal, biomass, nuclear, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Steam Turbines Market News:

- In June 2024, GE Power India Ltd (GEPIL) secured a ₹243.46 crore order from NTPC GE Power Services for renovation and modernization of LMZ steam turbines at Wanakbori thermal power station, Gujarat. The project aims to improve efficiency and extend the life of Unit 1 & 2 (210 MW each) and will be completed in 33 months. GEPIL will handle critical supplies, design, testing, and commissioning.

India Steam Turbines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steam Cycle, Combined Cycle Coal |

| Rated Capacities Covered | 1-120 Mw, 121-350 Mw, 351-750 Mw, Above 750 Mw |

| Exhaust Types Covered | Condensing, Non-Condensing |

| Fuel Types Covered | Coal, Biomass, Nuclear, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India steam turbines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India steam turbines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India steam turbines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India steam turbines market was valued at USD 934.50 Million in 2024.

The India steam turbines market is projected to exhibit a CAGR of 4.28% during 2025-2033, reaching a value of USD 1,403.91 Million by 2033.

The India steam turbines market is driven by rapid industrialization, expanding thermal power generation, and rising energy demands. Government initiatives supporting clean energy and modernization of aging infrastructure also contribute to market growth. Additionally, growing investments in cogeneration and combined heat and power systems in industries like sugar, cement, and steel further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)